|

Opportunity Costs

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, it is the "cost" incurred by not enjoying the ''benefit'' that would have been had if the second best available choice had been taken instead. The '' New Oxford American Dictionary'' defines it as "the loss of potential gain from other alternatives when one alternative is chosen". As a representation of the relationship between scarcity and choice, the objective of opportunity cost is to ensure efficient use of scarce resources. It incorporates all associated costs of a decision, both explicit and implicit. Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of output forgone, lost time, pleasure, or any other benefit that provides utility should also be considered an opportunity cost. Types Expl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the economy as a whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce Economic efficiency, efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the total of economic activity, dealing with the issues of Economic growth, growth, inflation, and unemployment—and with national policies relati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Time Invested

Return on Time Invested (ROTI) is a metric employed to assess the productivity and efficiency of time spent on a specific activity, project, or product. The concept is similar to return on investment (ROI), but instead of financial capital, ROTI measures the qualitative and quantitative outcomes derived from the time invested. The metric is relevant in contexts where time is a significant resource, including product management, personal productivity, business process optimization, and education or training evaluation. Calculation While the specific calculation of ROTI can vary depending on the context, a general formula can be expressed as: ROTI = Total value or Output obtained / Total time invested. After a meeting Some organizations use the ROTI method to evaluate meetings. Areas Project management ROTI is a metric used in product management to evaluate the efficiency of time allocation across various tasks and development phases. Product managers employ ROTI calculation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Economics

Health economics is a branch of economics concerned with issues related to Health care efficiency, efficiency, effectiveness, value and behavior in the production and consumption of health and healthcare. Health economics is important in determining how to improve health outcomes and lifestyle patterns through interactions between individuals, healthcare providers and clinical settings. Health economists study the functioning of healthcare systems and health-affecting behaviors such as smoking, diabetes, and obesity. One of the biggest difficulties regarding healthcare economics is that it does not follow normal rules for economics. Price and quality are often hidden by the third-party payer system of insurance companies and employers. Additionally, Quality-adjusted life year, QALYs (Quality Adjusted Life Years), one of the most commonly used measurements for treatments, is very difficult to measure and relies upon assumptions that are often unreasonable. A seminal 1963 arti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Opportunity Cost Of The COVID-19 Pandemic Australia

Opportunity may refer to: Places * Opportunity, Montana, an unincorporated community, United States * Opportunity, Nebraska, an unincorporated community, United States * Opportunity, Washington, a former census-designated place, United States * 39382 Opportunity, an asteroid Arts, entertainment, and media Music * "Opportunity" (Pete Murray song), 2006 * "Opportunity", a song by The Charlatans * "Opportunity", a song from '' Annie'' * " Opportunities (Let's Make Lots of Money)", a song by Pet Shop Boys * "Oppurtunities", by Jesper Kyd from the 2018 Indian film ''Tumbbad'' Other uses in arts, entertainment, and media * ''Opportunity'' (film), a 1918 film * '' Opportunity: A Journal of Negro Life'', a literary periodical of the Harlem Renaissance * '' The Opportunity'', a 17th-century play Finance * Opportunity International, a microfinance network that lends to the working poor * Opportunity NYC, a 2007–2012 experimental conditional cash transfer program in New York City ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Division Of Labour

The division of labour is the separation of the tasks in any economic system or organisation so that participants may specialise ( specialisation). Individuals, organisations, and nations are endowed with or acquire specialised capabilities, and either form combinations or trade to take advantage of the capabilities of others in addition to their own. Specialised capabilities may include equipment or natural resources as well as skills. Training and combinations of equipment and other assets acting together are often important. For example, an individual may specialise by acquiring tools and the skills to use them effectively just as an organisation may specialise by acquiring specialised equipment and hiring or training skilled operators. The division of labour is the motive for trade and the source of economic interdependence. An increasing division of labour is associated with the growth of total output and trade, the rise of capitalism, and the increasing complexity of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Absolute Advantage

In economics, the principle of absolute advantage is the ability of a party (an individual, or firm, or country) to produce a good or service more efficiently than its competitors. The Scottish economist Adam Smith first described the principle of absolute advantage in the context of international trade in 1776, using labor as the only input. Since absolute advantage is determined by a simple comparison of labor productiveness, it is possible for a party to have no absolute advantage in anything. Origin of the theory The concept of absolute advantage is generally attributed to the Scottish economist Adam Smith in his 1776 publication '' The Wealth of Nations,'' in which he countered mercantilist ideas. Smith argued that it was impossible for all nations to become rich simultaneously by following mercantilism because the export of one nation is another nation's import and instead stated that all nations would gain simultaneously if they practiced free trade and specialized i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comparative Advantage Example

The degrees of comparison of adjectives and adverbs are the various forms taken by adjectives and adverbs when used to compare two entities (comparative degree), three or more entities (superlative degree), or when not comparing entities (positive degree) in terms of a certain property or way of doing something. The usual degrees of comparison are the ''positive'', which denotes a certain property or a certain way of doing something without comparing (as with the English words ''big'' and ''fully''); the ''comparative degree'', which indicates ''greater'' degree (e.g. ''bigger'' and ''more fully'' omparative of superiorityor ''as big'' and ''as fully'' omparative of equalityor ''less big'' and ''less fully'' omparative of inferiority; and the ''superlative'', which indicates ''greatest'' degree (e.g. ''biggest'' and ''most fully'' uperlative of superiorityor ''least big'' and ''least fully'' uperlative of inferiority. Some languages have forms indicating a very large degree ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comparative Advantage

Comparative advantage in an economic model is the advantage over others in producing a particular Goods (economics), good. A good can be produced at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. Comparative advantage describes the economic reality of the gains from trade for individuals, firms, or nations, which arise from differences in their factor endowments or technological progress. David Ricardo developed the classical theory of comparative advantage in 1817 to explain why countries engage in international trade even when one country's workers are more efficient at producing ''every'' single good than workers in other countries. He demonstrated that if two countries capable of producing two commodities engage in the free market (albeit with the assumption that the capital and labour do not move internationally), then each country will increase its overall consumption by exporting the good for which it has a comparat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Capital

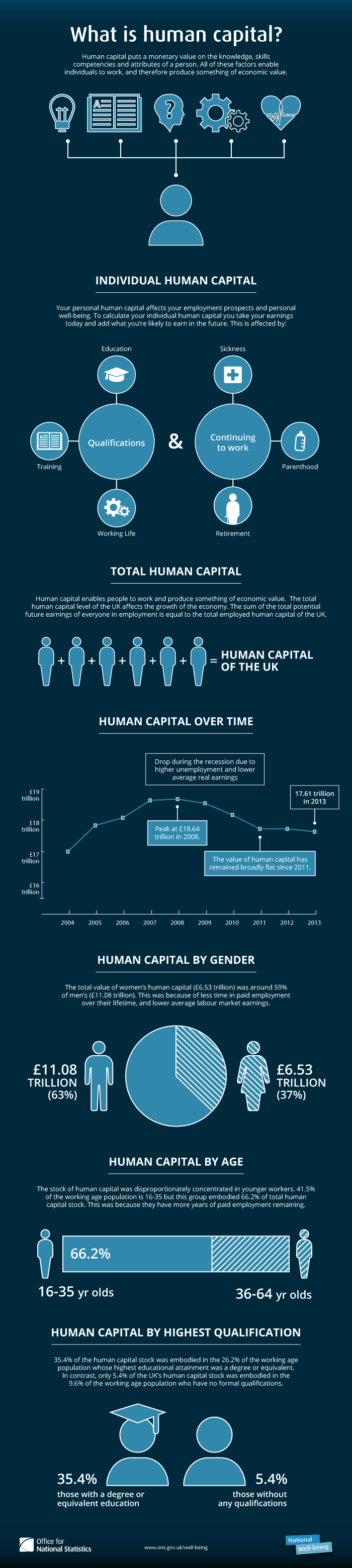

Human capital or human assets is a concept used by economists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a substantial impact on individual earnings. Research indicates that human capital investments have high economic returns throughout childhood and young adulthood. Companies can invest in human capital; for example, through education and training, improving levels of quality and production. History Adam Smith included in his definition of Capital (economics), capital "the acquired and useful abilities of all the inhabitants or members of the society". The first use of the term "human capital" may be by Irving Fisher. An early discussion with the phrase "human capital" was from Arthur Cecil Pigou: But the term only found widespread use in economics after its popularization by economists of the Chicago School of economics, Chicago School, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Value Added

In accounting, as part of financial statements analysis, economic value added is an estimate of a firm's economic profit, or the value created in excess of the Required rate of return, required return of the types of companies, company's shareholders. EVA is the net profit less the capital charge ($) for raising the firm's capital. The idea is that value is created when the return on the firm's economic capital employed exceeds the cost of that capital. This amount can be determined by making adjustments to Generally accepted accounting principles, GAAP accounting. There are potentially over 160 adjustments but in practice, only several key ones are made, depending on the company and its industry. Calculation EVA is net operating profit after taxes (or NOPAT) less a capital charge, the latter being the product of the cost of capital and the economic capital. The basic formula is: : \begin \text & = ( \text - \text ) \cdot (\text - \text) \\[8pt] & = \text - \text \cdot (\text - \ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |