|

Boutique Investment Bank

A boutique investment bank is an investment bank that specializes in at least one aspect of investment banking, generally corporate finance, although some banks' strengths are retail in nature, such as Charles Schwab. Of those involved in corporate finance, capital raising, mergers and acquisitions and restructuring and reorganizations are their primary activities. Boutiques usually provide advisory and consulting services, but lack capacity to provide funding. After the Gramm–Leach–Bliley Act, investment banks have either had a retail deposit base (JPMorgan Chase, Citi, Bank of America) or have had funding from overseas owners or from Wealth Management arms ( UBS, Deutsche Bank, Morgan Stanley). Boutique banks on the other hand often turn to other banks to provide funding or deal directly with capital rich firms such as insurers to provide capital for deals. Boutique investment banks generally work on smaller deals involving middle-market companies, and usually assist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Banking

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities FICC services (fixed income instruments, currencies, and commodities) or research (macroeconomic, credit or equity research). Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique market (specialized businesses). Unlike commercial banks and retail banks, inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and also published digitally that focuses on business and economic Current affairs (news format), current affairs. Based in London, the paper is owned by a Japanese holding company, Nikkei, Inc., Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson plc, Pearson sold the publication to Nikkei for Pound sterling, £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. In 2023, it was reported to have 1.3 million subscribers of which 1.2 million were digital. The newspaper has a prominent focus on Business journalism, financial journalism and economic analysis rather than News media, generalist reporting, drawing both criticism and acclaim. It sponsors an Financial Times and McKinsey Business Book of the Year Award, annual book ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PJT Partners

PJT Partners, Inc. is a global advisory-focused investment bank, founded in October 2015 as part of The Blackstone Group's spin-off of its financial and strategic advisory services businesses. PJT operates businesses across strategic advisory, strategic capital markets, restructuring, shareholder advisory and capital raising. The firm has advised on over $1 trillion in M&A transactions including AbbVie's $63 billion acquisition of Allergan, T-Mobile's $59 billion merger with Sprint, and Mylan's $50 billion merger with Pfizer subsidiary, Upjohn. The firm is headquartered in New York City, with additional offices in Boston, Chicago, Hong Kong, Houston, London, Los Angeles, Madrid, San Francisco and Sydney, and employs approximately 700 people. History and background In 2015, PJT Partners, Inc. was created from a merger of the advisory arm of The Blackstone Group (which had operated for thirty years) and PJT Capital LP, a strategic advisory firm founded by Paul Jefferey Taubman ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Centerview Partners

Centerview Partners is an American independent investment banking firm founded in 2006. Centerview operates primarily as an Independent advisory firm, investment banking advisory firm with approximately 80 partners and 500 professionals advising across various industries, geographies, transaction structures, and deal sizes. The firm is headquartered in New York City with offices in London, Paris, Menlo Park, California, Menlo Park and San Francisco. History Centerview was founded in July 2006 by Blair Effron, former Vice Chairman of UBS AG, and Robert Pruzan, former CEO of Dresdner Kleinwort Wasserstein, Dresdner Kleinwort Wasserstein North America and President of Wasserstein Perella & Co. In 2010, Robert E. Rubin, former U.S. Secretary of the Treasury, joined the firm as Counselor. In 2019, Rahm Emanuel joined the firm to launch the Chicago office. In 2023, Richard N. Haass, former president of the Council on Foreign Relations, Council of Foreign Relations, joined the firm as S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lazard

Lazard Inc. (formerly known as Lazard Ltd and Lazard Frères & Co.) is a financial advisory and asset management firm that engages in investment banking, asset management and other financial services, primarily with institutional clients. It is the world's largest independent investment bank, with principal executive offices in New York City, Paris and London. Lazard was founded in 1848 and operates from 41 cities across 26 countries in North America, Europe, Asia, Australia, and Central and South America. The firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals. History Early years On July 12, 1848, three French brothers, Alexandre Lazard, Lazare Lazard, and Simon Lazard, founded Lazard Frères & Co. as a dry goods merchant store in New Orleans, Louisiana. By 1851, Simon and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Evercore

Evercore Inc., formerly known as Evercore Partners, is a global independent investment banking advisory firm founded in 1995 by Roger Altman, David Offensend, and Austin Beutner. The firm has advised on over $4.7 trillion of merger, acquisition, and restructuring transactions since its founding. Evercore advises on mergers and acquisitions, divestitures, restructurings, financings, public offerings, private placements and other strategic transactions and provides institutional investors with macro and fundamental equity research, sales and trading execution. It offers wealth management, institutional asset management and private equity investing. Evercore is headquartered in New York City and has 28 offices in 11 countries across North America, Europe, South America and Asia, with approximately 1,950 employees. History Founding and establishment Evercore Partners was founded by Roger Altman in 1995, on the basis that clients would be best served by an investment b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.“US Business Cycle Expansions and Contractions” United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goliath

Goliath ( ) was a Philistines, Philistine giant in the Book of Samuel. Descriptions of Goliath's giant, immense stature vary among biblical sources, with texts describing him as either or tall. According to the text, Goliath issued a challenge to the Israelites, daring them to send forth a champion to engage him in single combat; he was ultimately defeated by the young shepherd David, employing a Sling (weapon)#Biblical accounts, sling and stone as a weapon. The narrative signified Saul, King Saul's unfitness to rule, as Saul himself should have fought for the Kingdom of Israel (united monarchy), Kingdom of Israel. Some modern scholars believe that the original slayer of Goliath may have been Elhanan, son of Jair, who features in 2 Samuel 21:19, in which Elhanan kills Goliath the Gittite, and that the authors of the Deuteronomist#Deuteronomistic history, Deuteronomistic history changed the original text to credit the victory to the more famous figure David. The phrase "#Mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

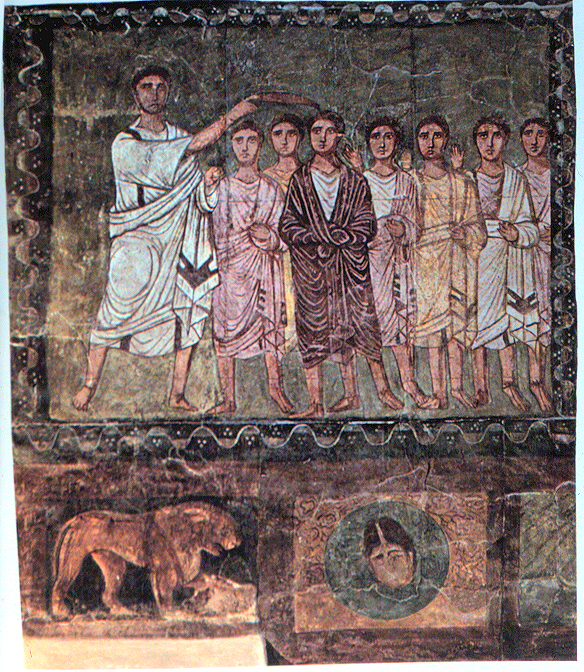

David

David (; , "beloved one") was a king of ancient Israel and Judah and the third king of the United Monarchy, according to the Hebrew Bible and Old Testament. The Tel Dan stele, an Aramaic-inscribed stone erected by a king of Aram-Damascus in the late 9th/early 8th centuries BCE to commemorate a victory over two enemy kings, contains the phrase (), which is translated as " House of David" by most scholars. The Mesha Stele, erected by King Mesha of Moab in the 9th century BCE, may also refer to the "House of David", although this is disputed. According to Jewish works such as the '' Seder Olam Rabbah'', '' Seder Olam Zutta'', and '' Sefer ha-Qabbalah'' (all written over a thousand years later), David ascended the throne as the king of Judah in 885 BCE. Apart from this, all that is known of David comes from biblical literature, the historicity of which has been extensively challenged,Writing and Rewriting the Story of Solomon in Ancient Israel; by Isaac Kalimi; page 3 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Investment Banks

The following list catalogues the largest, most profitable, and otherwise notable investment banks. This list of investment banks notes full-service banks, financial conglomerates, independent investment banks, private placement firms and notable acquired, merged, or bankrupt investment banks. As an industry it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique market (specialized businesses). Largest full-service investment banks The following are the largest full-service global investment banks; full-service investment banks usually provide both advisory and financing banking services, as well as sales, market making, and research on a broad array of financial products, including equities, credit, rates, currency, commodities, and their derivatives. The largest investment banks are noted with the following: # JPMorgan Chase # Goldman Sachs # BofA Securities # Morgan Stanley # Citigroup # UBS # Deutsche ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conglomerate (company)

A conglomerate () is a type of multi-industry company that consists of several different and unrelated List of legal entity types by country, business entities that operate in various industries. A conglomerate usually has a Holding company, parent company that owns and controls many Subsidiary, subsidiaries, which are legally independent but financially and strategically dependent on the parent company. Conglomerates are often large and Multinational corporation, multinational corporations that have a global presence and a diversified portfolio of products and services. Conglomerates can be formed by merger and acquisitions, Corporate spin-off, spin-offs, or joint ventures. Conglomerates are common in many countries and sectors, such as Media (communication), media, Finance, banking, Energy industry, energy, mining, manufacturing, retail, Arms industry, defense, and transportation. This type of organization aims to achieve economies of scale, market power, Risk management, ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |