|

Narasimham Committee On Banking Sector Reforms (1998)

From the 1991 India economic crisis to its status of List of countries by GDP (PPP), third largest economy in the world by 2011, India has grown significantly in terms of economic development, so has its banking in India, banking sector. During this period, recognizing the evolving needs of the sector, the Finance Ministry of the Government of India set up various committees with the task of analyzing India's banking sector and recommending legislation and regulations to make it more effective, competitive and efficient. Two such expert Committees were set up under the chairmanship of M. Narasimham, Maidavolu Narasimham. They submitted their recommendations in the 1990s in reports widely known as the Narasimham Committee-I (1991) report and the Narasimham Committee-II (1998) Report. These recommendations not only helped unleash the potential of banking in India, they are also recognized as a factor towards minimizing the impact of 2008 financial crisis. Unlike the Dirigisme, dir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1991 India Economic Crisis

The 1991 Indian economic crisis was an economic crisis in India resulting from a balance of payments deficit due to excess reliance on imports and other external factors. India's economic problems started worsening in 1985 as imports swelled, leaving the country in a twin deficit: the Indian trade balance was in deficit at a time when the government was running on a huge fiscal deficit (although the twin-deficit hypothesis is disputed). The fall of the Eastern Bloc, which had trade relations with India and allowed for rupee exchange, posed significant issues.The Soviet Union was India's largest trading partner until 1991, with bilateral trade of over $5 billion per year, the Dissolution of the Soviet Union, turmoil in USSR triggered the collapse in India's export. Towards the end of 1990, leading up to the Gulf War, the situation became dire. India's foreign exchange reserves were not enough to finance three weeks' worth of imports. Additionally, the Gulf War, specifically the con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public-sector Undertaking

Public Sector Undertakings (PSU) in India are government-owned entities in which at least 51% of stake is under the ownership of the Government of India or state governments. These types of firms can also be a joint venture of multiple PSUs. These entities perform commercial functions on behalf of the government. Depending on the level of government ownership, PSUs are officially classified into two categories: Central Public Sector Undertakings (CPSUs), owned by the central government or other CPSUs; and State Public Sector Undertakings (SPSUs), owned by state governments. CPSU and SPSU is further classified into Strategic Sector and Non-Strategic Sector. Depending on their financial performance and progress, CPSUs are granted the status of Maharatna, Navaratna, and Miniratna (Category I and II). Following India's independence in 1947, the limited pre-existing industries were insufficient for sustainable economic growth. The Industrial Policy Resolution of 1956, adopt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Planning Commission Of India

The Planning Commission was an institution in the Government of India which formulated India's Five-Year Plans, among other functions. In his first Independence Day speech in 2014, Prime Minister Narendra Modi announced his intention to dissolve the Planning Commission. It has since been replaced by a new institution named NITI Aayog. History Rudimentary economic planning, deriving from the sovereign authority of the state, was first initiated in India in 1938 by Congress President Netaji Subhash Chandra Bose, Atul Tiwari, Pandit Jawaharlal Nehru who had been persuaded by Meghnad Saha to set up a National Planning Committee. M. Visvesvaraya had been elected head of the Planning Committee. Meghnad Saha approached him and requested him to step down, putting forward the argument that planning needed a reciprocity between science and politics. M. Visvesvaraya generously agreed and Jawaharlal Nehru was made head of the National Planning Committee. The so-called "British ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small And Medium Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by many national agencies and international organizations such as the World Bank, the OECD, European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs outnumber large companies by a wide margin and also employ many more people. On a global scale, SMEs make up 90% of all companies and more than 50% of all employment. For example, in the EU, 99% of all businesses are SMEs. Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees acco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Bank

A universal bank is a type of bank which participates in many kinds of banking activities and is both a commercial bank and an investment bank as well as providing other financial services such as insurance. These are also called full-service financial firms, although there can also be full-service investment banks which provide wealth and asset management, trading, underwriting, researching as well as financial advisory. The concept is most relevant in the United Kingdom and the United States, where historically there was a distinction drawn between pure investment banks and commercial banks. In the US, this was a result of the Glass–Steagall Act of 1933. In both countries, however, since the 1980s the regulatory barrier to the combination of investment banks and commercial banks has largely been removed, and a number of universal banks have emerged in both jurisdictions. In other countries, the concept is less relevant as there was no regulatory distinction between inv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bimal Jalan

Bimal Jalan (born 17 August 1941) is a former Governor of Reserve Bank of India and was a nominated member of the Upper House of India's Parliament, the Rajya Sabha during 2003–2009. Education and career Jalan graduated from Presidency College, Calcutta, and later attended Cambridge and Oxford but no further detail as to his course of study is known publicly. Jalan held several administrative and advisory positions in the Government of India, namely, Chief Economic Adviser in the 1980s, Banking Secretary between 1985 and 1989 and Finance Secretary, Ministry of Finance between January 1991 and September 1992. In 1992-93 and then from 1998–2008, Jalan was the President of the Governing Body of thNational Council of Applied Economic Research Planning Commission in New Delhi. He was the Governor of Reserve Bank of India for two terms. The Government of India The Government of India (ISO 15919, ISO: Bhārata Sarakāra, legally the Union Government or Union of I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Adequacy Ratio

Capital Adequacy Ratio (CAR) also known as Capital to Risk (Weighted) Assets Ratio (CRAR), is the ratio of a bank's capital to its risk. National regulators track a bank's CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. It is a measure of a bank's capital. It is expressed as a percentage of a bank's risk-weighted credit exposures. The enforcement of regulated levels of this ratio is intended to protect depositors and promote stability and efficiency of financial systems around the world. Two types of capital are measured: * tier one capital, which can absorb losses without a bank being required to cease trading; and * tier two capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors. Formula Capital adequacy ratios (CARs) are a measure of the amount of a bank's core capital expressed as a percentage of its risk-weighted asset. Capital adequacy rat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitisation And Reconstruction Of Financial Assets And Enforcement Of Security Interest Act, 2002

The Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (also known as the SARFAESI Act) is an Indian law. It allows banks and other financial institutions to auction residential or commercial properties of defaulters to recover loans. The first asset reconstruction company (ARC) of India, ARCIL, was set up under this act. By virtue of the SARFAESI Act 2002, the Reserve Bank of India has the authority to register and regulate Asset Reconstruction Companies (ARCs). Under this act secured creditors (banks or financial institutions) have many rights for enforcement of security interest under section 13 of SARFAESI Act, 2002. If borrower of financial assistance defaults on repayment of a loan and their account is classified as Non performing Asset by secured creditor, then secured creditor may repossess the security asset before expiry of period of limitation by written notice. Summary The law does not apply to unsecured loans, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-performing Asset

A non-performing loan (NPL) is a bank loan that is subject to late repayment or is unlikely to be repaid by the borrower in full. Non-performing loans represent a major challenge for the banking sector, as they reduce profitability. They are often claimed to prevent banks from lending more to businesses and consumers, which in turn slows economic growth, although this theory is disputed. In the European Union, the management of the NPLs resulting from the 2008 financial crisis has become a politically sensitive topic, culminating in 2017 with the decision by the European Council to task the European Commission to launch an action plan to tackle NPLs. The action plan supports the fostering of a secondary market for NPLs and the creation of Asset Management Companies (aka bad banks). In December 2020, this action plan was revised in the wake of the COVID-19 pandemic crisis. Definition Non-performing loans are generally recognised as per the following criteria: * Payments of inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Union

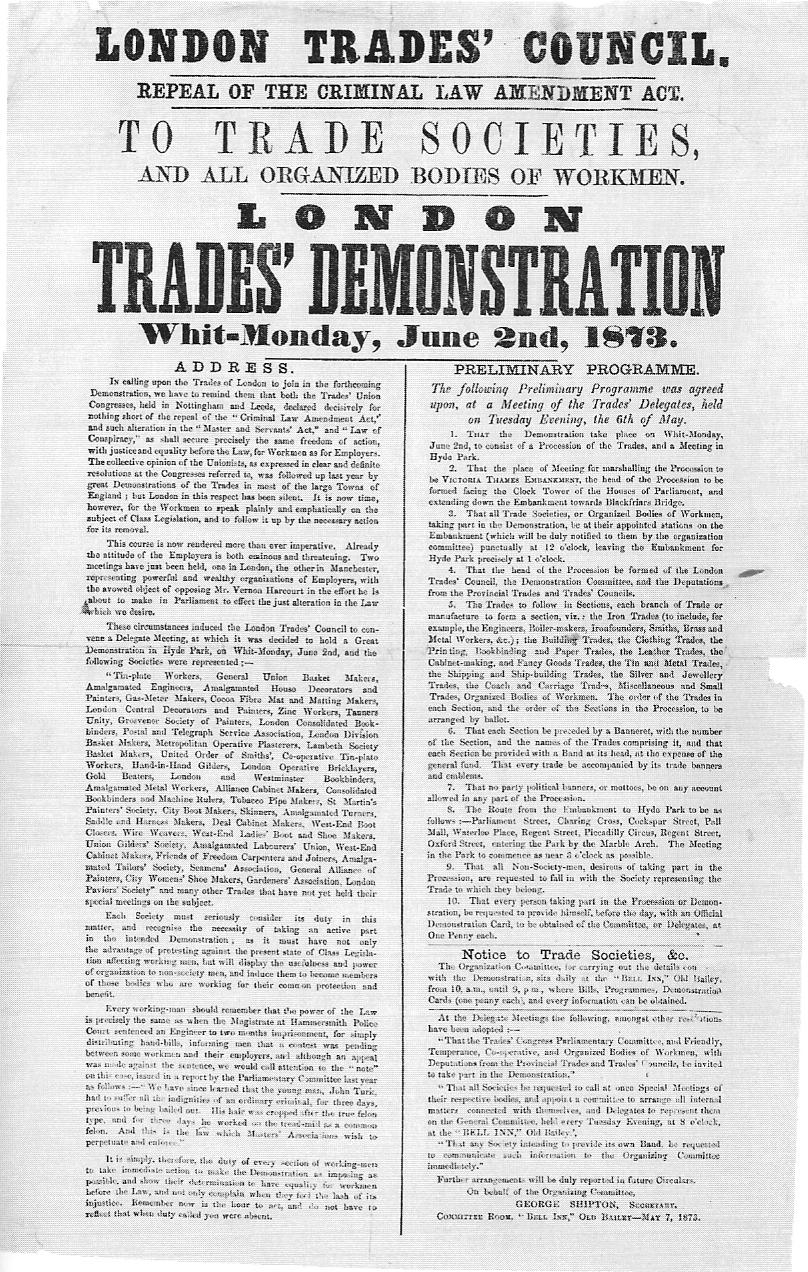

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages and Employee benefits, benefits, improving Work (human activity), working conditions, improving safety standards, establishing complaint procedures, developing rules governing status of employees (rules governing promotions, just-cause conditions for termination) and protecting and increasing the bargaining power of workers. Trade unions typically fund their head office and legal team functions through regularly imposed fees called ''union dues''. The union representatives in the workforce are usually made up of workplace volunteers who are often appointed by members through internal democratic elections. The trade union, through an elected leadership and bargaining committee, bargains with the employer on behalf of its members, known as t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank For Agriculture And Rural Development

The National Bank for Agriculture and Rural Development (NABARD) is an All India Development Financial Institution (DFI) and an apex Supervisory Body for overall supervision of Regional Rural Banks, State Cooperative Banks and District Central Cooperative Banks in India. It was established under the 'NABARD Act 1981'' passed by the Parliament of India. It ifully ownedby Government of India and functions under the Department of Financial Services (DFS) under the Ministry of Finance. History The importance of institutional credit in boosting rural economy has been clear to the Government of India right from its early stages of planning. Therefore, the Reserve Bank of India (RBI) at the insistence of the Government of India, constituted a Committee to Review the Arrangements For Institutional Credit for Agriculture and Rural Development (CRAFICARD) to look into these very critical aspects. The Committee was formed on 30 March 1979, under the Chairmanship of Shri B. Sivaraman, for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Housing Bank

National Housing Bank (NHB), is a regulatory body for overall regulation and licensing of housing finance companies in India. It is under the jurisdiction of Ministry of Finance, Government of India. It was set up on 9 July 1988 under the National Housing Bank Act, 1987. NHB states it has been established with an objective to operate as a principal agency to promote housing finance institutions both at local and regional levels and to provide financial and other support incidental to such institutions and for matters connected therewith. The Finance Act, 2019 has amended the National Housing Bank Act, 1987. The amendment confers the powers of regulation of Housing Finance Companies (HFCs) to the Reserve Bank of India Reserve Bank of India, abbreviated as RBI, is the central bank of the Republic of India, and regulatory body responsible for regulation of the Indian banking system and Indian rupee, Indian currency. Owned by the Ministry of Finance (India), Min .... NHB regi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |