|

The Intervention Of ECB In The Eurozone Crisis

The Intervention of ECB in the Eurozone Crisis were the interventions made between 2009 and 2010 by the European Central Bank (ECB) during the European debt crisis. In 2009–2010, due to substantial public and private sector debt, and "the intimate sovereign-bank linkages" the eurozone crisis impacted the periphery countries in Europe. This resulted in significant financial sector instability in Europe; banks' solvency risks grew, which had direct implications for their funding liquidity. The European central bank, as the monetary union's central bank, responded to the sovereign debt crisis with a series of conventional and unconventional measures, including a decrease in the key policy interest rate, and three-year long-term refinancing operation (LTRO) liquidity injections in December 2011 and February 2012, and the announcement of the outright monetary transactions (OMT) program in the summer of 2012. The ECB acted as a de facto lender-of-last-resort (LOLR) to the euro area b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International use, most important central banks with a balance sheet total of around 7 trillion. The Governing Council of the European Central Bank, ECB Governing Council makes monetary policy for the Eurozone and the European Union, administers the foreign exchange reserves of EU member states, engages in foreign exchange operations, and defines the intermediate monetary objectives and key interest rate of the EU. The Executive Board of the European Central Bank, ECB Executive Board enforces the policies and decisions of the Governing Council, and may direct the national central banks when doing so. The ECB has the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the volume must be approved by the EC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Secondary Market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the security by the issuer to a purchaser, who pays proceeds to the issuer, is the primary market. All sales after the initial sale of the security are sales in the secondary market. Whereas the term primary market refers to the market for new issues of securities, and " market is primary if the proceeds of sales go to the issuer of the securities sold," the secondary market in contrast is the market created by the later trading of such securities. With primary issuances of securities or financial instruments (the primary market), often an underwriter purchases these securities directly from issuers, such as corporations issuing shares in an initial public offering (IPO) or private placement. Then the underwriter re-sells the securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Easing

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application following the 2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets. Similar to conventional Open market operation, open-market operations used to implement monetary policy, a central bank implements quantitative easing by buying financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their Yield (finance), yield, while simultaneously increasing the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Syriza

The Coalition of the Radical Left – Progressive Alliance (), best known by the syllabic abbreviation SYRIZA ( ; ; a pun on the Greek adverb , meaning "from the roots" or "radically"), is a Centre-left politics, centre-left to Left-wing politics, left-wing List of political parties in Greece, political party in Greece. It was founded in 2004 as a Parliamentary group, political coalition of left-wing and radical left parties, and registered as a political party in 2012. A Democratic socialism, democratic socialist, Progressivism, progressive party, Syriza holds a Pro-Europeanism, pro-European stance. Syriza also advocates for Alter-globalization, alter-globalisation, LGBT rights in Greece, LGBT rights, and secularism. In the past, SYRIZA was described as a typical Left-wing populism, left-wing populist party, but this was disputed after its government term and its recent opposition. Syriza is the third largest party in the Hellenic Parliament. Former party chairman Alexis Tsipr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alexis Tsipras

Alexis Tsipras (, ; born 28 July 1974) is a Greek politician who served as Prime Minister of Greece from 2015 to 2019. A left-wing figure, Tsipras was leader of the List of political parties in Greece, Greek political party Syriza from 2008 to 2023. Tsipras is the fourth prime minister who has governed in the course of the 2010s Greek government-debt crisis. Originally an outspoken critic of the austerity policies implemented during the crisis, his tenure in office was marked by an intense austerity policy, mostly in the context of the Third Economic Adjustment Programme for Greece, third EU bailout to Greece (2015–18). Tsipras was born in Athens in 1974. He joined the Communist Youth of Greece in the late 1980s and in the 1990s was politically active in student protests against education reform plans, becoming the movement's spokesperson. He studied civil engineering at the National Technical University of Athens, graduating in 2000, and later undertook post-graduate stu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mario Draghi

Mario Draghi (; born 3 September 1947) is an Italian politician, economist, academic, banker, statesman, and civil servant, who served as the prime minister of Italy from 13 February 2021 to 22 October 2022. Prior to his appointment as prime minister, he served as the president of the European Central Bank (ECB) between 2011 and 2019. Draghi was also the chair of the Financial Stability Board between 2009 and 2011, and governor of the Bank of Italy between 2006 and 2011. After a lengthy career as an academic economist in Italy, Draghi worked for the World Bank in Washington, D.C., throughout the 1980s, and in 1991 returned to Rome to become director general of the Italian Treasury. He left that role after a decade to join Goldman Sachs, where he remained until his appointment as governor of the Bank of Italy in 2006. His tenure as Governor coincided with the 2008 Great Recession, and in the midst of this he was selected to become the first chair of the Financial Stability Boa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Banking Supervision

European Banking Supervision, also known as the Single Supervisory Mechanism (SSM), is the policy framework for the prudential supervision of banks in the euro area. It is centered on the European Central Bank (ECB), whose supervisory arm is referred to as ECB Banking Supervision. EU member states outside of the euro area can also participate on a voluntary basis, as was the case of Bulgaria as of late 2023. European Banking Supervision was established by Regulation 1024/2013 of the Council, also known as the SSM Regulation, which also created its central (albeit not ultimate) decision-making body, the ECB Supervisory Board. Under European Banking Supervision, the ECB directly supervises the larger banks that are designated as Significant Institutions. The other banks, known as Less Significant Institutions, are supervised by national bank supervision, banking supervisors ("national competent authorities") under supervisory oversight by the ECB. As of late 2022, the ECB directly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate economic stability, stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and poverty reduction, reduce poverty around the world." Established in July 1944 at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary systems, international monetary system after World War II. In its early years, the IMF primarily focused on facilitating fixed exchange rates across the developed worl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Stability Mechanism

The European Stability Mechanism (ESM) is an intergovernmental organization located in Luxembourg City, which operates under public international law for all eurozone member states having ratified a special ESM intergovernmental treaty. It was established on 27 September 2012 as a permanent firewall for the eurozone, to safeguard and provide instant access to financial assistance programmes for member states of the eurozone in financial difficulty, with a maximum lending capacity of €500 billion. It has replaced two earlier temporary EU funding programmes: the European Financial Stability Facility (EFSF) and the European Financial Stabilisation Mechanism (EFSM). Overview The Treaty Establishing the European Stability Mechanism stipulated that the organization would be established if member states representing 90% of its capital requirements ratified the founding treaty. This threshold was surpassed with Germany's completion of the ratification process on 27 September 2012, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield Spread

In finance, the yield spread or credit spread is the difference between the quoted rates of return on two different investments, usually of different credit qualities but similar maturities. It is often an indication of the risk premium for one investment product over another. The phrase is a compound of yield and spread. The "yield spread of X over Y" is generally the annualized percentage yield to maturity (YTM) of financial instrument X minus the YTM of financial instrument Y. There are several measures of yield spread relative to a benchmark yield curve, including interpolated spread ( I-spread), zero-volatility spread ( Z-spread), and option-adjusted spread (OAS). It is also possible to define a yield spread between two different maturities of otherwise comparable bonds. For example, if a certain bond with a 10-year maturity yields 8% and a comparable bond from the same issuer with a 5-year maturity yields 5%, then the term premium between them may be quoted as 8% – 5% ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

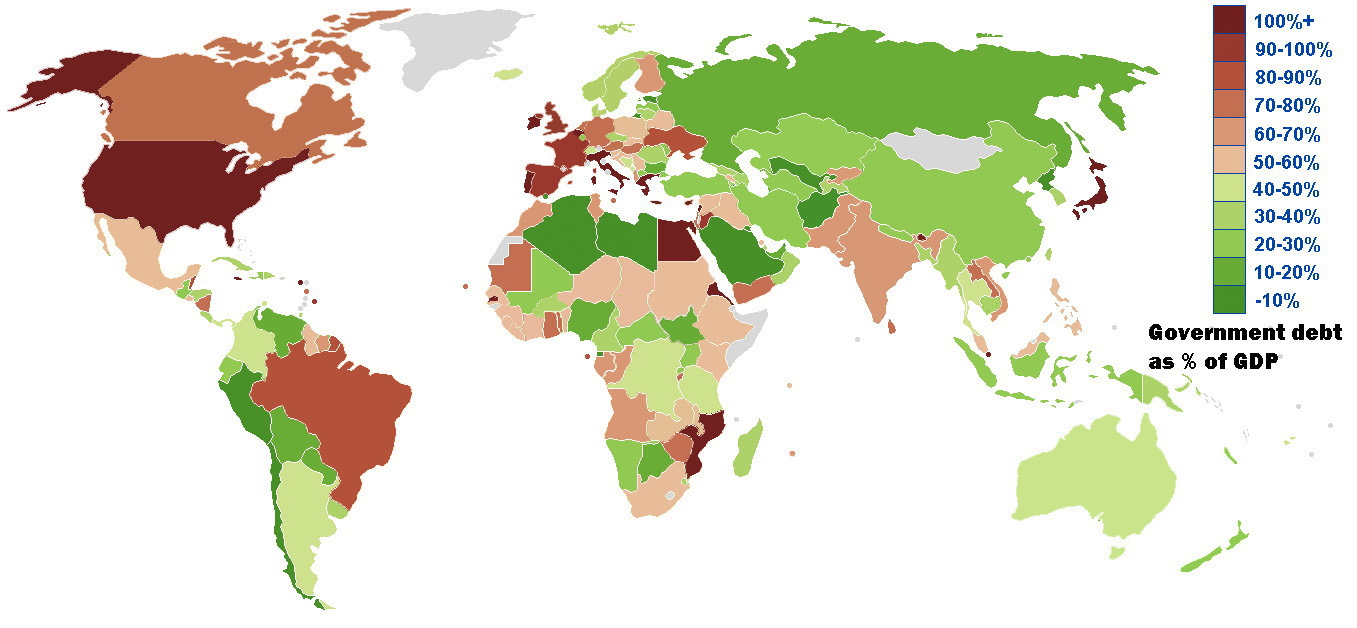

European Debt Crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The eurozone Member state of the European Union, member states of Greece, Portugal, Republic of Ireland, Ireland, and Cyprus were unable to repay or refinance their government debt or to bailout fragile banks under their national supervision and needed assistance from other eurozone countries, the European Central Bank (ECB), and the International Monetary Fund (IMF). The crisis included the Greek government-debt crisis, the 2008–2014 Spanish financial crisis, the 2010–2014 Portuguese financial crisis, the post-2008 Irish banking crisis and the post-2008 Irish economic downturn, as well as the 2012–2013 Cypriot financial crisis. The crisis contributed to changes in leadership in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Sl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |