|

Taxation In Israel

Taxation in Israel include income tax, capital gains tax, value-added tax and land appreciation tax. The primary law on income taxes in Israel is codified in the Income Tax Ordinance. There are also special tax incentives for new immigrants to encourage aliyah. Following Israel’s social justice protests in July 2011, Prime Minister Benjamin Netanyahu created the Trajtenberg Committee to hold discussions and make recommendations to the government's socio-economic cabinet, headed by Finance Minister Yuval Steinitz. During December 2011 the Knesset reviewed these recommendations and approved a series of amendments to Israel's tax law. Among the amendments were the raising of the corporate tax rate from 24% to 25% and possibly 26% in 2013. Additionally, a new top income bracket of 48% (instead of 45%) would be introduced for people earning more than NIS 489,480 per annum. People who earn more than NIS 1 million a year would pay a surtax of 2% on their income and taxation of c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Google

Google LLC (, ) is an American multinational corporation and technology company focusing on online advertising, search engine technology, cloud computing, computer software, quantum computing, e-commerce, consumer electronics, and artificial intelligence (AI). It has been referred to as "the most powerful company in the world" by the BBC and is one of the world's List of most valuable brands, most valuable brands. Google's parent company, Alphabet Inc., is one of the five Big Tech companies alongside Amazon (company), Amazon, Apple Inc., Apple, Meta Platforms, Meta, and Microsoft. Google was founded on September 4, 1998, by American computer scientists Larry Page and Sergey Brin. Together, they own about 14% of its publicly listed shares and control 56% of its stockholder voting power through super-voting stock. The company went public company, public via an initial public offering (IPO) in 2004. In 2015, Google was reorganized as a wholly owned subsidiary of Alphabet Inc. Go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Israel

Taxation in Israel include income tax, capital gains tax, value-added tax and land appreciation tax. The primary law on income taxes in Israel is codified in the Income Tax Ordinance. There are also special tax incentives for new immigrants to encourage aliyah. Following Israel’s social justice protests in July 2011, Prime Minister Benjamin Netanyahu created the Trajtenberg Committee to hold discussions and make recommendations to the government's socio-economic cabinet, headed by Finance Minister Yuval Steinitz. During December 2011 the Knesset reviewed these recommendations and approved a series of amendments to Israel's tax law. Among the amendments were the raising of the corporate tax rate from 24% to 25% and possibly 26% in 2013. Additionally, a new top income bracket of 48% (instead of 45%) would be introduced for people earning more than NIS 489,480 per annum. People who earn more than NIS 1 million a year would pay a surtax of 2% on their income and taxation of c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Immigration

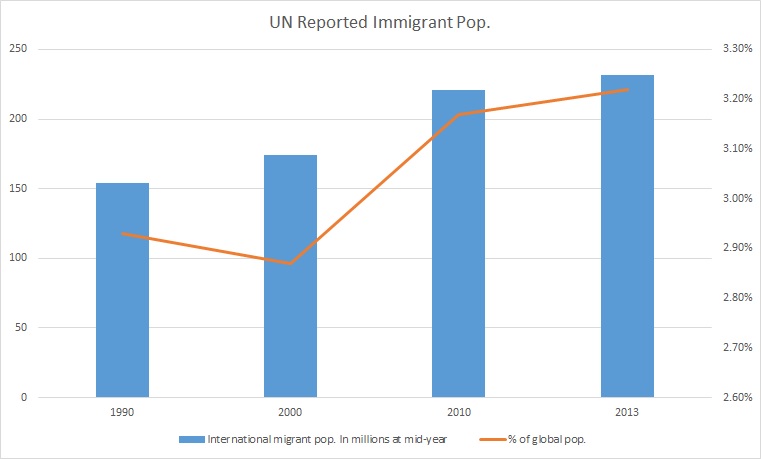

Immigration is the international movement of people to a destination country of which they are not usual residents or where they do not possess nationality in order to settle as Permanent residency, permanent residents. Commuting, Commuters, Tourism, tourists, and other short-term stays in a destination country do not fall under the definition of immigration or migration; Seasonal industry, seasonal labour immigration is sometimes included, however. Economically, research suggests that migration can be beneficial both to the receiving and sending countries. The academic literature provides mixed findings for the relationship between immigration and crime worldwide. Research shows that country of origin matters for speed and depth of immigrant assimilation, but that there is considerable assimilation overall for both first- and second-generation immigrants. Discrimination based on nationality is legal in most countries. Extensive evidence of discrimination against foreign-b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay to the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit (economics), profit or Reserve (accounting), reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to debt, borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a " defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms " retirement plan" and " superannuation" tend to refer to a pension granted upon retirement of the individual; the terminolog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalties

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or a fixed price per unit sold of an item of such, but there are also other modes and metrics of compensation.Guidelines for Evaluation of Transfer of Technology Agreements, United Nations, New York, 1979 A royalty interest is the right to collect a stream of future royalty payments. A license agreement defines the terms under which a resource or property are licensed by one party ( party means the periphery behind it) to another, either without restriction or subject to a limitation on term, business or geographic territory, type of product, etc. License agreements can be regulated, particularly where a government is the resource owner, or they can be private contracts that follow a general structure. However, certain types of franchise ag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a "defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a "defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and " superannuation" tend to refer to a pension granted upon retirement of the individual; the terminology var ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividends

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yerida

Yerida (, "descent") is emigration by Jews from the State of Israel (or in religious texts, Land of Israel). Yerida is the opposite of aliyah (, lit. "ascent"), which is immigration by Jews to Israel. Zionists are generally critical of the act of ''yerida'' and the term is somewhat derogatory. The emigration of non-Jewish Israelis is not included in the term. Common reasons for emigration given are the high cost of living, a desire to escape from the ongoing Arab–Israeli conflict, academic or professional ambitions, and disillusionment with Israeli society. Etymology Emigrants from Israel are known as ''yordim'' ("those who go down rom Israel). Immigrants to Israel are known as '' olim'' ("those who go up o Israel). The use of the Hebrew word "Yored" (which means "descending") is a modern renewal of a term taken from the Torah: "" ("I myself will go down with you to Egypt, and I will also bring you up again" Genesis 46:4), "" ("Now there was a famine in the land, and Abram ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Israeli New Shekel

The new Israeli shekel (, ; ; currency symbol, sign: Shekel sign, ₪; ISO 4217, ISO code: ILS; unofficial abbreviation: NIS), also known as simply the Israeli shekel (; ), is the currency of Israel and is also used as a legal tender in the Palestinian territories of the West Bank and the Gaza Strip. The new shekel is divided into 100 Israeli agora, agorot. The new shekel has been in use since 1 January 1986, when it replaced the hyperinflation, hyperinflated Old Israeli shekel, old shekel at a ratio of 1000:1. The currency sign for the new shekel is a combination of the first Hebrew letters of the words ''shekel'' () and ''ẖadash'' () (new). When the shekel sign is unavailable the abbreviation ''NIS'' ( and ) is used. History The origin of the name "shekel" () is from the ancient Biblical currency by the same name. An early Biblical reference is Abraham being reported to pay "four hundred shekels of silver" to Ephron the Hittite for the Cave of the Patriarchs in Hebron ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bituah Leumi

Bituah Leumi (, ''HaMossad LeBituach Leumi'', the National Insurance Institute of Israel) is Israel's national social security agency. History Bituah Leumi was established in April 1954. It collects health insurance contributions which are transferred to the various sick funds, and National Insurance contributions, for which both employers and employees are liable. Those paid below 60% of the average wage – 6,164 Israeli new shekels- pay a reduced rate. Contributions are paid as a percentage of income up to a maximum, which is uprated every year in line with the consumer price index. Israeli residents over the age of 18 must pay monthly National Insurance contributions with the exception of Israel Defense Forces soldiers, National Service volunteers, students enrolled in vocational training courses housewives whose husbands pay, people who became resident in Israel after they reached a specified age, Israeli residents living in a country with a reciprocal agreement with I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |