|

USDA Home Loan

A USDA Home Loan from the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, is a mortgage loan offered to rural property owners by the United States Department of Agriculture, Rural Development. Types of USDA Loans Guaranteed Loan For home loans that may have an income of up to 115% of the median income for the area. Families must be without adequate housing, but be able to afford the mortgage payments, including taxes and insurance. In addition, applicants must have reasonable credit histories. Additionally, the property must be located within the USDA RD Home Loan "footprint." USDA Loans offer 100% financing to qualified buyers, and allow for all closing costs to be either paid for by the seller or financed into the loan. USDA Home Loans have Maximum Household Income Limits which vary by the county in which you purchase a home; the income limits change annually. The Maximum Household Income Limits are based upon everyone in the home w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

USDA

The United States Department of Agriculture (USDA) is an United States federal executive departments, executive department of the Federal government of the United States, United States federal government that aims to meet the needs of commercial farming and livestock food production, promotes agricultural trade and production, works to assure food safety, protects natural resources, fosters rural communities and works to end hunger in the United States and internationally. It is headed by the secretary of agriculture, who reports directly to the president of the United States and is a member of the president's Cabinet of the United States, Cabinet. The current secretary is Brooke Rollins, who has served since February 13, 2025. Approximately 71% of the USDA's $213 billion budget goes towards nutrition assistance programs administered by the Food and Nutrition Service (FNS). The largest component of the FNS budget is the Supplemental Nutrition Assistance Program (formerly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Taxes

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or other geographical region, or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted with a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

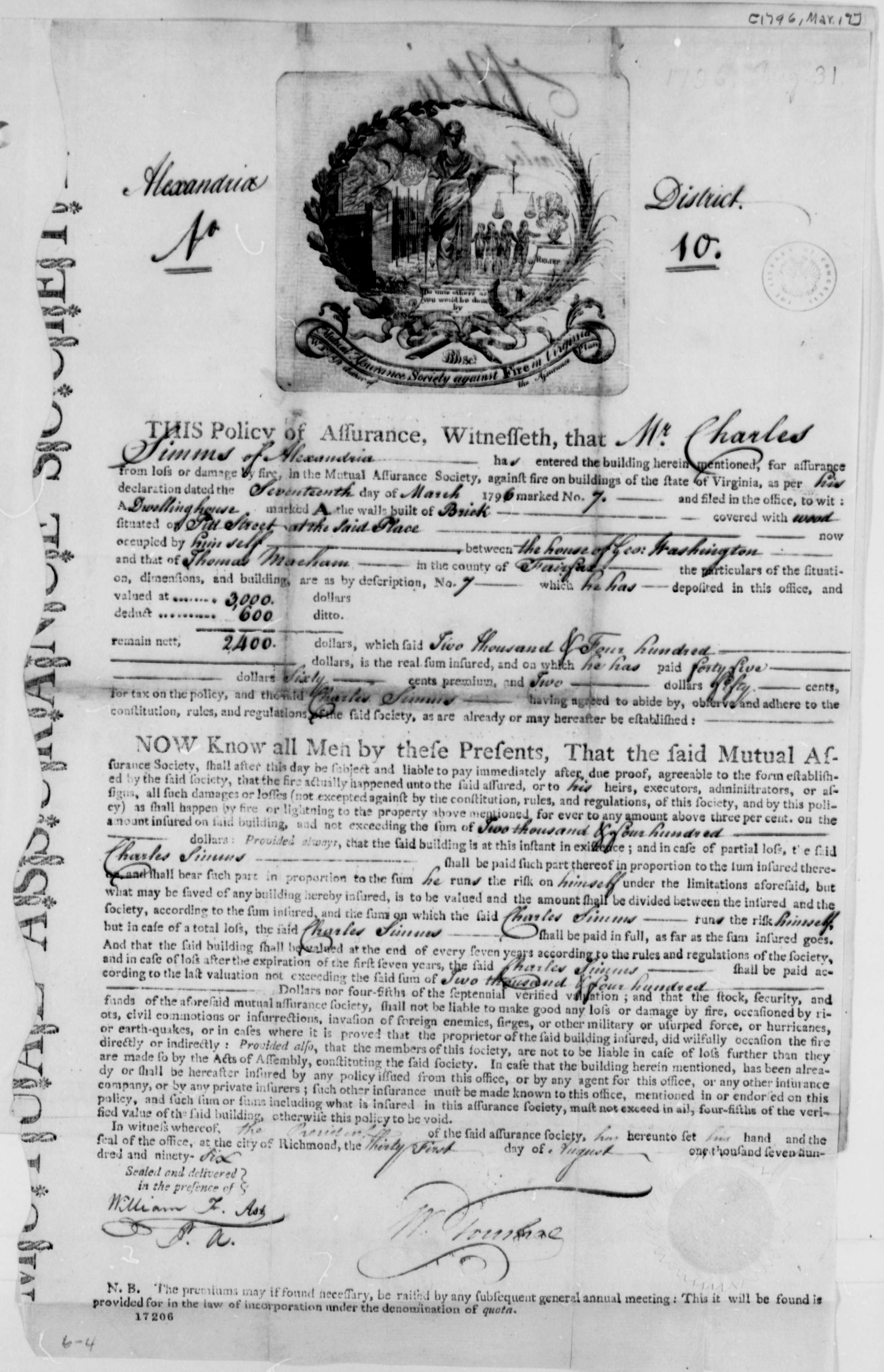

Property Insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils. Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning, explosion, cyber-attack, and theft. History Property insurance can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Farm Credit System

The Farm Credit System (FCS) in the United States is a nationwide network of borrower-owned lending institutions and specialized service organizations. The Farm Credit System provides more than $373 billion (as of 2022) in loans, leases, and related services to farmers, ranchers, rural homeowners, aquatic producers, timber harvesters, agribusinesses, and agricultural and rural utility cooperatives. As of 2021, the Farm Credit System provides more than 45% of the total market share of US farm business debt. Congress established the Farm Credit System in 1916 to provide a reliable source of credit for farmers and ranchers, by making loans to qualified borrowers at competitive rates and providing insurance and related services. Authority and oversight Congress established the Farm Credit System as a government-sponsored enterprise (GSE) when it enacted the Federal Farm Loan Act of 1916. Current authority is granted by the Farm Credit Act of 1971. The Farm Credit System is consider ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Of America

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five major island territories and various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's third-largest land area and third-largest population, exceeding 340 million. Its three largest metropolitan areas are New York, Los Angeles, and Chicago, and its three most populous states are California, Texas, and Florida. Paleo-Indians migrated from North Asia to North America over 12,000 years ago, and formed various civilizations. Spanish colonization led to the establishment in 15 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a Return (finance), return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |