|

Taxation In India

Taxes in India are levied by the Government of India, Central Government and the State governments of India, State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality. The authority to levy a tax is derived from the Constitution of India which allocates the power to levy various taxes between the Union Government and the State Governments. An important restriction on this power is Article 265 of the Constitution which states that "No tax shall be levied or collected except by the authority of law". Therefore, each tax levied or collected has to be backed by an accompanying law, passed either by the Parliament of India, Parliament or the Legislative Assembly, State Legislature. Nonetheless, tax evasion is a massive problem in India, ultimately catalyzing various negative effects on the country. In 2023–24, the Direct tax collections reported by CBDT were approximatel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

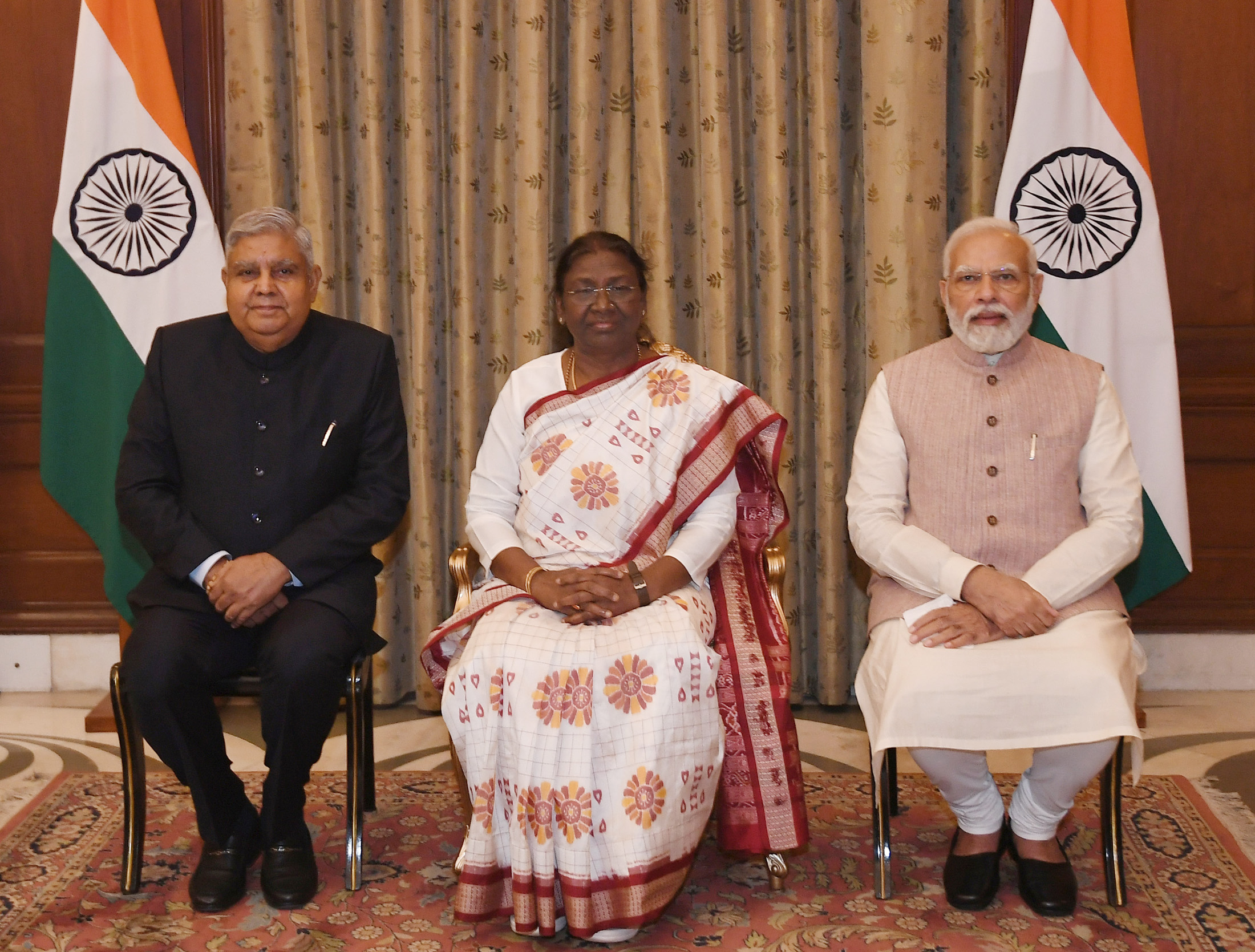

Government Of India

The Government of India (ISO 15919, ISO: Bhārata Sarakāra, legally the Union Government or Union of India or the Central Government) is the national authority of the Republic of India, located in South Asia, consisting of States and union territories of India, 36 states and union territories. The government is led by the president of India (currently ) who largely exercises the executive powers, and selects the Prime Minister of India, prime minister of India and other ministers for aid and advice. Government has been formed by the The prime minister and their senior ministers belong to the Union Council of Ministers, its executive decision-making committee being the Cabinet (government), cabinet. The government, seated in New Delhi, has three primary branches: the legislature, the executive and the judiciary, whose powers are vested in bicameral Parliament of India, Union Council of Ministers (headed by prime minister), and the Supreme Court of India respectively, with a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs

Customs is an authority or Government agency, agency in a country responsible for collecting tariffs and for controlling International trade, the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties (i.e. tariffs) and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, National security, security, and trade facilitation. Each country has its own laws and regulations for the import and export of goods into and out of a country, enforced by their respective customs authorities; the import/export of some goods may be restricted or forbidden entirely. A wide range of penalties are faced by those who break these laws. Overview Taxation The traditional function of customs has been the assessment and collection of custo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State List

The State List or List-II is a list of 61 items. Initially there were 66 items in the list in Schedule Seven to the Constitution of India. The legislative section is divided into three lists: the Union List, the State List and the Concurrent List. Unlike the federal governments of the United States, Switzerland or Australia, residual powers remain with the Union Government, as with the Canadian federal government. If any provision of a law made by the Legislature of State is repugnant to any provision of a lawmade by Parliament which Parliament is competent to enact, or to any provision of an existing law with respect to one of the matters enumerated in the Concurrent List, then, the law made by Parliament, whether passed before or after the law made by the Legislature of such State, or, as the case may be, the existing law, shall prevail and the law made by the Legislature of the State shall, to the extent of the repugnancy, be void. There is an exception to this in cases "whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inherita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Duty

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inheritanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth tax, net wealth, taxes on the change of ownership of property through Inheritance tax, inheritance or Gift tax, gift and Financial transaction tax, taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or other Region, geographical region, or a Local government, municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted with a rent tax, which is based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned withi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tobacco

Tobacco is the common name of several plants in the genus '' Nicotiana'' of the family Solanaceae, and the general term for any product prepared from the cured leaves of these plants. More than 70 species of tobacco are known, but the chief commercial crop is ''N. tabacum''. The more potent variant ''N. rustica'' is also used in some countries. Dried tobacco leaves are mainly used for smoking in cigarettes and cigars, as well as pipes and shishas. They can also be consumed as snuff, chewing tobacco, dipping tobacco, and snus. Tobacco contains the highly addictive stimulant alkaloid nicotine as well as harmala alkaloids. Tobacco use is a cause or risk factor for many deadly diseases, especially those affecting the heart, liver, and lungs, as well as many cancers. In 2008, the World Health Organization named tobacco use as the world's single greatest preventable cause of death. Etymology The English word 'tobacco' originates from the Spanish word ''taba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jet Fuel

Jet fuel or aviation turbine fuel (ATF, also abbreviated avtur) is a type of aviation fuel designed for use in aircraft powered by Gas turbine, gas-turbine engines. It is colorless to straw-colored in appearance. The most commonly used fuels for commercial aviation are Jet A and Jet A-1, which are produced to a standardized international specification. The only other jet fuel commonly used in civilian turbine-engine powered aviation is Jet B, which is used for its enhanced cold-weather performance. Jet fuel is a mixture of a variety of hydrocarbons. Because the exact composition of jet fuel varies widely based on petroleum source, it is impossible to define jet fuel as a ratio of specific hydrocarbons. Jet fuel is therefore defined as a performance specification rather than a chemical compound. Furthermore, the range of molecular mass between hydrocarbons (or different carbon numbers) is defined by the requirements for the product, such as the freezing point or smoke point. Keros ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Gas

Natural gas (also fossil gas, methane gas, and gas) is a naturally occurring compound of gaseous hydrocarbons, primarily methane (95%), small amounts of higher alkanes, and traces of carbon dioxide and nitrogen, hydrogen sulfide and helium. Methane is a colorless and odorless gas, and, after carbon dioxide, is the second-greatest greenhouse gas that contributes to global climate change. Because natural gas is odorless, a commercial odorizer, such as Methanethiol (mercaptan brand), that smells of hydrogen sulfide (rotten eggs) is added to the gas for the ready detection of gas leaks. Natural gas is a fossil fuel that is formed when layers of organic matter (primarily marine microorganisms) are thermally decomposed under oxygen-free conditions, subjected to intense heat and pressure underground over millions of years. The energy that the decayed organisms originally obtained from the sun via photosynthesis is stored as chemical energy within the molecules of methane and other ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gasoline

Gasoline ( North American English) or petrol ( Commonwealth English) is a petrochemical product characterized as a transparent, yellowish, and flammable liquid normally used as a fuel for spark-ignited internal combustion engines. When formulated as a fuel for engines, gasoline is chemically composed of organic compounds derived from the fractional distillation of petroleum and later chemically enhanced with gasoline additives. It is a high-volume profitable product produced in crude oil refineries. The ability of a particular gasoline blend to resist premature ignition (which causes knocking and reduces efficiency in reciprocating engines) is measured by its octane rating. Tetraethyl lead was once widely used to increase the octane rating but is not used in modern automotive gasoline due to the health hazard. Aviation, off-road motor vehicles, and racing car engines still use leaded gasolines. Other substances are frequently added to gasoline to improve chemical st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diesel Fuel

Diesel fuel, also called diesel oil, heavy oil (historically) or simply diesel, is any liquid fuel specifically designed for use in a diesel engine, a type of internal combustion engine in which fuel ignition takes place without a spark as a result of compression of the inlet air and then injection of fuel. Therefore, diesel fuel needs good compression ignition characteristics. The most common type of diesel fuel is a specific fractional distillation, fractional distillate of petroleum fuel oil, but alternatives that are not derived from petroleum, such as biodiesel, biomass to liquid (BTL) or gas to liquid (GTL) diesel are increasingly being developed and adopted. To distinguish these types, petroleum-derived diesel is sometimes called petrodiesel in some academic circles. Diesel is a high-volume product of oil refineries. In many countries, diesel fuel is standardized. For example, in the European Union, the standard for diesel fuel is EN 590. Ultra-low-sulfur diesel (ULSD) i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |