|

Tax Avoidance

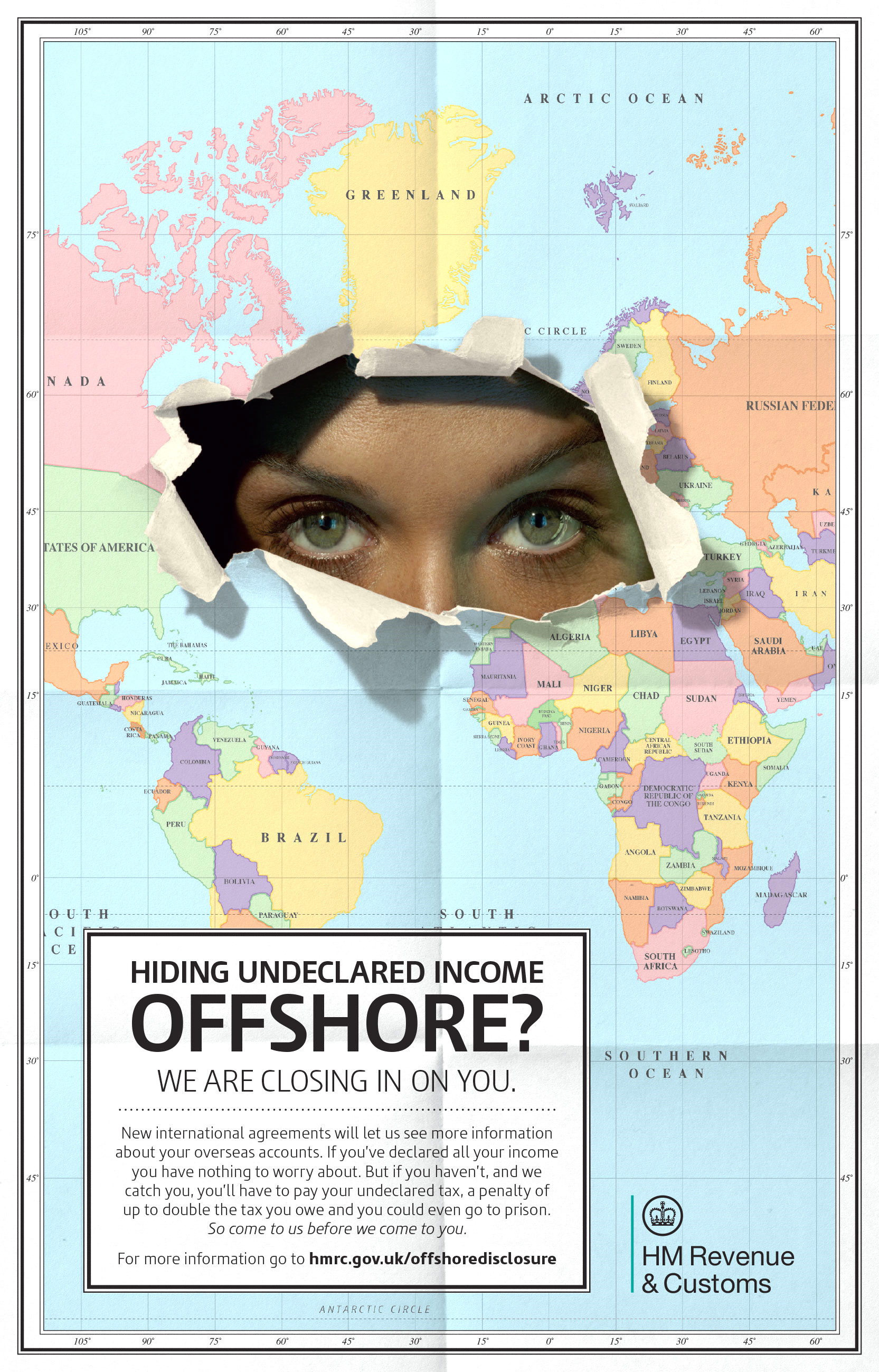

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Shelter

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities, including state and federal governments. The methodology can vary depending on local and international tax laws. Types of tax shelters Some tax shelters are questionable or even illegal: *Offshore companies. Due to differing tax rates and legislation in each country, tax benefits can be exploited. For example, if Import Co. buys $1 of goods from India and sells for $3, Import Co. will pay tax on $2 of taxable income. However, tax benefits can be exploited if Import Co. sets up an offshore subsidiary in the British Virgin Islands to buy the same goods for $1, sell the goods to Import Co. for $3 and sell it again in the domestic market for $3. This allows Import Co. to report taxable income of $0 (because it was purchased for $3 and sold for $3), thus paying no tax. While the subsidiary will have to pay tax on $2, the tax is payable to the tax authority of Brit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gregory V

Gregory may refer to: People and fictional characters * Gregory (given name), including a list of people and fictional characters with the given name * Gregory (surname), a surname * Gregory (The Walking Dead), fictional character from the walking dead * Gregory (Five Nights at Freddy's), main protagonist of '' Five Nights at Freddy's: Security Breach'' ** Places Australia *Gregory, a town in the Northern Territory * Gregory, Queensland, a town in the Shire of Burke ** Electoral district of Gregory, Queensland, Australia * Gregory, Western Australia. United States * Gregory, South Dakota * Gregory, Tennessee * Gregory, Texas Outer space * Gregory (lunar crater) * Gregory (Venusian crater) Other uses * "Gregory" (''The Americans''), the third episode of the first season of the television series ''The Americans'' See also * Greg (other) * Greggory * Gregoire (other) * Gregor (other) * Gregores (other) * Gregorian (other) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perpetual Traveler

A perpetual traveler (also PT, permanent tourist or prior taxpayer) is a person who bases different aspects of their life in different countries, without spending too long in any one place, under the belief that they can reduce taxes, avoid civic duties, and increase personal freedom. Books and services relating to the PT idea have been a staple of companies that specialise in marketing offshore financial centres, tax avoidance schemes, and personal privacy services. Principles The perpetual traveler idea proposes that individuals live in such a way that they are not considered a Residency (domicile), legal resident of any of the countries in which they spend time or operate. By lacking a legal permanent residence status, the theory goes, they may avoid the legal obligations which accompany residency, such as income and asset taxes, social security contributions, jury duty, and military service. The idea has been described as a "late capitalist nomadism". Flag theory The perpetua ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monaco

Monaco, officially the Principality of Monaco, is a Sovereign state, sovereign city-state and European microstates, microstate on the French Riviera a few kilometres west of the Regions of Italy, Italian region of Liguria, in Western Europe, on the Mediterranean Sea. It is a Enclave and exclave, semi-enclave bordered by France to the north, east and west. The principality is home to nearly 39,000 residents as of the 2020s, of whom about 9,883 are Monégasque people, Monégasque nationals. It is recognised as one of the wealthiest and most expensive places in the world. The official language of Monaco is French language, French. Monégasque dialect, Monégasque, English language, English and Italian language, Italian are also spoken and understood by many residents. With an area of , Monaco is the List of countries and dependencies by area, second-smallest sovereign state in the world, after Vatican City. Its population of 38,423 in 2024 makes it the List of countries by popula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Residence

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test. Domicile is, in common law jurisdictions, a different legal concept to residence, though the place of residence and the place of domicile would typically be the same. The criteria for residence in double taxation treaties may be different from those of d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Trust

An offshore trust is a conventional trust that is formed under the laws of an offshore jurisdiction. Generally offshore trusts are similar in nature and effect to their onshore counterparts; they involve a settlor transferring (or 'settling') assets (the 'trust property') on the trustees to manage for the benefit of a person, class or persons (the ' beneficiaries') or, occasionally, an abstract purpose. However, a number of offshore jurisdictions have modified their laws to make their jurisdictions more attractive to settlors forming offshore structures as trusts. Liechtenstein, a civil jurisdiction which is sometimes considered to be offshore, has artificially imported the trust concept from common law jurisdictions by statute. Uses of offshore trusts Official statistics on trusts are difficult to come by as in most offshore jurisdictions (and in most onshore jurisdictions), trusts are not required to be registered, however, it is thought that the most common use of offshore t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Company

The term "offshore company" or "offshore corporation" is used in at least two distinct and different ways. An offshore company may be a reference to: * a company, group or sometimes a division thereof, which engages in offshoring business processes. * International business companies (IBC) or other types of legal entities, which are incorporated under the laws of a jurisdiction, that prohibit local economic activities. The former use (companies formed in offshore jurisdictions) is probably the more common usage of the term. In isolated instances, the term can also be used in reference to companies with offshore oil and gas operations. Companies from offshore jurisdictions In relation to companies and similar entities which are incorporated in offshore jurisdictions, the use of both the words "offshore" and "company" can be varied in application. The extent to which a jurisdiction is regarded as offshore is often a question of perception and degree. Classic tax haven countr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). He is a former senior vice president and chief economist of the World Bank. He is also a former member and chairman of the U.S. Council of Economic Advisers. He is known for his support for the Georgist public finance theory and for his critical view of the management of globalization, of ''laissez-faire'' economists (whom he calls " free-market fundamentalists"), and of international institutions such as the International Monetary Fund and the World Bank. In 2000, Stiglitz founded the Initiative for Policy Dialogue (IPD), a think tank on international development based at Columbia University. He has been a member of the Columbia faculty since 2001 and received the university's highest academ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust (property)

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a designated person. In the English common law, the party who entrusts the property is known as the " settlor", the party to whom it is entrusted is known as the " trustee", the party for whose benefit the property is entrusted is known as the " beneficiary", and the entrusted property is known as the "corpus" or "trust property". A '' testamentary trust'' is an irrevocable trust established and funded pursuant to the terms of a deceased person's will. An inter vivos trust is a trust created during the settlor's life. The trustee is the legal owner of the assets held in trust on behalf of the trust and its beneficiaries. The beneficiaries are equitable owners of the trust property. Trustees have a fiduciary duty to manage the trust for the benefit of the equitable owners. Trustees must provide regular accountings of trust i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all Federal tribunals in the United States, U.S. federal court cases, and over State court (United States), state court cases that turn on questions of Constitution of the United States, U.S. constitutional or Law of the United States, federal law. It also has Original jurisdiction of the Supreme Court of the United States, original jurisdiction over a narrow range of cases, specifically "all Cases affecting Ambassadors, other public Ministers and Consuls, and those in which a State shall be Party." In 1803, the Court asserted itself the power of Judicial review in the United States, judicial review, the ability to invalidate a statute for violating a provision of the Constitution via the landmark case ''Marbury v. Madison''. It is also able to strike down presidential directives for violating either the Constitution or s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |