|

Multi-curve Framework

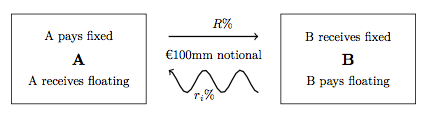

In finance, an interest rate swap (finance), swap (IRS) is an interest rate derivative, interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a Interest rate derivative#Linear and non-linear, "linear" IRD and one of the most Market liquidity, liquid, benchmark products. It has associations with forward rate agreement, forward rate agreements (FRAs), and with zero coupon swap, zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global Over-the-counter (finance), OTC Derivative (finance), derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Notional Principal Amount

The notional amount (or notional principal amount or notional value) on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument. This amount generally does not change and is thus referred to as '' notional.'' Explanation Contrast a bond with an interest rate swap: * In a bond, the buyer pays the principal amount at issue (start), then receives coupons (computed off this principal) over the life of the bond, then receives the principal back at maturity (end). * In a swap, no principal changes hands at inception (start) or expiry (end), and in the meantime, interest payments are computed based on a notional amount, which acts ''as if'' it were the principal amount of a bond, hence the term ''notional principal amount'', abbreviated to ''notional''. In simple terms, the notional principal amount is essentially how much of an asset or bonds a person owns. For example, if a premium bond were bought for £1, then the notional pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constant Maturity Swap

A constant maturity swap (CMS) is a swap that allows the purchaser to fix the duration of received flows on a swap. The floating leg of an interest rate swap typically resets against a published index. The floating leg of a constant maturity swap fixes against a point on the swap curve on a periodic basis. A constant maturity swap is an interest rate swap where the interest rate on one leg is reset periodically, but with reference to a market swap rate rather than LIBOR. The other leg of the swap is generally LIBOR, but may be a fixed rate or potentially another constant maturity rate. Constant maturity swaps can either be single currency or cross currency swaps. Therefore, the prime factor for a constant maturity swap is the shape of the forward implied yield curves. A single currency constant maturity swap versus LIBOR is similar to a series of differential interest rate fixes (or "DIRF") in the same way that an interest rate swap is similar to a series of forward rate agreem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero Coupon Swap

In finance, a zero coupon swap (ZCS) is an interest rate derivative (IRD). In particular it is a linear IRD, that in its specification is very similar to the much more widely traded interest rate swap (IRS). General description A zero coupon swap (ZCS)Pricing and Trading Interest Rate Derivatives: A Practical Guide to Swaps J H M Darbyshire, 2017, is a derivative contract made between two parties with terms defining two 'legs' upon which each party either makes or receives payments. One leg is the traditional fixed leg, whose cashflows are determined at the outset, usually defined by an agreed fixed rate of interest. A second leg is the traditional floating leg, whose payments at the outset are forecast but subject to change and dependent upon future publication of the interest rate inde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amortising Swap

An Amortising swap Frank J. Fabozzi, 2018''The Handbook of Financial Instruments'' Wiley is usually an interest rate swap in which the notional principal for the interest payments declines (i.e. is paid down) during the life of the swap, perhaps at a rate tied to the prepayment of a mortgage or to an interest rate benchmark such as the London Interbank Offered Rate (Libor). It is the opposite of the accreting swap. If the swap allows for uncertain contingent ups and downs in the notional principal, it is called a "roller-coaster swap". References Sources Further reading * Mark Rubinstein ''Rubinstein on Derivatives. Futures, Options and Dynamic Strategies'' 1999 Interest rates Swaps (finance) {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Swap

In finance, a currency swap (more typically termed a cross-currency swap, XCS) is an interest rate derivative (IRD). In particular it is a linear IRD, and one of the most liquid benchmark products spanning multiple currencies simultaneously. It has pricing associations with interest rate swaps (IRSs), foreign exchange (FX) rates, and FX swaps (FXSs). General description A cross-currency swap's (XCS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against two interest rate indexes denominated in two different currencies. It also specifies an initial exchange of notional currency in each different currency and the terms of that repayment of notional currency over the life of the swap. The most common XCS, and that traded in interbank markets, is a mark-to-market (MTM) XCS, whereby notional exchanges are regularly made throughout the life of the swap according to FX rate flu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basis Swap

A basis swap is an interest rate swap which involves the exchange of two floating rate financial instruments. A basis swap functions as a floating-floating interest rate swap under which the floating rate payments are referenced to different bases. The existence of a basis arises from demand and supply imbalances and where, for example, a basis is due for a borrower seeking dollars, this is indicative of a synthetic dollar interest rate in the FX market pricing higher than the direct dollar interest rate. The existence of the basis is a violation of the covered interest rate parity (CIP) condition. Usage of basis swaps for hedging Basis risk occurs for positions that have at least one paying and one receiving stream of cash flows that are driven by different factors and the correlation between those factors is less than one. Entering into a Basis Swap may offset the effect of gains or losses resulting from changes in the basis, thus reducing basis risk. # against exposure to curr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Day Count Convention

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days between two coupon payments, thus calculating the amount transferred on payment dates and also the accrued interest for dates between payments. The day count is also used to quantify periods of time when discounting a cash-flow to its present value. When a security such as a bond is sold between interest payment dates, the seller is eligible to some fraction of the coupon amount. The day count convention is used in many other formulas in financial mathematics as well. Development The need for day count conventions is a direct consequence of interest-earning investments. Different conventions were developed to address often conflicting requirements, including ease of calculation, constancy of time period (day, month, or year) and the ne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tenor (finance)

A tenor is a type of male singing human voice, voice whose vocal range lies between the countertenor and baritone voice types. It is the highest male chest voice type. Composers typically write music for this voice in the range from the second B below middle C to the G above middle C (i.e. B2 to G4) in choral music, and from the second B flat below middle C to the C above middle C (B2 to C5) in operatic music, but the range can extend at either end. Subtypes of tenor include the ''leggero'' tenor, lyric tenor, spinto tenor, dramatic tenor, heldentenor, and tenor buffo or . History The name "tenor" derives from the Latin word ''wikt:teneo#Latin, tenere'', which means "to hold". As noted in the "Tenor" article at ''Grove Music Online'': In polyphony between about 1250 and 1500, the [tenor was the] structurally fundamental (or 'holding') voice, vocal or instrumental; by the 15th century it came to signify the male voice that sang such parts. All other voices were normally calc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swap Spread

Swap spreads are the difference between the yield on a government bond or sovereign debt security and the fixed component of a swap, both of which have a similar time until maturity. Given that most sovereign debt securities such as government bonds are considered to be risk free securities the role of a swap spread is to reflect the risk levels of an agreement perceived by the investors involved. Swap spreads are therefore categorised to be an economic indication tool as the size of the swap spread reflects the level of risk aversion within the financial markets. Swap spreads is a term coined by economists to generate a tool to assess current market conditions. Swap spreads have become more popular as a metric of financial forecasting and measurement as a result of their increased correlation to financial market activity and volatility. Used as an indicator of economic activity, higher swap spreads are indicative of greater risk aversion within the market place. Governments, financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swap Rate

Swap or SWAP may refer to: Finance * Swap (finance), a derivative in which two parties agree to exchange one stream of cash flows against another * Barter Science and technology * Swap (computer programming), exchanging two variables in the memory of a computer * Swap partition, a partition on a computer storage used for paging * Swap file, a file on a computer storage used for paging * SWAP (instrument) (Sun Watcher using Active Pixel System Detector and Image Processing), a space instrument aboard the ''PROBA2'' satellite * SWAP (New Horizons) (Solar Wind At Pluto), a science instrument aboard the uncrewed New Horizons space probe * SWAP protein domain, in molecular biology * Size, weight and power (SWaP), see DO-297 Other * Swåp, an Anglo-Swedish folk music band * Sector-Wide Approach (SWAp), an approach to international development * Swap (film), a 2015 Philippine crime drama film See also * Swaps (horse) (1952–1972), a California-bred American Thoro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Date Rolling

In finance, date rolling occurs when a payment day or date used to calculate accrued interest falls on a holiday, according to a given business calendar. In this case, the date is moved forward or backward in time such that it falls in a business day, according to the same business calendar A calendar is a system of organizing days. This is done by giving names to periods of time, typically days, weeks, months and years. A calendar date, date is the designation of a single and specific day within such a system. A calendar is .... The choice of the date rolling rule is conventional. Conventional rules used in finance are: *Following business day: the payment date is rolled to the next business day. *Modified following business day: the payment date is rolled to the next business day unless doing so would cause the payment to be in the next calendar month, in which case the payment date is rolled to the previous business day. Many institutions have month-end accounting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |