|

Taxation In Hong Kong

Under Article 108 of the Basic Law of Hong Kong, the taxation system in Hong Kong is independent of, and different from, the taxation system in mainland China. In addition, under Article 106 of the Hong Kong Basic Law, Hong Kong has independent public finance, and no tax revenue is handed over to the Central Government in China. The taxation system in Hong Kong is generally considered to be one of the simplest, most transparent and straightforward systems in the world. Taxes are collected through the Inland Revenue Department (IRD). Since the Common Law System is applied in Hong Kong, judgements by the Courts and Boards of Review in tax law cases are used to assist the interpretation of taxation rules and concepts. Furthermore, the Inland Revenue Department issues Departmental Interpretation and Practice Notes (DIPNs) from time to time to clarify and elaborate on the tax rules and to smooth the tax collection process. Taxes collected in Hong Kong can be generally classified a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Law Of Hong Kong

The Basic Law of the Hong Kong Special Administrative Region of the People's Republic of China is a national law of China that serves as the organic law for the Hong Kong Special Administrative Region (HKSAR). With nine chapters, 160 articles and three annexes, the Basic Law was composed to implement Annex I of the 1984 Sino-British Joint Declaration. The Basic Law was enacted under the Constitution of China when it was adopted by the National People's Congress on 4 April 1990 and came into effect on 1 July 1997 after the handover of Hong Kong. It replaced Hong Kong's colonial constitution of the Letters Patent and the Royal Instructions. Drafted on the basis of the Joint Declaration, the Basic Law lays out the basic policies of China on Hong Kong, including the "one country, two systems" principle, such that the socialist governance and economic system then practised in mainland China would not be extended to Hong Kong. Instead, Hong Kong would continue its capitalist sy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In China

Taxes provide the most important revenue source for the Government of the People's Republic of China. Value-added tax (VAT) produces the largest share of tax revenue in China and corporate income tax producing the next largest share. Tax is a key component of macro-economic policy, and greatly affects China's economic and social development. With the changes made since the 1994 tax reform, China has sought to set up a streamlined tax system geared to a socialist market economy. Most taxes are based on regulations established by the State Council. Detailed tax rules are established by the State Council Committee on Tariff Regulations, the Ministry of Finance, the State Taxation Administration, and the Customs Office. A few kinds of taxes are based on laws passed by the National People's Congress. Types of taxes VAT produces the largest share of China's tax revenue. Corporate income tax is the next largest. Taxes in China include: *Turnover taxes. This includes VAT and Cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the world. Hong Kong was established as a colony of the British Empire after the Qing dynasty ceded Hong Kong Island in 1841–1842 as a consequence of losing the First Opium War. The colony expanded to the Kowloon Peninsula in 1860 and was further extended when the United Kingdom obtained a 99-year lease of the New Territories in 1898. Hong Kong was occupied by Japan from 1941 to 1945 during World War II. The territory was handed over from the United Kingdom to China in 1997. Hong Kong maintains separate governing and economic systems from that of mainland China under the principle of one country, two systems. Originally a sparsely populated area of farming and fishing villages,. the territory is now one of the world's most signific ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inland Revenue Department (Hong Kong)

The Inland Revenue Department (IRD) is the Hong Kong government department responsible for collecting taxes and duties. History The Inland Revenue Department was established on 1 April 1947. Initially it administered only one piece of legislation, the Inland Revenue Ordinance, which was enacted on 3 May 1947. The department subsequently absorbed various elements of the Treasury, including the Estate Duty Office (in 1949), the Stamp Duty Office (1956), and responsibility for collection of entertainments, bets and sweeps, and public dance-halls taxes (1956). In December 1979, the department's headquarters moved to Windsor House in Causeway Bay, a building that was specially designed with a second lift core for the department. In order to save on rental costs, the department moved again, in December 1991, to the eponymous government-owned Revenue Tower in Wanchai, where it remains headquartered as of 2020. Ordinances administered The IRD is responsible for the administration ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Law

Common law (also known as judicial precedent, judge-made law, or case law) is the body of law primarily developed through judicial decisions rather than statutes. Although common law may incorporate certain statutes, it is largely based on precedent—judicial rulings made in previous similar cases. The presiding judge determines which precedents to apply in deciding each new case. Common law is deeply rooted in Precedent, ''stare decisis'' ("to stand by things decided"), where courts follow precedents established by previous decisions. When a similar case has been resolved, courts typically align their reasoning with the precedent set in that decision. However, in a "case of first impression" with no precedent or clear legislative guidance, judges are empowered to resolve the issue and establish new precedent. The common law, so named because it was common to all the king's courts across England, originated in the practices of the courts of the English kings in the centuries fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

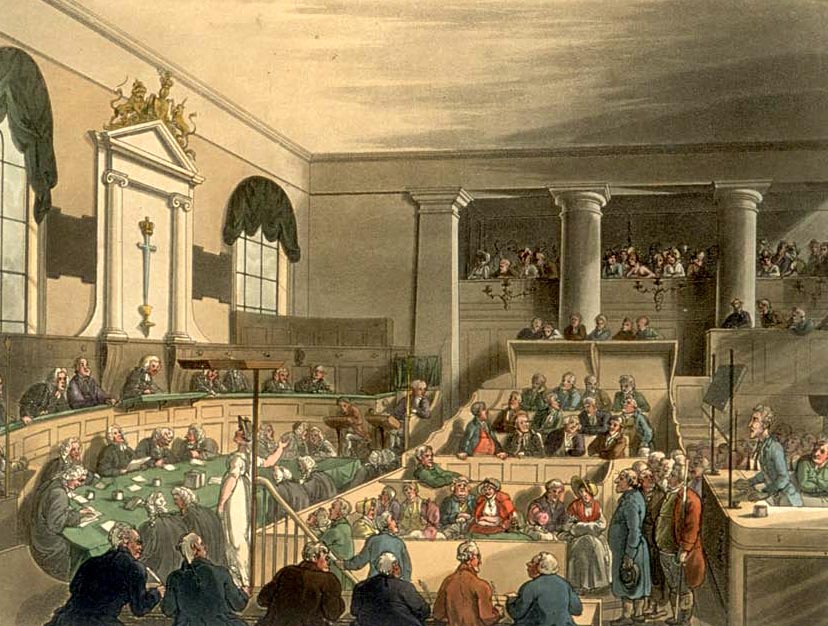

Courts And Boards Of Review

A court is an institution, often a government entity, with the authority to adjudicate legal disputes between parties and administer justice in civil, criminal, and administrative matters in accordance with the rule of law. Courts generally consist of judges or other judicial officers, and are usually established and dissolved through legislation enacted by a legislature. Courts may also be established by constitution or an equivalent constituting instrument. The practical authority given to the court is known as its jurisdiction, which describes the court's power to decide certain kinds of questions, or petitions put to it. There are various kinds of courts, including trial courts, appellate courts, administrative courts, international courts, and tribunals. Description A court is any person or institution, often as a government institution, with the authority to adjudicate legal disputes between parties and carry out the administration of justice in civil, criminal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Tax

Although the actual definitions vary between jurisdictions, in general, a direct tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a distinction between direct and indirect taxes depending on whether the tax payer is the actual taxpayer or if the amount of tax is supported by a third party, usually a client. The term may be used in economic and political analyses, and may have legal implications in some jurisdictions. In the United States of America, the term has special constitutional significance because of two provisions in the U.S. Constitution that any ''direct taxes'' imposed by the national government be apportioned among the states on the basis of population. It is also significant in the European Union, where direct taxation remains the sole responsibility of member states. General meaning In general, a direct tax is one imposed upon an individual person (juristic person, jurist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inland Revenue Ordinance

The Inland Revenue Ordinance is one of Hong Kong's Ordinances. It regulates the inland revenue of Hong Kong. Most commonly used sections Interpretation IRO Section.2 Interpretation of some terms using in the ordinance. Property tax IRO Section.5 Charge of property tax IRO Section.5B Ascertainment of assessable value IRO Section.7C Rental Bad debts (irrecoverable & recovered) Salaries tax IRO Section.8 Charge of salaries tax IRO Section.9 Definition of income from employment Profit tax IRD Rules 5 Charge of Profit tax in respect of non-resident IRO Section.14 Charge of profits tax IRO Section.15 Certain amounts deemed trading receipts IRO Section.16 Ascertainment of chargeable profits IRO Section.17 Deductions not allowed Tax computation IRO Section.18 Basis for computing profits IRO Section.18F Adjustment of assessable profits IRO Section.19 Treatment of losses IRO Section.20 Liability of certain non-resident persons IRO Section.20A Consignment Tax IRO ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., the effect and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natural) on whom it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge University Press

Cambridge University Press was the university press of the University of Cambridge. Granted a letters patent by King Henry VIII in 1534, it was the oldest university press in the world. Cambridge University Press merged with Cambridge Assessment to form Cambridge University Press and Assessment under Queen Elizabeth II's approval in August 2021. With a global sales presence, publishing hubs, and offices in more than 40 countries, it published over 50,000 titles by authors from over 100 countries. Its publications include more than 420 academic journals, monographs, reference works, school and university textbooks, and English language teaching and learning publications. It also published Bibles, runs a bookshop in Cambridge, sells through Amazon, and has a conference venues business in Cambridge at the Pitt Building and the Sir Geoffrey Cass Sports and Social Centre. It also served as the King's Printer. Cambridge University Press, as part of the University of Cambridge, was a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sole Proprietor

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by only one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people. The sole trader receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are that of the proprietor; the business is not a separate legal entity. The arrangement is a "sole" proprietorship in contrast with a partnership, which has at least two owners. Sole proprietors may use a trade name or business name other than their legal name. They may have to trademark their business name legally if it differs from their own legal name, with the process varying depending upon country of residence. Advantages and disadv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |