|

Financial Quote

A financial quotation refers to specific market data relating to a security or commodity. While the term quote specifically refers to the bid price or ask price of an instrument, it may be more generically used to relate to the last price which this security traded at ("last sale"). This may refer to both exchange-traded and over-the-counter financial instruments. Bid and ask The bid price (also known as the buy price) and the ask price (also known as the sell price) of a security are the prices (and often quantities) at which buyers and sellers are willing to purchase or sell that security. The bid shows the current price at which a buyer is willing to purchase shares, while the ask shows the current price at which they are willing to sell. The quantities at which these trades are placed are referred to as "bid size" and "ask size". For instance, if a trader submits a limit order to buy 1,000 shares of MSFT at $28.00, this order will appear in a market maker for MSFT's book ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Data

In finance, market data is price and other related data for a financial instrument reported by a trading venue such as a stock exchange. Market data allows traders and investors to know the latest price and see historical trends for instruments such as equities, fixed-income products, derivatives, and currencies. The market data for a particular instrument would include the identifier of the instrument and where it was traded such as the ticker symbol and exchange code plus the latest bid and ask price and the time of the last trade. It may also include other information such as volume traded, bid, and offer sizes and static data about the financial instrument that may have come from a variety of sources. It is used in conjunction with the related financial reference data that is typically distributed ahead of market data. There are a number of financial data vendors that specialize in collecting, cleaning, collating, and distributing market data and this has become the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral. Since 2007, it has been part of the London Stock Exchange Group (LSEG, which the exchange also lists (ticker symbol LSEG)). Despite a post-Brexit exodus of stock listings from the LSE, it was the most valued stock exchange in Europe as of 2023. According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares. According to a 2020 Financial Conduct Authority report, approximately 15% of British adults reported having investments in stocks and shares. History Coffee House The Royal Exchange, London, Royal Exchange had been founded by the English financier Thomas Gresham and Sir Richard Clough on the model of the The Belgian bourse of Antwerp, An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Data

In finance, market data is price and other related data for a financial instrument reported by a trading venue such as a stock exchange. Market data allows traders and investors to know the latest price and see historical trends for instruments such as equities, fixed-income products, derivatives, and currencies. The market data for a particular instrument would include the identifier of the instrument and where it was traded such as the ticker symbol and exchange code plus the latest bid and ask price and the time of the last trade. It may also include other information such as volume traded, bid, and offer sizes and static data about the financial instrument that may have come from a variety of sources. It is used in conjunction with the related financial reference data that is typically distributed ahead of market data. There are a number of financial data vendors that specialize in collecting, cleaning, collating, and distributing market data and this has become the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SEAQ

The Stock Exchange Automated Quotation system (or SEAQ) is a system for trading small-cap London Stock Exchange (LSE) companies. Stocks need to have at least two market-makers to be eligible for trading via SEAQ. New securities cannot be listed via the SEAQ system. In the LSE, only AIM stocks with low liquidity are traded on the SEAQ market. It is a quote-driven market made by specialized and competing dealers, also known as market-makers. The system contains no public limit order book. The idea behind the SEAQ system is that individual investors should always be able to trade and that the element of competition between market-makers should lead to narrower dealing Bid–ask spreads. However, Bid/Ask spreads and hence trading costs on SEAQ are typically high because of the combination of the market-maker driven trading system and the lack of liquidity. Regulation The AIM market is not considered to be an EURM (European Regulated Market), it is instead classified as multil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSEurofirst 300 Index

FTSE International Limited trading as FTSE Russell ( "Footsie") is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf. It operates the well known UK FTSE 100 Index as well as a number of other indices. FTSE stands for Financial Times Stock Exchange. History The FTSE Group was created in 1995 by Pearson (former parent of the ''Financial Times'') and the London Stock Exchange Group. In 2005, together with Dow Jones, FTSE launched the Industry Classification Benchmark, a taxonomy used to segregate markets into sectors. In 2010, the joint venture with Xinhua Finance was terminated, the index series was renamed into FTSE China Index Series; the Hong Kong incorporated company was renamed to "FTSE China Index Limited". In 2011, Pearson sold its stake to LSE. Main business FTSE Group operates 250,000 indices calculated across 80 countries and in 2015 was the number th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSE 100

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is the United Kingdom's best-known stock market index of the 100 most market capitalisation, highly capitalised blue chip (stock market), blue chips listed on the London Stock Exchange. History The index started on 3 January 1984, having been constructed by the London Stock Exchange to better reflect activity on the market. The index would replace the Financial Times' own FT 30 after its public unveiling on 14 February. As late as 10 February, the Stock Exchange referred to the index as 'SE 100', cutting out the Financial Times who had not contributed to its construction. Recognition was ultimately given to the fact that having the FT involved in the official launch possessed value. The new index allowed the Stock Exchange's own London Traded Options Market (LTOM) to launch an option (finance), options contract derived from the FTSE's real-time da ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blue Chip (stock Market)

A blue chip is capital stock of a Corporation, stock corporation with a national reputation for quality, reliability, and the ability to operate profitably in both good and bad times. Origin As befits the sometimes high-risk nature of stock picking, the term "blue chip" derives from the card game poker. The simplest sets of casino token, poker chips include casino token#Colors, white, red, and blue chips, with American tradition dictating that the blues are highest in value. In the United States, blue chips were traditionally used for higher values such that "blue chip" used in noun and adjectival word sense, senses are attested since 1873 and 1894, respectively. This established connotation was first extended to the sense of a blue-chip stock in the 1920s. According to Dow Jones & Company, Dow Jones company folklore, this sense extension was coined by Oliver Gingold (an early employee of the company that would become Dow Jones) sometime in the 1920s, when Gingold was standing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

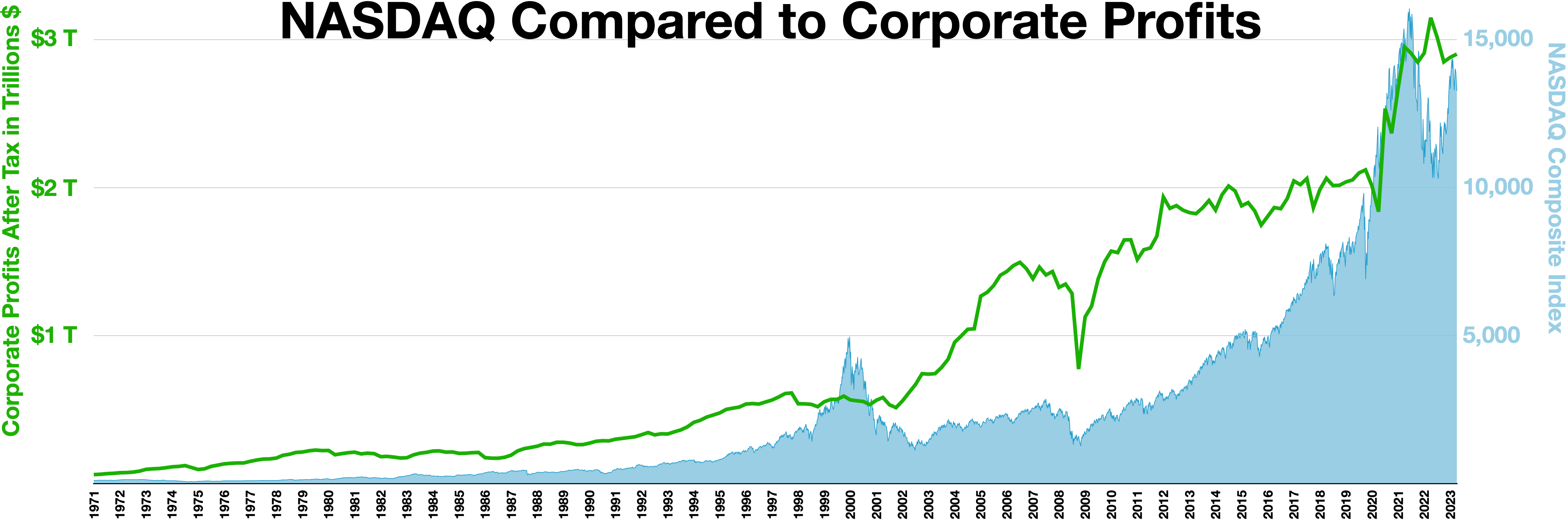

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Domain

The public domain (PD) consists of all the creative work to which no Exclusive exclusive intellectual property rights apply. Those rights may have expired, been forfeited, expressly Waiver, waived, or may be inapplicable. Because no one holds the exclusive rights, anyone can legally use or reference those works without permission. As examples, the works of William Shakespeare, Ludwig van Beethoven, Miguel de Cervantes, Zoroaster, Lao Zi, Confucius, Aristotle, L. Frank Baum, Leonardo da Vinci and Georges Méliès are in the public domain either by virtue of their having been created before copyright existed, or by their copyright term having expired. Some works are not covered by a country's copyright laws, and are therefore in the public domain; for example, in the United States, items excluded from copyright include the formulae of Classical mechanics, Newtonian physics and cooking recipes. Other works are actively dedicated by their authors to the public domain (see waiver) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order Matching System

An order matching system or simply matching system is an electronic system that matches order (exchange), buy and sell orders for a stock market, commodity market or other financial exchanges. The order matching system is the core of all electronic Exchange (organized market), exchanges and are used to execute orders from participants in the exchange. Orders are usually entered by members of an exchange and executed by a central system that belongs to the exchange. The algorithm that is used to match orders varies from system to system and often involves rules around best execution. The order matching system and implied order system or Implication engine is often part of a larger electronic trading system which will usually include a settlement system and a central securities depository that are accessed by electronic trading platforms. These services may or may not be provided by the organisation that provides the order matching system. The matching algorithms decide the effic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or " book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bid–ask Spread

The bid–ask spread (also bid–offer or bid/ask and buy/sell in the case of a market maker) is the difference between the prices quoted (either by a single market maker or in a Order book (trading), limit order book) for an immediate sale (Ask price, ask) and an immediate purchase (Bid price, bid) for Shares, stocks, futures contracts, Option (finance), options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless market, frictionless asset. Liquidity The trader initiating the transaction is said to demand market liquidity, liquidity, and the other party (counterparty) to the transaction supplies liquidity. Liquidity demanders place market orders and liquidity suppliers place limit orders. For a round trip (a purchase and sale together) the liquidity demander pays the spread and the liquidity supplier earns the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |