|

Home Bank Of Canada

The Home Bank of Canada was a Canadian bank that experienced meteoric growth from its start in 1903 to its sensational and costly collapse in 1923. Its collapse shattered pubic trust in banks and encouraged growth in bank reform sentiment among the powerful farmer organizations of the time. It was incorporated July 10, 1903, in Toronto but did not receive a Treasury Board certificate to operate as a chartered bank until the next year. It succeeded the earlier Toronto Savings Bank, which had been founded in 1854 by Bishop Armand-François-Marie de Charbonnel and the local chapter of the Society of St. Vincent de Paul and later Home Savings and Loans in 1871. The failure of Home Bank on August 18, 1923, was the subject of a Canadian Royal Commission initiated by Prime Minister William Lyon Mackenzie King in 1924. Founded with the support of the Roman Catholic Church, James Mason and Henry Pellatt represented a benign board of directors including E.G. Gooderham, Claude Macdonnel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arm's Length Principle

The arm's length principle (ALP) is the condition or the fact that the parties of a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction". It is used specifically in contract law to arrange an agreement that will stand up to legal scrutiny, even though the parties may have shared interests (e.g., employer-employee) or are too closely related to be seen as completely independent (e.g., the parties have familial ties). An arm's length relationship is distinguished from a fiduciary relationship, where the parties are not on an equal footing, but rather, power and information asymmetries exist. It is also one of the key elements in international taxation as it allows an adequate allocation of profit taxation rights among countries that conclude double tax conventions, through transfer pricing, among each other. Transfer pricing and the arm's length principle were one of the focal points of the base erosion and profit s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1903

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ancien ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defunct Banks Of Canada

{{Disambiguation ...

Defunct may refer to: * ''Defunct'' (video game), 2014 * Zombie process or defunct process, in Unix-like operating systems See also * * :Former entities * End-of-life product * Obsolescence Obsolescence is the process of becoming antiquated, out of date, old-fashioned, no longer in general use, or no longer useful, or the condition of being in such a state. When used in a biological sense, it means imperfect or rudimentary when comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Insurance

Deposit insurance, deposit protection or deposit guarantee is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance or deposit guarantee systems are one component of a financial system safety net that promotes financial stability. Process Banks are allowed (and usually encouraged) to lend or invest most of the money deposited with them instead of safe-keeping the full amounts (see fractional-reserve banking). If many of a bank's borrowers fail to repay their loans when due, the bank's creditors, including its depositors, risk loss. Because they rely on customer deposits that can be withdrawn on little or no notice, banks in financial trouble are prone to bank runs, where depositors seek to withdraw funds quickly ahead of a possible bank insolvency. Because banking institution failures have the potential to trigger a broad spectrum of harmful events, including ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

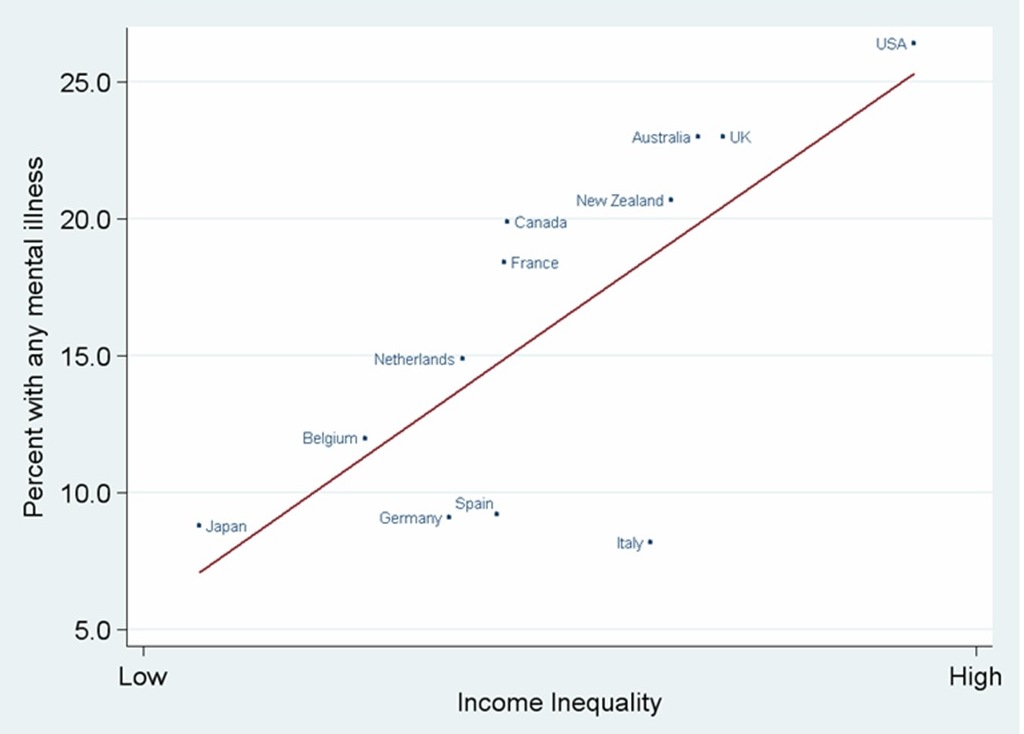

Nervous Breakdown

A mental disorder, also referred to as a mental illness, a mental health condition, or a psychiatric disability, is a behavioral or mental pattern that causes significant distress or impairment of personal functioning. A mental disorder is also characterized by a clinically significant disturbance in an individual's cognition, emotional regulation, or behavior, often in a social context. Such disturbances may occur as single episodes, may be persistent, or may be relapsing–remitting. There are many different types of mental disorders, with signs and symptoms that vary widely between specific disorders. A mental disorder is one aspect of mental health. The causes of mental disorders are often unclear. Theories incorporate findings from a range of fields. Disorders may be associated with particular regions or functions of the brain. Disorders are usually diagnosed or assessed by a mental health professional, such as a clinical psychologist, psychiatrist, psychiatri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dominion Bank

The Dominion Bank was a Canadian bank that was chartered in 1869 and based in Toronto, Ontario. On February 1, 1955, it merged with the Bank of Toronto to form the Toronto-Dominion Bank. History The Dominion Bank's charter received royal assent on 22 June 1869. In 1871, the Dominion Bank was launched by entrepreneurs and professionals under the leadership of James Austin with the opening of its first branch on King Street in Toronto, Ontario. They were dedicated to creating a new institution “conducive to the general prosperity of that section of the country.” The Dominion Bank was a cautious institution, “selecting its customers carefully, serving them well, and duly prospering with them” (in the words of the official history). It too created a network of branches, and in 1872 became the first Canadian bank to have two branches in one city – Toronto. With the maturing of the Canadian economy and the opening of northern Ontario and the West in 1880s and 1890s, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Ontario

The Government of Ontario () is the body responsible for the administration of the Provinces and territories of Canada, Canadian province of Ontario. The term ''Government of Ontario'' refers specifically to the executive—political Minister of the Crown, ministers of the Crown (the Cabinet/Executive Council), appointed on the Advice (constitutional law), advice of the premier, and the Nonpartisanship, non-partisan Ontario Civil service, Public Service (whom the Executive Council directs), who staff ministries and agencies to deliver government policies, programs, and services—which Corporate identity, corporately brands itself as the ''Government of Ontario'', or more formally, His Majesty's Government of Ontario (). Role of the Crown , as monarch of Canada is also the King in Right of Ontario. As a Commonwealth realm, the Canadian monarch is Personal union, shared with 14 other independent countries within the Commonwealth of Nations. Within Canada, the monarch exerci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intent (law), intentional deception to deprive a victim of a legal right or to gain from a victim unlawfully or unfairly. Fraud can violate Civil law (common law), civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, such as obtaining a passport, travel document, or driver's licence. In cases of mortgage fraud, the perpetrator may attempt to qualify for a mortgage by way of false statements. Terminology Fraud can be defined as either a civil wrong or a criminal act. For civil fraud, a government agency or person or entity harmed by fraud may bring litigation to stop the fraud, seek monetary damages, or both. For cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian National Railway

The Canadian National Railway Company () is a Canadian Class I freight railway headquartered in Montreal, Quebec, which serves Canada and the Midwestern and Southern United States. CN is Canada's largest railway, in terms of both revenue and the physical size of its rail network, spanning Canada from the Atlantic coast in Nova Scotia to the Pacific coast in British Columbia across approximately of track. In the late 20th century, CN gained extensive capacity in the United States by taking over such railroads as the Illinois Central. CN is a public company with 24,671 employees and, , a market cap of approximately US$75 billion. CN was government-owned, as a Canadian Crown corporation, from its founding in 1919 until being privatized in 1995. , Bill Gates was the largest single shareholder of CN stock, owning a 14.2% interest through Cascade Investment and his own Gates Foundation. From 1919 to 1978, the railway was known as "Canadian National Railways" (CNR). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Populism

Populism is a essentially contested concept, contested concept used to refer to a variety of political stances that emphasize the idea of the "common people" and often position this group in opposition to a perceived elite. It is frequently associated with anti-establishment and anti-political sentiment. The term developed in the late 19th century and has been applied to various politicians, parties, and movements since that time, often assuming a pejorative tone. Within political science and other social sciences, several different definitions of populism have been employed, with some scholars proposing that the term be rejected altogether. Etymology and terminology The term "populism" has long been subject to mistranslation and used to describe a broad and often contradictory array of movements and beliefs. Its usage has spanned continents and contexts, leading many scholars to characterize it as a vague or overstretched concept, widely invoked in political discourse, yet i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). There is no official definition of a recession, according to the International Monetary Fund, IMF. In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom and Canada, a recession is defined as negative economic growth for two consecutive qu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |