|

Financial Crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banking crises, banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial Economic bubble, bubbles, currency crisis, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (for example, the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is little consensus and financial crises continue to occur from time to time. It is apparent however that a consistent feature of bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvency, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

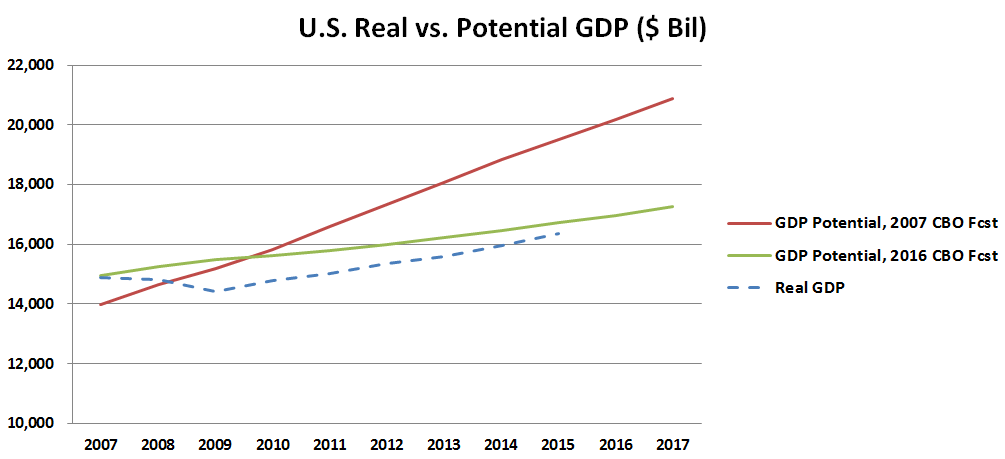

Economic Stagnation

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, ''slow'' means significantly slower than potential growth as estimated by macroeconomists, even though the growth rate may be nominally higher than in other countries not experiencing economic stagnation. Secular stagnation theory The term "secular stagnation" was originally coined by Alvin Hansen in 1938 to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration". Warnings similar to secular stagnation theory have been issued after all deep recessions, but they usually turned out to be wrong because they underestimated the potential of existing technologies.Pagano and Sbracia (2014"The secular stagnation h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998 Russian Financial Crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defaulting on its debt. The crisis had severe impacts on the economies of many neighboring countries. Background and course of events The Russian economy had set up a path for improvement after the Soviet Union had split into different countries. Russia was supposed to provide assistance to the former Soviet states and, as a result, imported heavily from them. In Russia, foreign loans financed domestic investments. When it was unable to pay back those foreign borrowings, the ruble devalued. In mid-1997, Russia had finally found a way out of inflation. The economic supervisors were happy about inflation coming to a standstill. Then the crisis hit, and supervisors had to implement a new policy. Both Russia and the countries that exported to i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

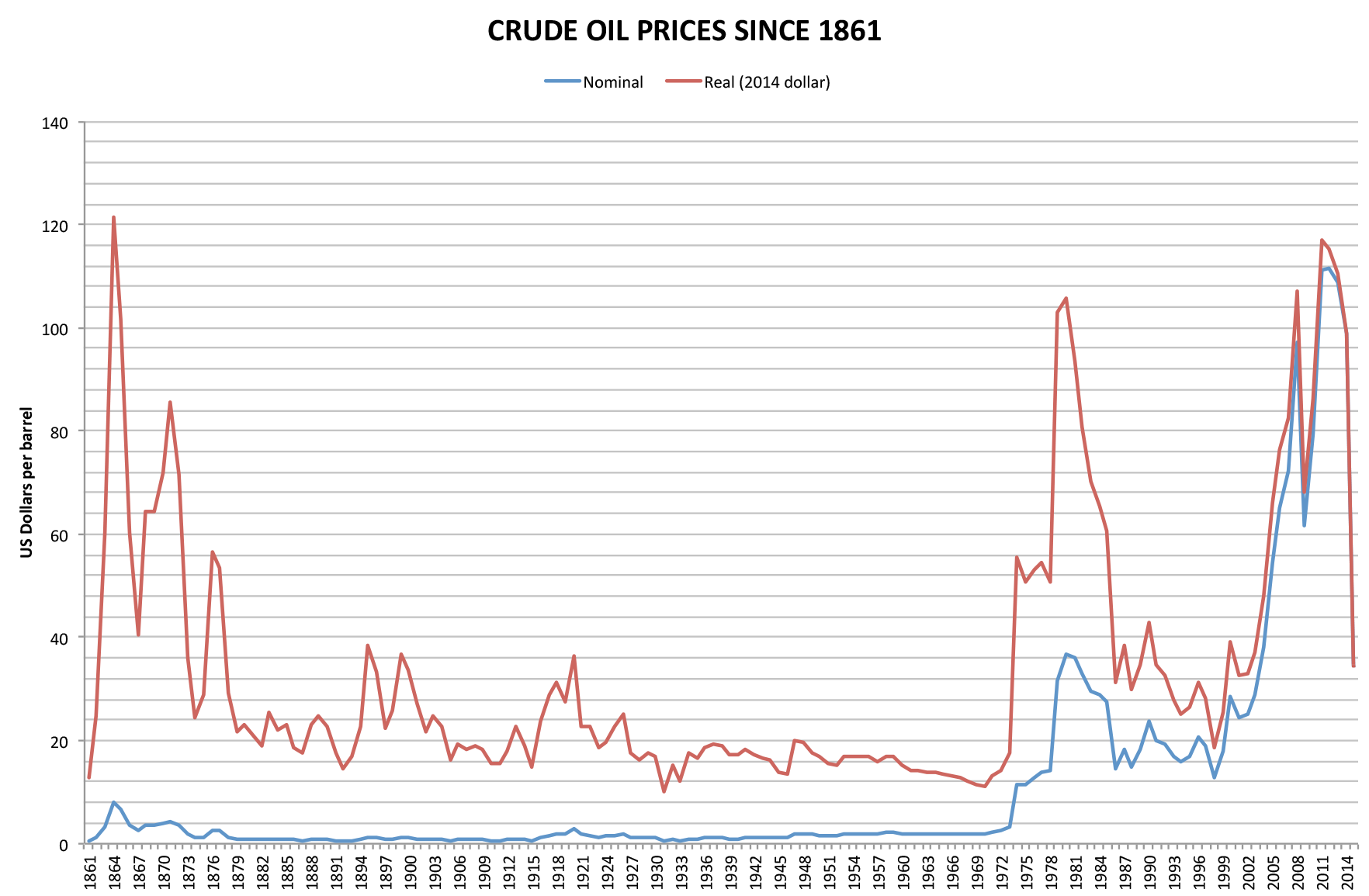

Latin American Debt Crisis

The Latin American debt crisis (; ) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as '' La Década Perdida'' (The Lost Decade), when Latin American countries reached a point where their foreign debt exceeded their earning power, and they could not repay it. The IMF's response to the crisis has been criticized for prolonging unsustainable borrowing and transferring private banking losses onto taxpayers, which deepened the region’s debt overhang and delayed necessary market corrections. Origins In the 1960s and 1970s, many Latin American countries, notably Brazil, Argentina, and Mexico, borrowed huge sums of money from international creditors for industrialization, especially infrastructure programs. These countries had soaring economies at the time, so the creditors were happy to provide loans. Initially, developing countries typically garnered loans through public routes like the World Bank. After 1973, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

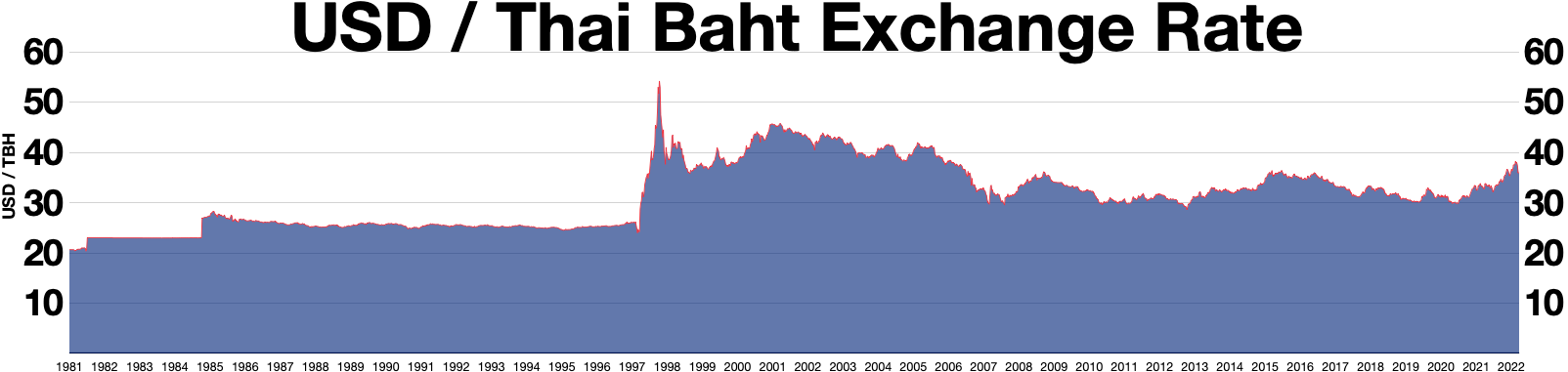

Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the '' Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as part of the European Monetary System (EMS), to reduce exchange rate variability and achieve monetary stability in Europe. After the adoption of the euro, policy changed to linking currencies of EU countries outside the eurozone to the euro (having the common currency as a central point). The goal was to improve the stability of those currencies, as well as to gain an evaluation mechanism for potential eurozone members. As of January 2025, two currencies participate in ERM II: the Danish krone and the Bulgarian lev. Intent and operation The ERM is based on the concept of fixed currency exchange rate margins, but with exchange rates variable within those margins. This is also known as a semi-pegged system. Before the introduction of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Flight

Capital flight, in economics, is the rapid flow of assets or money out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be erratic or untrustworthy behavior by leadership, an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength. This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country—depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime. This fall is particularly damaging when the capital belongs to the people of the affected country because not only are the citizens now burdened by the loss in the economy and devaluation of their currency but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sudden Stop (economics)

A sudden stop in capital flows is defined as a sudden slowdown in private capital inflows into emerging market economies, and a corresponding sharp reversal from large current account deficits into smaller deficits or small surpluses. Sudden stops are usually followed by a sharp decrease in output, private spending and credit to the private sector, and real exchange rate depreciation. The term "sudden stop" was inspired by a banker’s comment on a paper by Rüdiger Dornbusch and Alejandro Werner about Mexico, that "it is not speed that kills, it is the sudden stop." Sudden stops are commonly described as periods that contain at least one observation where the year-on-year fall in capital flows lies at least two standard deviations below its sample mean. The start of the sudden stop period is determined by the first time the annual change in capital flows falls one standard deviation below the mean and the end of the sudden stop period is determined once the annual change in ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to stimulus measures during the Great Recession, and the COVID-19 recession. Governments may take on debt when the government's spending desires do not match government revenue flows. Taking d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a currency basket, basket of other currencies, or another measure of value, such as gold standard, gold or silver standard, silver. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating exchange rate, floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |