|

Goods And Services Tax (India) Revenue Statistics

From 1 May 2018 onwards Ministry of Finance of Government of India started releasing monthly GST revenue collection data via official press release through Press Information Bureau. And to further improve transparency Government of India started issuing state-wise monthly collection data from 1 January 2020. Revenue Collections Monthly National Revenue CollectionsOfficial Source State-Wise Monthly Revenue Collections States Note: ''Below tables does not include GST on import of goods'' Andhra Pradesh Arunachal Pradesh Assam Bihar Chhattisgarh Goa Gujarat Haryana Himachal Pradesh Jharkhand Karnataka Kerala Madhya Pradesh Maharashtra Manipur Meghalaya Mizoram Nagaland Odisha Punjab Rajasthan Sikkim Tamil Nadu Telangana Tripura Uttar Pradesh Uttarakhand West Bengal Union Territories Note: Below tables does not include GST on import of goods Andaman and Nicobar Island ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Ministry Of Finance (India)

The Ministry of Finance (IAST: ''Vitta Maṃtrālaya'') is a ministry within the Government of the Republic of India concerned with the economy of India, serving as the Treasury of India. In particular, it concerns itself with taxation, financial legislation, financial institutions, capital markets, currency regulation, banking service, centre and state finances, and the Union Budget. The Ministry of Finance is the apex controlling authority of ''four'' central civil services namely Indian Revenue Service, Indian Audit and Accounts Service, Indian Economic Service and Indian Civil Accounts Service. It is also the apex controlling authority of one of the central commerce services namely Indian Cost and Management Accounts Service. History Sir Ramasamy Chetty Kandasamy Shanmukham Chetty KCIE (17 October 1892 – 5 May 1953) was the first Finance Minister of independent India. He presented the first budget of independent India on 26 November 1947. Department of Econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

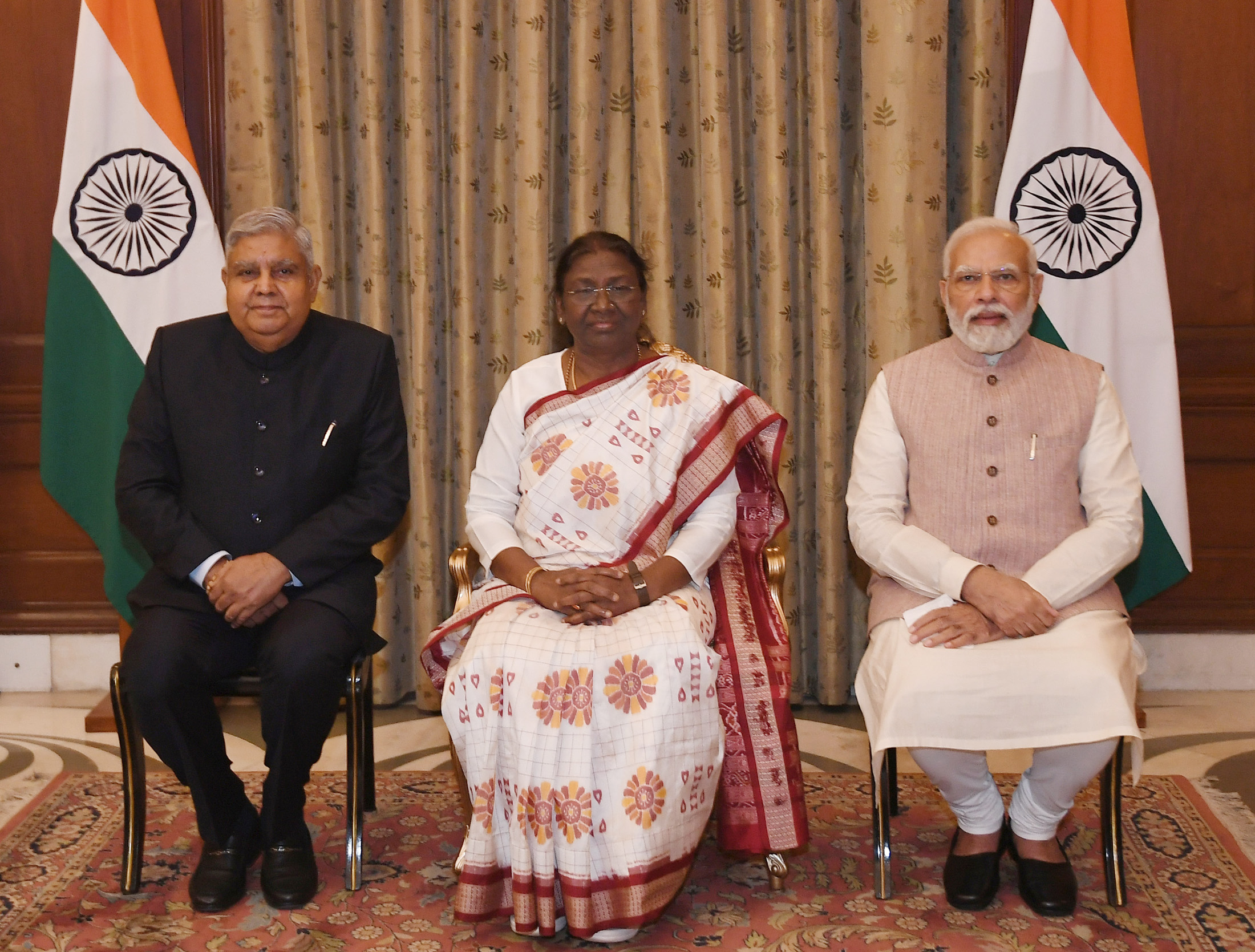

Government Of India

The Government of India (ISO 15919, ISO: Bhārata Sarakāra, legally the Union Government or Union of India or the Central Government) is the national authority of the Republic of India, located in South Asia, consisting of States and union territories of India, 36 states and union territories. The government is led by the president of India (currently ) who largely exercises the executive powers, and selects the Prime Minister of India, prime minister of India and other ministers for aid and advice. Government has been formed by the The prime minister and their senior ministers belong to the Union Council of Ministers, its executive decision-making committee being the Cabinet (government), cabinet. The government, seated in New Delhi, has three primary branches: the legislature, the executive and the judiciary, whose powers are vested in bicameral Parliament of India, Union Council of Ministers (headed by prime minister), and the Supreme Court of India respectively, with a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Goods And Services Tax (India)

The Goods and Services Tax (GST) is a successor to VAT used in India on the supply of goods and service. Both VAT and GST have the same taxation slabs. It is a comprehensive, multistage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from point of consumption and not point of origin like previous taxes. Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic beverages, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system. There is a special rate of 0.25% on rough precious and semi-precious ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Press Information Bureau

The Press Information Bureau, commonly abbreviated as PIB, is a nodal agency of the Government of India under Ministry of Information and Broadcasting. Based in National Media Centre, New Delhi, Press Information Bureau disseminates information to print, electronic and web media on government plans, policies, programme initiatives and achievements. It is available in 14 Indian official languages, which are Dogri, Punjabi, Bengali, Odia, Gujarati, Marathi, Meitei ( Manipuri), Tamil, Kannada, Telugu, Malayalam, Konkani and Urdu, in addition to Hindi and English, out of the 22 official languages of the Republic of India. The head of PIB is also the Official Spokesperson of the Government of India and holds the rank of Principal Director General (Special Secretary equivalent). The post is currently headed by Rajesh Malhotra. History The Press Information Bureau was established in June 1919 as a small cell under Home Ministry under the British government. Its main task w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Live Mint

''Mint'' is an Indian business and financial daily newspaper published by HT Media, a Delhi-based media group which is controlled by the K. K. Birla family. The K. K. Birla family also publishes ''Hindustan Times''. Mint has been running since 2007 and specializes in business and politics. It publishes a single national edition distributed in New Delhi, Mumbai, Bangalore, Hyderabad, Chennai, Kolkata, Pune, Ahmedabad and Chandigarh. Mint is not published on Sunday. Every Saturday, it prints its sister magazine, Mint Lounge. It was India's first newspaper to be published in the Berliner format. The former editor of the '' Wall Street Journal India'', Raju Narisetti ran ''Mint'' from its founding in 2007 to 2008. Narisetti was succeeded by Sukumar Ranganathan, who served as an editor until 2017. In 2014, ''Mint'' and the Wall Street ''Journal'' ended their seven-year editorial partnership. The companies now have a content syndication agreement as well as a subscriptions bundle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Business Today (India)

''Business Today'' is an Indian fortnightly business magazine published by Living Media, Living Media India Limited, in publication since 1992. Circulation ''Business Today'' has the highest circulation and readership amongst business magazines, and is among the top 10 English-language magazines across genres. It is published once a fortnight, and commands a readership base of 1.7 million readers. Events ''Business Today'' events is a group of programmes that includes the signature BT MindRush and BT Best CEO Awards. BT does events such as India@100 Economy Summit. Leadership In May 2021, India Today Group elevated Rahul Kanwal to the role of executive director of ''Business Today''. References External links Official website 1992 establishments in India Biweekly magazines published in India India Today Group Business magazines published in India Magazines established in 1992 English-language magazines published in India {{business-mag-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

The Hindu Business Line

''Business Line'', known as ''The Hindu Business Line'', is an Indian business newspaper A newspaper is a Periodical literature, periodical publication containing written News, information about current events and is often typed in black ink with a white or gray background. Newspapers can cover a wide variety of fields such as poli ... published by Kasturi & Sons, the publishers of the newspaper ''The Hindu'' headquartered in Chennai, India. The newspaper covers priority industry verticals, such as agriculture, aviation, automotive, IT, in weekly specials. The paper is printed at 17 centres across India, reaching List of metropolitan areas in India, metros as well as emerging Classification of Indian cities#Population-based classification, Tier I and Tier II cities. ''Business Line'' has a daily circulation of 1,17,000 copies, per the Audit Bureau of Circulations (India), Audit Bureau of Circulation in 2016. See also *List of newspapers in India References External links ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Inland Customs Line

The Inland Customs Line, incorporating the Great Hedge of India (or Indian Salt Hedge), was a customs barrier built by the British Colonial India, colonial rulers of India to prevent smuggling of salt from coastal regions in order to avoid the substantial History of the British salt tax in India, salt tax. The customs line was begun under the East India Company and continued into British Raj, direct British rule. The line had its beginnings in a series of customs houses established in Bengal in 1803 to prevent the smuggling of salt to avoid the tax. These customs houses were eventually formed into a continuous barrier that was brought under the control of the Inland Customs Department in 1843. The line was gradually expanded as more territory was brought under British control until it covered more than , often running alongside rivers and other natural barriers. It ran from the Punjab Province (British India), Punjab in the northwest to the princely states of Orissa Tributary S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Taxation In India

Taxes in India are levied by the Government of India, Central Government and the State governments of India, State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality. The authority to levy a tax is derived from the Constitution of India which allocates the power to levy various taxes between the Union Government and the State Governments. An important restriction on this power is Article 265 of the Constitution which states that "No tax shall be levied or collected except by the authority of law". Therefore, each tax levied or collected has to be backed by an accompanying law, passed either by the Parliament of India, Parliament or the Legislative Assembly, State Legislature. Nonetheless, tax evasion is a massive problem in India, ultimately catalyzing various negative effects on the country. In 2023–24, the Direct tax collections reported by CBDT were approximatel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Value Added Taxes

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the 193 countries with UN membership employ a VAT, including all OECD members except the United States. History German indust ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |