|

Securities Exchange Act Of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landmark piece of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law. Companies raise billions of dollars by issuing securities in what is known as the primary market. Contrasted with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer, frequently through brokers or dealers. Trillions of dollars are made and lost each year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commerce And Trade

Commerce is the organized system of activities, functions, procedures and institutions that directly or indirectly contribute to the smooth, unhindered large-scale exchange (distribution through transactional processes) of goods, services, and other things of value at the right time, place, quantity, quality and price through various channels among the original producers and the final consumers within local, regional, national or international economies. The diversity in the distribution of natural resources, differences of human needs and wants, and division of labour along with comparative advantage are the principal factors that give rise to commercial exchanges. Commerce consists of trade and aids to trade (i.e. auxiliary commercial services) taking place along the entire supply chain. Trade is the exchange of goods (including raw materials, intermediate and finished goods) and services between buyers and sellers in return for an agreed-upon price at traditional (or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 8-K

Form 8-K is a very broad form used to notify investors in United States public companies of specified events that may be important to shareholders or the United States Securities and Exchange Commission. This is one of the most common types of forms filed with the SEC. After a significant event like bankruptcy or departure of a CEO, a public company generally must file a Current Report on Form 8-K within four business days to provide an update to previously filed quarterly reports on Form 10-Q and/or Annual Reports on Form 10-K. Form 8-K is required to be filed by public companies with the SEC pursuant to the Securities Exchange Act of 1934, as amended. Academic researchers make this report metadata available as structured datasets in the Harvard Dataverse. When Form 8-K is required Form 8-K is used to notify investors of a current event. These types of events include: * signing, amending or terminating material definitive agreements not made in the ordinary course of busine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 10-Q

Form 10-Q, (also known as a 10-Q or 10Q) is a quarterly report mandated by the United States federal Securities and Exchange Commission, to be filed by publicly traded corporations. Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, the 10-Q is an SEC filing that must be filed quarterly with the US Securities and Exchange Commission. It contains similar information to the annual form 10-K, however the information is generally less detailed, and the financial statements are generally unaudited. Information for the final quarter of a firm's fiscal year is included in the 10-K, so only three 10-Q filings are made each year. These reports generally compare last quarter to the current quarter and last year's quarter to this year's quarter. The SEC put this form in place to facilitate better informed investors. The form 10-Q must be filed within 40 days for large accelerated filers and accelerated filers or 45 days after the end of the fiscal quarter for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 10-K

A Form 10-K is an annual report required by the U.S. Securities and Exchange Commission (SEC), that gives a comprehensive summary of a company's financial performance. Although similarly named, the annual report on Form 10-K is distinct from the often glossy " annual report to shareholders", which a company must send to its shareholders when it holds an annual meeting to elect directors (though some companies combine the annual report and the 10-K into one document). The 10-K includes information such as company history, organizational structure, executive compensation, equity, subsidiaries, and audited financial statements, among other information. Companies with more than $10 million in assets and a class of equity securities that is held by more than 2000 owners must file annual and other periodic reports, regardless of whether the securities are publicly or privately traded. Up until March 16, 2009, smaller companies could use Form 10-KSB. If a shareholder requests a company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as to the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC). Overview The Financial Industry Regulatory Authority is the largest independent regulator for all securities firms doing business in the United States. FINRA's mission is to protect investors by making sure the United States securities industry operates fairly and honestly. As of October 2023, FINRA oversaw 3,394 brokerage firms, 149,887 branch offices and approximately 612,457 registered securities representatives. FINRA ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-regulatory Organization

Self-regulation may refer to: *Emotional self-regulation *Self-control, in sociology/psychology *Self-regulated learning, in educational psychology *Self-regulation theory (SRT), a system of conscious personal management *Industry self-regulation, the process of monitoring one's own adherence to industry standards *Self-regulatory organization, in business and finance *Homeostasis, a state of steady internal conditions maintained by living things *Emergence, the phenomenon in which unpredictable outcomes emerge from complex systems *Self-regulating variable resistance cables used for Trace heating#Self regulating, trace heating *Spontaneous order See also *Self-limiting (other) {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maloney Act

Maloney is a surname of Irish origin. The name 'Maloney' is derived from the Irish ''Ó Maoldhomhnaigh''.https://books.google.com/books?id=mZt3oGtk1KgC&pg=PA189&dq=maloney+Ó+Maoldhomhnaigh&hl=en&newbks=1&newbks_redir=0&source=gb_mobile_search&sa=X&ved=2ahUKEwj9wrHgyO-MAxVuMtAFHV24IjcQ6AF6BAgMEAM#v=onepage&q=maloney%20Ó%20Maoldhomhnaigh&f= Notable people with the surname include: * Anna Maloney, British screenwriter * Brian Maloney, Irish Gaelic football player * Philip Maloney, Professional Irish Adult Movie star from Longford * Carolyn B. Maloney (born 1948), American politician from New York; U.S. representative * Charles Garrett Maloney (1913–2006), American Roman Catholic bishop in Louisville, Kentucky * Christopher Maloney (other), several people * Dan Maloney (1950–2018), Canadian professional ice hockey player * Dave Maloney (born 1956), Canadian professional ice hockey player * David Maloney (1933–2006), British television director and producer * David Malo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NYSE American

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange. NYSE Euronext acquired AMEX on October 1, 2008, with AMEX integrated with the Alternext European small-cap exchange and renamed the NYSE Alternext U.S. In March 2009, NYSE Alternext U.S. was changed to NYSE Amex Equities. On May 10, 2012, NYSE Amex Equities changed its name to NYSE MKT LLC. Following the SEC approval of competing stock exchange IEX in 2016, NYSE MKT rebranded as NYSE American and introduced a 350-microsecond delay in trading, referred to as a "speed bump", which is also present on the IEX. History The Curb market The exchange grew out of the loosely organized curb market of curbstone brokers on Broad Street in Manhattan. Efforts to organize and standardize the market started ear ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ

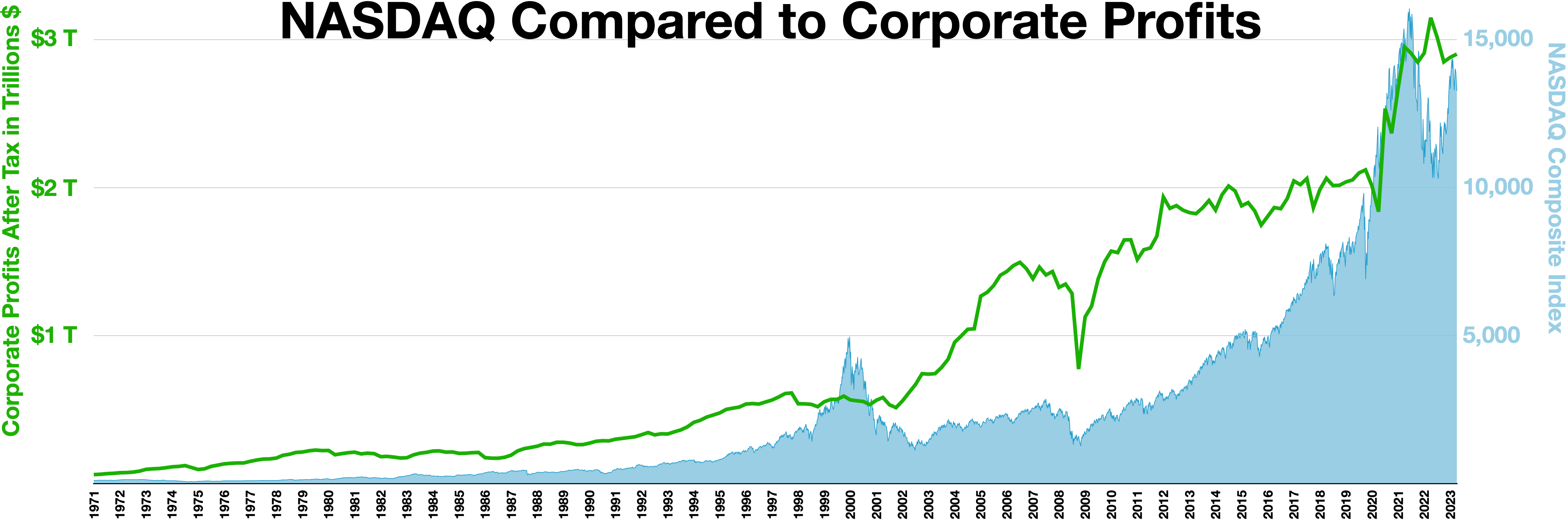

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Maker

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the difference, which is called the ''bid–ask spread'' or ''turn.'' This stabilizes the market, reducing price variation (Volatility (finance), volatility) by setting a trading price range for the asset. In U.S. markets, the U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price. A Designated Primary Market Maker (DPM) is a specialized market maker approved by an exchange to guarantee a buy or sell position in a particular assigned security, option, or option index. In currency exchange Most foreign exchange trading firms are market makers, as are many banks. The foreign exchange market maker both buys foreign currency from clients and sells it to other clients. They derive income from the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |