|

Policy Uncertainty

Policy uncertainty (also called regime uncertainty) is a class of economic risk where the future path of government policy is uncertain, raising risk premia and leading businesses and individuals to delay spending and investment until this uncertainty has been resolved. Policy uncertainty may refer to uncertainty about monetary or fiscal policy, the tax or regulatory regime, or uncertainty over electoral outcomes that will influence political leadership. The Great Recession During the Great Recession of the late 2000s and the years following it, many academics, policymakers, and business leaders have asserted that levels of policy uncertainty had risen dramatically and had contributed to the depth of the recession and the weakness of the following recovery. United States Much of the policy uncertainty in the United States has revolved around fiscal policy as well as uncertainty over the tax code. This is best exemplified by partisan fights in the United States Congress over the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. One international standard definition of risk is the "effect of uncertainty on objectives". The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security, privacy, etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and general guidelines on managing risks faced by organizations. Definitions of risk Oxford English Dictionary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

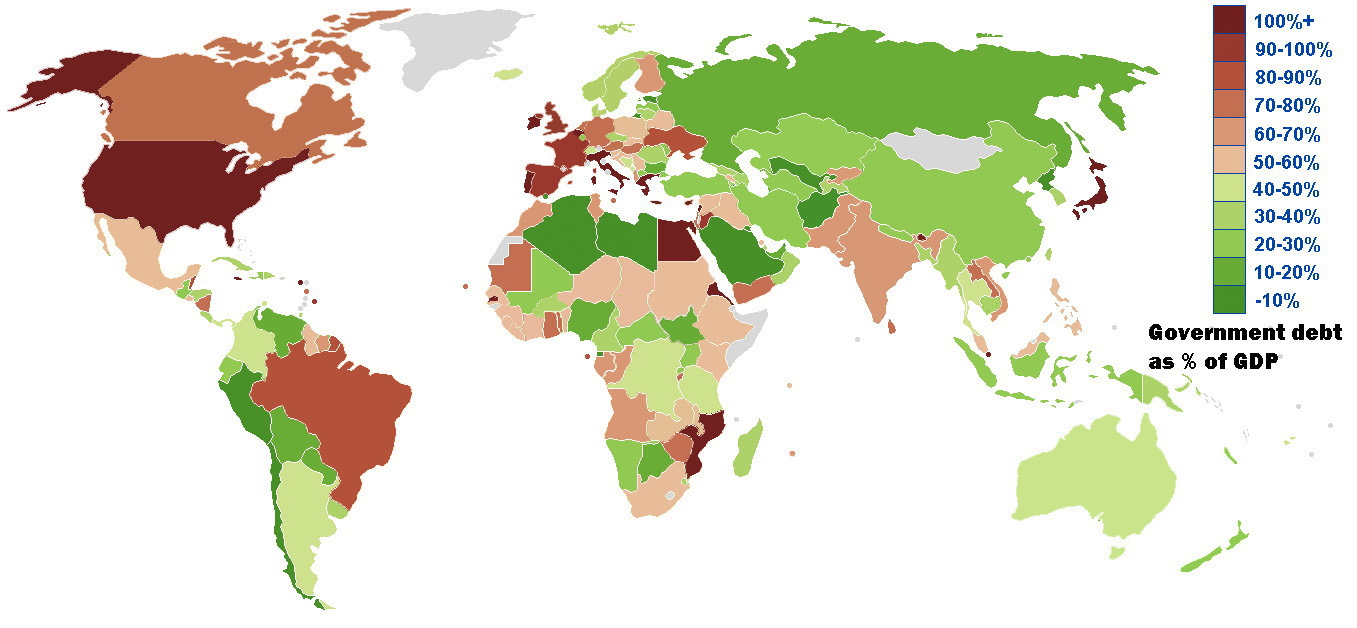

European Sovereign-debt Crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The eurozone member states of Greece, Portugal, Ireland, and Cyprus were unable to repay or refinance their government debt or to bailout fragile banks under their national supervision and needed assistance from other eurozone countries, the European Central Bank (ECB), and the International Monetary Fund (IMF). The crisis included the Greek government-debt crisis, the 2008–2014 Spanish financial crisis, the 2010–2014 Portuguese financial crisis, the post-2008 Irish banking crisis and the post-2008 Irish economic downturn, as well as the 2012–2013 Cypriot financial crisis. The crisis contributed to changes in leadership in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Higgs

Robert Higgs (born February 1, 1944) is an American economic historian and economist combining material from Public Choice, the New institutional economics, and the Austrian school of economics; and describes himself as a " libertarian anarchist" in political and legal theory and public policy. His writings in economics and economic history have most often focused on the causes, means, and effects of government power and growth. Academic career Higgs earned a Ph.D. in economics from the Johns Hopkins University and has held teaching positions at the University of Washington, Lafayette College, and Seattle University. He has also been a visiting scholar at Oxford University and Stanford University. He held a visiting professorship at the University of Economics, Prague in 2006, and has supervised dissertations in the Ph.D. program at Universidad Francisco Marroquín, where he is currently an honorary professor of economics and history. Higgs has been a Senior Fellow in Pol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Profit

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both explicit and implicit costs. It is different from accounting profit, which only relates to the explicit costs that appear on a firm's financial statements. An accountant measures the firm's accounting profit as the firm's total revenue minus only the firm's explicit costs. An economist includes all costs, both explicit and implicit costs, when analyzing a firm. Therefore, economic profit is smaller than accounting profit. ''Normal profit'' is often viewed in conjunction with economic profit. Normal profits in business refer to a situation where a company generates revenue that is equal to the total costs incurred in its operation, thus allowing it to remain operational in a competitive industry. It is the minimum profit level that a company can ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

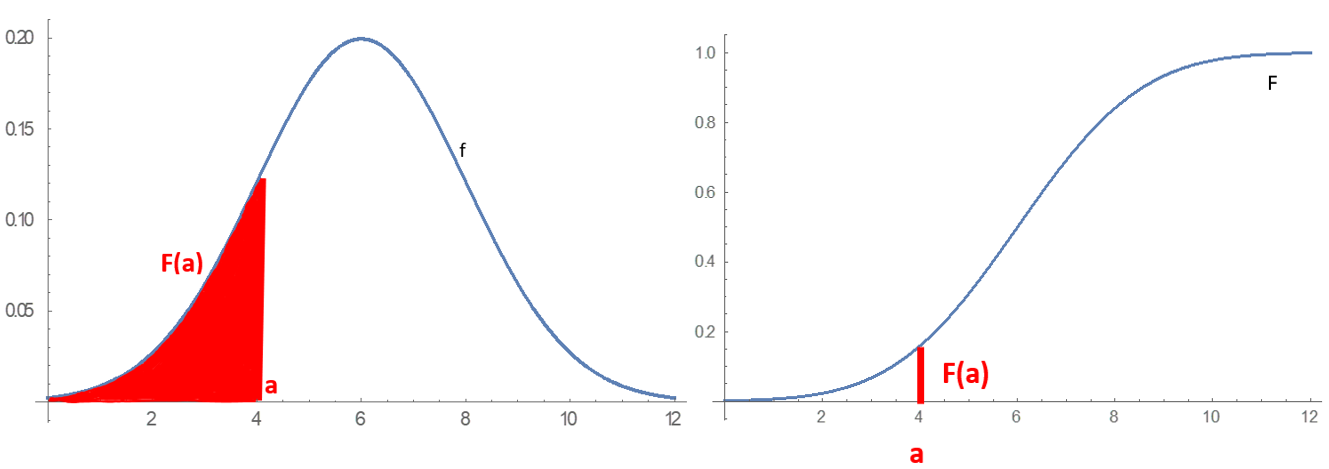

Probability Distribution

In probability theory and statistics, a probability distribution is a Function (mathematics), function that gives the probabilities of occurrence of possible events for an Experiment (probability theory), experiment. It is a mathematical description of a Randomness, random phenomenon in terms of its sample space and the Probability, probabilities of Event (probability theory), events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that fair coin, the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A prob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Knightian Uncertainty

In economics, Knightian uncertainty is a lack of any quantifiable knowledge about some possible occurrence, as opposed to the presence of quantifiable risk (e.g., that in statistical noise or a parameter's confidence interval). The concept acknowledges some fundamental degree of ignorance, a limit to knowledge, and an essential unpredictability of future events. Knightian uncertainty is named after University of Chicago economist Frank Knight (1885–1972), who distinguished risk and uncertainty in his 1921 work ''Risk, Uncertainty, and Profit:''Knight, F. H. (1921Risk, Uncertainty, and Profit Boston, MA: Hart, Schaffner & Marx; Houghton Mifflin Company :"Uncertainty must be taken in a sense radically distinct from the familiar notion of Risk, from which it has never been properly separated.... The essential fact is that 'risk' means in some cases a quantity susceptible of measurement, while at other times it is something distinctly not of this character; and there are far- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago School (economics)

The Chicago school of economics is a Neoclassical economics, neoclassical Schools of economic thought, school of economic thought associated with the work of the faculty at the University of Chicago, some of whom have constructed and popularized its principles. Milton Friedman and George Stigler are considered the leading scholars of the Chicago school. Chicago macroeconomic theory rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. The Saltwater and freshwater economics, freshwater–saltwater distinction is largely antiquated today, as the two traditions have heavily incorporated ideas from each other. Specifically, new Keynesian economics was developed as a response to new classical economics, electing to incorporate the insight of rational expectations without giving up the traditional Keynesian focus on imperfect competition and sticky wages. Chicago econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frank Hyneman Knight

Frank Hyneman Knight (November 7, 1885 – April 15, 1972) was an American economist who spent most of his career at the University of Chicago, where he became one of the founders of the Chicago School. Nobel laureates Milton Friedman, George Stigler and James M. Buchanan were all students of Knight at Chicago. Ronald Coase said that Knight, without teaching him, was a major influence on his thinking. F.A. Hayek considered Knight to be one of the major figures in preserving and promoting classical liberal thought in the twentieth century. Paul Samuelson named Knight (along with Harry Gunnison Brown, Allyn Abbott Young, Henry Ludwell Moore, Wesley Clair Mitchell, Jacob Viner, and Henry Schultz) as one of the several "American saints in economics" born after 1860. Life and career Knight ( BA, Milligan College, 1911; BS and AM, Tennessee, 1913; PhD, Cornell, 1916) was born in 1885 in McLean County, Illinois, the son of Julia Ann (Hyneman) and Winton Cyrus Knight. After his ea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International use, most important central banks with a balance sheet total of around 7 trillion. The Governing Council of the European Central Bank, ECB Governing Council makes monetary policy for the Eurozone and the European Union, administers the foreign exchange reserves of EU member states, engages in foreign exchange operations, and defines the intermediate monetary objectives and key interest rate of the EU. The Executive Board of the European Central Bank, ECB Executive Board enforces the policies and decisions of the Governing Council, and may direct the national central banks when doing so. The ECB has the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the volume must be approved by the EC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global systemically important financial institutions (G-SIFIs) are forced to participate in the recapitalization process but taxpayers are not. Some governments also have the power to participate in the insolvency process; for instance, the U.S. government intervened in the General Motors bailout of 2009–2013. A bailout can, but does not necessarily, avoid an insolvency process. The term ''bailout'' is maritime in origin and describes the act of removing water from a sinking vessel using a bucket. Overview A bailout could be done for profit motives, such as when a new investor resurrects a floundering company by buying its shares at firesale prices, or for social objectives, such as when, hypothetically speaking, a wealthy philanthropist reinvent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |