|

Tax Reduction Act Of 1975

The United States Tax Reduction Act of 1975 provided a 10-percent rebate on 1974 tax liability ($200 cap). It created a temporary $30 general tax credit for each taxpayer and dependent. It started the Earned Income Tax Credit (EITC), which, at the time, provided an income tax credit to certain individuals.Dilworth, Kevin (November 3, 1975).12,000 may get break in taxes. ''Democrat and Chronicle'' (Rochester, New York). p. 1B, 6B. The EITC gave a tax credit to individuals who had at least one dependent, maintained a household, and had earned income of less than $8,000 during the year. The tax credit was $400 for individuals with earned income of less than $4,000. The tax credit was an amount less than $400 for individuals whose income was between $4,000 and $7,999 during the year. The investment tax credit was temporarily increased to 10 percent through 1976. The minimum standard deduction was temporarily increased to $1,900 (joint returns) for one year. For one year, the perce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code Of 1954

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was the Int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Al Ullman

Albert Conrad Ullman (March 9, 1914 – October 11, 1986) was an American politician in the Democratic Party who represented in the United States House of Representatives from 1957 to 1981. One of the most influential Oregonians ever to be elected to Congress, along with Senator Wayne Morse, Ullman presided over the powerful House Committee on Ways and Means during a period of time in which he was deeply involved in shaping national policy on issues relating to taxation, budget reform, federal entitlement programs, international trade, and energy. Background Ullman was born in Great Falls, Montana, and raised initially at Gildford, Montana, after which the family moved to Cathcart, near Snohomish, Washington, where his father ran a small country grocery store. Two of his grandparents were German immigrants, and the other two had emigrated from Bohemia, then part of the Austro-Hungarian Empire. In 1935, he graduated from Whitman College in Walla Walla, Washington (where he played ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Democratic Party (United States)

The Democratic Party is a Centre-left politics, center-left political parties in the United States, political party in the United States. One of the Major party, major parties of the U.S., it was founded in 1828, making it the world's oldest active political party. Its main rival since the 1850s has been the Republican Party (United States), Republican Party, and the two have since dominated American politics. The Democratic Party was founded in 1828 from remnants of the Democratic-Republican Party. Senator Martin Van Buren played the central role in building the coalition of state organizations which formed the new party as a vehicle to help elect Andrew Jackson as president that year. It initially supported Jacksonian democracy, agrarianism, and Manifest destiny, geographical expansionism, while opposing Bank War, a national bank and high Tariff, tariffs. Democrats won six of the eight presidential elections from 1828 to 1856, losing twice to the Whig Party (United States) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

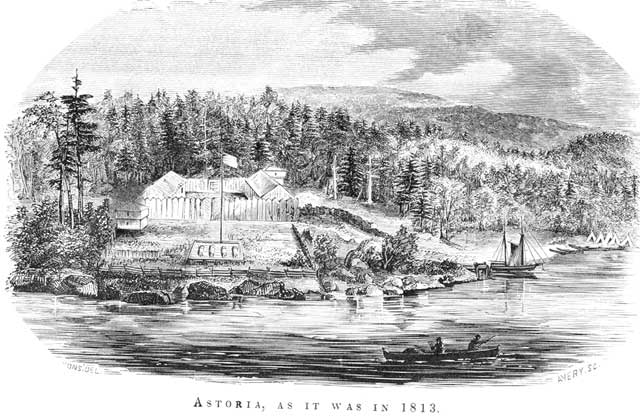

Oregon

Oregon ( , ) is a U.S. state, state in the Pacific Northwest region of the United States. It is a part of the Western U.S., with the Columbia River delineating much of Oregon's northern boundary with Washington (state), Washington, while the Snake River delineates much of its eastern boundary with Idaho. The 42nd parallel north, 42° north parallel delineates the southern boundary with California and Nevada. The western boundary is formed by the Pacific Ocean. Oregon has been home to many Indigenous peoples of the Americas, indigenous nations for thousands of years. The first European traders, explorers, and settlers began exploring what is now Oregon's Pacific coast in the early to mid-16th century. As early as 1564, the Spanish expeditions to the Pacific Northwest, Spanish began sending vessels northeast from the Philippines, riding the Kuroshio Current in a sweeping circular route across the northern part of the Pacific. In 1592, Juan de Fuca undertook detailed mapping a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Committee On Ways And Means

The Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other programs including Social Security, unemployment benefits, Medicare, the enforcement of child support laws, Temporary Assistance for Needy Families, foster care, and adoption programs. Members of the Ways and Means Committee are not allowed to serve on any other House Committee unless they are granted a waiver from their party's congressional leadership. It has long been regarded as the most prestigious committee of the House of Representatives. The United States Constitution requires that all bills regarding taxation must originate in the U.S. House of Representatives, and House rules dictate that all bills regarding taxation must pass through Ways and Means. This system imparts upon the committee and its members a significant degree of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gerald Ford

Gerald Rudolph Ford Jr. (born Leslie Lynch King Jr.; July 14, 1913December 26, 2006) was the 38th president of the United States, serving from 1974 to 1977. A member of the Republican Party (United States), Republican Party, Ford assumed the presidency after the resignation of President Richard Nixon, under whom he had served as the 40th vice president of the United States, vice president from 1973 to 1974 following Spiro Agnew's resignation. Prior to that, he served as a member of the U.S. House of Representatives from 1949 to 1973. Ford was born in Omaha, Nebraska, and raised in Grand Rapids, Michigan. He attended the University of Michigan, where he played for Michigan Wolverines football, the university football team, before eventually attending Yale Law School. Afterward, he served in the U.S. Naval Reserve from 1942 to 1946. Ford began his political career in 1949 as the U.S. representative from Michigan's 5th congressional district, serving in this capacity for nearly 25 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. The earned income tax credit has been part of political debates in the United States over ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable. The standard deduction is available to individuals who are US citizens or resident aliens. The standard deduction is based on filing status and typically increases each year, based on inflation measurements from the previous year. It is not available to nonresident aliens residing in the United States (with few exceptions, for example, students from India on F1 visa status can use the standard deduction). Additional amounts are available for persons who are blind and/or are at least 65 years of age. The standard deduction is distinct from the personal exemption, which was set to $0 by the Tax Cuts and Jobs Act of 2017 for tax yea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adjusted Gross Income

In the United States income tax system, adjusted gross income (AGI) is an individual's total gross income minus specific deductions. It is used to calculate taxable income, which is AGI minus allowances for personal exemptions and itemized deductions. For most individual tax purposes, AGI is more relevant than gross income. Gross income is sales price of goods or property, minus cost of the property sold, plus other income. It includes wages, interest, dividends, business income, rental income, and all other types of income. Adjusted gross income is gross income less deductions from a business or rental activity and 21 other specific items. Several deductions (''e.g.'' medical expenses and miscellaneous itemized deductions) are limited based on a percentage of AGI. Certain phase outs, including those of lower tax rates and itemized deductions, are based on levels of AGI. Many states base state income tax on AGI with certain deductions. Adjusted gross income is calculat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

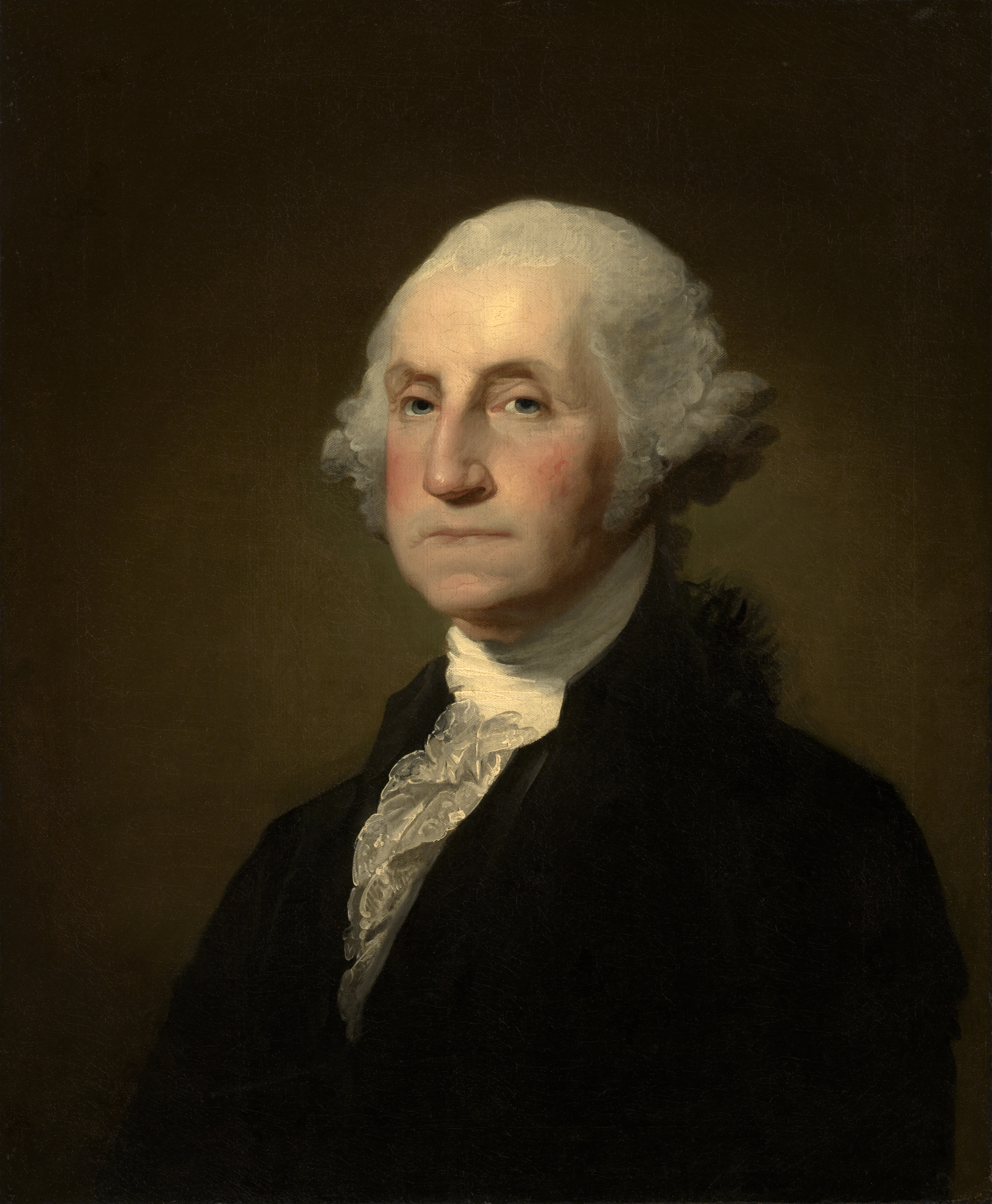

President Of The United States

The president of the United States (POTUS) is the head of state and head of government of the United States. The president directs the Federal government of the United States#Executive branch, executive branch of the Federal government of the United States, federal government and is the Powers of the president of the United States#Commander-in-chief, commander-in-chief of the United States Armed Forces. The power of the presidency has grown since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasing role in American political life since the beginning of the 20th century, carrying over into the 21st century with some expansions during the presidencies of Presidency of Franklin D. Roosevelt, Franklin D. Roosevelt and Presidency of George W. Bush, George W. Bush. In modern times, the president is one of the world's most powerful political figures and the leader of the world's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Taxation Legislation

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film * ''The United'' (film), an unreleased Arabic-language film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe * "United (Who We Are)", a song by XO-IQ, featured in the television ser ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |