|

Income Tax On Gambling

Rules concerning income tax and gambling vary internationally. United States In the United States, gambling wins are taxable. The Internal Revenue Code contains a specific provision regulating income-tax deductions of gambling losses. Under Section 165(d) of the Internal Revenue Code, losses from “wagering transactions” may be deducted to the extent of gains from gambling activities. Essentially, in order to qualify for a deduction of losses from wagering, the taxpayer can only deduct ''up to'' the amount of gains accrued from wagering. In '' Commissioner v. Groetzinger'', the Supreme Court Justice Blackmun alludes to Section 165(d) which was a legislative attempt to close the door on suspected abuse of gambling loss deductions. Bettors who win $600 or more on certain gambling activities may receive Form W-2G, which reports the amount of gambling income and any federal income tax withheld. However, all gambling winnings are taxable, regardless of whether the bettor receives a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gambling

Gambling (also known as betting or gaming) is the wagering of something of Value (economics), value ("the stakes") on a Event (probability theory), random event with the intent of winning something else of value, where instances of strategy (game theory), strategy are discounted. Gambling thus requires three elements to be present: consideration (an amount wagered), risk (chance), and a prize. The outcome of the wager is often immediate, such as a single roll of dice, a spin of a roulette wheel, or a horse crossing the finish line, but longer time frames are also common, allowing wagers on the outcome of a future sports contest or even an entire sports season. The term "gaming" in this context typically refers to instances in which the activity has been specifically permitted by law. The two words are not mutually exclusive; ''i.e.'', a "gaming" company offers (legal) "gambling" activities to the public and may be regulated by one of many gaming control boards, for example, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxpayer

A taxpayer is a person or organization (such as a company) subject to pay a tax. Modern taxpayers may have an identification number, a reference number issued by a government to citizens or firms. The term "taxpayer" generally characterizes one who pays taxes. A taxpayer is an individual or entity that is obligated to make payments to municipal or government taxation-agencies. Taxes can exist in the form of income taxes and/or property taxes imposed on owners of real property (such as homes and vehicles), along with many other forms. People may pay taxes when they pay for goods and services which are taxed. The term "taxpayer" often refers to the workforce of a country which pays for government systems and projects through taxation. The taxpayers' money becomes part of the public funds, which comprise all money spent or invested by government to satisfy individual or collective needs or to generate future benefits. For tax purposes, business entities are also taxpayers, mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissioner V

A commissioner (commonly abbreviated as Comm'r) is, in principle, a member of a commission or an individual who has been given a Wiktionary: commission, commission (official charge or authority to do something). In practice, the title of commissioner has evolved to include a variety of senior officials, often sitting on a specific commission. In particular, the commissioner frequently refers to senior police or government officials. A high commissioner is equivalent to an ambassador, originally between the United Kingdom and the Dominions and now between all Commonwealth states, whether Commonwealth realms, republics in the Commonwealth of Nations, republics or countries having a monarch other than that of the realms. The title is sometimes given to senior officials in the private sector; for instance, many North American sports leagues. There is some confusion between commissioners and commissary, commissaries because other European languages use the same word for both. Therefore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consideration

Consideration is a concept of English law, English common law and is a necessity for simple contracts but not for special contracts (contracts by deed). The concept has been adopted by other common law jurisdictions. It is commonly referred to as one of the six or seven elements of a contract. The court in ''Currie v Misa'' declared consideration to be a "Right, Interest, Profit, Benefit, or Forbearance, Detriment, Loss, Responsibility". Thus, consideration is a promise of something of value given by a promissor in exchange for something of value given by a promisee; and typically the thing of value is goods, money, or an act. Forbearance to act, such as an adult promising to refrain from smoking, is enforceable if one is thereby surrendering a legal right. Consideration may be thought of as the concept of value offered and accepted by people or organisations entering into contracts. Anything of value promised by one party to the other when making a contract can be treate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total population of over 84 million in an area of , making it the most populous member state of the European Union. It borders Denmark to the north, Poland and the Czech Republic to the east, Austria and Switzerland to the south, and France, Luxembourg, Belgium, and the Netherlands to the west. The Capital of Germany, nation's capital and List of cities in Germany by population, most populous city is Berlin and its main financial centre is Frankfurt; the largest urban area is the Ruhr. Settlement in the territory of modern Germany began in the Lower Paleolithic, with various tribes inhabiting it from the Neolithic onward, chiefly the Celts. Various Germanic peoples, Germanic tribes have inhabited the northern parts of modern Germany since classical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of countries and dependencies by area, second-largest country by total area, with the List of countries by length of coastline, world's longest coastline. Its Canada–United States border, border with the United States is the world's longest international land border. The country is characterized by a wide range of both Temperature in Canada, meteorologic and Geography of Canada, geological regions. With Population of Canada, a population of over 41million people, it has widely varying population densities, with the majority residing in List of the largest population centres in Canada, urban areas and large areas of the country being sparsely populated. Canada's capital is Ottawa and List of census metropolitan areas and agglomerations in Canada, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

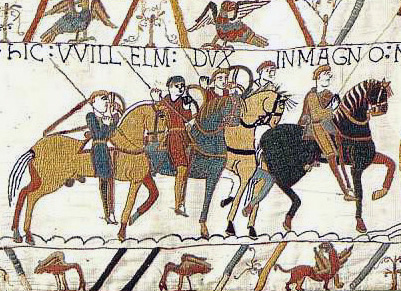

William E

William is a masculine given name of Germanic origin. It became popular in England after the Norman conquest in 1066,All Things William"Meaning & Origin of the Name"/ref> and remained so throughout the Middle Ages and into the modern era. It is sometimes abbreviated "Wm." Shortened familiar versions in English include Will or Wil, Wills, Willy, Willie, Bill, Billie, and Billy. A common Irish form is Liam. Scottish diminutives include Wull, Willie or Wullie (as in Oor Wullie). Female forms include Willa, Willemina, Wilma and Wilhelmina. Etymology William is related to the German given name ''Wilhelm''. Both ultimately descend from Proto-Germanic ''*Wiljahelmaz'', with a direct cognate also in the Old Norse name ''Vilhjalmr'' and a West Germanic borrowing into Medieval Latin ''Willelmus''. The Proto-Germanic name is a compound of *''wiljô'' "will, wish, desire" and *''helmaz'' "helm, helmet".Hanks, Hardcastle and Hodges, ''Oxford Dictionary of First Names'', Oxfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxable Income

Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that some types of income are not taxable (sometimes called non-assessable income) and some expenditures not deductible in computing taxable income. Some systems base tax on taxable income of the current period, and some on prior periods. Taxable income may refer to the income of any taxpayer, including individuals and corporations, as well as entities that themselves do not pay tax, such as partnerships, in which case it may be called “net profit”. Most systems require that all income realized (or derived) be included in taxable income. Some systems provide tax exemption for some types of income. Many systems impose tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |