|

Trinity Study

In finance, investment advising, and retirement planning, the Trinity study is an informal name used to refer to an influential 1998 paper by three professors of finance at Trinity University in the US. It is one of a category of studies that attempt to determine "safe withdrawal rates" from retirement portfolios that contain stocks and thus grow (or shrink) irregularly over time. In the original study success was primarily judged by whether portfolio lasted for the desired payout period, i.e., the investor did not run out of money during their retirement years before passing away; capital preservation was not a primary goal, but the "terminal value" of portfolios was considered for those investors who may wish to leave bequests. Study and conclusions "The 4% Rule" refers to one of the scenarios examined by the authors. The context is one of annual withdrawals from a retirement portfolio containing a mix of stocks and bonds. The 4% refers to the portion of the portfolio withdra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trinity University (Texas)

Trinity University is a private liberal arts college in San Antonio, Texas. Founded in 1869, its student body consists of about 2,600 undergraduate and 200 graduate students. Trinity offers 49 majors and 61 minors among six degree programs, and has an endowment of $1.856 billion. History Cumberland Presbyterians founded Trinity in 1869 in Tehuacana, Texas, from the remnants of three small Cumberland Presbyterian colleges that had lost significant enrollment during the Civil War: "Chapel Hill College" (founded 1849), "Ewing College" (founded 1848), and "Larissa College" (founded 1855). John Boyd, who had served in the Congress of the Republic of Texas from 1836 to 1845 and in the Texas Senate from 1862 to 1863, donated 1,100 acres of land and financial assistance to establish the new university. Believing that the school needed the support of a larger community, the university moved in 1902 to Waxahachie, Texas. In 1906, the university, along with many Cumberland Pres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Withdrawal Rate

At retirement, individuals stop working and no longer get employment earnings, and enter a phase of their lives, where they rely on the assets they have accumulated, to supply money for their spending needs for the rest of their lives. Retirement spend-down, or withdrawal rate, is the strategy a retiree follows to spend, decumulate or withdraw assets during retirement. Retirement planning aims to prepare individuals for retirement spend-down, because the different spend-down approaches available to retirees depend on the decisions they make during their working years. Actuaries and financial planners are experts on this topic. Importance More than 10,000 Post-World War II baby boomers will reach age 65 in the United States every day between 2014 and 2027. This represents the majority of the more than 78 million Americans born between 1946 and 1964. As of 2014, 74% of these people are expected to be alive in 2030, which highlights that most of them will live for many years be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bequests

A devise is the act of giving real property by will, traditionally referring to real property. A bequest is the act of giving property by will, usually referring to personal property. Today, the two words are often used interchangeably due to their combination in many wills as ''devise and bequeath'', a legal doublet. The phrase ''give, devise, and bequeath'', a legal triplet, has been used for centuries, including the will of William Shakespeare. The word ''bequeath'' is a verb form for the act of making a ''bequest''. Etymology Bequest comes from Old English , "to declare or express in words"—cf. "quoth". Interpretations Part of the process of probate involves interpreting the instructions in a will. Some wordings that define the scope of a bequest have specific interpretations. "All the estate I own" would involve all of the decedent's possessions at the moment of death. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a statistical estimate of the level of prices of goods and services bought for consumption purposes by households. It is calculated as the weighted average price of a market basket of Goods, consumer goods and Service (economics), services. Changes in CPI track changes in prices over time. The items in the basket are updated periodically to reflect changes in consumer spending habits. The prices of the goods and services in the basket are collected (often monthly) from a sample of retail and service establishments. The prices are then adjusted for changes in quality or features. Changes in the CPI can be used to track inflation over time and to compare inflation rates between different countries. While the CPI is not a perfect measure of inflation or the cost of living, it is a useful tool for tracking these economic indicators. It is one of several Price index, price indices calculated by many national statistical agencies. Overview A CPI is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ibbotson Associates

Roger G. Ibbotson (born May 27, 1943) is Professor Emeritus in Practice of Finance at thYale School of Management He is also chairman oZebra Capital Management LLC He has written extensively on capital market returns, cost of capital, and international investment. He is the founder, advisor, and former chairman of Ibbotson Associates, now a Morningstar Company. He has written numerous books and articles includin''Stocks, Bonds, Bills, and Inflation''with Rex Sinquefield, which serves as a standard reference for information and capital market returns. Professor Ibbotson conducts research on a broad range of financial topics, including popularity, liquidity, investment returns, mutual funds, international markets, portfolio management, and valuation. He has recently publishe''Popularity: A Bridge between Classical and Behavioral Finance''an''Lifetime Financial Advice'' He has also co-authored two books with Gary Brinson, ''Global Investing'' and ''Investment Markets''. He is a re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laurence Kotlikoff

Laurence Jacob Kotlikoff (born January 30, 1951) is an American economist who has served as a professor of economics at Boston University since 1984.https://kotlikoff.net/wp-content/uploads/2024/02/Vita-2-21-24-Laurence-Kotlikoff.pdf A specialist in macroeconomics and public finance, he has contributed to a range of fields, including climate change and carbon taxation, the global macroeconomic transition and the future of economic power, inequality, fiscal progressivity, economic guides to personal financial behavior, banking reform, marginal taxation and labor supply, healthcare reform, and social security. He is the author of over 20 books, and his scholarly articles have been published in a range of journals, including the ''American Economic Review'', the ''Quarterly Journal of Economics'', and the ''Journal of Political Economy''. Born in 1951, Kotlikoff received a BA in economics from the University of Pennsylvania in 1973, and a PhD in economics from Harvard Unive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Smoothing

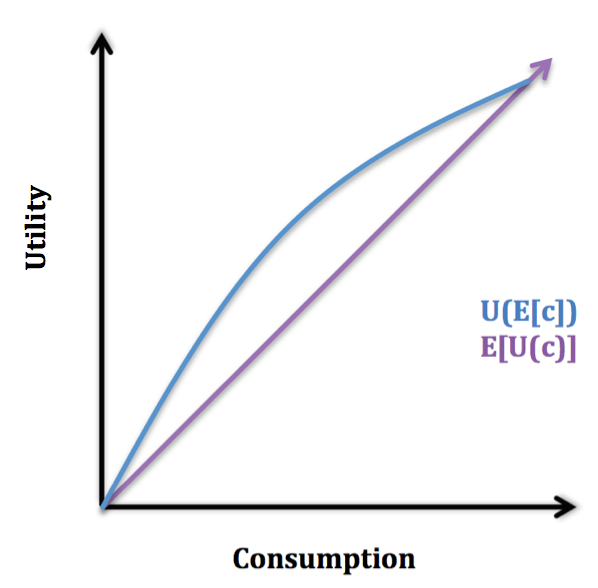

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their careers set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FIRE Movement

Fire is the rapid oxidation of a fuel in the exothermic chemical process of combustion, releasing heat, light, and various reaction products. Flames, the most visible portion of the fire, are produced in the combustion reaction when the fuel reaches its ignition point temperature. Flames from hydrocarbon fuels consist primarily of carbon dioxide, water vapor, oxygen, and nitrogen. If hot enough, the gases may become ionized to produce plasma. The color and intensity of the flame depend on the type of fuel and composition of the surrounding gases. Fire, in its most common form, has the potential to result in conflagration, which can lead to permanent physical damage. It directly impacts land-based ecological systems worldwide. The positive effects of fire include stimulating plant growth and maintaining ecological balance. Its negative effects include hazards to life and property, atmospheric pollution, and water contamination. When fire removes protective vegetation, heavy r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement Spend-down

At retirement, individuals stop working and no longer get employment earnings, and enter a phase of their lives, where they rely on the assets they have accumulated, to supply money for their spending needs for the rest of their lives. Retirement spend-down, or withdrawal rate, is the strategy a retiree follows to spend, decumulate or withdraw assets during retirement. Retirement planning aims to prepare individuals for retirement spend-down, because the different spend-down approaches available to retirees depend on the decisions they make during their working years. Actuaries and financial planners are experts on this topic. Importance More than 10,000 Post-World War II baby boomers will reach age 65 in the United States every day between 2014 and 2027. This represents the majority of the more than 78 million Americans born between 1946 and 1964. As of 2014, 74% of these people are expected to be alive in 2030, which highlights that most of them will live for many years be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job for health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |