|

Interest In Possession Trust

An interest in possession trust is a trust in which at least one beneficiary has the right to receive the income generated by the trust (if trust funds are invested) or the right to enjoy the trust assets for the present time in another way. The beneficiary with the right to enjoy the trust property for the time being is said to have an interest in possession and is colloquially described as an income beneficiary, or the life tenant. Beneficiaries of a trust have an interest in possession if they have the immediate and automatic right to receive the income arising from the trust property as it arises, or have the use and enjoyment of it, such as by living in a property owned by the trustees. Such a beneficiary is also known as an income beneficiary or life tenant. There may be more than one income beneficiary, who may have either a joint tenancy or as tenants in common. The trustee must pass all of the income received, less any trustees' expenses, to the beneficiary/ies. For in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Law

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a designated person. In the English common law, the party who entrusts the property is known as the "settlor", the party to whom it is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the "beneficiary", and the entrusted property is known as the "corpus" or "trust property". A ''testamentary trust'' is an irrevocable trust established and funded pursuant to the terms of a deceased person's will. An inter vivos trust is a trust created during the settlor's life. The trustee is the legal owner of the assets held in trust on behalf of the trust and its beneficiaries. The beneficiaries are equitable owners of the trust property. Trustees have a fiduciary duty to manage the trust for the benefit of the equitable owners. Trustees must provide regular accountings of trust income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiary (trust)

In trust law, a beneficiary (also known by the Law French terms and trust), is the person or persons who are entitled to the benefit of any trust arrangement. A beneficiary will normally be a natural person, but it is perfectly possible to have a company (law), company as the beneficiary of a trust, and this often happens in sophisticated commercial transaction structures. With the exception of charitable trusts, and some specific anomalous purpose trust, non-charitable purpose trusts, all trusts are required to have ascertainable beneficiaries. Generally speaking, there are no strictures as to who may be a beneficiary of a trust; a beneficiary can be a minor, or under a mental disability (in fact many trusts are created specifically for persons with those legal disadvantages). It is also possible to have trusts for unborn children, although the trusts must Vesting, vest within the applicable perpetuity period. Categorization There are various ways in which beneficiaries of tru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Tenant

In common law and statutory law, a life estate (or life tenancy) is the ownership of immovable property for the duration of a person's life. In legal terms, it is an estate in real property that ends at death, when the property rights may revert to the original owner or to another person. The owner of a life estate is called a "life tenant". The person who will take over the rights upon death is said to have a "remainder" interest and is known as a "remainderman". Principles The ownership of a life estate is of limited duration because it ends at the death of a person. Its owner is the life tenant (typically also the 'measuring life') and it carries with it right to enjoy certain benefits of ownership of the property, chiefly income derived from rent or other uses of the property and the right of occupation, during his or her possession. Because a life estate ceases to exist at the death of the measuring person's life, the life tenant, a temporary owner, may short-term let b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trustee

Trustee (or the holding of a trusteeship) is a legal term which, in its broadest sense, refers to anyone in a position of trust and so can refer to any individual who holds property, authority, or a position of trust or responsibility for the benefit of another. A trustee can also be a person who is allowed to do certain tasks but not able to gain income.''Black's Law Dictionary, Fifth Edition'' (1979), p. 1357, . Although in the strictest sense of the term a trustee is the holder of property on behalf of a beneficiary, the more expansive sense encompasses persons who serve, for example, on the board of trustees of an institution that operates for a charity, for the benefit of the general public, or a person in the local government. A trust can be set up either to benefit particular persons or for any charitable purposes (but not generally for non-charitable purposes): typical examples are a will trust for the testator's children and family, a pension trust (to confer bene ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Tenancy

In property law, a concurrent estate or co-tenancy is any of various ways in which property is owned by more than one person at a time. If more than one person owns the same property, they are commonly referred to as co-owners. Legal terminology for co-owners of real estate is either co-tenants or joint tenants, with the latter phrase signifying a right of survivorship. Most common law jurisdictions recognize tenancies in common and joint tenancies. Many jurisdictions also recognize tenancies by the entirety, which is effectively a joint tenancy between married persons. Many jurisdictions refer to a joint tenancy as a joint tenancy with right of survivorship, but they are the same, as every joint tenancy includes a right of survivorship. In contrast, a tenancy in common does not include a right of survivorship. The type of co-ownership does not affect the right of co-owners to sell their fractional interest in the property to others during their lifetimes, but it does affect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Remainderman

In common law countries a remainderman is a person who inherits or is entitled to inherit property upon the termination of the estate of the former owner. Usually, this occurs due to the death or termination of the former owner's life estate, but this can also occur due to a specific notation in a trust passing ownership from one person to another. For example, if the owner of property makes a grant of that property "to John for life, and then to Jane," Jane is entitled to a future interest, called a remainder, and is termed a remainderman. Another example is say Mary leaves her books to Mark her son, and if he doesn't want them he leaves them to his daughter Ruth, who also doesn't want them and leaves to Mary's brother Michael, who is the remainderman. In the US under the required minimum distribution rules for retirement accounts, the remaindermen beneficiaries must be included in the list of beneficiaries provided to the IRA custodian or plan trustee, for purposes of the trus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax In The United Kingdom

In the United Kingdom, inheritance tax is a transfer tax. It was introduced with effect from 18 March 1986, replacing capital transfer tax. The UK has the fourth highest inheritance tax rate in the world, according to conservative think tank, the Tax Foundation, though only a very small proportion of the population pays it. 3.7% of deaths recorded in the UK in the 2020-21 tax year resulted in inheritance tax liabilities. History Prior to the introduction of estate duty by the Finance Act 1894, there was a complex system of different taxes relating to the inheritance of property, that applied to either realty (land) or personalty (other personal property): # From 1694, probate duty, introduced as a stamp duty on wills entered in probate in 1694, applying to personalty. # From 1780, legacy duty, an inheritance duty paid by the receiver of personalty, graduated according to consanguinity # From 1853, succession duty, a duty introduced by the Succession Duty Act 1853 ( 16 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital (economics)

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. A typical example is the machinery used in a factory. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." The means of production is as a "... series of heterogeneous commodities, each having specific technical characteristics ..." "capital goods", are one of the three types of intermediate goods used in the production process, the other two being land and labour. The three are also known collectively as "primary factors of production". This classification originated during the classical economics period and has remained the dominant method for classification. Capital can be increased by the use of a production process (see production function and factors of production). Outputs of the production process are normally classif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

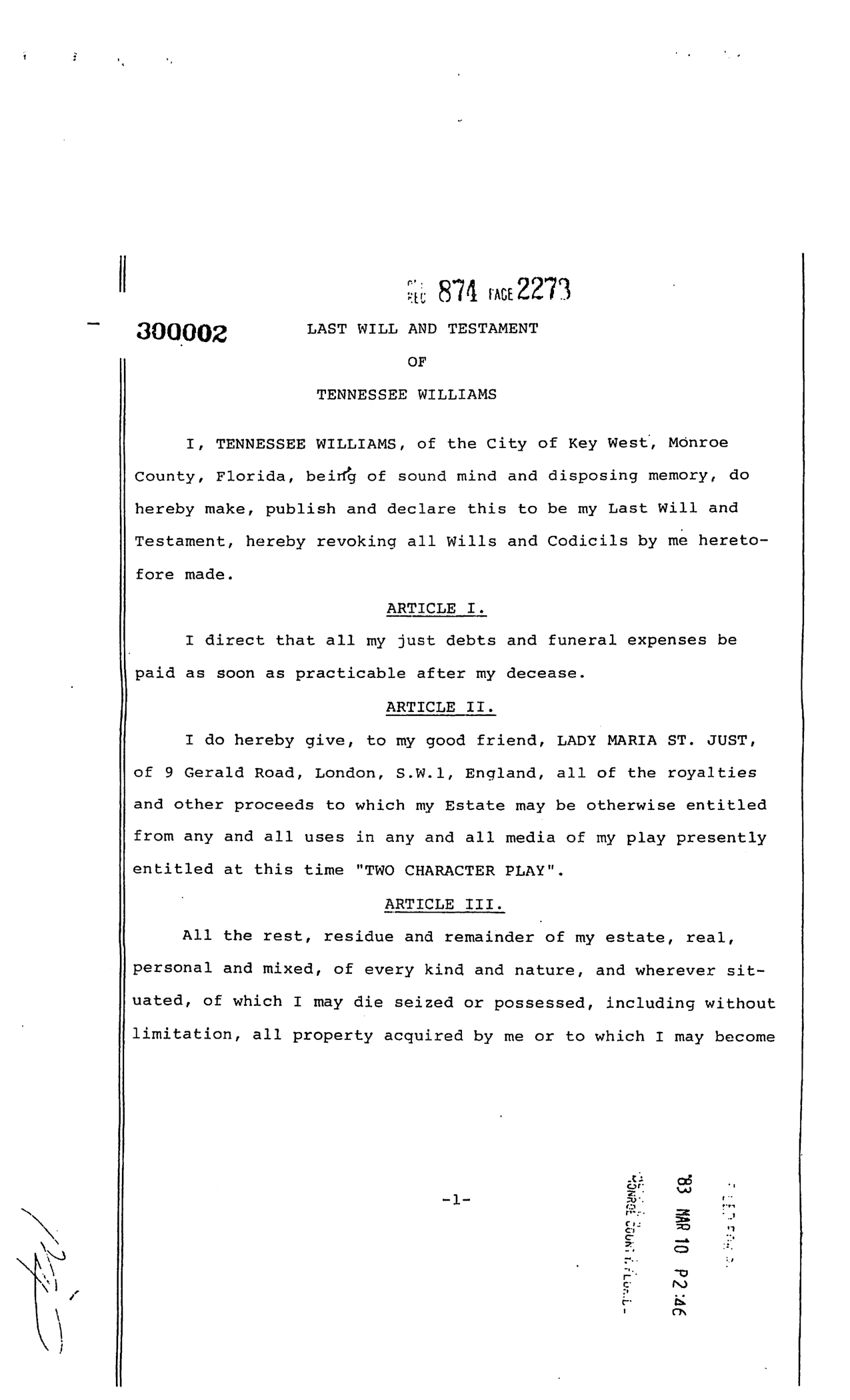

Will (law)

A will and testament is a legal document that expresses a person's (testator) wishes as to how their property ( estate) is to be distributed after their death and as to which person ( executor) is to manage the property until its final distribution. For the distribution (devolution) of property not determined by a will, see inheritance and intestacy. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the popular title of the document as "last will and testament"), records show the terms have been used interchangeably. Thus, the word "will" validly applies to both personal and real property. A will may also create a testamentary trust that is effective only after the death of the testator. History Throughout most of the world, the disposition of a dead person's estate has been a matter of social custom. According to Plutarch, the written will was invented by Solon. Originally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Settlor

In trust law, a settlor is a person who settles (i.e. gives into trust) their property for the benefit of the beneficiary. In some legal systems, a settlor is also referred to as a trustor, or occasionally, a grantor or donor. Where the trust is a testamentary trust, the settlor is usually referred to as the ''testator''. The settlor may also be the trustee of the trust (where he declares that he holds his own property on trusts) or a third party may be the trustee (where he transfers the property to the trustee on trusts). In the common law of England and Wales, it has been held, controversially, that where a trustee declares an intention to transfer trust property to a trust of which he is one of several trustees, that is a valid settlement notwithstanding the property is not vested in the other trustees. Capacity to be a trustee is generally co-extensive with the ability to hold and dispose of a legal or beneficial interest in property. In practice, special considerations aris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |