|

Stock Exchange Of Hong Kong

The Stock Exchange of Hong Kong (, SEHK, also known as Hong Kong Stock Exchange) is a stock exchange based in Hong Kong. It is one of the largest stock exchanges in Asia and the 9th largest globally by market capitalization as of August 2024. The exchange plays a crucial role in connecting international investors with mainland Chinese companies, serving as a major platform for capital raising. Unlike mainland Chinese exchanges, it operates under Hong Kong’s distinct regulatory framework, which allows greater access to foreign investors. The stock exchange is owned (through its subsidiary Stock Exchange of Hong Kong Limited) by Hong Kong Exchanges and Clearing Limited (HKEX), a holding company that it also lists () and that in 2021 became the world's largest bourse operator in terms of market capitalization, surpassing Chicago-based CME. A 2021 poll reported that approximately 57% of Hong Kong adults had money invested in the stock market. The physical trading floor at ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong Exchanges And Clearing

Hong Kong Exchanges and Clearing Limited (HKEX; ) operates a range of equity, commodity, fixed income and currency markets through its wholly owned subsidiaries The Stock Exchange of Hong Kong Limited (SEHK), Hong Kong Futures Exchange Limited (HKFE) and London Metal Exchange (LME). As of December 2024, HKEX has a market capitalization of approximately US$35 trillion and 2,631 listed companies, making it the List of major stock exchanges, 8th largest stock exchange globally. HKEX was the 10th largest stock exchange in terms of IPO proceeds in the first quarter of 2024. The Group also operates four clearing houses in Hong Kong: Hong Kong Securities Clearing Company Limited (HKSCC), HKFE Clearing Corporation Limited (HKCC), the SEHK Options Clearing House Limited (SEOCH) and OTC Clearing Hong Kong Limited (OTC Clear). HKSCC, HKCC and SEOCH provide Clearing (finance), integrated clearing, Settlement (finance), settlement, depository and nominee activities to their participants, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Clearing And Settlement System

Hong Kong Exchanges and Clearing Limited (HKEX; ) operates a range of equity, commodity, fixed income and currency markets through its wholly owned subsidiaries The Stock Exchange of Hong Kong Limited (SEHK), Hong Kong Futures Exchange Limited (HKFE) and London Metal Exchange (LME). As of December 2024, HKEX has a market capitalization of approximately US$35 trillion and 2,631 listed companies, making it the 8th largest stock exchange globally. HKEX was the 10th largest stock exchange in terms of IPO proceeds in the first quarter of 2024. The Group also operates four clearing houses in Hong Kong: Hong Kong Securities Clearing Company Limited (HKSCC), HKFE Clearing Corporation Limited (HKCC), the SEHK Options Clearing House Limited (SEOCH) and OTC Clearing Hong Kong Limited (OTC Clear). HKSCC, HKCC and SEOCH provide integrated clearing, settlement, depository and nominee activities to their participants, while OTC Clear provides OTC interest rate derivatives and non-del ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carrie Lam

Carrie Lam Cheng Yuet-ngor ( Cheng; ; born 13 May 1957) is a retired Hong Kong politician who served as the fourth Chief Executive of Hong Kong from 2017 to 2022, after serving as Chief Secretary for Administration for five years. After graduating from the University of Hong Kong, Lam joined the British Hong Kong civil service in 1980 and served in various government agencies, including as Director of Social Welfare from 2000 to 2004 and Director General of the Hong Kong Economic and Trade Office in London from 2004 to 2006. She became a key official in 2007 when she was appointed Secretary for Development. During her tenure, she earned the nickname "tough fighter" for her role in the controversial demolition of the Queen's Pier in 2008. Lam became Chief Secretary for Administration under the Leung Chun-ying administration in 2012. From 2013 to 2015 Lam headed the task force on the 2014 electoral reform and held talks with student and opposition leaders during the wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leung Chun-ying

Leung Chun-ying ( zh, t=梁振英; born 12 August 1954), also known as CY Leung, is a Hong Kong politician and chartered surveyor who has served as vice-chairman of the National Committee of the Chinese People's Political Consultative Conference since March 2017. He was previously the third Chief Executive of Hong Kong between 2012 and 2017. A surveyor by profession, Leung entered politics when he joined the Hong Kong Basic Law Consultative Committee (HKBLCC) in 1985 and became its secretary-general in 1988. In 1999, he was appointed the convenor of the Executive Council of Hong Kong, a position he held until 2011, when he resigned to run in the 2012 Chief Executive election. Initially regarded as the underdog, Leung ran a successful campaign against front-runner Henry Tang, receiving 689 votes from the Election Committee and with the support of the Liaison Office. At the beginning of his administration, Leung faced the anti- Moral and National Education protests and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tseung Kwan O

Tseung Kwan O New Town, commonly known as Tseung Kwan O ( zh, t=將軍澳新市鎮, j=Zoeng1 gwan1 ou3 san1 si5 zan3), is one of the nine New towns of Hong Kong, new towns in Hong Kong, built mainly on Land reclamation in Hong Kong, reclaimed land in the northern half of Junk Bay in southeastern New Territories, after which it is named. Development of the new town was approved in 1982, with the initial population intake occurring in 1988. As of 2016, the town is home to around 396,000 residents. The total development area of Tseung Kwan O, including its industrial estate, is about , with a planned population of 445,000. Major residential neighbourhoods within the new town include Tsui Lam Estate, Tsui Lam, Po Lam, Hang Hau, Tseung Kwan O Town Centre, Tiu Keng Leng (also known by its English name Rennie's Mill) and Siu Chik Sha, etc. Administratively, the new town belongs to Sai Kung District in southeastern New Territories, although it is often incorrectly regarded as part of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Growth Enterprise Market

Growth Enterprise Market (GEM) () is a board of the Stock Exchange of Hong Kong for growth companies that do not fulfill the requirements of profitability or track record for the main board of the exchange. Opened 1999. GEM operates on the philosophy of "buyers beware" and "let the market decide" based on a strong disclosure regime. Its rules and requirements are designed to foster a culture of self compliance by listed issuers and sponsors in the discharge of their respective responsibilities. The following major features are to support this philosophy: Greater, More Frequent and Timely Disclosure GEM requires a listing applicant to disclose in detail its past business history and its future business plans which are key components of the listing documents. After listing, a GEM issuer is required to make half yearly comparison of its business progress with the business plan for the first 2 financial years, publish quarterly accounts in addition to half yearly and annual accounts ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Asian Financial Crisis

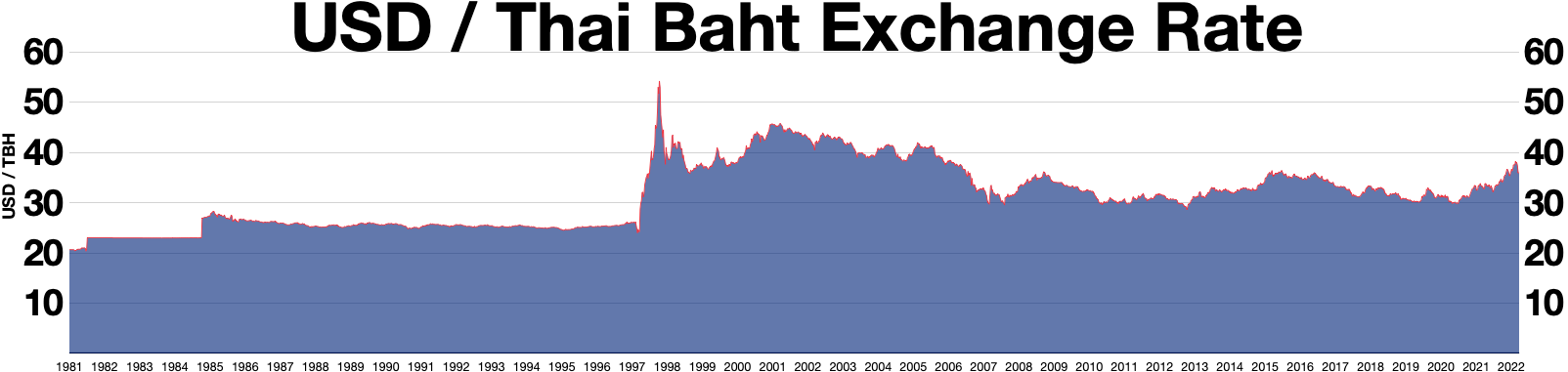

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tracker Fund Of Hong Kong

Tracker Fund of Hong Kong or TraHK is an index exchange-traded fund (ETF) which provides investment results that correspond to the performance of the Hang Seng Index in the Hong Kong stock market. History In 1998, the Hong Kong SAR Government acquired a substantial portfolio of Hong Kong shares to sustain linked exchange rate during the Asian Financial Crisis. To minimise disruption to the market, the Government chose to launch the Initial public offering (IPO) of an ETF, "the Tracker Fund of Hong Kong", in 1999 as the first step in its disposal programme. State Street Global Advisors was appointed as the Fund Manager and State Street Bank and Trust Company State Street Bank and Trust Company (SSBT), commonly known as State Street Global Services, is a subsidiary of State Street Corporation organized as a trust company based in Massachusetts. The company is the largest custodian bank in the world an ... was appointed as the Trustee of TraHK. In March 2022, Hang Seng I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

H Share

H shares () refer to the shares of companies incorporated in mainland China that are traded on the Hong Kong Stock Exchange. Many companies float their shares simultaneously on the Hong Kong market and one of the two mainland Chinese stock exchanges in Shanghai or Shenzhen, they are known as A+H companies. H shares are also held by a Street name securities, nominee service company "HKSCC Nominees Limited" (HKSCC for Hong Kong Securities Clearing Company), which was owned by Hong Kong Exchanges and Clearing. Price discrepancies between the H shares and the A share (mainland China), A share counterparts of the same company are not uncommon. A shares generally trade at a premium to H shares as the People's Republic of China government restricts mainland Chinese people from investing abroad and foreigners from investing in the A-share markets in mainland China. Tsingtao Brewery was the first enterprise to offer H-shares when it became the first Chinese firm listed on the Hong Kong ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ian Hay Davison

Ian Frederic Hay Davison (1931–2022) was an accountant, chairman, executive and bell ringer. He was the chief executive of Lloyd's of London from 1982 and helped to reform the insurer. In 1988, he led a report on the management and operations of the Hong Kong Stock Exchange, following its closure during the Black Monday crash of 1987. Defects were found and reforms recommended. In 1998, the Institute of Chartered Accountants in England and Wales The Institute of Chartered Accountants in England and Wales (ICAEW) is a professional membership organisation that promotes, develops and supports chartered accountants and students around the world. As of December 2024, it has over 210,000 memb ... recognised him with the Founding Societies’ Centenary Award for his outstanding contributions. He campaigned to reopen Templecombe railway station and became an enthusiastic bell ringer. References 1931 births 2022 deaths Alumni of the London School of Economics Briti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Monday (1987)

Black Monday (also known as Black Tuesday in some parts of the world due to time zone differences) was a global, severe and largely unexpected stock market crash on Monday, October 19, 1987. Worldwide losses were estimated at US$1.71 trillion. The severity sparked fears of extended economic instability or a reprise of the Great Depression. Possible explanations for the initial fall in stock prices include a fear that stocks were significantly overvalued and were certain to undergo a correction, persistent US trade and budget deficits, and rising interest rates. Another explanation for Black Monday comes from the decline of the dollar, followed by a lack of faith in governmental attempts to stop that decline. In February 1987, leading industrial countries had signed the Louvre Accord, hoping that monetary policy coordination would stabilize international money markets, but doubts about the viability of the accord created a crisis of confidence. The fall may have been acceler ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong Exchanges And Clearing Limited

Hong Kong Exchanges and Clearing Limited (HKEX; ) operates a range of equity, commodity, fixed income and currency markets through its wholly owned subsidiaries The Stock Exchange of Hong Kong Limited (SEHK), Hong Kong Futures Exchange Limited (HKFE) and London Metal Exchange (LME). As of December 2024, HKEX has a market capitalization of approximately US$35 trillion and 2,631 listed companies, making it the 8th largest stock exchange globally. HKEX was the 10th largest stock exchange in terms of IPO proceeds in the first quarter of 2024. The Group also operates four clearing houses in Hong Kong: Hong Kong Securities Clearing Company Limited (HKSCC), HKFE Clearing Corporation Limited (HKCC), the SEHK Options Clearing House Limited (SEOCH) and OTC Clearing Hong Kong Limited (OTC Clear). HKSCC, HKCC and SEOCH provide integrated clearing, settlement, depository and nominee activities to their participants, while OTC Clear provides OTC interest rate derivatives and non-del ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |