|

Hotelling's Rule

Hotelling's rule defines the net price path as a function of time while maximizing economic rent in the time of fully extracting a non-renewable natural resource. The maximum rent is also known as Hotelling rent or scarcity rent and is the maximum rent that could be obtained while emptying the stock resource. In an efficient exploitation of a non-renewable and non-augmentable resource, the percentage change in net-price per unit of time should equal the discount rate in order to maximise the present value of the resource capital over the extraction period. This concept was the result of analysis of non-renewable resource management by Harold Hotelling, published in the ''Journal of Political Economy'' in 1931, on the basis of his previous research on depreciation (see Hotelling 1925), which invites us to consider with caution the application of Hotelling's rule to concrete natural resources, in particular fossil fuels (coal, oil, gas). Devarajan and Fisher note that a similar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Path

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services. In some situations, especially when the product is a service rather than a physical good, the price for the service may be called something else such as "rent" or "tuition". Prices are influenced by production costs, supply of the desired product, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted in currency, quantities of goods or vouchers. * In modern economies, prices are generally expressed in units of some form of currency. (More specifically, for raw materials they are expressed as currency per unit weight, e.g. euros per kilogram or Rands per KG.) * Although prices could be quoted as quantities of other goods or services, this sort of barter exchange is rarely seen. Prices are sometimes quoted in terms of vouchers such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

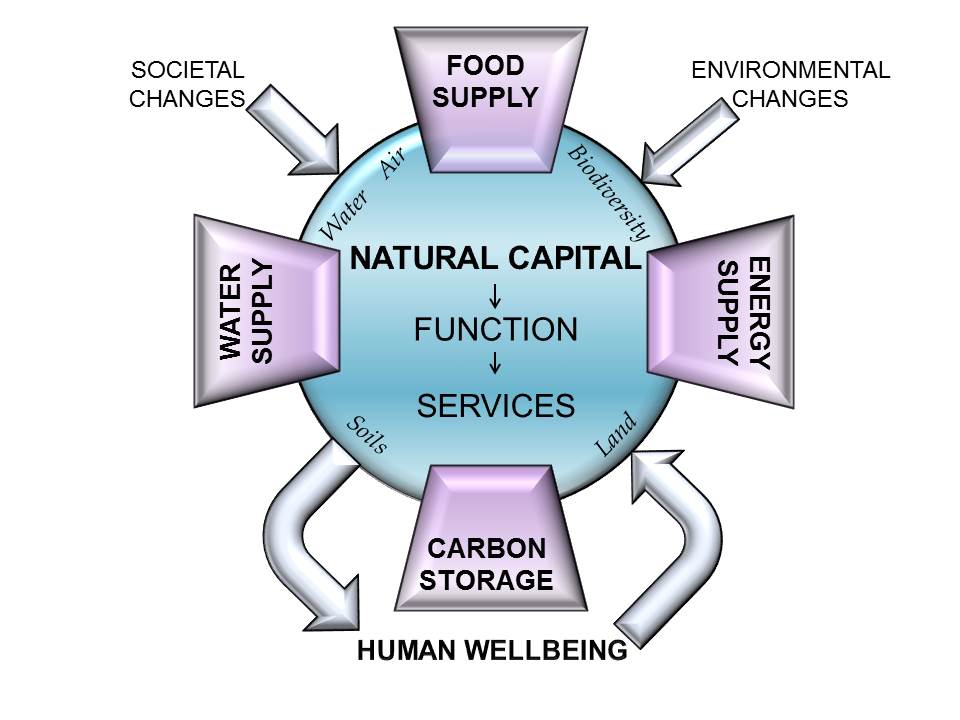

Natural Capital

Natural capital is the world's stock of natural resources, which includes geology, soils, air, water and all living organisms. Some natural capital assets provide people with free goods and services, often called ecosystem services. All of these underpin our economy and society, and thus make human life possible. It is an extension of the economic notion of capital (resources which enable the production of more resources) to goods and services provided by the natural environment. For example, a well-maintained forest or river may provide an indefinitely sustainable flow of new trees or fish, whereas over-use of those resources may lead to a permanent decline in timber availability or fish stocks. Natural capital also provides people with essential services, like water catchment, erosion control and crop pollination by insects, which in turn ensure the long-term viability of other natural resources. Since the continuous supply of services from the available natural capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renting

Renting, also known as hiring or letting, is an agreement where a payment is made for the use of a good, service or property owned by another over a fixed period of time. To maintain such an agreement, a rental agreement (or lease) is signed to establish the roles and expectations of both the tenant and landlord. There are many different types of leases. The type and terms of a lease are decided by the landlord and agreed upon by the renting tenant. History Various types of rent are referenced in Roman law: rent (''canon'') under the long leasehold tenure of Emphyteusis; rent (''reditus'') of a farm; ground-rent (''solarium''); rent of state lands (''vectigal''); and the annual rent (''prensio'') payable for the ''jus superficiarum'' or right to the perpetual enjoyment of anything built on the surface of land. Reasons for renting There are many possible reasons for renting instead of buying, for example: *In many jurisdictions (including India, Spain, Australia, Unit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eponyms In Economics

An eponym is a noun after which or for which someone or something is, or is believed to be, named. Adjectives derived from the word ''eponym'' include ''eponymous'' and ''eponymic''. Eponyms are commonly used for time periods, places, innovations, biological nomenclature, astronomical objects, works of art and media, and tribal names. Various orthographic conventions are used for eponyms. Usage of the word The term ''eponym'' functions in multiple related ways, all based on an explicit relationship between two named things. ''Eponym'' may refer to a person or, less commonly, a place or thing for which someone or something is, or is believed to be, named. ''Eponym'' may also refer to someone or something named after, or believed to be named after, a person or, less commonly, a place or thing. A person, place, or thing named after a particular person share an eponymous relationship. In this way, Elizabeth I of England is the eponym of the Elizabethan era, but the Elizabethan e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Political Economy

The ''Journal of Political Economy'' is a monthly peer-reviewed academic journal published by the University of Chicago Press. Established by James Laurence Laughlin in 1892, it covers both theoretical and empirical economics. In the past, the journal published quarterly from its introduction through 1905, ten issues per volume from 1906 through 1921, and bimonthly from 1922 through 2019. The editor-in-chief is Esteban Rossi-Hansberg (University of Chicago). It is considered one of the top five journals in economics. JPE Micro and JPE Macro In 2023, University of Chicago Press announced the establishment of Journal of Political Economy Microeconomics (JPE Micro) and Journal of Political Economy Macroeconomics (JPE Macro), two new journals that are vertically integrated with the Journal of Political Economy. Abstracting and indexing The journal is abstracted and indexed in EBSCO, ProQuest, EconLit, Research Papers in Economics, Current Contents/Social & Behavioral Scien ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quarterly Journal Of Economics

''The Quarterly Journal of Economics'' is a peer-reviewed academic journal published by the Oxford University Press for the Harvard University Department of Economics. Its current editors-in-chief are Robert J. Barro, Lawrence F. Katz, Nathan Nunn, Andrei Shleifer, and Stefanie Stantcheva. History It is the oldest professional journal of economics in the English language, and second-oldest in any language after the . It covers all aspects of the field—from the journal's traditional emphasis on micro-theory to both empirical and theoretical macroeconomics. Reception According to the ''Journal Citation Reports'', the journal has a 2015 impact factor of 6.662, ranking it first out of 347 journals in the category "Economics". It is generally regarded as one of the top 5 journals in economics, together with the '' American Economic Review'', ''Econometrica'', the '' Journal of Political Economy'', and '' The Review of Economic Studies''. Notable papers Some of the most inf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Economic Literature

The ''Journal of Economic Literature'' is a peer-reviewed academic journal, published by the American Economic Association, that surveys the academic literature in economics. It was established by Arthur Smithies in 1963 as the ''Journal of Economic Abstracts'',Journal of Economic Literature: About JEL , retrieved 6 May 2011. and is currently one of the highest ranked journals in economics. /ref> As a , it mainly features essays and reviews of recent economic theories (as opposed to the latest research). The |

Hartwick's Rule

In resource economics, Hartwick's rule defines the amount of investment in produced capital (buildings, roads, knowledge stocks, etc.) that is needed to exactly offset declining stocks of non-renewable resources. This investment is undertaken so that the standard of living does not fall as society moves into the indefinite future. Solow (1974) shows that, given a degree of substitutability between produced capital and natural resources, one way to design a sustainable consumption program for an economy is to accumulate produced capital sufficiently rapidly so that the pinch from the shrinking exhaustible resource stock is precisely countered by the services from the enlarged produced capital stock. Hartwick's rule – often abbreviated as "invest resource rents" – requires that a nation invest all rent earned from exhaustible resources currently extracted, where "rent" is defined along paths that maximize returns to owners of the resource stock. The rule extends to the case of m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Faustmann's Formula

Faustmann's formula, or the Faustmann model, gives the present value of the income stream for forest rotation. It was derived by the German forester Martin Faustmann in 1849. The ''rotation problem'', deciding when to cut down the forest, means solving the problem of maximising Faustmann's formula and this was solved by Bertil Ohlin in 1921 to become the ''Faustmann-Ohlin theorem'', although other German foresters were aware of the correct solution in 1860. : ƒ(''T'') is the stock of timber at time ''T'' : ''p'' the price of timber and is constant : which implies that the value of the forest at time ''T'' is ''pf''(''T'') : ''r'' is the discount rate and is also constant. The Faustmann formula is as follows: : PV = pf(T) \exp(-rT) \cdot = \frac. From this formula two theorems are interpreted: : The optimal time to cut the forest is when the time rate of change of its value is equal to interest on the value of the forest plus the interest on the value of the land. :The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Von Thünen Rent

The term () is used in German surnames either as a nobiliary particle indicating a noble patrilineality, or as a simple preposition used by commoners that means or . Nobility directories like the often abbreviate the noble term to ''v.'' In medieval or early modern names, the particle was at times added to commoners' names; thus, meant . This meaning is preserved in Swiss toponymic surnames and in the Dutch , which is a cognate of but also does not necessarily indicate nobility. Usage Germany and Austria The abolition of the monarchies in Germany and Austria in 1919 meant that neither state has a privileged nobility, and both have exclusively republican governments. In Germany, this means that legally ''von'' simply became an ordinary part of the surnames of the people who used it. There are no longer any legal privileges or constraints associated with this naming convention. According to German alphabetical sorting, people with ''von'' in their surnames – of nobl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ricardian Equivalence

The Ricardian equivalence proposition (also known as the Ricardo–de Viti–Barro equivalence theorem) is an economic hypothesis holding that consumers are forward-looking and so internalize the government's budget constraint when making their consumption decisions. This leads to the result that, for a given pattern of government spending, the method of financing such spending does not affect agents' consumption decisions, and thus, it does not change aggregate demand. Introduction Governments can finance their expenditures by creating new money, by levying taxes, or by issuing bonds. Since bonds are loans, they must eventually be repaid—presumably by raising taxes in the future. The choice is therefore "tax now or tax later." Suppose that the government finances some extra spending through deficits; i.e. it chooses to tax later. According to the hypothesis, taxpayers will anticipate that they will have to pay higher taxes in future. As a result, they will save, rather than s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shadow Price

A shadow price is the monetary value assigned to an abstract or intangible commodity which is not traded in the marketplace. This often takes the form of an externality. Shadow prices are also known as the recalculation of known market prices in order to account for the presence of distortionary market instruments (e.g. quotas, tariffs, taxes or subsidies). Shadow prices are the real economic prices given to goods and services after they have been appropriately adjusted by removing distortionary market instruments and incorporating the societal impact of the respective good or service. A shadow price is often calculated based on a group of assumptions and estimates because it lacks reliable data, so it is subjective and somewhat inaccurate. The need for shadow prices arises as a result of “externalities” and the presence of distortionary market instruments. An externality is defined as a cost or benefit incurred by a third party as a result of production or consumption of a g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |