|

Secured Loan

A secured loan is a loan in which the borrower Pledge (law), pledges some asset (e.g. a car or property) as collateral (finance), collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral, and if the borrower default (finance), defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally loaned to the borrower. An example is the foreclosure of a home. From the creditor's perspective, that is a category of debt in which a lender has been granted a portion of the bundle of rights to specified property. If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount. The opposite of secured debt/loan is unsecured debt, which is not connected to any specific piece of property. Instead, the creditor may satisfy t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the 2008 financial crisis, the UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the Financial Services Act 2012 received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority of the Bank of England. Until its abolition, Lord Turner of Ecchinswell was the FSA's chairman an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Title Owner

In property law, title is an intangible construct representing a bundle of rights in a piece of property in which a party may own either a legal interest or equitable interest. The rights in the bundle may be separated and held by different parties. It may also refer to a formal document, such as a deed, that serves as evidence of ownership. Conveyance of the document (transfer of title to the property) may be required in order to transfer ownership in the property to another person. Title is distinct from possession, a right that often accompanies ownership but is not necessarily sufficient to prove it (for example squatting). In many cases, possession and title may each be transferred independently of the other. For real property, land registration and recording provide public notice of ownership information. '' Possession'' is the actual holding of a thing, whether or not one has any right to do so. The '' right of possession'' is the legitimacy of possession (with or witho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mechanics Lien

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The lien exists for both real property and personal property. In the realm of real property, it is called by various names, including, generically, construction lien. The term "lien" comes from a French root, with a meaning similar to link, which is itself ultimately descended from the Latin ''ligamen'', meaning "bond" and ''ligare'', meaning "to bind". Mechanic's liens on property in the United States date from the 18th century. History and reasons for existence Mechanic's liens in their modern form were first conceived by Thomas Jefferson, to encourage construction in the new capital city of Washington. They were established by the Maryland General Assembly, of which the city of Washington was then a part. However, it is not likely that Jefferson single-handedly dreamed up the idea. At the time Jefferson promoted the law, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Law

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt, usually a mortgage loan. '' Hypothec'' is the corresponding term in civil law jurisdictions, albeit with a wider sense, as it also covers non-possessory lien. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land (or the equivalent) from the owner to the mortgage lender, on the condition that this interest will be returned to the owner when the terms of the mortgage have been satisfied or performed. In other words, the mortgage is a security for the loan that the lender makes to the borrower. The word is a Law French term meaning "dead pledge," originally only referring to the Welsh mortgage (''see below''), but in the later Middle Ages was applied to all gages and reinterpreted by folk etymology to mean that the pledge ends (dies) either when the obligati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lien

A lien ( or ) is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the ''lienee'' and the person who has the benefit of the lien is referred to as the ''lienor'' or ''lien holder''. The etymological root is Anglo-French ''lien'' or ''loyen'', meaning "bond", "restraint", from the Latin ''ligamen'', from ''ligare'' "to bind". In the United States, the term lien generally refers to a wide range of encumbrances and would include other forms of Mortgage law, mortgage or charge. In the US, a lien characteristically refers to ''Nonpossessory interest in land, nonpossessory'' security interests (see generally: ). In other common-law countries, the term lien refers to a very specific type of security interest, being a passive right to retain (but not sell) property until the debt or other obligation is discharged. In contrast to the usag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security Interest

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the '' collateral'') which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: a person is loaned money from a bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan. Although most security interests are created by agreement between the parties, it is also possible for a security interest to arise by operation of law. For example, in many jurisdictions a mechanic who repairs a car benefits from a lien over the car for the cost of repairs. This lien arises by operation of law in the absence of any agreement between the parties. Most security interests are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

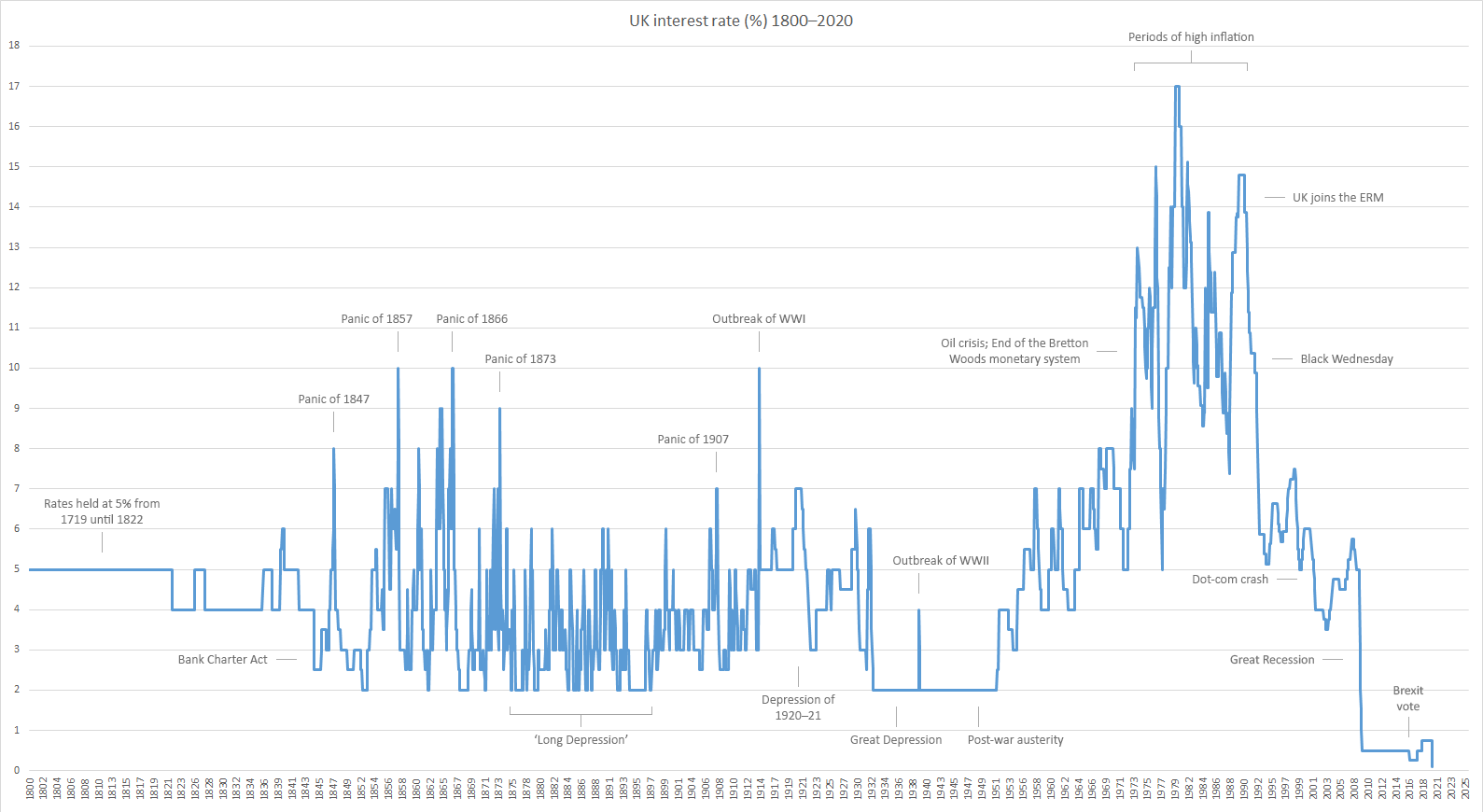

Bank Of England Base Rate

In the United Kingdom, the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day. It is the Bank of England's key interest rate for enacting monetary policy. It is more analogous to the US discount rate than to the federal funds rate. The security for the lending can be any of a list of eligible securities (commonly gilts) and the transactions are overnight repurchase agreements. Changes are recommended by the Monetary Policy Committee and enacted by the Governor. On 2 August 2018 the Bank of England base rate was increased to 0.75%, but then cut to 0.25% on 11 March 2020, and shortly thereafter to an all-time low of 0.1% on 19 March, as emergency measures during the COVID-19 pandemic. On 15 December 2021, the Monetary Policy Committee voted 8-1 to increase the bank rate to 0.25%, and subsequently increased it thirteen more times to 5.25% on 02 August 2023. As of 21 August 2024 the bank rate sits ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Risk

Credit risk is the chance that a borrower does not repay a loan In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the deb ... or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal payment, leading to disrupted cash flows and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants. Losses can arise in a number of circumstances, for example: * A consumer may fail to make a payment due on a mortgage loan, credit card, line of credit, or other loan. * A company is unable to repay asset- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December 2019. Soon after, it spread to other areas of Asia, and COVID-19 pandemic by country and territory, then worldwide in early 2020. The World Health Organization (WHO) declared the outbreak a public health emergency of international concern (PHEIC) on 30 January 2020, and assessed the outbreak as having become a pandemic on 11 March. COVID-19 symptoms range from asymptomatic to deadly, but most commonly include fever, sore throat, nocturnal cough, and fatigue. Transmission of COVID-19, Transmission of the virus is often airborne transmission, through airborne particles. Mutations have variants of SARS-CoV-2, produced many strains (variants) with varying degrees of infectivity and virulence. COVID-19 vaccines were developed rapidly and deplo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance And Leasing Association

The Finance and Leasing Association (FLA) is the leading trade association A trade association, also known as an industry trade group, business association, sector association or industry body, is an organization founded and funded by businesses that operate in a specific Industry (economics), industry. Through collabor ... for the UK consumer credit, motor finance and asset finance sectors, and the largest organisation of its type in Europe. Members of FLA include: banks, subsidiaries of banks and building societies, the finance arms of retailers and manufacturing companies as well as independent firms. They also represent 75% of "second charge" lenders and in the wake of the growing credit and mortgage problems, have extended their support of so-called responsible lending. Members provide a range of services including: finance leasing, operating leasing, hire purchase, conditional sale, personal contract purchase plans, personal lease plans, secured and unsecured personal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |