|

Taxation In Armenia

Taxation in Armenia is regulated by the State Revenue Committee, which is the tax authority of the Armenian government. Meanwhile, the Armenian Tax Service is responsible for the collection of taxes, providing revenue services, preventing tax fraud and tax evasion, and implementing various tax reform programs in conjunction with the State Revenue Committee. Type of tax Employee income tax From 1 January 2020, Armenia switched to a flat income taxation system, which, regardless of the amount, will tax wages at 23%. Moreover, until 2023 the taxation rate will gradually decrease from 23% to 20%. Corporate income tax Reforms adopted in June 2019, aims to boost medium-term economic activity and to increase tax compliance. Among other measures, the corporate income tax was reduced by two percentage points to 18.0 per cent and the tax on dividends for non-resident organizations halved to 5.0 per cent. Special taxation for small business From 1 January 2020, Armenia abandoned ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Revenue Committee (Armenia)

The State Revenue Committee (SRC) () is the tax and customs authority of the Armenian government, headquartered in Yerevan. The State Revenue Committee is the regulating body, established under Law of Armenia, Armenian law, to regulate tax services, customs regulations, and customs services in Armenia. The committee works closely with the Central Bank of Armenia and directly oversees the Armenian Customs Service and the Armenian Tax Service. International cooperation Former Head of the SRC, Suren Adamyan, stated that “In the field of tax administration reforms the SRC closely collaborates with the International Monetary Fund, World Bank, United States Agency for International Development, U.S. Agency for International Development, and the European Union. Armenia became a full Member states of the World Customs Organization, member of the World Customs Organization in 1992. The SRC joined the Intra-European Organisation of Tax Administrations in 2010. Suren Adamyan stated, "Our p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

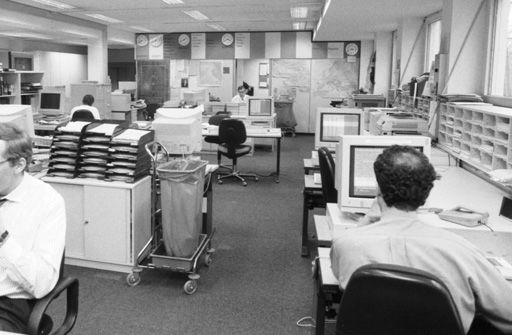

RFE/RL

Radio Free Europe/Radio Liberty (RFE/RL) is a media organization broadcasting news and analyses in 27 languages to 23 countries across Eastern Europe, Central Asia, the Caucasus, and the Middle East. Headquartered in Prague since 1995, RFE/RL operates 21 local bureaus with over 500 core staff, 1,300 freelancers, and 680 employees. Nicola Careem serves as the editor-in-chief. Founded during the Cold War, RFE began in 1949 targeting Soviet satellite states, while RL, established in 1951, focused on the Soviet Union. Initially funded covertly by the CIA until 1972, the two merged in 1976. RFE/RL was headquartered in Munich from 1949 to 1995, with additional broadcasts from Portugal's Glória do Ribatejo until 1996. Soviet authorities jammed their signals, and communist regimes often infiltrated their operations. Today, RFE/RL is a private 501(c)(3) corporation supervised by the United States Agency for Global Media, which oversees all government-supported international broa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Armenia

Taxation in Armenia is regulated by the State Revenue Committee, which is the tax authority of the Armenian government. Meanwhile, the Armenian Tax Service is responsible for the collection of taxes, providing revenue services, preventing tax fraud and tax evasion, and implementing various tax reform programs in conjunction with the State Revenue Committee. Type of tax Employee income tax From 1 January 2020, Armenia switched to a flat income taxation system, which, regardless of the amount, will tax wages at 23%. Moreover, until 2023 the taxation rate will gradually decrease from 23% to 20%. Corporate income tax Reforms adopted in June 2019, aims to boost medium-term economic activity and to increase tax compliance. Among other measures, the corporate income tax was reduced by two percentage points to 18.0 per cent and the tax on dividends for non-resident organizations halved to 5.0 per cent. Special taxation for small business From 1 January 2020, Armenia abandoned ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rates Of Europe

This is a list of the maximum potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to either the corporation or the individual in the listed country. Graphs File:Top Marginal Tax Rates In Europe.webp, Top Marginal Tax Rates In Europe 2022 10% 20% 30% 40% 50% 60% File:Payroll and income tax by country.png, Payroll and income tax by OECD Country (2021) File:Federal Sales Taxes.png, Federal Sales Taxes Summary list The quoted income tax rate is, except where noted, the top rate of tax: most jurisdictions have lower rate of taxes for low levels of income. Some countries also have lower rates of corporation tax for smaller companies. In 1980, the top rates of most European countries were above 60%. Today most European countries have rates below 50%. Per country information: income tax bands Austria Austria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ministry Of Finance (Armenia)

The Ministry of Finance of Armenia () is a republican body of executive authority, which elaborates and implements the policies of the Republic of Armenia Government in the areas of fiscal revenue collection, public finance administration. Former Ministers First Republic of Armenia * Khachatur Karchikyan (06.07.1918-04.11.1918) * Artashes Enfiajyan (04.11.1918-24.06.1919) * Grigor Jaghetyan (24.06.1919-05.08.1919) *Sargis Araratyan (10.08.1919-05.05.1920) *Abraham Gyulkhandanyan (05.05.1920-23.11.1920) * Hambardzum Terteryan (25.11.1920-02.12.1920) Source: Republic of Armenia * Janik Janoyan (18.09.1990-16.02.1993) * Levon Barkhudaryan (1993-1997) * Armen Darbinyan (15.05.1997-10.04.1998) * Edward Sandoyan (20.04.1998-15.06.1999) * Levon Barkhudaryan (15.06.1999-11.11.2000) * Vardan Khachatryan (11.11.2000-09.04.2008) * Tigran Davtyan (21.04.2008-17.12.2010) * Vache Gabrielyan (17.12.2010-09.04.2013) * Davit Sargsyan (09.05.2013-26.04.2014) * Gagik Khachatryan (26 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Countries By Tax Revenue As Percentage Of GDP

This article lists countries alphabetically, with total tax revenue as a percentage of gross domestic product (GDP) for the listed countries. The tax percentage for each country listed in the source has been added to the chart. According to World Bank, "GDP at purchaser's prices is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. Data are in current U.S. dollars. Dollar figures for GDP are converted from domestic currencies using single year official exchange rates. For a few countries where the official exchange rate does not reflect the rate effectively applied to actual foreign exchange transactions, an alternative conversion factor is used. Tax revenue refers to compulsory transfers to the central government for public purposes. Cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Countries By Tax Rates

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the Tax incidence, tax burden falls differently on different groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, Income tax, individual income tax, capital gains tax, wealth tax (excl. property tax), property tax, inheritance tax and sales tax (incl. Value-added tax, VAT and GST). Personal income tax includes all applicable taxes, including all unvested social security contributions. Vested social security contributions are not included as they contribute to the personal wealth and will be paid back upon retirement or emigration, either as lump sum or as pension. Only social security contributions without a ceiling can be included in the highest marginal tax rate as only those are effectively a tax for general distribution among the population. The table is not exhaustive in representing the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Armenia

The economy of Armenia grew by 5.9% in 2024, according to estimates by the International Monetary Fund, with total output amounting to $25.5 billion. GDP contracted sharply in 2020 by 7.1%, mainly due to the COVID-19 recession and the Second Nagorno-Karabakh War, Second Nagorno-Karabakh War with Azerbaijan. In contrast it grew by 7.6% in 2019, 5.8% in 2021, 12.6% in 2022 and 8.3% in 2023. Between 2012 and 2018 GDP grew 40.7%, and key banking indicators like assets and credit exposures almost doubled. While part of the Soviet Union, the economy of Armenian Soviet Socialist Republic, Armenia was based largely on manufacturing industry—chemicals, electronic products, machinery, processed food, synthetic rubber and textiles; it was highly dependent on outside resources. Armenian mines produce copper, zinc, gold and lead. The vast majority of energy is produced with imported fuel from Russia, including gas and nuclear fuel for Armenia's Armenian Nuclear Power Plant, Metsamor nuclear ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the Member states of the United Nations, 193 countries with UN membership employ a VAT, including all OECD members except the Tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Armenian Government

The Government of the Republic of Armenia () or the executive branch of the Armenian government is an executive council of government ministers in Armenia. It is one of the three main governmental branches of Armenia and is headed by the Prime Minister of Armenia. Current government The incumbent government of Armenia is led by Prime Minister Nikol Pashinyan who, as leader of Civil Contract (the party which won elections in December 2018), was appointed prime minister on 14 January 2019 by President Armen Sarkissian. Powers Powers of Government granted by former revision of Constitution (accepted in 2005) Resignation of the Government and its formation Following the Article 55 of Armenian Constitution, the Republic's president must accept resignation of the government on the day of # first sitting of newly elected Nation Assembly # assumption of the office by the president of the Republic # expression of the vote of no confidence to the Government # resignation of the prim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Armenian Dram

The Armenian dram (; Armenian dram sign, sign: ֏; abbreviation: դր.; ISO 4217, ISO code: AMD) is the currency of Armenia. It was historically subdivided into 100 luma (). The Central Bank of Armenia is responsible for issuance and circulation of dram banknotes and coins, as well as implementing the monetary policy of Armenia. The word ''dram'' means "money" and is cognate with the Greek Modern drachma, drachma and the Arabic dirham, as well as the English weight unit Dram (unit), dram. History The first instance of a "dram" currency was in the period from 1199 to 1375, when silver coins called ''dram'' or ''tram'' were issued. Dram or Takvorin coinage would periodically continue to be produced for some time until the loss of Armenia's independence. The establishment of Russian Armenia saw the adoption of the Imperial ruble, followed by a series of attempts to localize the Russian ruble under the Soviet Union and Commonwealth of Independent States (CIS). On 21 September 199 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |