|

Open-end Fund

Open-end fund (or open-ended fund) is a collective investment scheme that can issue and redeem shares at any time. An investor will generally purchase shares in the fund directly from the fund itself, rather than from the existing shareholders. The term contrasts with a closed-end fund, which typically issues at the outset all the shares that it will issue, with such shares usually thereafter being tradable among investors. Open-ended funds are available in most developed countries, but the terminology and operating rules vary. US mutual funds, UK unit trusts and OEICs, European SICAVs, and hedge funds are all examples of open-ended funds. The price at which shares in an open-ended fund are issued or can be redeemed will vary in proportion to the net asset value of the fund and so directly reflects its performance. Fees There may be a percentage charge levied on the purchase of shares or units. Some of these fees are called an initial charge (UK) or 'front-end load' (US) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collective Investment Scheme

An investment fund is a way of investment, investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification (finance), diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PIMCO

Pacific Investment Management Company LLC (PIMCO) is an American investment management firm. While it has a specific focus on active fixed income management worldwide, it manages investments in many asset classes, including fixed income, share capital, equities and other financial assets across public and private markets. PIMCO is one of the largest investment managers, actively managing more than $2 trillion in assets for central banks, sovereign wealth funds, pension funds, corporations, foundations and endowments, as well as individual investors around the world. According to the Sovereign Wealth Fund Institute, PIMCO is the 6th-largest asset manager in the world by managed Assets under management, AUM. PIMCO's headquarters are in Newport Beach, California, near the Pacific Ocean. The firm has over 3,100 employees working in 22 offices throughout the Americas, Europe, and Asia. PIMCO and Allianz Global Investors manage around Euro, €2.5 trillion of third-party assets. PIMCO ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Funds

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable securities, or short collective inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

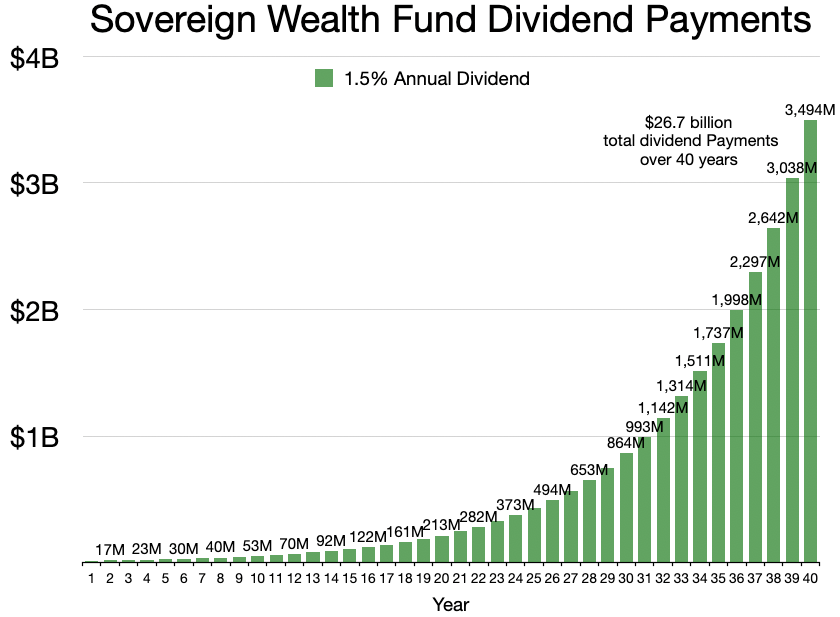

Sovereign Wealth Fund

A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned investment fund that invests in real and financial assets such as stocks, Bond (finance), bonds, real estate, precious metals, or in alternative investments such as private equity funds or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Moneta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Of Funds

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A fund of funds may be "fettered", meaning that it invests only in funds managed by the same investment company, or "unfettered", meaning that it can invest in external funds run by other managers. There are different types of FOF, each investing in a different type of collective investment scheme (typically one type per FOF), for example a mutual fund FOF, a hedge fund FOF, a private-equity FOF, or an investment trust FOF. The original Fund of Funds was created by Bernie Cornfeld in 1962. It went bankrupt after being looted by Robert Vesco. Features Investing in a collective investment scheme may increase diversity compared with a small investor holding a smaller range of securities directly. Investing in a fund of funds may achieve grea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Boutique Investment Bank

A boutique investment bank is an investment bank that specializes in at least one aspect of investment banking, generally corporate finance, although some banks' strengths are retail in nature, such as Charles Schwab. Of those involved in corporate finance, capital raising, mergers and acquisitions and restructuring and reorganizations are their primary activities. Boutiques usually provide advisory and consulting services, but lack capacity to provide funding. After the Gramm–Leach–Bliley Act, investment banks have either had a retail deposit base (JPMorgan Chase, Citi, Bank of America) or have had funding from overseas owners or from Wealth Management arms ( UBS, Deutsche Bank, Morgan Stanley). Boutique banks on the other hand often turn to other banks to provide funding or deal directly with capital rich firms such as insurers to provide capital for deals. Boutique investment banks generally work on smaller deals involving middle-market companies, and usually assist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Investment Banks

The following list catalogues the largest, most profitable, and otherwise notable investment banks. This list of investment banks notes full-service banks, financial conglomerates, independent investment banks, private placement firms and notable acquired, merged, or bankrupt investment banks. As an industry it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique market (specialized businesses). Largest full-service investment banks The following are the largest full-service global investment banks; full-service investment banks usually provide both advisory and financing banking services, as well as sales, market making, and research on a broad array of financial products, including equities, credit, rates, currency, commodities, and their derivatives. The largest investment banks are noted with the following: # JPMorgan Chase # Goldman Sachs # BofA Securities # Morgan Stanley # Citigroup # UBS # Deutsche ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Private-equity Firms

Below is a list of notable private equity firms. Largest private equity firms by PE capital raised Each year Private Equity International publishes the PEI 300, a ranking of the largest private-equity firms by how much capital they have raised for private-equity investment in the last five years. In the 2025 ranking, KKR regained the top spot from Blackstone Inc. who fell to third, behind EQT AB. List of investment banking private equity groups ^ Defunct banking institution Notable private equity firms Americas * 3G Capital * ABS Capital * Adams Street Partners * Advent International * AEA Investors * American Securities * Angelo, Gordon & Co. * Apollo Global Management * Ares Management * Arlington Capital Partners * Auldbrass Partners * Avenue Capital Group * Avista Capital Partners * Bain Capital * BDT & MSD Partners * Berkshire Partners * Blackstone Group * Blue Owl Capital * Blum Capital * Brentwood Associates * Bruckmann, Ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Hedge Funds

Below is a list of notable Hedge fund, hedge funds. Largest hedge fund firms Below are the 20 largest hedge funds in the world ranked by discretionary assets under management (AUM) as of mid-2024. Only assets in private funds following Alternative investment, hedge fund strategies are counted. Some of these managers also manage public funds and offer non-hedge fund strategies. The data for this table comes from ''Pensions & Investments'' with data compiled as of June 2024. Notable hedge fund firms Americas * Acadian Asset Management * Adage Capital Management * Alphadyne Asset Management * AlphaSimplex Group * Altimeter Capital * Angelo Gordon * Appaloosa Management * AQR Capital Management * Archegos Capital Management * Assured Investment Management * Atlantic Investment Management * Aurelius Capital Management * Avenue Capital Group * Baker Brothers Advisors * Balyasny Asset Management * Beach Point Capital Management * Bracebridge Capital * Bridgewater Associates * Cany ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Closed-end Fund

A closed-end fund (CEF), also known as a closed-end mutual fund, is an investment vehicle fund that raises capital by issuing a fixed number of shares at its inception, and then invests that capital in financial assets such as stocks and bonds. After inception it is closed to new capital, although fund managers sometimes employ leverage. Investors can buy and sell the existing shares in secondary markets. CEFs are the oldest form of pooled investment still used in the United States, dating to the 1800s. In the United States, closed-end funds sold publicly must be registered under both the Securities Act of 1933 and the Investment Company Act of 1940. U.S.-based closed-end funds are referred to under the law as ''closed-end companies'' and form one of three SEC-recognized types of investment companies along with mutual funds and unit investment trusts. Like their better-known open-ended cousins, closed-end funds are usually sponsored by a fund management company. The fund's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unit Trust

A unit trust is a form of collective investment constituted under a trust deed. A unit trust pools investors' money into a single fund, which is managed by a fund manager. Unit trusts offer access to a wide range of investments, and depending on the trust, it may invest in securities such as shares, bonds, gilts, and also properties, mortgage and cash equivalents. Those investing in the trust own "units", whose price is called the "net asset value" (NAV). The number of these units is not fixed and when more is invested in a unit trust (by investors opening accounts or adding to their accounts), more units are created. In addition to the UK, trusts are found in Fiji, Ireland, the Isle of Man, Guernsey, Jersey, New Zealand, Australia, Kenya, Uganda, Tanzania, Namibia, South Africa, Singapore, Malaysia and Zimbabwe. History The first unit trust was launched in the UK in 1931 by M&G under the inspiration of Ian Fairbairn. The rationale behind the launch was to emulate the c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital'), and the open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond fund, bond or fixed income funds, stock fund, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. The primary structures of mutual funds are open-end funds, closed-end funds, and unit investment trusts. Over long durations, passively managed funds consistently outperform actively m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |