|

Jenkins V. Commissioner

In ''Jenkins v. Commissioner'', T.C. Memo 1983-667 (U.S. Tax Court Memos 1983), the U.S. Tax Court held that the payments Conway Twitty, a country singer, made to investors in a defunct restaurant business known as "Twitty Burger, Inc." were deductible under § 162 of the Internal Revenue Code as ordinary and necessary business expenses of petitioner's business as a country music performer. Facts The petitioner, Harold L. Jenkins, was a well-known country music singer who was commonly known by his stage name of "Conway Twitty". Conway had been a musical performer since the 1950s, but it was not until the late 1960s that Conway became well-established in the country music industry.''Jenkins v. Commissioner'', T.C. Memo 1983-667 (U.S. Tax Court Memos 1983) at 4. By mid-1970, Conway Twitty had 43 Number 1 hit records. In 1968, Twitty Burger, Inc. was formed by Conway, along with approximately 75 friends and business associates who invested money in Twitty Burger for the operatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Tax Court

The United States Tax Court (in case citations, T.C.) is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides (in part) that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service. Though taxpayers may choose to litigate tax matters in a variety of legal settings, outside of bankruptcy, the Tax Court is the only forum in which taxpayers may do so without having first paid the disputed tax in full. Parties who contest the imposition of a tax may also bring an action in any United States District Court, or in the United States Court of Federal Claims; however these venues require that the tax be paid first, and that the party then file a lawsuit to recover the contested amount paid (the "full payment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CCH (company)

CCH, formerly Commerce Clearing House, is a provider of software and information services for tax, accounting and audit workers. Since 1995 it has been a subsidiary of Wolters Kluwer. History CCH has been publishing materials on U.S. tax law and tax compliance since the inception of the modern U.S. federal income tax in 1913. Wolters Kluwer bought the company in 1995. Today, the company is also recognized , IRS, Internal Revenue Service. for its software and integrated workflow tools. CCH operates on a global scale and includes operations in the , , ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code Section 162(a)

Section 162(a) of the Internal Revenue Code ((a)), is part of United States taxation law. It concerns deductions for business expenses. It is one of the most important provisions in the Code, because it is the most widely used authority for deductions. If an expense is not deductible, then Congress considers the cost to be a consumption expense. Section 162(a) requires six different elements in order to claim a deduction. It must be an ::1) ordinary ::2) and necessary ::3) expense ::4) that was paid or incurred during the taxable year ::5) in carrying on ::6) a trade or business activity.(a). These elements have been interpreted by the courts and administrative agencies to determine if an expenditure is deductible as a business expense. Ordinary and Necessary In general, the expense should be routine and directly related to the business activity. Ordinary does not require be habitual or made often; the court only requires that the expense is one that is ordinary and necessa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Expense

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or "remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc. In accounting, ''expense'' is any specific outflow of cash or other valuable assets from a person or company to another person or company. This outflow is generally one side of a trade for products or services that have equal or better current or future value to the buyer than to the seller. Technically, an expense is an event in which a proprietary stake is dim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

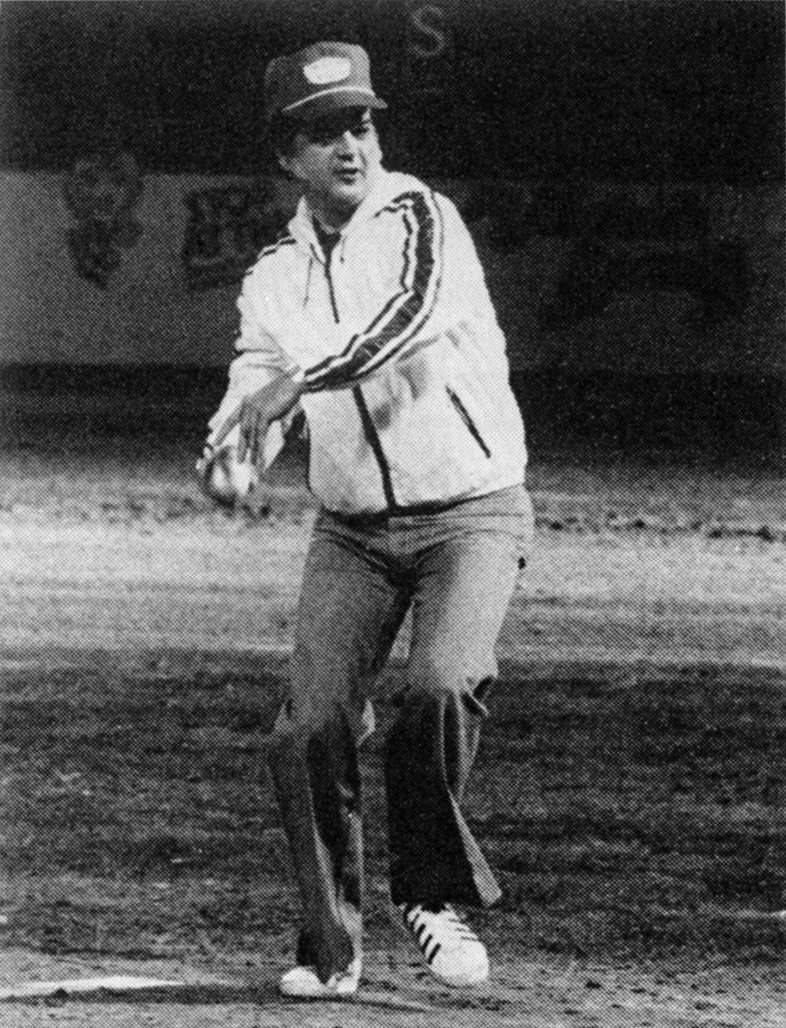

Conway Twitty

Harold Lloyd Jenkins (September 1, 1933 – June 5, 1993), better known by his stage name Conway Twitty, was an American singer and songwriter. Initially a part of the 1950s rockabilly scene, Twitty was best known as a country music performer. From 1971 to 1976, Twitty received a string of Country Music Association awards for duets with Loretta Lynn. He was inducted into both the Country Music and Rockabilly Halls of Fame. Twitty was known for his frequent use of romantic and sentimental themes in his songs. Due to his following being compared to a religious revival, comedian Jerry Clower nicknamed Twitty "The High Priest of Country Music", the eventual title of his 33rd studio album. Twitty achieved stardom with hit songs like " Hello Darlin'", "You've Never Been This Far Before", and " Linda on My Mind". Twitty topped '' ''Billboard'''s'' Hot Country Songs chart 40 times in his career, a record that stood for 20 years until it was broken by George Strait, and topped the ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Petitioner

{{Unreferenced, date=December 2009 A petitioner is a person who pleads with governmental institution for a legal remedy or a redress of grievances, through use of a petition. In the courts The petitioner may seek a legal remedy if the state or another private person has acted unlawfully. In this case, the petitioner, often called a plaintiff, will submit a plea to a court to resolve the dispute. To the government On the other hand, the petitioner may be complaining against the law it to "... make no law... abridging... the right of the people peaceably to assemble, and to petition the government for redress of grievances". A petitioner need not seek a change to an existing law. Often, petitioners speak against (or in support of) legislative proposals as these progress. The Whig party A group of 17th century English politicians became known as Petitioners, due to their support of the Exclusion Bill, a bill which would prevent the succession to the throne of the Catholic James, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Country Music

Country (also called country and western) is a genre of popular music that originated in the Southern and Southwestern United States in the early 1920s. It primarily derives from blues, church music such as Southern gospel and spirituals, old-time, and American folk music forms including Appalachian, Cajun, Creole, and the cowboy Western music styles of Hawaiian, New Mexico, Red Dirt, Tejano, and Texas country. Country music often consists of ballads and honky-tonk dance tunes with generally simple form, folk lyrics, and harmonies often accompanied by string instruments such as electric and acoustic guitars, steel guitars (such as pedal steels and dobros), banjos, and fiddles as well as harmonicas. Blues modes have been used extensively throughout its recorded history. The term ''country music'' gained popularity in the 1940s in preference to ''hillbilly music'', with "country music" being used today to describe many styles and subgenres. It came to encompas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hit Record

A hit song, also known as a hit record, hit single or simply a hit, is a recorded song or instrumental that becomes broadly popular or well-known. Although ''hit song'' means any widely played or big-selling song, the specific term ''hit record'' usually refers to a single that has appeared in an official music chart through repeated radio airplay audience impressions, or significant streaming data and commercial sales. Historically, before the dominance of recorded music, commercial sheet music sales of individual songs were similarly promoted and tracked as singles and albums are now. For example, in 1894, Edward B. Marks and Joe Stern released ''The Little Lost Child'', which sold more than a million copies nationwide, based mainly on its success as an illustrated song, analogous to today's music videos. Chart hits In the United States and the United Kingdom, a single is usually considered a hit when it reaches the top 40 of the ''Billboard'' Hot 100 or the top 75 of the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expense

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or "remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc. In accounting, ''expense'' is any specific outflow of cash or other valuable assets from a person or company to another person or company. This outflow is generally one side of a trade for products or services that have equal or better current or future value to the buyer than to the seller. Technically, an expense is an event in which a proprietary stake i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |