|

Murphy V. IRS

''Marrita Murphy and Daniel J. Leveille, Appellants v. Internal Revenue Service and United States of America, Appellees'' (commonly known as ''Murphy v. IRS''), is a tax case in which the United States Court of Appeals for the District of Columbia Circuit originally held that the taxation of Negligent infliction of emotional distress, emotional distress awards by the federal government is unconstitutional. That decision was vacated, or rendered void, by the Court on December 22, 2006. The Court eventually overturned its original decision, finding against Murphy in an opinion issued on July 3, 2007. The July 3, 2007 decision was that the taxpayer's recovery could be taxed under Article I, Section 8 of the Constitution even if the recovery were not "income" under the Sixteenth Amendment to the United States Constitution, Sixteenth Amendment. The Court conceded that this rationale for granting a rehearing and overturning the original decision was not in the government's original app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The District Of Columbia Circuit

The United States Court of Appeals for the District of Columbia Circuit (in case citations, D.C. Cir.) is one of the thirteen United States Courts of Appeals. It has the smallest geographical jurisdiction of any of the U.S. courts of appeals, and it covers only the United States District Court for the District of Columbia, U.S. District Court for the District of Columbia. It meets at the E. Barrett Prettyman United States Courthouse in Washington, D.C., Washington, DC. The D.C. Circuit is often considered to be second only to the United States Supreme Court, U.S. Supreme Court in status and prestige, and it is sometimes unofficially termed "the second highest court in the land". Because its jurisdiction covers the District of Columbia, it tends to be the main federal appellate court for issues of U.S. United States administrative law, administrative law and United States constitutional law, constitutional law. Four of the nine current Supreme Court justices were previously judg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negligent Infliction Of Emotional Distress

The tort of negligent infliction of emotional distress (NIED) is a controversial cause of action, which is available in nearly all U.S. states but is severely constrained and limited in the majority of them. The underlying concept is that one has a legal duty to use reasonable care to avoid causing emotional distress to another individual. If one fails in this duty and unreasonably causes emotional distress to another person, that actor will be liable for monetary damages to the injured individual. The tort is to be contrasted with intentional infliction of emotional distress in that there is no need to prove intent to inflict distress. That is, an accidental infliction, if negligent, is sufficient to support a cause of action. History NIED began to develop in the late nineteenth century, but only in a very limited form, in the sense that plaintiffs could recover for consequential emotional distress as a component of damages when a defendant negligently inflicted physic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The District Of Columbia Circuit Cases

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film * ''The United'' (film), an unreleased Arabic-language film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe * "United (Who We Are)", a song by XO-IQ, featured in the television ser ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Ruling 74-77

Revenue Ruling 74-77 is the 1974 income tax ruling by the Internal Revenue Service (IRS) determining that a taxpayer may exclude from gross income "damages for alienation of affections" and for the "surrender of the custody of minor child".Economics of Tax Law, Volume 1, Page 498-503, by David A. Weisbach. Sol. Op. 132 The ruling superseded Sol. Op. 132, I-1 C.B. 92 (1922), "since the position stated therein is set forth under the current statute and regulations in this Revenue Ruling", referring to and 26 C.F.R. § 1.104-1. That case excluded from gross income the amounts received by the taxpayer "as damages for alienation of affections or for the surrender of the custody of his child, whether under agreement of the parties or pursuant to judgment of the court." In that case, an individual taxpayer received certain amounts in settlement of his suit for damages on account of alienation of affections and in consideration for the surrender of the custody of his minor child. Thes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

District Of Columbia

Washington, D.C., formally the District of Columbia and commonly known as Washington or D.C., is the capital city and Federal district of the United States, federal district of the United States. The city is on the Potomac River, across from Virginia, and shares land borders with Maryland to its north and east. It was named after George Washington, the first president of the United States. The district is named for Columbia (personification), Columbia, the female National personification, personification of the nation. The Constitution of the United States, U.S. Constitution in 1789 called for the creation of a federal district under District of Columbia home rule, exclusive jurisdiction of the United States Congress, U.S. Congress. As such, Washington, D.C., is not part of any U.S. state, state, and is not one itself. The Residence Act, adopted on July 16, 1790, approved the creation of the Capital districts and territories, capital district along the Potomac River. The city ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Precedent

Precedent is a judicial decision that serves as an authority for courts when deciding subsequent identical or similar cases. Fundamental to common law legal systems, precedent operates under the principle of ''stare decisis'' ("to stand by things decided"), where past judicial decisions serve as case law to guide future rulings, thus promoting consistency and predictability. Precedent is a defining feature that sets common law systems apart from Civil law (legal system), civil law systems. In common law, precedent can either be something courts must follow (binding) or something they can consider but do not have to follow (persuasive). Civil law (legal system), Civil law systems, in contrast, are characterized by comprehensive Code of law, codes and detailed statutes, with no emphasis on precedent, and where judges primarily focus on fact-finding and applying codified law. Courts in common law systems rely heavily on case law, which refers to the collection of precedents and le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Capital

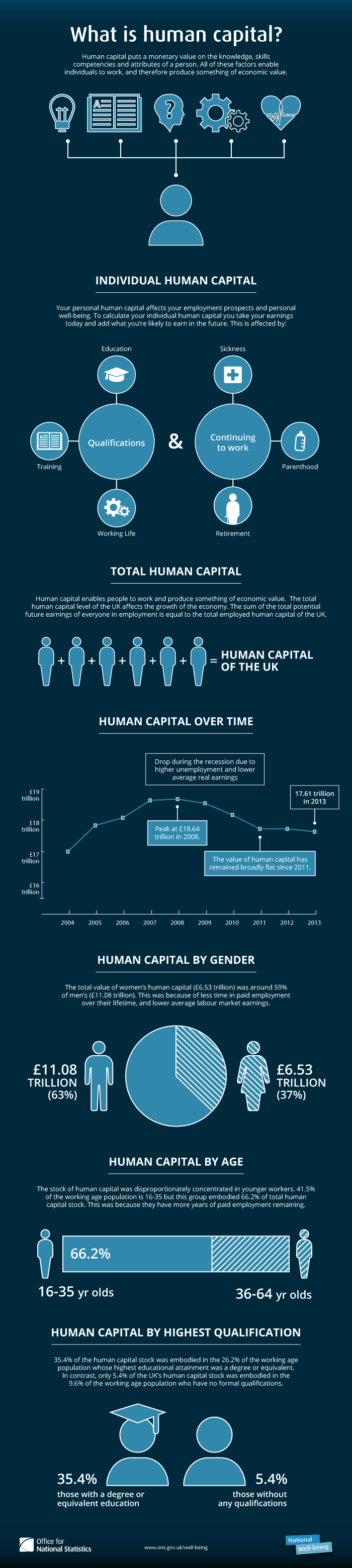

Human capital or human assets is a concept used by economists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a substantial impact on individual earnings. Research indicates that human capital investments have high economic returns throughout childhood and young adulthood. Companies can invest in human capital; for example, through education and training, improving levels of quality and production. History Adam Smith included in his definition of Capital (economics), capital "the acquired and useful abilities of all the inhabitants or members of the society". The first use of the term "human capital" may be by Irving Fisher. An early discussion with the phrase "human capital" was from Arthur Cecil Pigou: But the term only found widespread use in economics after its popularization by economists of the Chicago School of economics, Chicago School, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissioner V

A commissioner (commonly abbreviated as Comm'r) is, in principle, a member of a commission or an individual who has been given a Wiktionary: commission, commission (official charge or authority to do something). In practice, the title of commissioner has evolved to include a variety of senior officials, often sitting on a specific commission. In particular, the commissioner frequently refers to senior police or government officials. A high commissioner is equivalent to an ambassador, originally between the United Kingdom and the Dominions and now between all Commonwealth states, whether Commonwealth realms, republics in the Commonwealth of Nations, republics or countries having a monarch other than that of the realms. The title is sometimes given to senior officials in the private sector; for instance, many North American sports leagues. There is some confusion between commissioners and commissary, commissaries because other European languages use the same word for both. Therefore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kohn, Kohn & Colapinto

Kohn, Kohn & Colapinto is a Washington, D.C.–based international whistleblower rights law firm specializing in anti-corruption and whistleblower law, representing whistleblowers who seek rewards, or who are facing employer retaliation, for reporting violations of the False Claims Act, Foreign Corrupt Practices Act, Dodd-Frank Wall Street Reform, Sarbanes-Oxley Acts, Commodity and Security Exchange Acts and the IRS Whistleblower law. The firm's most notable client is Bradley Birkenfeld, a private banker who blew the whistle on UBS AG's aiding and abetting of tax fraud by the Swiss bank's American clientele. Other notable clients include Danske Bank whistleblower Howard Wilkinson, who exposed what many experts believe to be the largest money laundering scandal in world banking history, and Linda Tripp, the former White House and U.S. Department of Defense employee who blew the whistle on President Bill Clinton's affair with Monica Lewinsky. __TOC__ Current operations Kohn, K ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David K

David (; , "beloved one") was a king of ancient Israel and Judah and the third king of the United Monarchy, according to the Hebrew Bible and Old Testament. The Tel Dan stele, an Aramaic-inscribed stone erected by a king of Aram-Damascus in the late 9th/early 8th centuries BCE to commemorate a victory over two enemy kings, contains the phrase (), which is translated as " House of David" by most scholars. The Mesha Stele, erected by King Mesha of Moab in the 9th century BCE, may also refer to the "House of David", although this is disputed. According to Jewish works such as the ''Seder Olam Rabbah'', '' Seder Olam Zutta'', and ''Sefer ha-Qabbalah'' (all written over a thousand years later), David ascended the throne as the king of Judah in 885 BCE. Apart from this, all that is known of David comes from biblical literature, the historicity of which has been extensively challenged,Writing and Rewriting the Story of Solomon in Ancient Israel; by Isaac Kalimi; page 32; Cam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reporter

The ''Federal Reporter'' () is a case law reporter in the United States that is published by West Publishing and a part of the National Reporter System. It begins with cases decided in 1880; pre-1880 cases were later retroactively compiled by West Publishing into a separate reporter, '' Federal Cases''. The fourth and current ''Federal Reporter'' series publishes decisions of the United States courts of appeals and the United States Court of Federal Claims; prior series had varying scopes that covered decisions of other federal courts as well. Though the ''Federal Reporter'' is an unofficial reporter and West is a private company that does not have a legal monopoly over the court opinions it publishes, it has so dominated the industry in the United States that legal professionals, including judges, uniformly cite to the ''Federal Reporter'' for included decisions. Approximately 30 new volumes are published each year. Distinctions The ''Federal Reporter'' has always publi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |