|

Federal Reserve Bank Of Chicago

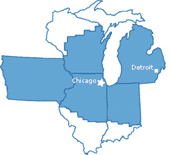

The Federal Reserve Bank of Chicago (informally the Chicago Fed) is one of twelve Federal Reserve Banks that, along with the Federal Reserve Board of Governors, make up the Federal Reserve System, the United States' central bank. The Chicago Fed serves the Seventh District, which encompasses the northern portions of Illinois and Indiana, southern Wisconsin, the Lower Peninsula of Michigan, and the state of Iowa. In addition to participation in the formulation of monetary policy of the United States, monetary policy, each Reserve Bank supervises member banks and Bank holding company, bank holding companies, provides financial services to depository institutions and the U.S. government, and monitors economic conditions in its District. The Chicago Fed was established on May 18, 1914, when representatives from five Seventh District banks formally signed the Chicago Fed's organization certificate. The Bank officially opened for business on Monday, November 16, 1914. Responsibilities ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LaSalle Street

LaSalle Street is a major north-south street in Chicago named for René-Robert Cavelier, Sieur de La Salle, a 17th century French explorer of the Illinois Country. The portion that runs through the Chicago Loop is considered to be Chicago's financial district. Route description South Side South of the Financial District, LaSalle Street gets cut off for a while by the Amtrak/Metra Rail yard from Taylor St to 1600 South. It runs parallel to the Rock Island District Metra line. South of 26th Street, it serves as a frontage road for the Dan Ryan Expressway until 47th street, where it merges with Wentworth Avenue. South of 47th, it starts and stops as a local street until it finally terminates at Sibley Boulevard in Dolton, Illinois, Dolton. In the Loop The stretch of LaSalle Street and its adjacent buildings in the Loop is recognized as the West Loop–LaSalle Street Historic District. The south end of LaSalle Street terminates at the art-deco Chicago Board of Trade Buildin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Fed Map

Chicago is the most populous city in the U.S. state of Illinois and in the Midwestern United States. With a population of 2,746,388, as of the 2020 United States census, 2020 census, it is the List of United States cities by population, third-most populous city in the United States after New York City and Los Angeles. As the county seat, seat of Cook County, Illinois, Cook County, the List of the most populous counties in the United States, second-most populous county in the U.S., Chicago is the center of the Chicago metropolitan area, often colloquially called "Chicagoland" and home to 9.6 million residents. Located on the shore of Lake Michigan, Chicago was incorporated as a city in 1837 near a Chicago Portage, portage between the Great Lakes and the Mississippi River, Mississippi River watershed. It grew rapidly in the mid-19th century. In 1871, the Great Chicago Fire destroyed several square miles and left more than 100,000 homeless, but Chicago's population continued to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Graham, Anderson, Probst And White

Graham, Anderson, Probst & White (GAP&W) was a Chicago architectural firm that was founded in 1912 as Graham, Burnham & Co. This firm was the successor to D. H. Burnham & Co. through Daniel Burnham's surviving partner, Ernest R. Graham, and Burnham's sons, Hubert Burnham and Daniel Burnham Jr. In 1917, the Burnhams left to form their own practice, which eventually became Burnham Brothers, and Graham and the remaining members of Graham, Burnham & Co. – Graham, (William) Peirce Anderson, Edward Mathias Probst, and Howard Judson White – formed the resulting practice. The firm also employed Victor Andre Matteson. Background Graham, Anderson, Probst & White was the largest architectural firm under one roof during the first half of the twentieth century. The firm's importance to Chicago's architectural legacy cannot be overstated, nor can its connection to Burnham. The firm was headquartered in Burnham's own Railway Exchange Building. In part from its connection to Burnham, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Loop

The Loop is Chicago's central business district and one of the city's 77 municipally recognized Community areas in Chicago, community areas. Located at the center of downtown Chicago on the shores of Lake Michigan, it is the second-largest business district in North America, after Midtown Manhattan in New York City. The world headquarters and regional offices of several global and national businesses, retail establishments, restaurants, hotels, museums, theaters, and libraries—as well as many of Chicago's most famous attractions—are located in the Loop. The district also hosts Chicago's Chicago City Hall, City Hall, the seat of Cook County, Illinois, Cook County, offices of the state of Illinois, United States federal offices, as well as several foreign consulates. The intersection of State Street (Chicago), State Street and Madison Street (Chicago), Madison Street in the Loop is the origin point for the address system on Roads and expressways in Chicago, Chicago's street gri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anna Paulson (economist)

Anna Louise Paulson (born 1964/1965) is an American economist who is Executive Vice President and Director of Research of the Federal Reserve Bank of Chicago. Beginning on July 1, 2025, she will be the 12th President of the Federal Reserve Bank of Philadelphia. She is a member of the American Economic Association The American Economic Association (AEA) is a learned society in the field of economics, with approximately 23,000 members. It publishes several peer-reviewed journals, including the Journal of Economic Literature, American Economic Review, an ...’s Committee on the Status of Women in the Economics Profession and a past board member of the Western Economic Association International. Her research focuses on how households and firms cope with risk and incomplete financial markets, and how their financial decision-making is influenced by economic events. Selected works * Paulson, Anna L., and Robert Townsend. "Entrepreneurship and financial constraints in Thai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Executive Officer

A chief executive officer (CEO), also known as a chief executive or managing director, is the top-ranking corporate officer charged with the management of an organization, usually a company or a nonprofit organization. CEOs find roles in various organizations, including public and private corporations, Nonprofit organization, nonprofit organizations, and even some government organizations (notably state-owned enterprises). The governor and CEO of a corporation or company typically reports to the board of directors and is charged with maximizing the value of the business, which may include maximizing the profitability, market share, revenue, or another financial metric. In the nonprofit and government sector, CEOs typically aim at achieving outcomes related to the organization's mission, usually provided by legislation. CEOs are also frequently assigned the role of the main manager of the organization and the highest-ranking officer in the C-suite. Origins The term "chief executi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of Atlanta

The Federal Reserve Bank of Atlanta (informally the Atlanta Fed and the Bank), is the sixth district of the 12 Federal Reserve Banks of the United States and is headquartered in midtown Atlanta, Georgia. The Atlanta Fed covers the U.S. states of Alabama, Florida, and Georgia, the eastern two-thirds of Tennessee, the southern portion of Louisiana, and southern Mississippi as part of the Federal Reserve System. Along with its Atlanta headquarters, the Banks operates five branches with the sixth district, which are located in Birmingham, Alabama, Birmingham, Jacksonville, Florida, Jacksonville, Miami, Florida, Miami, Nashville, Tennessee, Nashville, and New Orleans, Louisiana, New Orleans. These branches provide cash to banks, savings and loans, and other depository institutions; electronic funds transfer, transfer money electronically; and Automated Clearing House, clear millions of cheque, checks. In addition to supporting the U.S. financial system, the Atlanta Fed carries ou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of Cleveland

The Federal Reserve Bank of Cleveland is the Cleveland, Ohio, Cleveland-based headquarters of the U.S. Federal Reserve System's Fourth Federal Reserve Districts, District. The district is composed of Ohio, western Pennsylvania, eastern Kentucky, and the Northern Panhandle of West Virginia, northern panhandle of West Virginia. It has branch offices in Cincinnati and Pittsburgh, Pennsylvania, Pittsburgh. The check processing center in Columbus, Ohio, was closed in 2005. Since August 21, 2024, Beth M. Hammack has been serving as the bank's chief executive officer and president (corporate title), president. The bank building is a 13-story 203 foot high-rise, located at Superior Avenue and East 6th Street in downtown Cleveland. It was designed by the Cleveland firm of Walker and Weeks and completed in 1923. Its exterior architecture emulates an Renaissance architecture, Italian Renaissance palazzo, and is clad in Etowah marble, Georgia pink marble. An extension to the building desig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the president or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms." Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Money

Digital currency (digital money, electronic money or electronic currency) is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card. Digital currencies exhibit properties similar to traditional currencies, but generally do not have a classical physical form of fiat currency historically that can be held in the hand, like currencies with printed banknotes or minted coins. However, they do have a physical form in an unclassical sense coming from the computer to computer and computer to human interactions and the information and processing power of the servers that store and keep track o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing (finance)

In banking and finance, clearing refers to all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks. Description In trading, clearing is necessary because the speed of trades is much faster than the cycle time for completing the underlying transaction. It involves the management of post-trading, pre-settlement credit exposures to ensure that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement. Processes included in clearing are reporting/monitoring, risk margining, netting of trades to single positions, tax handling, and failure handling. Systemically important payment systems (SIPS) are payment systems which have the characteristic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |