|

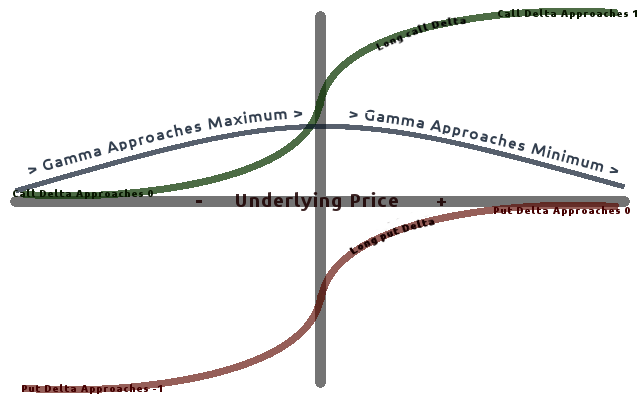

Option Delta

In mathematical finance, the Greeks are the quantities (known in calculus as partial derivatives; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised model o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often with the help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vomma

In mathematical finance, the Greeks are the quantities (known in calculus as partial derivatives; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised model ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Model (economics)

An economic model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world. Overview In general terms, economic models have two functions: first as a simplification of and abstraction from observed data, and second as a means of selection of data based on a paradigm of econometric study. ''Simplification'' is particularly important for economics given the enormous complexity of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange ( JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black–Scholes Model

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing Derivative (finance), derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of option style, European-style option (finance), options and shows that the option has a ''unique'' price given the risk of the security and its expected return (instead replacing the security's expected return with the risk-neutral rate). The equation and model are named after economists Fischer Black and Myron Scholes. Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited. The main principle behind the model is to hedge (finance), hedge the option by buying and selling the underlying asset in a specific way to eliminate risk. This type of hedging is called "continuou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delta Hedging

In finance, delta neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged when small changes occur in the value of the underlying security (having zero delta). Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. A related term, delta hedging, is the process of setting or keeping a portfolio as close to delta-neutral as possible. In practice, maintaining a zero delta is very complex because there are risks associated with re-hedging on large movements in the underlying stock's price, and research indicates portfolios tend to have lower cash flows if re-hedged too frequently.De Weert F. pp. 74-81 Delta hedging may be accomplished by trading underlying securities of the portfolio. See for details. Mathematical interpret ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partial Derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant (as opposed to the total derivative, in which all variables are allowed to vary). Partial derivatives are used in vector calculus and differential geometry. The partial derivative of a function f(x, y, \dots) with respect to the variable x is variously denoted by It can be thought of as the rate of change of the function in the x-direction. Sometimes, for the partial derivative of z with respect to x is denoted as \tfrac. Since a partial derivative generally has the same arguments as the original function, its functional dependence is sometimes explicitly signified by the notation, such as in: f'_x(x, y, \ldots), \frac (x, y, \ldots). The symbol used to denote partial derivatives is ∂. One of the first known uses of this symbol in mathematics is by Marquis de Condorcet from 1770, who used it for partial differ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk Management

Financial risk management is the practice of protecting Value (economics), economic value in a business, firm by managing exposure to financial risk - principally credit risk and market risk, with more specific variants as listed aside - as well as some aspects of operational risk. As for risk management more generally, financial risk management requires identifying the sources of risk, measuring these, and crafting plans to mitigation, mitigate them. See for an overview. Financial risk management as a "science" can be said to have been bornW. Kenton (2021)"Harry Markowitz" investopedia.com with modern portfolio theory, particularly as initiated by Professor Harry Markowitz in 1952 with his article, "Portfolio Selection"; see . The discipline can be qualitative and quantitative; as a specialization of risk management, however, financial risk management focuses more on when and how to Hedge (finance), hedge, often using financial instruments to manage costly exposures to risk. * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Schwarz's Theorem

In mathematics, the symmetry of second derivatives (also called the equality of mixed partials) is the fact that exchanging the order of partial derivatives of a multivariate function :f\left(x_1,\, x_2,\, \ldots,\, x_n\right) does not change the result if some continuity conditions are satisfied (see below); that is, the second-order partial derivatives satisfy the identities :\frac \left( \frac \right) \ = \ \frac \left( \frac \right). In other words, the matrix of the second-order partial derivatives, known as the Hessian matrix, is a symmetric matrix. Sufficient conditions for the symmetry to hold are given by Schwarz's theorem, also called Clairaut's theorem or Young's theorem. In the context of partial differential equations, it is called the Schwarz integrability condition. Formal expressions of symmetry In symbols, the symmetry may be expressed as: :\frac \left( \frac \right) \ = \ \frac \left( \frac \right) \qquad\text\qquad \frac \ =\ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ultima

Ultima may refer to: Places * Ultima, Victoria, a town in Australia * Pangaea Ultima, a supercontinent to occur in the future * ''Ultima'', the larger lobe of the trans-Neptunian object 486958 Arrokoth, nicknamed ''Ultima Thule'' Companies and products * Ultima Foods, a division of Quebec-based dairy company Agropur * Ultima Sports Ltd, a manufacturer of sports cars based in England * Junkers Profly Ultima, a German homebuilt aircraft design * Kodak Ultima, a brand of photo paper for inkjet printers sold by Eastman Kodak * Kyosho Ultima, a radio-controlled car made by Kyosho * Nissan Altima, a model of car by Nissan Games * Baroque chess, known in the northeastern region of the United States as "Ultima" * ''Ultima'' (series), a series of video games **'' Ultima I'', which was first released as ''Ultima'' * Ultima (''Final Fantasy''), a recurring boss, weapon and spell in the ''Final Fantasy'' franchise * Ultima (''Freedom City''), characters in ''Freedom City'' Music * U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Color

Color (or colour in English in the Commonwealth of Nations, Commonwealth English; American and British English spelling differences#-our, -or, see spelling differences) is the visual perception based on the electromagnetic spectrum. Though color is not an inherent property of matter, color perception is related to an object's light absorption, emission spectra, emission, Reflection (physics), reflection and Transmittance, transmission. For most humans, colors are perceived in the visible light spectrum with three types of cone cells (trichromacy). Other animals may have a different number of cone cell types or have eyes sensitive to different wavelengths, such as bees that can distinguish ultraviolet, and thus have a different color sensitivity range. Animal perception of color originates from different light wavelength or spectral sensitivity in cone cell types, which is then processed by the brain. Colors have perceived properties such as hue, colorfulness (saturation), and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |