|

Homestead Exemption In Florida

The homestead exemption in Florida may refer to three different types of homestead exemptions under Florida law: # exemption from forced sale before and at death per Art. X, Section 4(a)-(b) of the Florida Constitution # restrictions on and alienation, Art. X, Section 4(c) of the Florida Constitution; # and |

Homestead Exemption

The homestead exemption is a legal regime to protect the value of the homes of residents from property taxes, creditors, and circumstances that arise from the death of the homeowner's spouse, disability, or other situations. Such laws are found in the statutes or the constitution of many of the states in the United States. The homestead exemption in some states of the South has its legal origins in the exemption laws of the Spanish Empire. In other states, they were enacted in response to the effects of 19th-century economy. Description Homestead exemption laws typically have four primary features: # Preventing the forced sale of a home to meet the demands of creditors, usually except mortgages, mechanic's liens, or sales to pay property taxes # Providing the surviving spouse with shelter # Providing an exemption from property taxes on a home # Allowing a tax-exempt homeowner to vote on property tax increases to homeowners over the threshold, by bond or millage requests Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Lien Sale

A tax sale is the forced sale of property (usually real estate) by a governmental entity for unpaid taxes by the property's owner. The sale, depending on the jurisdiction, may be a tax deed sale (whereby the actual property is sold) or a tax lien sale (whereby a lien on the property is sold) Under the tax lien sale process, depending on the jurisdiction, after a specified period of time if the lien is not redeemed, the lienholder may seek legal action which will result in the lienholder either automatically obtaining the property, or forcing a future tax deed sale of the property and possibly obtaining the property as a result. General The governmental entity can be any level of government that can assess and collect property taxes or other governmental debt, such as counties (parishes, in the case of Louisiana), cities, townships (in New England and other jurisdictions), and school districts (in places where they are independent of other governmental jurisdictions, such as in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Law In Florida

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, rent, sell, exchange, transfer, give away, or destroy it, or to exclude others from doing these things, as well as to perhaps abandon it; whereas regardless of the nature of the property, the owner thereof has the right to properly use it under the granted property rights. In economics and political economy, there are three broad forms of property: private property, public property, and collective property (or ''cooperative propert''y). Property may be jointly owned by more than one party equally or unequally, or according to simple or complex agreements; to distinguish ownership and easement from rent, there is an expectation that each party's will with regard to the property be clearly defined and unconditional.. The parties may expect the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of Florida

The law of Florida consists of several levels, including constitutional, statutory, and regulatory law, as well as case law and local law. The '' Florida Statutes'' form the general statutory law of Florida. Sources The Constitution of Florida is the foremost source of state law. Legislation is enacted by the Florida Legislature, published in the '' Laws of Florida'', and codified in the '' Florida Statutes''. State agencies publish regulations (sometimes called administrative law) in the '' Florida Administrative Register'' (FAR), which are in turn codified in the '' Florida Administrative Code'' (FAC). Florida's legal system is based on common law, which is interpreted by case law through the decisions of the Supreme Court, District Courts of Appeal, and Circuit Courts, which are published in the ''Florida Cases'', '' Southern Reporter'', ''Florida Law Weekly'', and ''Florida Law Weekly Supplement''. Counties and municipalities may also promulgate local ordinances. There are a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Estate

In common law and statutory law, a life estate (or life tenancy) is the ownership of immovable property for the duration of a person's life. In legal terms, it is an estate in real property that ends at death, when the property rights may revert to the original owner or to another person. The owner of a life estate is called a "life tenant". The person who will take over the rights upon death is said to have a "remainder" interest and is known as a "remainderman". Principles The ownership of a life estate is of limited duration because it ends at the death of a person. Its owner is the life tenant (typically also the 'measuring life') and it carries with it right to enjoy certain benefits of ownership of the property, chiefly income derived from rent or other uses of the property and the right of occupation, during his or her possession. Because a life estate ceases to exist at the death of the measuring person's life, the life tenant, a temporary owner, may short-term let b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minor (law)

In law, a minor is someone under a certain age, usually the age of majority, which demarcates an underage individual from legal adulthood. The age of majority depends upon Jurisdiction (area), jurisdiction and application, but it is commonly 18. ''Minor'' may also be used in contexts that are unconnected to the overall age of majority. For example, the smoking age, smoking and legal drinking age, drinking age in the United States is 21, and younger people below this age are sometimes called ''minors'' in the context of tobacco and alcohol law, even if they are at least 18. The terms underage or ''minor'' often refer to those under the age of majority, but may also refer to a person under other legal age limits, such as the age of consent, marriageable age, driving age, voting age, Legal working age, working age, etc. Such age limits are often different from the age of majority. The concept of ''minor'' is not sharply defined in most jurisdictions. The age of criminal responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

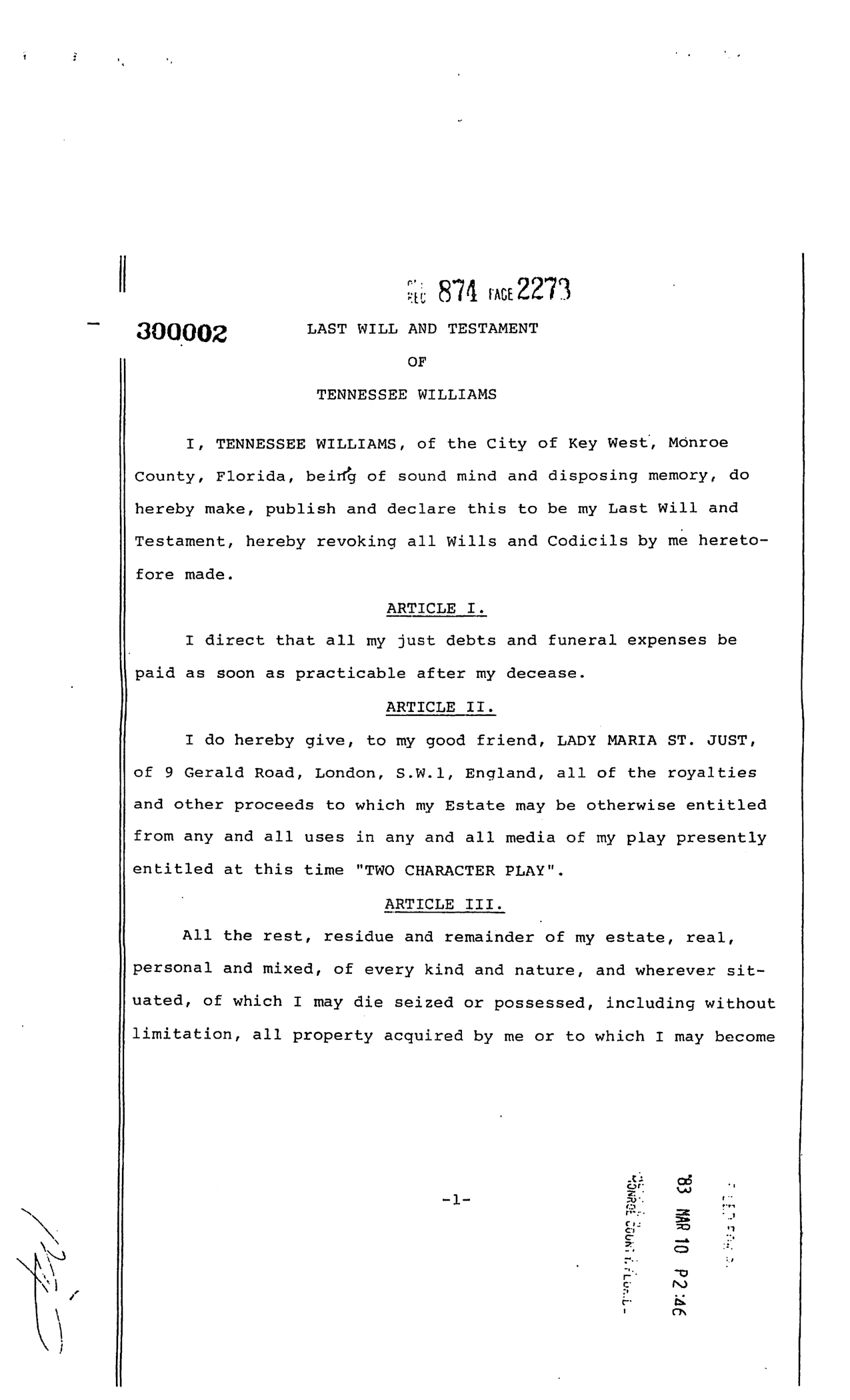

Will (law)

A will and testament is a legal document that expresses a person's (testator) wishes as to how their property ( estate) is to be distributed after their death and as to which person ( executor) is to manage the property until its final distribution. For the distribution (devolution) of property not determined by a will, see inheritance and intestacy. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the popular title of the document as "last will and testament"), records show the terms have been used interchangeably. Thus, the word "will" validly applies to both personal and real property. A will may also create a testamentary trust that is effective only after the death of the testator. History Throughout most of the world, the disposition of a dead person's estate has been a matter of social custom. According to Plutarch, the written will was invented by Solon. Originally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Taxes

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or other geographical region, or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted with a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ad Valorem

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ''ad valorem'' tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event (e.g. inheritance tax, expatriation tax, or tariff). In some countries, a stamp duty is imposed as an ''ad valorem'' tax. Operation All ad valorem taxes are collected according to the determined value of the taxed item. In the most common application of ad valorem taxes, namely municipal property taxes, public tax assessors regularly assess the property owner's real estate in order to determine its current value. The determined value of the property is used to calculate the annual tax collected by the municipality or any other government entity upon the property owner. Ad valorem taxes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45th president from 2017 to 2021. Born into a wealthy family in the New York City borough of Queens, Trump graduated from the University of Pennsylvania in 1968 with a bachelor's degree in economics. He became the president of his family's real estate business in 1971, renamed it the Trump Organization, and began acquiring and building skyscrapers, hotels, casinos, and golf courses. He launched side ventures, many licensing the Trump name, and filed for six business bankruptcies in the 1990s and 2000s. From 2004 to 2015, he hosted the reality television show ''The Apprentice (American TV series), The Apprentice'', bolstering his fame as a billionaire. Presenting himself as a political outsider, Trump won the 2016 United States presidential e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forced Sale

A partition is a term used in the law of real property to describe an act, by a court order or otherwise, to divide up a concurrent estate into separate portions representing the proportionate interests of the owners of property. It is sometimes described as a forced sale. Under the common law, any owner of property who owns an undivided concurrent interest in land can seek such a division. In some cases, the parties agree to a specific division of the land; if they are unable to do so, the court will determine an appropriate division. A sole owner, or several owners, of a piece of land may partition their land by entering a deed poll (sometimes referred to as "carving out"). Why forced sales occur Forced sales generally occur because owners of property are unable to agree upon certain aspects of the ownership. The owners may disagree on how to use the property, the amount of money to invest into the property, on their right to occupy and use the whole of the property. If the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |