|

Trade Finance Technology

Trade finance technology (abbreviated TradeTech, tradetech, or sometimes Trade Tech) refers to the use of technology, innovation, and software to support and digitally transform the trade finance industry. TradeTech can be seen as a subcategory under FinTech. As digital information becomes more readily accessible, convenient, and available, the trade finance industry is being gradually modernised and digitally transformed. TradeTech puts a particular emphasis on the application of technology and software to modernise trade finance. Definition TradeTech is the technology, software, and innovation that aims to enhance traditional financial methods in international trade and that is applied in making available trade finance and related services. TradeTech seeks to reduce transaction costs for businesses, lower compliance costs, and increase efficiency and transparency for firms, regulators and consumers. The application of TradeTech results in new business models, applications, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logistics

Logistics is the part of supply chain management that deals with the efficient forward and reverse flow of goods, services, and related information from the point of origin to the Consumption (economics), point of consumption according to the needs of customers. Logistics management is a component that holds the supply chain together. The resources managed in logistics may include tangible goods such as materials, equipment, and supplies, as well as food and other edible items. In military logistics, it is concerned with maintaining army supply lines with food, armaments, ammunition, and spare parts apart from the transportation of troops themselves. Meanwhile, civil logistics deals with acquiring, moving, and storing raw materials, semi-finished goods, and finished goods. For organisations that provide Waste collection, garbage collection, mail deliveries, Public utility, public utilities, and after-sales services, logistical problems must be addressed. Logistics deals with t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Technology

Financial technology (abbreviated as fintech) refers to the application of innovative technologies to products and services in the financial industry. This broad term encompasses a wide array of technological advancements in financial services, including mobile banking, online lending platforms, digital payment systems, robo-advisors, and blockchain-based applications such as cryptocurrencies. Financial technology companies include both startup company, startups and established technology and financial firms that aim to improve, complement, or replace traditional financial services. Evolution The evolution of financial technology spans over a century, marked by significant technological innovations that have revolutionized the financial industry. While the application of technology to finance has deep historical roots, the term "financial technology" emerged in the late 20th century and gained prominence in the 1990s. The earliest documented use of the term dates back to 1967, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-bank Financial Institution

A non-banking financial institution (NBFI) or non-bank financial company (NBFC) is a financial institution that is not legally a bank; it does not have a full banking license or is not supervised by a national or international banking regulatory agency. NBFC facilitate bank-related financial services, such as investment, risk pooling, contractual savings, and market brokering. Examples of these include hedge funds, insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. In 1999, Alan Greenspan identified the role of NBFIs in strengthening an economy, as they provide "multiple alternatives to transform an economy's savings into capital investment which act as backup facilities should the primary form of intermediation fail." Operations of non-bank financial institutions are not typically covered under a country's banking regulations. Etymology The term ''non-bank'' likely started as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small And Medium-sized Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by many national agencies and international organizations such as the World Bank, the OECD, European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs outnumber large companies by a wide margin and also employ many more people. On a global scale, SMEs make up 90% of all companies and more than 50% of all employment. For example, in the EU, 99% of all businesses are SMEs. Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel Accords

The Basel Accords refer to the banking supervision accords (recommendations on banking regulations) issued by the Basel Committee on Banking Supervision (BCBS). Basel I was developed through deliberations among central bankers from major countries. In 1988, the Basel Committee published a set of minimum capital requirements for banks. This is also known as the 1988 Basel Accord, and was enforced by law in the Group of Ten (G-10) countries in 1992. A new set of rules known as Basel II was developed and published in 2004 to supersede the Basel I accords. Basel III was a set of enhancements to in response to the 2008 financial crisis. It does not supersede either Basel I or II but focuses on reforms to the Basel II framework to address specific issues, including related to the risk of a bank run. The Basel Accords have been integrated into the consolidated Basel Framework, which comprises all of the current and forthcoming standards of the Basel Committee on Banking Supervisio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Funding

Funding is the act of providing resources to finance a need, program, or project. While this is usually in the form of money, it can also take the form of effort or time from an organization or company. Generally, this word is used when a firm uses its internal reserves to satisfy its necessity for cash, while the term financing is used when the firm acquires capital from external sources. Sources of funding include credit, venture capital, donations, grants, savings, subsidies, and taxes. Funding methods such as donations, subsidies, and grants that have no direct requirement for return of investment are described as "soft funding" or "crowdfunding". Funding that facilitates the exchange of equity ownership in a company for capital investment via an online funding portal per the Jumpstart Our Business Startups Act (alternately, the "JOBS Act of 2012") (U.S.) is known as equity crowdfunding. Funds can be allocated for either short-term or long-term purposes. Economics I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intent (law), intentional deception to deprive a victim of a legal right or to gain from a victim unlawfully or unfairly. Fraud can violate Civil law (common law), civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, such as obtaining a passport, travel document, or driver's licence. In cases of mortgage fraud, the perpetrator may attempt to qualify for a mortgage by way of false statements. Terminology Fraud can be defined as either a civil wrong or a criminal act. For civil fraud, a government agency or person or entity harmed by fraud may bring litigation to stop the fraud, seek monetary damages, or both. For cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Purchase Orders

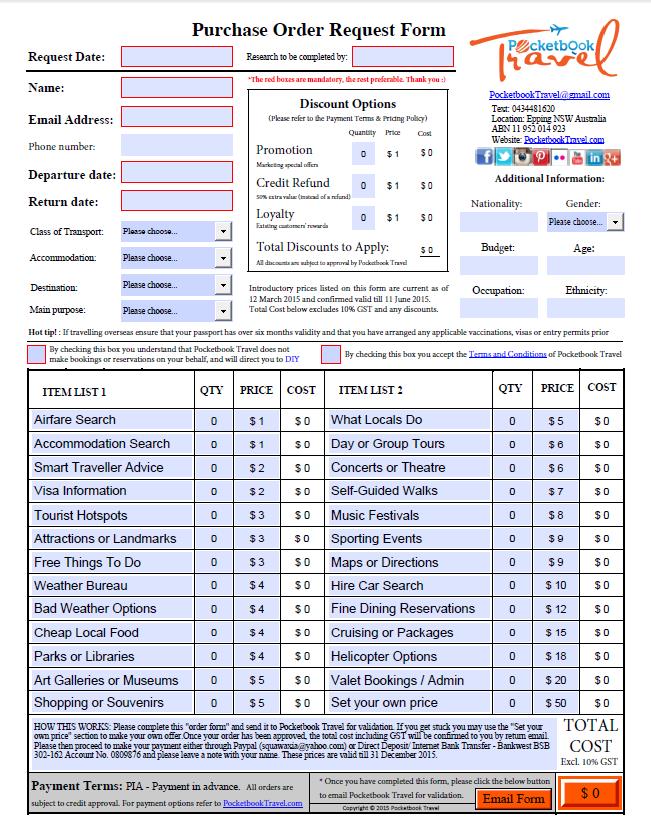

A purchase order, often abbreviated to PO, is a commercial document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services required. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders. An indent is a purchase order often placed through an agent ( indent agent) under specified conditions of sale. The issue of a purchase order does not itself form a contract. If no prior contract exists, then it is the acceptance of the order by the seller that forms a contract between the buyer and seller. Overview Purchase orders allow buyers to clearly and openly communicate with the sellers to maintain transparency. They may also help a purchasing agent to manage incoming orders and pending orders. Sellers are also protected by the use of purchase orders, in case of a buyer's refusal to pay for goods or services. Purc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Invoices

An invoice, bill, tab, or bill of costs is a commercial document that includes an itemized list of goods or services furnished by a seller to a buyer relating to a sale transaction, that usually specifies the price and terms of sale, quantities, and agreed-upon prices and terms of sale for products or services the seller had provided the buyer. Payment terms are usually stated on the invoice. These may specify that the buyer has a maximum number of days to pay and is sometimes offered a discount if paid before the due date. The buyer could have already paid for the products or services listed on the invoice. To avoid confusion and consequent unnecessary communications from buyer to seller, some sellers clearly state in large and capital letters on an invoice whether it has already been paid. From a seller's point of view, an invoice is a ''sales invoice''. From a buyer's point of view, an invoice is a ''purchase invoice''. The document indicates the buyer and seller, but the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental, Social And Corporate Governance

Environmental, social, and governance (ESG) is shorthand for an investment, investing principle that prioritizes environmental issues, social issues, and corporate governance. Investing with ESG considerations is sometimes referred to as socially responsible investing, ''responsible investing'' or, in more proactive cases, ''impact investing''. The term ESG first came to prominence in a 2004 report titled "Who Cares Wins", which was a joint initiative of financial institutions at the invitation of the United Nations (UN). By 2023, the ESG movement had grown from a UN corporate social responsibility initiative into a global phenomenon representing more than US$30 trillion in assets under management. Criticisms of ESG vary depending on viewpoint and area of focus. These areas include data quality and a lack of standardization; evolving regulation and politics; greenwashing; and variety in the definition and assessment of social good. Some critics argue that ESG serves as a de f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |