|

Expense Account

An expense account is the right to reimbursement of money spent by employees for work-related purposes. Some common expense accounts are Cost of sales, utilities expense, discount allowed, cleaning expense, depreciation expense, delivery expense, income tax expense, insurance expense, interest expense, advertising expense, promotion expense, repairs expense, maintenance expense, rent expense, salaries and wages expense, transportation expense, supplies expense and refreshment expense. Normal Balance To increase an expense account, it must be debited. To decrease an expense account, it must be credited. The normal expense account balance is a debit. In order to understand why expenses are debited, it is relevant to note the accounting equation, Assets = Liabilities + Equity. Expenses show up under the equity portion of the equation because equity is common stock plus retained earnings and retained earnings are revenues minus expenses minus dividends. Expenses are considered te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Washington

George Washington (, 1799) was a Founding Fathers of the United States, Founding Father and the first president of the United States, serving from 1789 to 1797. As commander of the Continental Army, Washington led Patriot (American Revolution), Patriot forces to victory in the American Revolutionary War against the British Empire. He is commonly known as the Father of the Nation for his role in bringing about American independence. Born in the Colony of Virginia, Washington became the commander of the Virginia Regiment during the French and Indian War (1754–1763). He was later elected to the Virginia House of Burgesses, and opposed the perceived oppression of the American colonists by the British Crown. When the American Revolutionary War against the British began in 1775, Washington was appointed Commanding General of the United States Army, commander-in-chief of the Continental Army. He directed a poorly organized and equipped force against disciplined British troops. Wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Revolution

The American Revolution (1765–1783) was a colonial rebellion and war of independence in which the Thirteen Colonies broke from British America, British rule to form the United States of America. The revolution culminated in the American Revolutionary War, which was launched on April 19, 1775, in the Battles of Lexington and Concord. Leaders of the American Revolution were Founding Fathers of the United States, colonial separatist leaders who, as British subjects, initially Olive Branch Petition, sought incremental levels of autonomy but came to embrace the cause of full independence and the necessity of prevailing in the Revolutionary War to obtain it. The Second Continental Congress, which represented the colonies and convened in present-day Independence Hall in Philadelphia, formed the Continental Army and appointed George Washington as its commander-in-chief in June 1775, and unanimously adopted the United States Declaration of Independence, Declaration of Independence ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

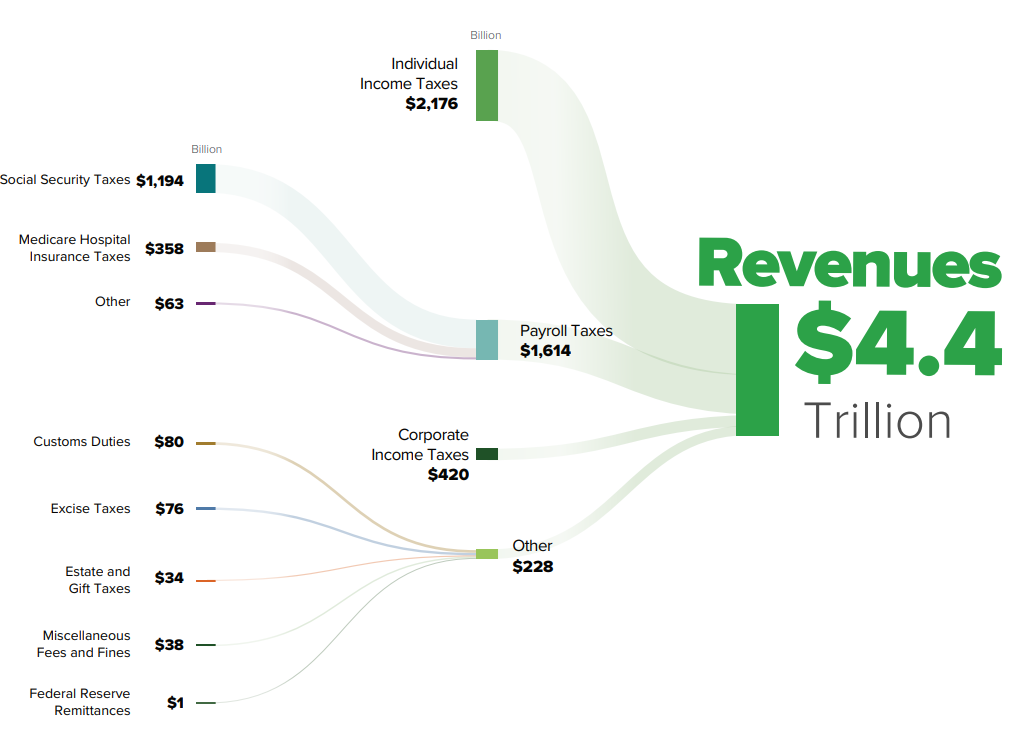

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Receipt

A receipt (also known as a packing list, packing slip, packaging slip, (delivery) docket, shipping list, delivery list, bill of the parcel, Manifest (transportation), manifest, or customer receipt) is a document acknowledging that something has been received, such as money or property in payment following a sale or other transfer of goods or provision of a service. All receipts must have the date of purchase on them. If the recipient of the payment is legally required to collect sales tax or Value-added tax, VAT from the customer, the amount would be added to the receipt, and the collection would be deemed to have been on behalf of the relevant tax authority. In many countries, a retailer is required to include the sales tax or VAT in the displayed price of goods sold, from which the tax amount would be calculated at the point of sale and remitted to the tax authorities in due course. Similarly, amounts may be deducted from amounts payable, as in the case of Withholding tax, ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxable Income

Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that some types of income are not taxable (sometimes called non-assessable income) and some expenditures not deductible in computing taxable income. Some systems base tax on taxable income of the current period, and some on prior periods. Taxable income may refer to the income of any taxpayer, including individuals and corporations, as well as entities that themselves do not pay tax, such as partnerships, in which case it may be called “net profit”. Most systems require that all income realized (or derived) be included in taxable income. Some systems provide tax exemption for some types of income. Many systems impose tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Itemized Deduction

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income Tax return (United States), tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available. Most taxpayers are allowed a choice between itemized deductions and the standard deduction. After computing their adjusted gross income (AGI), taxpayers can itemize deductions (from a list of allowable items) and subtract those itemized deductions from their AGI amount to arrive at the taxable income. Alternatively, they can elect to subtract the standard deduction for their filing status to arrive at the taxable income. In other words, the taxpayer may generally deduct the total itemized deduction amount or the applicable standard deduction amount, whichever is greater. The choice between the standard deduction and itemizing involves a number of considerations: * Only a taxpayer eligible for the standard deducti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auditor

An auditor is a person or a firm appointed by a company to execute an audit.Practical Auditing, Kul Narsingh Shrestha, 2012, Nabin Prakashan, Nepal To act as an auditor, a person should be certified by the regulatory authority of accounting and auditing or possess certain specified qualifications. Generally, to act as an external auditor of the company, a person should have a certificate of practice from the regulatory authority. Types of auditors * External auditor/ Statutory auditor is an independent firm engaged by the client subject to the audit, to express an opinion on whether the company's financial statements are free of material misstatements, whether due to fraud or error. For publicly traded companies, external auditors may also be required to express an opinion over the effectiveness of internal controls over financial reporting. External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements. Mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Freight Expense

In accounting, the concept of a freight expense or freight spend account can be generalized as a payment for sending out a product to a customer. It falls under the umbrella category of expenses and is treated like other expense accounts in relation to the accounting equation, however, under generally accepted accounting rules, if the freight is Freight expense has a normal debit Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value ''to'' that account, and a cred ... balance. Increases are recorded as debits while decreases are recorded as credits. In relation to other accounts, the Freight Expense account is similar to the "Cost of Sales-Freight" account, but are two totally different entities. While the Freight Expense account is increased for payments towards outgoing goods, the Cost of Sales-Freight account i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of the longest-running newspapers in the United States, the ''Times'' serves as one of the country's Newspaper of record, newspapers of record. , ''The New York Times'' had 9.13 million total and 8.83 million online subscribers, both by significant margins the List of newspapers in the United States, highest numbers for any newspaper in the United States; the total also included 296,330 print subscribers, making the ''Times'' the second-largest newspaper by print circulation in the United States, following ''The Wall Street Journal'', also based in New York City. ''The New York Times'' is published by the New York Times Company; since 1896, the company has been chaired by the Ochs-Sulzberger family, whose current chairman and the paper's publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |