|

Taxation In England

In the United Kingdom, taxation may involve payments to at least three different levels of government: Government of the United Kingdom, central government (HM Revenue and Customs), Devolution in the United Kingdom, devolved governments and Local government in the United Kingdom, local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, United Kingdom corporation tax, corporation tax and Hydrocarbon oil duty, fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for decriminalised parking enforcement, on-street parking. In the fiscal year 2023–24, total government revenue was forecast to be £1,139.1 billion, or 40.9 per cent of Gross domestic product, GDP, with income taxes and National Insurance contributions standing at around £470 billion. History A uniform Land Tax (Eng ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen Dowell

Stephen Dowell (1 May 1833 – 28 March 1898) was an English historian and legal writer, best known for his history of taxation in England. Biography Dowell was born on 1 May 1833, in Shorwell on the Isle of Wight, to Stephen Wilkinson Dowell and Julia (), daughter of Thomas Beasley of Seafield, County Dublin. Stephen Wilkinson was born in 1802. He served as the rector of Mottistone and Shorwell, and—from 1848 to his death in 1870—vicar of Gosfield, Essex. Dowell was educated at Cheltenham College, which he entered upon its opening in 1841. He received further education in Sherborne and Highgate schools, afterwards attending Corpus Christi College, Oxford, which he matriculated into on 7 June 1851. Dowell graduated BA in 1855, proceeding to MA in 1872. The same year he received his BA, he was article to the London solicitor R. Bray. He played first-class cricket for the Marylebone Cricket Club against Sussex at Lewes in 1860. On 1 May 1862, Dowell was admitted studen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Peel

Sir Robert Peel, 2nd Baronet (5 February 1788 – 2 July 1850), was a British Conservative statesman who twice was Prime Minister of the United Kingdom (1834–1835, 1841–1846), and simultaneously was Chancellor of the Exchequer (1834–1835). He previously was Home Secretary twice (1822–1827, 1828–1830). He is regarded as the father of modern British policing, owing to his founding of the Metropolitan Police while he was Home Secretary. Peel was one of the founders of the modern Conservative Party. The son of a wealthy textile manufacturer and politician, Peel was the first prime minister from an industrial business background. He earned a double first in classics and mathematics from Christ Church, Oxford. He entered the House of Commons in 1809 and became a rising star in the Tory Party. Peel entered the Cabinet as home secretary (1822–1827), where he reformed and liberalised the criminal law and created the modern police force, leading to a new type of officer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Window Tax

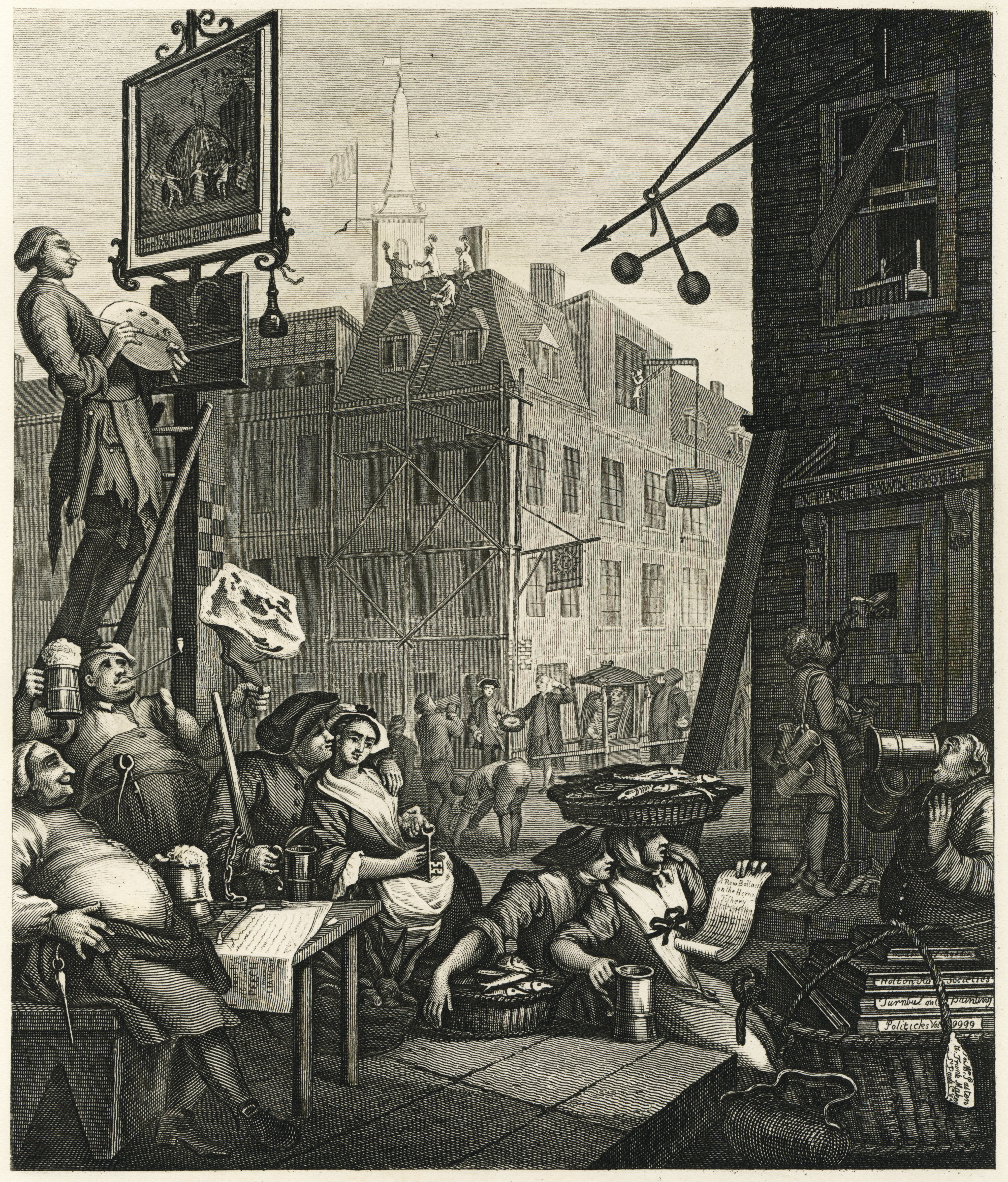

Window tax was a property tax based on the number of windows in a house. It was a significant social, cultural, and architectural force in England, Scotland, France and Ireland during the 18th and 19th centuries. To avoid the tax, some houses from the period can be seen to have bricked-up window-spaces (which can be (re)glazed later). In England and Wales it was introduced in 1696 and in Scotland from 1748. It was repealed in both cases in 1851. In France it was established in 1798 and was repealed in 1926. History The tax was introduced in England and Wales in 1696 under King William III and was designed to impose tax relative to the prosperity of the taxpayer, but without the controversy that then surrounded the idea of income tax. At that time, many people in Britain opposed income tax, on principle, because the disclosure of personal income was perceived by them to represent an unacceptable governmental intrusion into private matters, and a potential threat to personal libe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malt Tax

A malt tax is a tax upon the making or sale of malted grain, which has been prepared using a process of steeping and drying to encourage germination and the conversion of its starch into sugars. Used in the production of beer and whisky for centuries, it is also an ingredient in modern foods. Background Until the late 19th century, lack of access to clean drinking water meant particularly in urban areas, it was often safer to drink so-called small beer. These had relatively low levels of alcohol and were routinely drunk throughout the day by both workers and children; in 1797, one educationalist suggested for '...more robust children, water is preferable, and for the weaker ones, small beer ...'. This meant malt was seen as an essential part of dietary health for the poor and taxing it caused widespread dissent. Taxation In England, malt was first taxed in 1644 by the Crown to help finance the English Civil War. Article 14 of the Acts of Union 1707 between England and Scotland ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Battle Of Waterloo

The Battle of Waterloo was fought on Sunday 18 June 1815, near Waterloo, Belgium, Waterloo (then in the United Kingdom of the Netherlands, now in Belgium), marking the end of the Napoleonic Wars. The French Imperial Army (1804–1815), French Imperial Army under the command of Napoleon, Napoleon I was defeated by two armies of the Seventh Coalition. One was a United Kingdom of Great Britain and Ireland, British-led force with units from the United Kingdom of Great Britain and Ireland, United Kingdom, the United Kingdom of the Netherlands, Netherlands, Kingdom of Hanover, Hanover, Duchy of Brunswick, Brunswick, and Duchy of Nassau, Nassau, under the command of field marshal Arthur Wellesley, 1st Duke of Wellington, Arthur Wellesley, Duke of Wellington. The other comprised three corps of the Kingdom of Prussia, Prussian army under Field Marshal Gebhard Leberecht von Blücher, Blücher. The battle was known contemporaneously as the ''Battle of Mont-Saint-Jean, Belgium, Mont Saint ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peace Of Amiens

The Treaty of Amiens (, ) temporarily ended hostilities between France, the Spanish Empire, and the United Kingdom at the end of the War of the Second Coalition. It marked the end of the French Revolutionary Wars; after a short peace it set the stage for the Napoleonic Wars. Britain gave up most of its recent conquests; France was to evacuate Naples and Egypt. Britain retained Ceylon (Sri Lanka) and Trinidad. It was signed in the Hôtel de Ville (City Hall) of Amiens on 25 March 1802 (4 Germinal X in the French Revolutionary calendar) by Joseph Bonaparte and Charles Cornwallis, 1st Marquess Cornwallis as a "Definitive Treaty of Peace". The consequent peace lasted only one year (18 May 1803) and was the only period of general peace in Europe between 1793 and 1814. Under the treaty, Britain recognised the French Republic. Together with the Treaty of Lunéville (1801), the Treaty of Amiens marked the end of the Second Coalition, which had waged war against Revolutionary Fra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Addington

Henry Addington, 1st Viscount Sidmouth (30 May 175715 February 1844) was a British Tories (British political party), Tory statesman who served as prime minister of the United Kingdom from 1801 to 1804 and as Speaker of the House of Commons (United Kingdom), Speaker of the House of Commons from 1789 to 1801. Addington is best known for obtaining the Treaty of Amiens in 1802, an unfavourable peace with First French Empire, Napoleonic France which marked the end of the War of the Second Coalition, Second Coalition during the French Revolutionary Wars. When that treaty broke down, Addington resumed the war without allies. He conducted relatively weak defensive hostilities, ahead of what would become the War of the Third Coalition. He was forced from office in favour of William Pitt the Younger, who had preceded Addington as prime minister. Addington is also known for his reactionary crackdown on advocates of democratic reforms during a ten-year spell as Home Secretary from 1812 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shilling

The shilling is a historical coin, and the name of a unit of modern currency, currencies formerly used in the United Kingdom, Australia, New Zealand, other British Commonwealth countries and Ireland, where they were generally equivalent to 12 pence or one-twentieth of a Pound (currency), pound before being phased out during the 1960s and 1970s. Currently the shilling is used as a currency in five east African countries: Kenyan shilling, Kenya, Tanzanian shilling, Tanzania, Ugandan shilling, Uganda, Somali shilling, Somalia, and the ''de facto'' country of Somaliland shilling, Somaliland. The East African Community additionally plans to introduce an East African shilling. History The word ''shilling'' comes from Anglo-Saxon language, Anglo-Saxon phrase "Scilling", a monetary term meaning literally "twentieth of a pound", from the Proto-Germanic root :wikt:Reconstruction:Proto-Germanic/skiljaną, skiljaną meaning literally "to separate, split, divide", from :wikt:Reconstr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (symbol: £; currency code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling, and the word '' pound'' is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency in continuous use since its inception. In 2022, it was the fourth-most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and the renminbi, it forms the basket of currencies that calculate the value of IMF special drawing rights. As of late 2022, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Pence

The British pre-decimal penny was a denomination of sterling coinage worth of one pound or of one shilling. Its symbol was ''d'', from the Roman denarius. It was a continuation of the earlier English penny, and in Scotland it had the same monetary value as one pre-1707 Scottish shilling, thus the English penny was called in Scottish Gaelic. The penny was originally minted in silver, but from the late 18th century it was minted in copper, and then after 1860 in bronze. The plural of "penny" is "pence" (often added as an unstressed suffix) when referring to an amount of money, and "pennies" when referring to a number of coins. Thus 8''d'' is eightpence or eight pence, but "eight pennies" means specifically eight individual penny coins. Before Decimal Day in 1971, sterling used the Carolingian monetary system (£sd), under which the largest unit was a pound (£) divisible into 20 shillings (s), each of 12 pence (d). The pre-decimal penny was demonetised on 1 September 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |