|

UK Social Security

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system. History Before the official establishment of the modern welfare state, clear examples of social welfare existed to help the poor and vulnerable within British society. A key date in the welfare state's history is 1563; when Queen Elizabeth I's government encouraged the wealthier members of society to give to the poor, by passing the Poor Act 1562. The welfare state in the modern sense was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the Poor Relief Act 1601 (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Manchester University Press

Manchester University Press is the university press of the University of Manchester, England, and a publisher of academic books and journals. Manchester University Press has developed into an international publisher. It maintains its links with the University. Publishing Manchester University Press publishes monographs and textbooks for academic teaching in higher education. In 2012 it was producing about 145 new books annually and managed a number of journals. Areas of expertise are history, politics and international law, literature and theatre studies, and visual culture. MUP books are marketed and distributed by Oxford University Press in the United States and Canada, and in Australia by Footprint Books; all other global territories are covered from Manchester itself. Some of the press's books were formerly published in the US by Barnes & Noble, Inc., New York. Later the press established an American office in Dover, New Hampshire. Open access Manchester University Pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

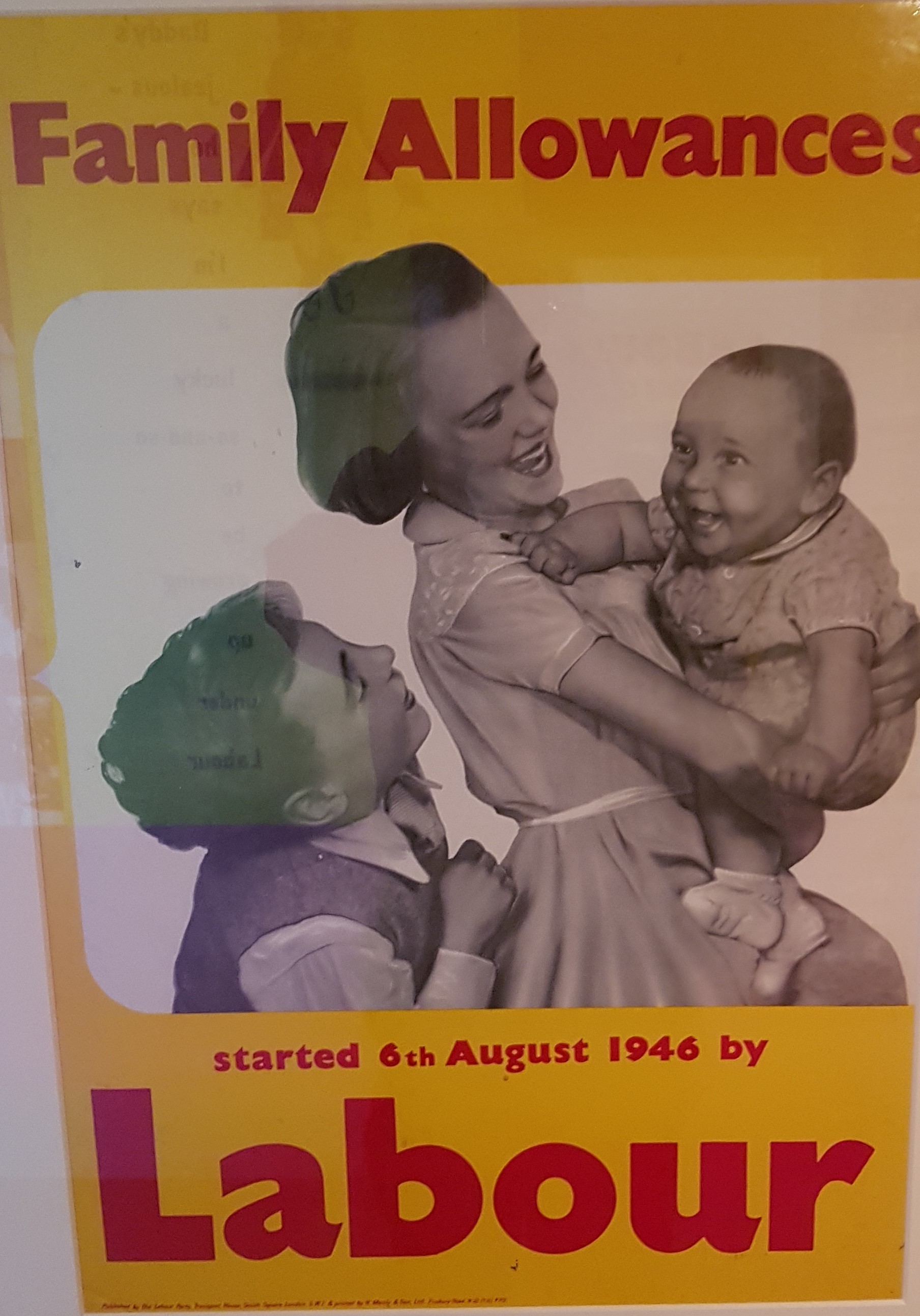

Family Allowance

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefit. In most child benefit is means-testing, means-tested and the amount paid is usually dependent on the number of children. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, the system of child benefit payments, once termed child endowment and currently called Social Security (Australia)#Family Tax benefit, Family Tax Benefit, is income tested and linked to the Income tax in Australia#Family Tax Benefit, Australian Income tax system. It can be clai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of The Minimum Wage

The history of minimum wage is about the attempts and measures governments have made to introduce, ascertain, uphold and enforce a minimum wage. New Zealand New Zealand enacted the first national minimum wage laws in 1894 by the '' Industrial Conciliation and Arbitration Act'', which, unlike the wages board of Victoria, established arbitration boards to enforce compulsory arbitration. Australia In 1896, the Colony of Victoria amended the ''Factories and Shops Act'' to create a wages board. The wages board did not set a universal minimum wage; rather it set basic wages for six industries that were considered to pay low wages. First enacted as a four-year experiment, the wages board was renewed in 1900 and made permanent in 1904; by that time it covered 150 different industries.Waltman, Jerold. "The Politics of the Minimum Wage." University of Illinois Press. 2000 By 1902, other Australian jurisdictions, such as New South Wales and Western Australia, had also formed wages boards ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Insurance Act 1920

The Unemployment Insurance Act 1920 ( 10 & 11 Geo. 5. c. 30) was an act of Parliament in the United Kingdom. It created the dole (weekly cash unemployment benefits) system of payments to unemployed workers. The act passed at a time of very little unemployment, when the Conservatives dominated Parliament. It set up the dole system that provided 15 weeks of unemployment benefits to cover over 11 million workers—practically the entire civilian working population except domestic service, farm workers, railway workers, and civil servants. Funded in part by weekly contributions from both employers and employed, it provided weekly payments of 15s for unemployed men and 12s for unemployed women. Historian Charles Loch Mowat Charles Loch Mowat (4 October 1911 – 23 June 1970) was a British-born American historian. Biography Mowat was educated at Marlborough College and St John's College, Oxford. John Ramsden (ed.), ''The Oxford Companion to Twentieth Century B ... calls this le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance Act

The National Insurance Act 1911 ( 1 & 2 Geo. 5. c. 55) created National Insurance, originally a system of health insurance for industrial workers in Great Britain based on contributions from employers, the government, and the workers themselves. It was one of the foundations of the modern welfare state. It also provided unemployment insurance for designated cyclical industries. It formed part of the wider social welfare reforms of the Liberal Governments of 1906–1915, led by Henry Campbell-Bannerman and H. H. Asquith. David Lloyd George, the Liberal Chancellor of the Exchequer, was the prime moving force behind its design, negotiations with doctors and other interest groups, and final passage, assisted by Home Secretary Winston Churchill. Background Lloyd George followed the example of Germany, which under Chancellor Otto von Bismarck had provided compulsory national insurance against sickness from 1884. After visiting Germany in 1908, Lloyd George said in his 1909 Budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roy Jenkins

Roy Harris Jenkins, Baron Jenkins of Hillhead (11 November 1920 – 5 January 2003) was a British politician and writer who served as the sixth President of the European Commission from 1977 to 1981. At various times a Member of Parliament (MP) for the Labour Party and the Social Democratic Party (SDP), and a peer for the Liberal Democrats, he was Chancellor of the Exchequer and Home Secretary under the Wilson and Callaghan Governments. The son of Arthur Jenkins, a coal-miner and Labour MP, Jenkins was educated at the University of Oxford and served as an intelligence officer during the Second World War. Initially elected as MP for Southwark Central in 1948, he moved to become MP for Birmingham Stechford in 1950. On the election of Harold Wilson after the 1964 election, Jenkins was appointed Minister of Aviation. A year later, he was promoted to the Cabinet to become Home Secretary. In this role, Jenkins embarked on a major reform programme; he sought to build ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Winston Churchill

Sir Winston Leonard Spencer Churchill (30 November 1874 – 24 January 1965) was a British statesman, military officer, and writer who was Prime Minister of the United Kingdom from 1940 to 1945 (Winston Churchill in the Second World War, during the Second World War) and again from 1951 to 1955. For some 62 of the years between 1900 and 1964, he was a Member of Parliament (United Kingdom), member of parliament (MP) and represented a total of five Constituencies of the Parliament of the United Kingdom, constituencies over that time. Ideologically an adherent to economic liberalism and imperialism, he was for most of his career a member of the Conservative Party (UK), Conservative Party, which he led from 1940 to 1955. He was a member of the Liberal Party (UK), Liberal Party from 1904 to 1924. Of mixed English and American parentage, Churchill was born in Oxfordshire into the wealthy, aristocratic Spencer family. He joined the British Army in 1895 and saw action in British R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Lloyd George

David Lloyd George, 1st Earl Lloyd-George of Dwyfor (17 January 1863 – 26 March 1945) was Prime Minister of the United Kingdom from 1916 to 1922. A Liberal Party (United Kingdom), Liberal Party politician from Wales, he was known for leading the United Kingdom of Great Britain and Ireland, United Kingdom during the First World War, for social-reform policies, for his role in the Paris Peace Conference (1919–1920), Paris Peace Conference, and for negotiating the establishment of the Irish Free State. Born in Chorlton-on-Medlock, Manchester, and raised in Llanystumdwy, Lloyd George gained a reputation as an orator and proponent of a Welsh blend of radical Liberal ideas that included support for Welsh devolution, the Disestablishment of the Church in Wales, disestablishment of the Church of England in Wales, equality for labourers and tenant farmers, and reform of land ownership. He won 1890 Caernarvon Boroughs by-election, an 1890 by-election to become the Member of Parliam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

People's Budget

The 1909/1910 People's Budget was a proposal of the Liberal government that introduced unprecedented taxes on the lands and incomes of Britain's wealthy to fund new social welfare programmes, such as non-contributary old age pensions under Old Age Pensions Act 1908. It passed the House of Commons in 1909 but was blocked by the House of Lords for a year and became law in April 1910. It was championed by the Chancellor of the Exchequer, David Lloyd George, and his young ally Winston Churchill, who was then President of the Board of Trade and a fellow Liberal; called the "Terrible Twins" by certain Conservative contemporaries. William Manchester, one of Churchill's biographers, called the People's Budget a "revolutionary concept" because it was the first budget in British history with the expressed intent of redistributing wealth equally amongst the British population. It was a key issue of contention between the Liberal government and the Conservative-dominated House of Lord ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a " defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms " retirement plan" and " superannuation" tend to refer to a pension granted upon retirement of the individual; the terminolog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |