|

Moelis

Moelis & Company is a global investment bank that provides financial advisory services to corporations, governments, and financial sponsors. The firm advises on strategic decisions such as mergers and acquisitions, recapitalizations and restructurings and other corporate finance matters.Moelis & Company Overview ''Company Website'' Moelis has advised on more than $4 trillion in transactions since its inception. It was founded in 2007 and is headquartered in New York City, with 20 offices in North and South America, Europe, the Middle East, Asia and Australia.Moelis & Company History ''Company Website'' It has 1078 employees, including 765 investment bankers. Of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

399 Park Avenue

399 Park Avenue is a 41-story office building that occupies the entire block between Park Avenue and Lexington Avenue and 53rd Street and 54th Street in Midtown Manhattan, New York City. The building was the world headquarters of Citigroup from 1961, when it moved from 55 Wall Street, until 2015, when the company moved to 388 Greenwich Street. History The building lot was assembled by Vincent Astor who initially planned to build a 46-story Astor Plaza on the site. Astor had problems completing the assembly of the lots of mostly residential buildings as a pharmacy held out. In 1974, the company opened the Citigroup Center annex across Lexington to the east. In 1987, Citigroup sold one third of its interest in the building along with two-thirds of its interest in Citigroup Center to Dai-Ichi Mutual Life Insurance Company for $670 million. At the time, Citigroup said it was moving many of its offices to One Court Square in Long Island City, Queens. Citigroup moved out of the to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jefferies Group

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. This includes mergers and acquisitions, restructuring, and other financial advisory services. The Capital Markets segment also includes its securities trading (including the results of its indirectly partially owned subsidiary, Jefferies High Yield Trading, LLC) and investment banking activities. On November 12, 2012, Jefferies announced its merger with Leucadia National Corporation, its largest shareholder. At that time, Leucadia common shares were trading at $21.14 per share. As of December 31, 2015, Leucadia shares were trading at $17.39 per share. Jefferies remains independent and is the largest operating company within the Jefferies Financial Group, as Leucadia was renamed in May ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Värde Partners

Värde Partners (Värde) is an American alternative investment management firm headquartered in Minneapolis, Minnesota. The firm focuses on investments in credit-related assets and distressed securities although it has also expanded into other areas of alternative investments including real estate. Outside the United States, the firm has offices in Luxembourg, London, Mumbai and Singapore. Background Värde Partners was founded in 1993 by three former Cargill financial executives, George Hicks, Marcia Page and Greg McMillan. Värde gets its name from the Swedish word for value. Värde originally started as a hedge fund that focused on distressed securities and grew slowly in its early years before expanding into other alternative investments. It has been viewed as a much lower profile firm compared to others such as Kohlberg Kravis Roberts, The Carlyle Group and Apollo Global Management, and Hicks has stated the firm's intention is to "do a good job and be a great place to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kohlberg Kravis Roberts

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global private-equity and investment company. , the firm had completed private-equity investments in portfolio companies with approximately $710 billion of total enterprise value. Its assets under management (AUM) and fee paying assets under management (FPAUM) were $553 billion and $446 billion, respectively. KKR was founded in 1976 by Jerome Kohlberg Jr., and cousins Henry Kravis and George R. Roberts, all of whom had previously worked together at Bear Stearns, where they completed some of the earliest leveraged buyout transactions. Since its founding, KKR has completed a number of transactions, including the 1989 leveraged buyout of RJR Nabisco, which was the largest buyout in history to that point, as well as the 2007 buyout of TXU, which is currently the largest buyout completed to date. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Bank

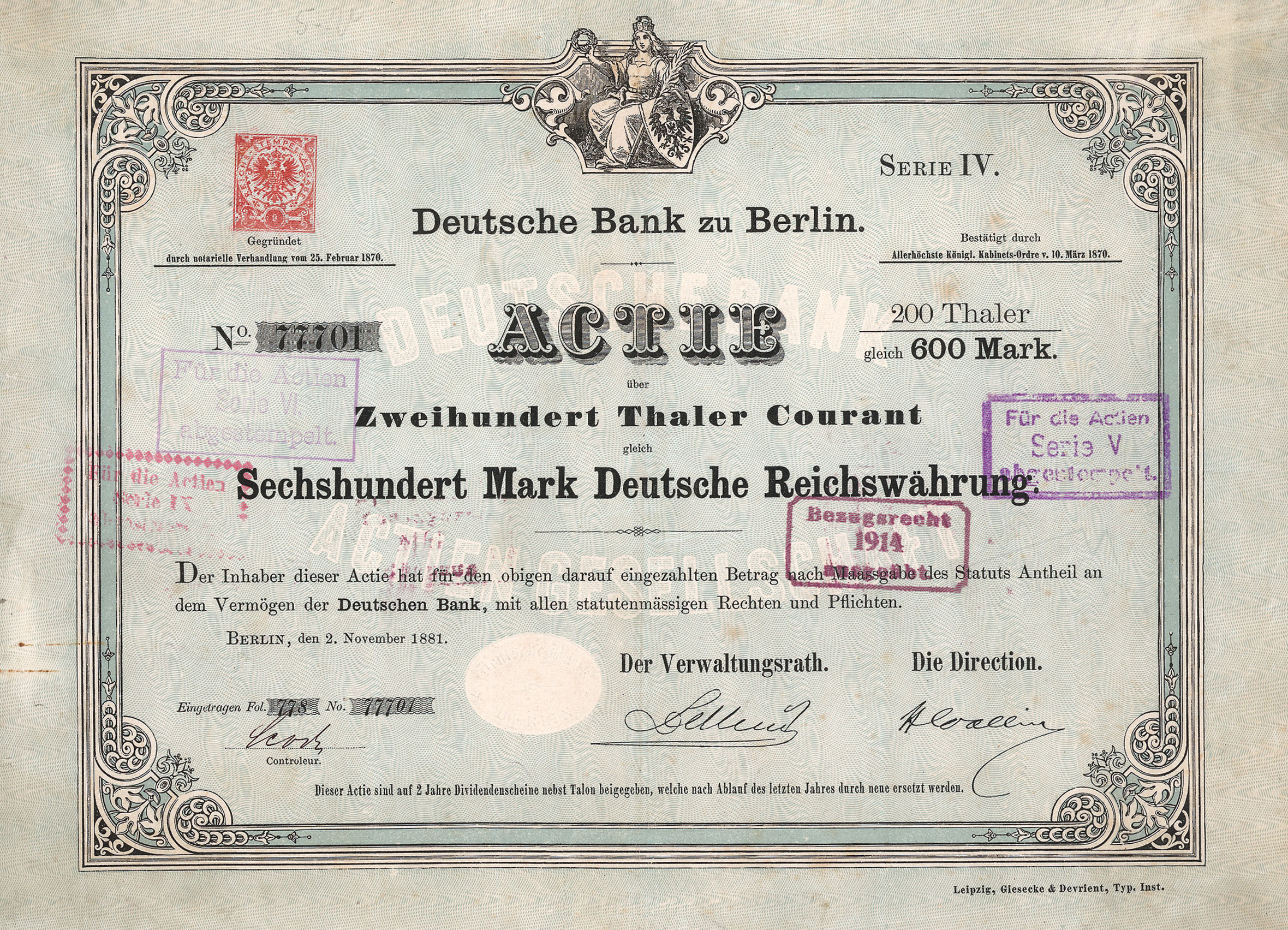

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foster's Group

Foster's Group Pty. Ltd. was an Australian beer group with interests in brewing and soft drinks, known for Foster's Lager, now called Carlton & United Breweries since the company was renamed in 2011. Foster's was founded in 1888 in Melbourne, Victoria by two American brothers, who sold the brewery a year later. The company was renamed prior to sale to British-South African multinational SABMiller in 2011. Foster's wine business was split into a separate company, Treasury Wine Estates, in May 2011. In October 2016 Anheuser-Busch InBev acquired SABMiller, which ceased trading as a corporation, making the Foster's Group a direct subsidiary of the parent company. In June 2020, Carlton and United Breweries was sold to the Japanese beverage giant, Asahi Group Holdings. History Foster's was founded in Melbourne in 1888 by two American brothers William and Ralph Foster of New York, United States, who happened to own a refrigeration plant. Cooling was necessary to brew and store ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SABMiller

SABMiller plc was an Anglo–South African multinational brewing and beverage company headquartered in Woking, England on the outskirts of London until 10 October 2016 when it was acquired by AB InBev for US$107-billion. It was the world's second-largest brewer measured by revenues (after Anheuser-Busch InBev) and was also a major bottler of Coca-Cola. Its brands included Foster's, Miller, and Pilsner Urquell. It operated in 80 countries worldwide and in 2009 sold around 21 billion litres of beverages. Since 10 October 2016, SABMiller is a business division of AB InBev, a Belgian multinational corporation with headquarters in Leuven. SABMiller was founded as South African Breweries in 1895 to serve a growing market of miners and prospectors in and around Johannesburg. Two years later, it became the first industrial company to list on the Johannesburg Stock Exchange. From the early 1990s onwards, the company increasingly expanded internationally, making several acquisitions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest bank in the United States, and the world's List of largest banks#By market capitalization, largest bank by market capitalization as of 2024. As the largest of the Big Four (banking)#United States, Big Four banks in America, the firm is considered Systemically important financial institution, systemically important by the Financial Stability Board. Its size and scale have often led to enhanced regulatory oversight as well as the maintenance of an internal "Fortress Balance Sheet". The firm is headquartered in Midtown Manhattan and is set return to its former location at the new under-construction JPMorgan Chase Building at 270 Park Avenue (2021–present), 270 Park Avenue in November 2025. JPMorgan Chase was created in 2000 by the mergers and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natixis

BPCE (for Banque Populaire Caisse d'Epargne) is a major French banking group formed by the 2009 merger of two major retail banking groups, Groupe Caisse d'Épargne and Groupe Banque Populaire. As of 2021, it was France's fourth-largest bank, the seventh largest in Europe, and the nineteenth in the world by total assets. It has more than 8,200 branches nationwide under their respective brand names serving nearly 150 million customers. Its wholesale banking subsidiary Natixis, previously a separately listed company, was delisted and came under full ownership of Groupe BPCE in 2021. BPCE has been designated as a Significant Institution since the entry into force of European Banking Supervision in late 2014, and as a consequence is directly supervised by the European Central Bank. It is also designated as a global systemically important bank (G-SIB) by the Financial Stability Board. History In 2008 and early 2009, the French state provided around 7 billion euros of financial s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Europe, The Middle East And Africa

Europe, the Middle East and Africa, commonly known by its acronym EMEA among the North American business spheres, is a geographical region used by institutions, governments and global spheres of marketing, media and business when referring to this region. The acronym EMEA is a shorthand way of referencing the two continents (Africa and Europe) and the Middle Eastern sub-continent all at once. As the name suggests, the region includes all of the countries found on the continents of Africa and Europe, as well as the countries that make up the Middle East. The region is generally accepted to include all European nations and all African nations, and extends east to Iran, including part of Russia. Typically, the acronym does not include overseas territories of mainland countries in the region, such as French Guiana. However, the term is not completely clear, and while it usually refers to Europe, the Middle East and Africa, it is not uncommon for businesses and other institutions to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Glitnir (bank)

Glitnir was an international Icelandic bank. It was created by the state-directed merger of the country's three privately held banks - ''Alþýðubanki'' (Union Bank), ''Verzlunarbanki'' (Bank of Commerce) and ''Iðnaðarbanki'' (Industrial Bank) - and one failing publicly held bank - ''Útvegsbanki'' (Fisheries Bank) - to form ''Íslandsbanki'' in 1990. At the time, ''Íslandsbanki'' was the only major privately held commercial bank in Iceland. It was publicly listed on the Iceland Stock Exchange, in 1993. ''Íslandsbanki'' subsequently merged with FBA Icelandic Investment Bank in 2000. On 20 February 2009, in light of the Icelandic financial crisis, the bank's name was changed back to the original Íslandsbanki. By 15 October 2009, it was decided that 95% of the new Íslandsbanki would be taken over by the creditors of Old Glitnir, while the government of Iceland would retain ownership of the remaining 5%. Ownership A third of the company was owned by Stodir. A large share ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Co-operative Bank

The Co-operative Bank p.l.c. is a British retail and commercial bank based in Manchester, England. Established as a bank for co-operators and co-operatives following the principles of the Rochdale Pioneers, the business evolved in the 20th century into a mid-sized British high street bank, operating throughout the UK mainland. Transactions took place at cash desks in Co-op stores until the 1960s, when the bank set up a small network of branches that grew from six to a high of 160; in 2023 it had 50 branches. The Co-operative Bank is the only UK high street bank with a customer-led ethical policy which is incorporated into the bank's articles of association. The policy was introduced in 1992 and incorporated into the bank's constitution in 2013, then revised and expanded in 2015 in line with over 320,000 customer responses to a poll. Despite its name, the bank has never been a cooperative itself. In the 1970s it was registered as a separate PLC that was wholly owned by the co- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |