|

SIPC

The Securities Investor Protection Corporation (SIPC ) is a federally mandated, non-profit, member-funded, United States government corporation created under the Securities Investor Protection Act (SIPA) of 1970 that mandates membership of most US-registered broker-dealers. Although created by federal legislation and overseen by the Securities and Exchange Commission, the SIPC is neither a government agency nor a regulator of broker-dealers. The purpose of the SIPC is to expedite the recovery and return of missing customer cash and assets during the liquidation of a failed investment firm. Board of Directors The SIPC has a Board of Directors which determines the policies that govern the operations of the SIPC. The board consists of seven members. All members serve for terms of three years. Two members of the board are appointed by the Secretary of the Treasury and the Federal Reserve Board from among the officers and employees of the Department of the Treasury and from among the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Investor Protection Act

The Securities Investor Protection Act of 1970 is the U.S. federal law that established the Securities Investor Protection Corporation (SIPC). It was enacted by the 91st United States Congress and signed into law by Richard Nixon on December 30, 1970., , codified at through Most brokers and dealers registered under the Securities Exchange Act of 1934 The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A land ... are required to be members of the SIPC. The SIPC maintains a fund that is intended to protect investors against the misappropriation of their funds and of most types of securities in the event of the failure of their broker. References External links Securities Investor Protection Act of 1970 [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market manipulation. Created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act), the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, and the Sarbanes–Oxley Act of 2002, among other statutes. Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated entities submit quarterly and annual reports, as well as other periodic disclosures. In addition to annual financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker-dealer

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and derivatives trading process. Although many broker-dealers are "independent" firms solely involved in broker-dealer services, many others are business units or subsidiaries of commercial banks, investment banks or investment companies. When executing trade orders on behalf of a customer, the institution is said to be acting as a broker. When executing trades for its own account, the institution is said to be acting as a dealer. Securities bought from clients or other firms in the capacity of dealer may be sold to clients or other firms acting again in the capacity of dealer, or they may become a part of the firm's holdings. In addition to execution of securities transactions, broker-dealers are also the main sellers and distributors o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dodd–Frank Wall Street Reform And Consumer Protection Act , and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry.

Responding to widespread calls for changes to the financial regulatory system, in June 2009, President Barack Obama introduced a proposal for a "sweeping overhaul of the United States financial regulatory system, a transformation on a scale not seen since the reforms that followed the Great Depression in the United States, Great De ...

The Dodd–Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd–Frank, is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the Great Recession The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

K Street NW

K Street is a major thoroughfare in the United States capital of Washington, D.C., known as a center for lobbying and the location of numerous advocacy groups, law firms, trade associations, and think tanks. In political discourse, "K Street" has become a metonym for lobbying in the United States, the same way Wall Street in New York City became a metonym for the U.S. financial markets, since many lobbying firms are or traditionally were located on the section in Northwest Washington which passes from Georgetown through a portion of Downtown Washington, D.C. Location In the Washington D.C. street grid there are three unconnected east-to-west street segments designated as K Street NW / NE, and also a southern K Street. The middle segment of K Street NW / NE, which carries a segment of U.S. Route 29, begins in the city's Northwest quadrant as K Street NW, just west of the abutment of the old Aqueduct Bridge on the Georgetown waterfront. The street travels east underneath t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banknote

A banknote or bank notealso called a bill (North American English) or simply a noteis a type of paper money that is made and distributed ("issued") by a bank of issue, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to Redemption value, redeem the notes for legal tender (usually gold or silver coin) when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authority, monetary authorities. By extension, the word "banknote" is sometimes used (including by collectors) to refer more generally to paper money, but in a strict sense notes that have not been issued by banks, e.g. government notes, are not banknotes. National banknotes are often, but not always, legal tender, meaning that courts of law are required to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 until Resignation of Richard Nixon, his resignation in 1974. A member of the Republican Party (United States), Republican Party, he previously served as the 36th Vice President of the United States, vice president under President Dwight D. Eisenhower from 1953 to 1961, and also as a United States House of Representatives, representative and United States Senate, senator from California. Presidency of Richard Nixon, His presidency saw the reduction of U.S. involvement in the Vietnam War, ''détente'' with the Soviet Union and China, the Apollo 11 Moon landing, and the establishment of the United States Environmental Protection Agency, Environmental Protection Agency and Occupational Safety and Health Administration. Nixon's second term ended early when he became the only U.S. president to resign from office, as a result of the Watergate scandal. Nixon was born ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

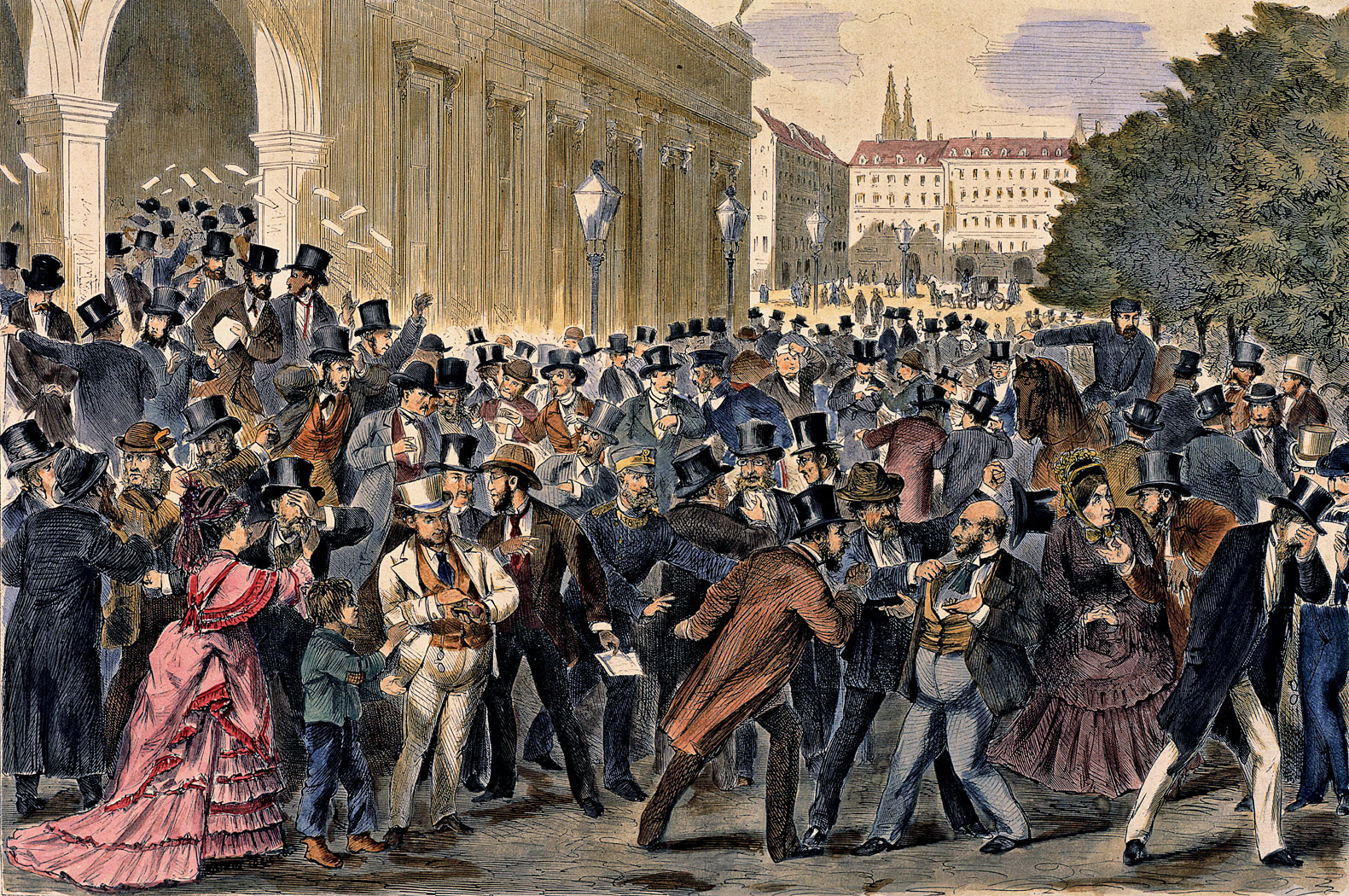

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banking crises, banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial Economic bubble, bubbles, currency crisis, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (for example, the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is little consensus and financial crises continue to occur from time to time. It is apparent however that a consistent feature of bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession Of 1969–70

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster (e.g. a pandemic). There is no official definition of a recession, according to the IMF. In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom and Canada, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certificates Of Deposit

A certificate of deposit (CD) is a time deposit sold by banks, thrift institutions, and credit unions in the United States. CDs typically differ from savings accounts because the CD has a specific, fixed term before money can be withdrawn without penalty and generally higher interest rates. CDs require a minimum deposit and may offer higher rates for larger deposits. The bank expects the CDs to be held until maturity, at which time they can be withdrawn and interest paid. In the United States, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for banks and by the National Credit Union Administration (NCUA) for credit unions. The consumer who opens a CD may receive a paper certificate, but it is now common for a CD to consist simply of a book entry and an item shown in the consumer's periodic bank statements. Consumers who want a hard copy that verifies their CD purchase may request a paper statement from the bank, or print out their own from the financial in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |