|

Bancor

The bancor was a supranational currency that John Maynard Keynes and E. F. Schumacher conceptualised in the years 1940–1942 and which the United Kingdom proposed to introduce after World War II. The name was inspired by the French ''banque or'' ('bank gold'). This newly created supranational currency would then be used in international trade as a unit of account within a multilateral clearing system—the International Clearing Union—which would also need to be founded. Overview John Maynard Keynes proposed an explanation for the ineffectiveness of monetary policy to stem the Great Depression, as well as a non-monetary interpretation of the depression, and finally an alternative to a monetary policy for meeting the depression. Keynes believed that in times of heavy unemployment, interest rates could not be lowered by monetary policies. The ability for capital to move between countries seeking the highest interest rate frustrated Keynesian policies. By closer governm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Clearing Union

The International Clearing Union (ICU) was one of the institutions proposed to be set up at the 1944 United Nations Monetary and Financial Conference at Bretton Woods, New Hampshire, in the United States, by British economist John Maynard Keynes. Its aim was to establish regulation of currency exchange, a role eventually taken by the International Monetary Fund (IMF). The International Clearing Union (ICU) would be a global bank whose role would be the clearance of trade between nations, similar to a trade exchange with every country as a member. All international trade would be denominated in a special unit of account, the proposed bancor. The bancor was to have had a fixed exchange rate with national currencies, and would have been used to measure the balance of trade between nations. Goods exported would add bancors to a country's account, while goods imported would subtract them. Each nation would be incentivized to keep their bancor balance close to zero by one of two me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynes 1933

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the schools of economic thought, school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream economics, mainstream macroeconomics. He is known as the "father of macroeconomics". During the Great Depression of the 1930s, Keynes spearheaded Keynesian Revolution, a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, automatically provide full employment, as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods System

The Bretton Woods system of monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the Jamaica Accords in 1976. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to countries with balance of payments de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods Conference

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 allied nations at the Mount Washington Hotel, in Bretton Woods, New Hampshire, United States, to regulate what would be the international monetary and financial order after the conclusion of World War II. The conference was held from July 1 to 22, 1944. Agreements were signed that, after legislative ratification by member governments, established the International Bank for Reconstruction and Development (IBRD, later part of the World Bank group) and the International Monetary Fund (IMF). This led to what was called the Bretton Woods system for international commercial and financial relations. Background Multilateral economic cooperation among countries was crucial for the post-war world economies. Countries sought to establish an international monetary and financial system that fostered collaboration and growth among the parti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomics, macroeconomic theories and Economic model, models of how aggregate demand (total spending in the economy) strongly influences Output (economics), economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the aggregate supply, productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes, including economic recession, recessions when demand is too low and inflation when demand is too high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between a government and their central bank. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Triffin Dilemma

In international finance, the Triffin dilemma (sometimes the Triffin paradox) is the conflict of economic interests that arises between short-term domestic and long-term international objectives for countries whose currencies serve as global reserve currencies. This dilemma was identified in the 1960s by Belgian-American economist Robert Triffin. He noted that a country whose currency is the global reserve currency, held by other nations as foreign exchange (FX) reserves to support international trade, must somehow supply the world with its currency in order to fulfill world demand for these FX reserves. This supply function is nominally accomplished by international trade, with the country holding reserve currency status being required to run an inevitable trade deficit. After going off of the gold standard in 1971 and setting up the petrodollar system later in the 1970s, the United States accepted the burden of such an ongoing trade deficit in 1985 with its permanent trans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zhou Xiaochuan

Zhou Xiaochuan (; born 29 January 1948) is a Chinese economist. Zhou served as the governor of the People's Bank of China from 2002 to 2018. Zhou previously served as vice governor of the People's Bank of China, director of the State Administration of Foreign Exchange, governor of China Construction Bank, and chairman of the China Securities Regulatory Commission. He retired in 2018. Early life and education Born in Yixing, Jiangsu province, he was the son of Zhou Jiannan and Yang Weizhe (). The elder Zhou was the head of the Electric and Industrial Bureau of the North East district in 1949. He later became Vice Minister of the First Department of Machinery Development in 1961. During the Cultural Revolution, Zhou Xiaochuan joined the Production and Construction Corps in Heilongjiang province while his father was persecuted. Zhou Xiaochuan graduated from Beijing Institute of Chemical Technology (now Beijing University of Chemical Technology) in 1975 and received a Ph. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing (finance)

In banking and finance, clearing refers to all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks. Description In trading, clearing is necessary because the speed of trades is much faster than the cycle time for completing the underlying transaction. It involves the management of post-trading, pre-settlement credit exposures to ensure that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement. Processes included in clearing are reporting/monitoring, risk margining, netting of trades to single positions, tax handling, and failure handling. Systemically important payment systems (SIPS) are payment systems which have the characteristic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

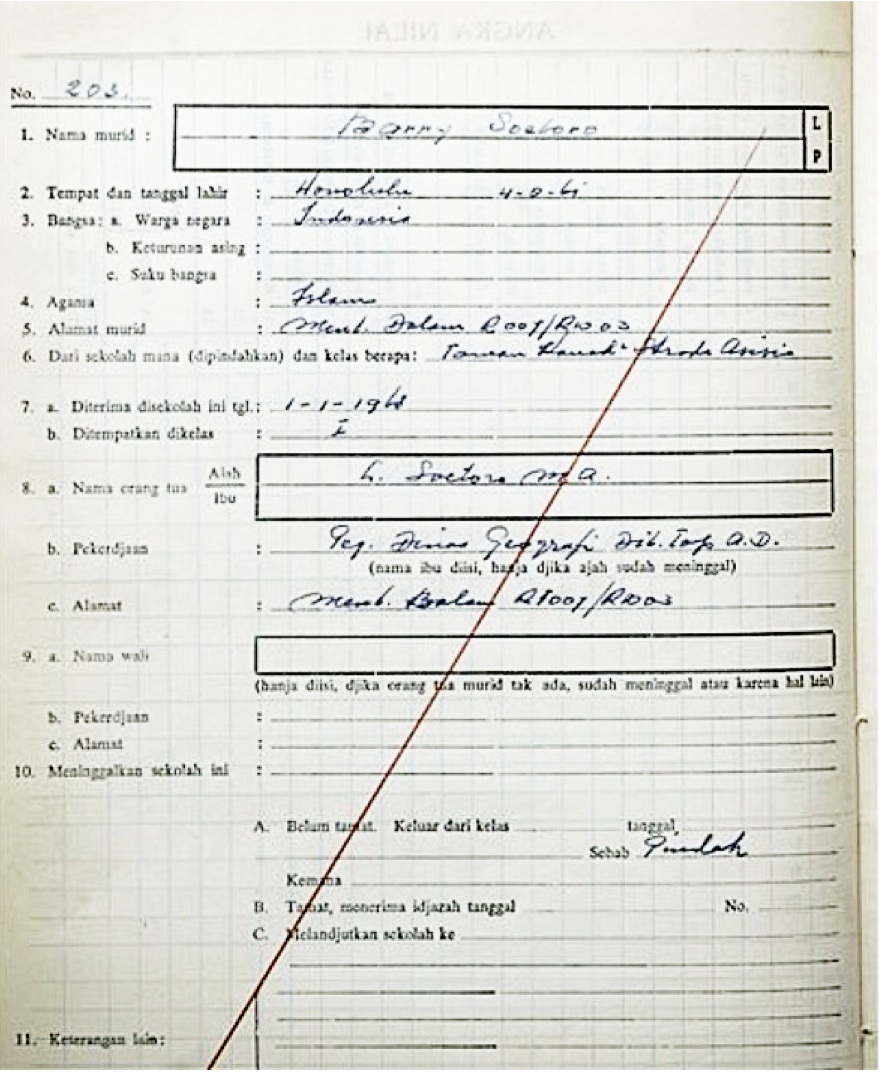

Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. Obama previously served as a U.S. senator representing Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004. Born in Honolulu, Hawaii, Obama graduated from Columbia University in 1983 with a Bachelor of Arts degree in political science and later worked as a community organizer in Chicago. In 1988, Obama enrolled in Harvard Law School, where he was the first black president of the ''Harvard Law Review''. He became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. In 1996, Obama was elected to represent the 13th district in the Illinois Senate, a position he held until 2004, when he successfully ran for the U.S. Senate. In the 2008 pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |