|

Store Of Value

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved. The most common store of value in modern times has been money, currency, or a commodity like a precious metal or financial capital. The point of any store of value is risk management due to a stable demand for the underlying asset. Money as a store of value Monetary economics is the branch of economics which analyses the functions of money. Storage of value is one of the three generally accepted functions of money. The other functions are the medium of exchange, which is used as an intermediary to avoid the inconveniences of the coincidence of wants, and the unit of account, which allows the value of various goods, services, assets and liabilities to be rendered in multiples of the same unit. Money is well-suited to storing value because of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. ''Total assets'' can also be called the ''balance sheet total''. Assets can be grouped into two major classes: Tangible property, tangib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saving

Saving is income not spent, or deferred Consumption (economics), consumption. In economics, a broader definition is any income not used for immediate consumption. Saving also involves reducing expenditures, such as recurring Cost, costs. Methods of saving include putting money in, for example, a savings account, a pension, pension account, an investment fund, or kept as cash. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher. Saving does not automatically include interest. ''Saving'' differs from ''savings''. The former refers to the act of not consuming one's assets, whereas the latter refers to either multiple opportunities to reduce costs; or one's assets in the form of cash. Saving refers to an activity occurring over time, a stock and flow, flow variable, whereas savings refers to something that exists at any one time, a stock and flow, stock variable. This disti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Tender

Legal tender is a form of money that Standard of deferred payment, courts of law are required to recognize as satisfactory payment in court for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which, when offered ("tendered") in payment of a debt, extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. It is generally only mandatory to recognize the payment of legal tender in the discharge of a monetary debt from a debtor to a creditor. Sellers offering to enter into contractual relationship, such as a contract for the sale of goods, do not need to accept legal tender and may instead contractually require payment using electronic methods, foreign currencies or any other legally recognized object of value. Coins and banknotes are usually defined as legal tender in many countries, but personal cheque, checks, credit c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit (finance)

A deposit is the act of placing cash (or cash equivalent) with some entity, most commonly with a financial institution, such as a bank. The deposit is a credit for the party (individual or organization) who placed it, and it may be taken back (withdrawn) in accordance with the terms agreed at time of deposit, transferred to some other party, or used for a purchase at a later date. Deposits are usually the main source of funding for banks. Types Demand deposit A demand deposit is a deposit that can be withdrawn or otherwise debited on short notice. Transaction accounts (known as "checking" or "current" accounts depending on the country) can be used to pay other parties, while savings accounts are typically payable only to the depositor or another bank account, and may have limits on the frequency of withdrawal. Time deposit Deposits which are kept for any specific time period are called time deposit or often as term deposit. * Term deposit (or ''time deposit''), bear a fixed t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developed Country

A developed country, or advanced country, is a sovereign state that has a high quality of life, developed economy, and advanced technological infrastructure relative to other less industrialized nations. Most commonly, the criteria for evaluating the degree of economic development are the gross domestic product (GDP), gross national product (GNP), the per capita income, level of industrialization, amount of widespread infrastructure and general standard of living. Which criteria are to be used and which countries can be classified as being developed are subjects of debate. Different definitions of developed countries are provided by the International Monetary Fund and the World Bank; moreover, HDI ranking is used to reflect the composite index of life expectancy, education, and income per capita. In 2025, 40 countries fit all three criteria, while an additional 21 countries fit two out of three. Developed countries have generally more advanced post-industrial economies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coins

A coin is a small object, usually round and flat, used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by a government. Coins often have images, numerals, or text on them. The faces of coins or medals are sometimes called the ''obverse'' and the ''reverse'', referring to the front and back sides, respectively. The obverse of a coin is commonly called ''heads'', because it often depicts the head of a prominent person, and the reverse is known as ''tails''. The first metal coins – invented in the ancient Greek world and disseminated during the Hellenistic period – were precious metal–based, and were invented in order to simplify and regularize the task of measuring and weighing bullion (bulk metal) carried around for the purpose of transactions. They carried their value within the coins themselves, but the stampings also induced manipu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paper Money

Paper money, often referred to as a note or a bill (North American English), is a type of negotiable promissory note that is payable to the bearer on demand, making it a form of currency. The main types of paper money are government notes, which are directly issued by political authorities, and banknotes issued by banks, namely banks of issue including central banks. In some cases, paper money may be issued by other entities than governments or banks, for example merchants in pre-modern China and Japan. "Banknote" is often used synonymously for paper money, not least by collectors, but in a narrow sense banknotes are only the subset of paper money that is issued by banks. Paper money is often, but not always, legal tender, meaning that courts of law are required to recognize them as satisfactory payment of money debts. Counterfeiting, including the forgery of paper money, is an inherent challenge. It is countered by anticounterfeiting measures in the printing of paper money. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash

In economics, cash is money in the physical form of currency, such as banknotes and coins. In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately (as in the case of money market accounts). Cash is seen either as a reserve for payments, in case of a structural or incidental negative cash flow or as a way to avoid a downturn on financial markets. Etymology The English word ''cash'' originally meant , and later came to have a secondary meaning . This secondary usage became the sole meaning in the 18th century. The word ''cash'' comes from the Middle French , which comes from the Old Italian , and ultimately from the Latin . History In Western Europe, after the fall of the Western Roman Empire, coins, silver jewelry and hacksilver (silver objects hacked into pieces) were for centuries the only form of money, until Venetian merchants started using silver bars for larg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond Of National Loan Issued By Polish National Government 1863

Bond or bonds may refer to: Common meanings * Bond (finance), a type of debt security * Bail bond, a commercial third-party guarantor of surety bonds in the United States * Fidelity bond, a type of insurance policy for employers * Chemical bond, the attraction of atoms, ions or molecules to form chemical compounds * Emotional bond, an emotional attachment between one or more individuals. People * Bond (surname) * Bonds (surname) * Mr. Bond (musician), Austrian rapper Arts and entertainment * James Bond, a series of works about the eponymous fictional character * James Bond (literary character), a British secret agent in a series of novels and films * Bond (string quartet), an Australian/British string quartet ** '' Bond: Video Clip Collection'', a video collection from the band * Bond (Canadian band), a Canadian rock band in the 1970s * ''The Bond'' (2007 book), an American autobiography written by The Three Doctors * '' The Bond'', a 1918 film by Charlie Chaplin support ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demurrage Money

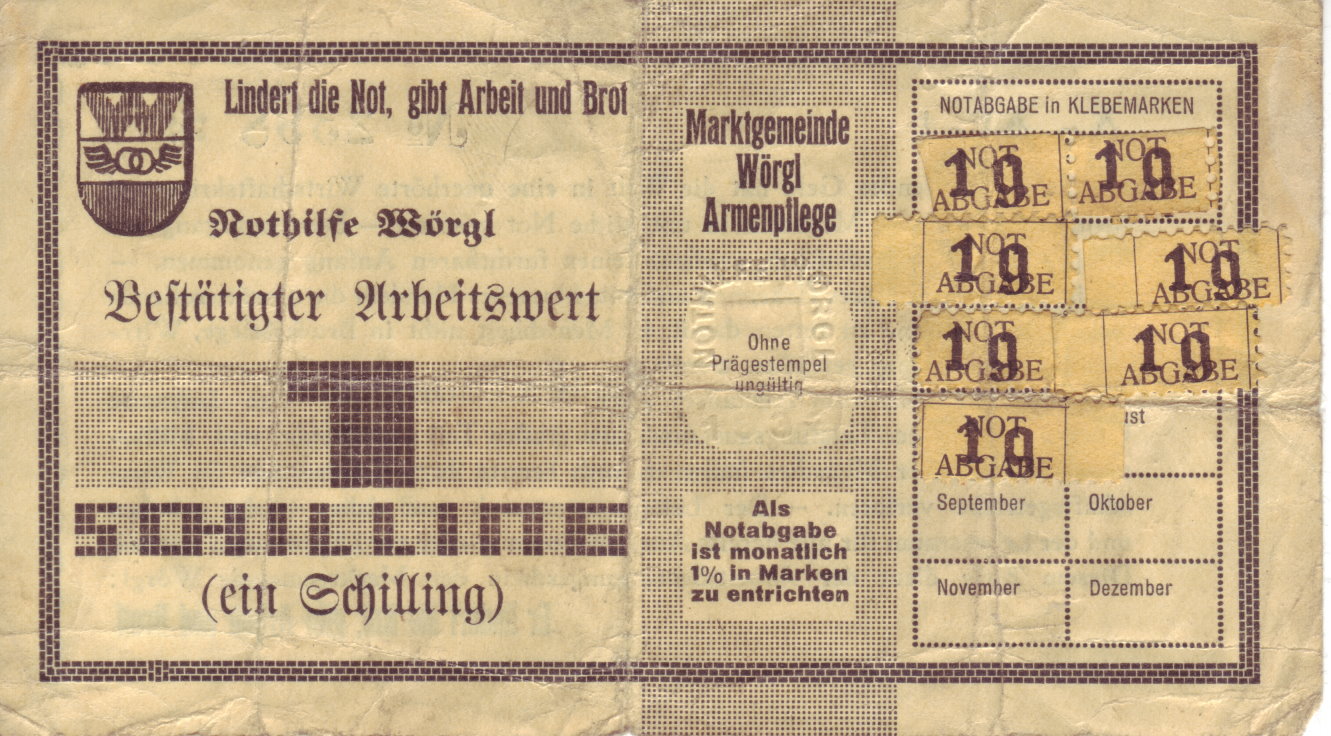

Demurrage currency, also known as depreciating money or stamp scrip in its paper money form, is a type of money that is designed to gradually lose purchasing power at a flat constant rate. Unlike traditional money, demurrage is designed to only be a ''temporary'' store of value. Demurrage money functions primarily as a medium of exchange and unit of account. In some cases, demurrage currencies have been employed as Notgeld, emergency currencies, intended to keep the circular flow of income running throughout the economy during recessions and times of war, due to their faster circulation velocities. Demurrage is sometimes cited as economically advantageous, usually in the context of complementary currency systems. The German-Argentine economist, Silvio Gesell, advocated for demurrage currency as part of the Freiwirtschaft economic system. He referred to demurrage as ''Freiwirtschaft#Freigeld, Freigeld'' 'free money' — "free" because it would be freed from hoarding and interest. Ge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.Milton Friedman, ''Money Mischief: Episodes in Monetary History'', Houghton Mifflin Harcourt (1994) p. 37. Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |