|

Markup Pricing

A markup rule is the pricing practice of a producer with market power, where a firm charges a fixed mark-up over its marginal cost.Roger LeRoy Miller, ''Intermediate Microeconomics Theory Issues Applications, Third Edition'', New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988. Derivation of the markup rule Mathematically, the markup rule can be derived for a firm with price-setting power by maximizing the following expression for profit: : \pi = P(Q)\cdot Q - C(Q) :where :Q = quantity sold, :P(Q) = inverse demand function, and thereby the price at which Q can be sold given the existing demand :C(Q) = total cost of producing Q. : \pi = economic profit Profit maximization means that the derivative of \pi with respect to Q is set equal to 0: :P'(Q)\cdot Q+P-C'(Q)=0 : where :P'(Q) = the derivative of the inverse demand function. :C'(Q) = marginal cost–the derivative of total cost with respect t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue. This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. The size of the gap, which encapsulates the firm's level of market dominance, is determined by the residual demand curve's form. A steeper reverse demand indicates higher earnings and more dominance in the market. Such propensities contradict Perfect competition, perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (economics)

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both Explicit cost, explicit and implicit cost, implicit costs. It is different from accounting profit, which only relates to the explicit costs that appear on a firm's financial statements. An accountant measures the firm's accounting profit as the firm's total revenue minus only the firm's explicit costs. An Economists, economist includes all costs, both explicit and implicit costs, when analyzing a firm. Therefore, economic profit is smaller than accounting profit. ''Normal profit'' is often viewed in conjunction with economic profit. Normal profits in business refer to a situation where a company generates revenue that is equal to the total costs incurred in its operation, thus allowing it to remain operational in a competitive industry. It is the mi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inverse Demand Function

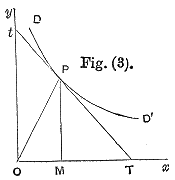

In economics, an inverse demand function is the mathematical relationship that expresses price as a function of quantity demanded (it is therefore also known as a price function). Historically, the economists first expressed the price of a good as a function of demand (holding the other economic variables, like income, constant), and plotted the price-demand relationship with demand on the x (horizontal) axis (the demand curve). Later the additional variables, like prices of other goods, came into analysis, and it became more convenient to express the demand as a multivariate function (the demand function): = f(, , ...), so the original demand curve now depicts the ''inverse'' demand function = f^() with extra variables fixed. Definition In mathematical terms, if the demand function is = f(), then the inverse demand function is = f^(). The value of the inverse demand function is the highest price that could be charged and still generate the quantity demanded. This is useful ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desire to purchase and the ability to pay for a commodity. Demand is always expressed in relation to a particular price and a particular time period since demand is a flow concept. Flow is any variable which is expressed per unit of time. Demand thus does not refer to a single isolated purchase, but a continuous flow of purchases. Factors influencing demand The factors that influence the decisions of household (individual consumers) to purchase a commodity are known as the determinants of demand. Some important determinants of demand are: The price of the commodity: Most important determinant of the demand for a commodity is the price of the commodity itself. Normally there is an inverse relationship between the price of the commodity and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Total Cost

In economics, total cost (TC) is the minimum financial cost of producing some quantity of output. This is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes inputs such as labor and raw materials, plus fixed cost, which is independent of the quantity of a good produced and includes inputs that cannot be varied in the short term such as buildings and machinery, including possibly sunk costs. Total cost in economics includes the total opportunity cost (benefits received from the next-best alternative) of each Factors of production, factor of production as part of its fixed or variable costs. The additional total cost of one additional unit of production is called marginal cost. The marginal cost can also be calculated by finding the derivative of total cost or variable cost. Either of these derivatives work because the total cost includes variable cost and fixed cost, but fixed cost is a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Maximization

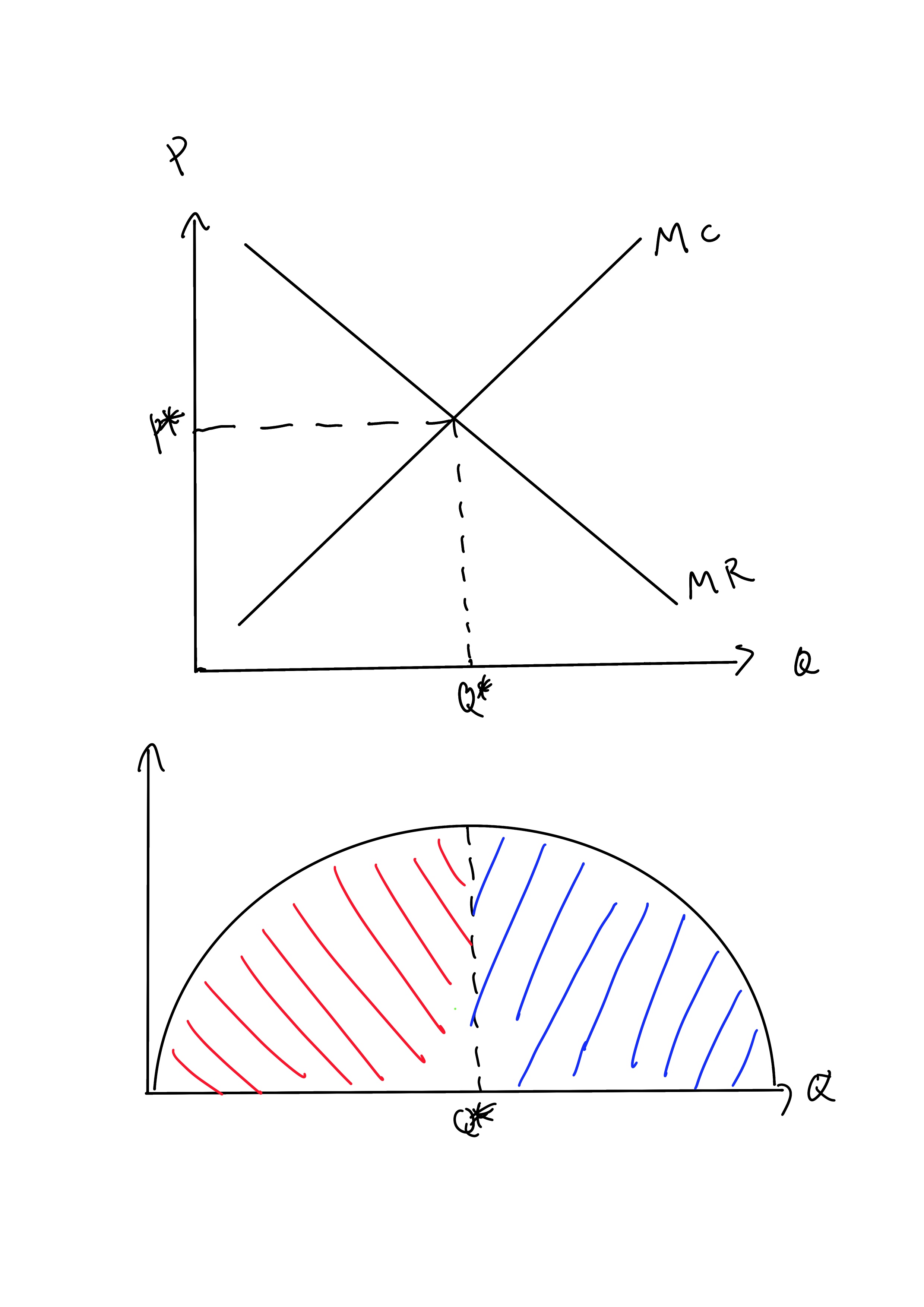

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a " rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative

In mathematics, the derivative is a fundamental tool that quantifies the sensitivity to change of a function's output with respect to its input. The derivative of a function of a single variable at a chosen input value, when it exists, is the slope of the tangent line to the graph of the function at that point. The tangent line is the best linear approximation of the function near that input value. For this reason, the derivative is often described as the instantaneous rate of change, the ratio of the instantaneous change in the dependent variable to that of the independent variable. The process of finding a derivative is called differentiation. There are multiple different notations for differentiation. '' Leibniz notation'', named after Gottfried Wilhelm Leibniz, is represented as the ratio of two differentials, whereas ''prime notation'' is written by adding a prime mark. Higher order notations represent repeated differentiation, and they are usually denoted in Leib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Revenue

Marginal revenue (or marginal benefit) is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit.Bradley R. chiller, "Essentials of Economics", New York: McGraw-Hill, Inc., 1991.Edwin Mansfield, "Micro-Economics Theory and Applications, 3rd Edition", New York and London:W.W. Norton and Company, 1979.Roger LeRoy Miller, "Intermediate Microeconomics Theory Issues Applications, Third Edition", New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988.John Black, "Oxford Dictionary of Economics", New York: Oxford University Press, 2003. Marginal revenue is the increase in revenue from the sale of one additional unit of product, i.e., the revenue from the sale of the last unit of product. It can be positive or negative. Marginal revenue is an important concept in vendor analysis.Primont, D. F., & Primont, D. (1995). Further Evidence of Po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly Rent

In economics, economic rent is any payment to the owner of a factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made (including imputed value) or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities (e.g., patents). In the moral economy of neoclassical economics, assuming the market is natural, and does not come about by state and social contrivance, economic rent includes income gained by labor or state beneficiaries or other "contrived" exclusivity, such as labor guilds and unofficial corruption. Overview In the moral economy of the economics tradition broadly, economic rent is distinct from producer surplus, or normal profit, both of which are theorized to involve productive human action. Economic rent is also independent of opportunity cost, unlike economic profit, where opportunity cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |