|

Subsidies

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic. Subsidies take various forms— such as direct government expenditures, tax incentives, soft loans, price support, and government provision of goods and services. For instance, the government may distribute direct payment subsidies to individuals and households during an economic downturn in order to help its citizens pay their bills and to stimulate economic activity. Here, subsidies act as an effective financial aid issued when the ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Usha Haley

Usha C. V. Haley is an American author and academic, currently W. Frank Barton Distinguished Chair of International Business and Professor of Management at the W. Frank Barton School of Business at Wichita State University in the U.S. state of Kansas. She is also Director of the Center for International Business Advancement at Wichita State University and elected Chair of the independent World Trade Council of Wichita. Prior to this, she was at other universities including West Virginia University, Massey University in New Zealand and at Harvard Kennedy School, Harvard University. Haley is credited with providing the intellectual foundations on understanding subsidies to Chinese industry with her book of the same name and testimonies, used as a basis for the current trade wars. See http://ushahaley.academia.edu. Born in Mumbai, India, she received a bachelor's degree in Politics at Elphinstone College, Mumbai and then went on to get graduate degrees from various American universitie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rail Subsidies

Many countries offer subsidies to their railways because of the social and economic benefits that it brings. The economic benefits can greatly assist in funding the rail network. Those countries usually also fund or subsidize road construction, and therefore effectively also subsidize road transport. Rail subsidies vary in both size and how they are distributed, with some countries funding the infrastructure and others funding trains and their operators, while others have a mixture of both. Subsidies can be used for either investment in upgrades and new lines, or to keep lines running that create economic growth. Rail subsidies are largest in China ($130 billion), Europe (€73 billion) and India ($35.8 billion), while the United States has relatively small subsidies for passenger rail with freight not subsidized. Social and economic benefits of rail Railways channel growth toward dense city agglomerations and along their arteries. These arrangements help to regenerate cities, inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization headquartered in Geneva, Switzerland that regulates and facilitates international trade. Governments use the organization to establish, revise, and enforce the rules that govern international trade in cooperation with the United Nations System. The WTO is the world's largest international economic organization, with 166 members representing over 98% of global trade and global GDP. The WTO facilitates trade in goods, trade in services, services and intellectual property among participating countries by providing a framework for negotiating trade agreements, which usually aim to reduce or eliminate tariffs, Import quota, quotas, and other Trade barrier, restrictions; these agreements are signed by representatives of member governments. (The document's printed folio numbers do not match the PDF page numbers.) and ratified by their legislatures. It also administers independent dispute resolution for enforcing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Expenditure

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Spending by a government that issues its own currency is nominally self-financing. However, under a full employment assumption, to acquire resources produced by its population without potential inflationary pressures, removal of purchasing power must occur via government bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Expenditures

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Sustainability

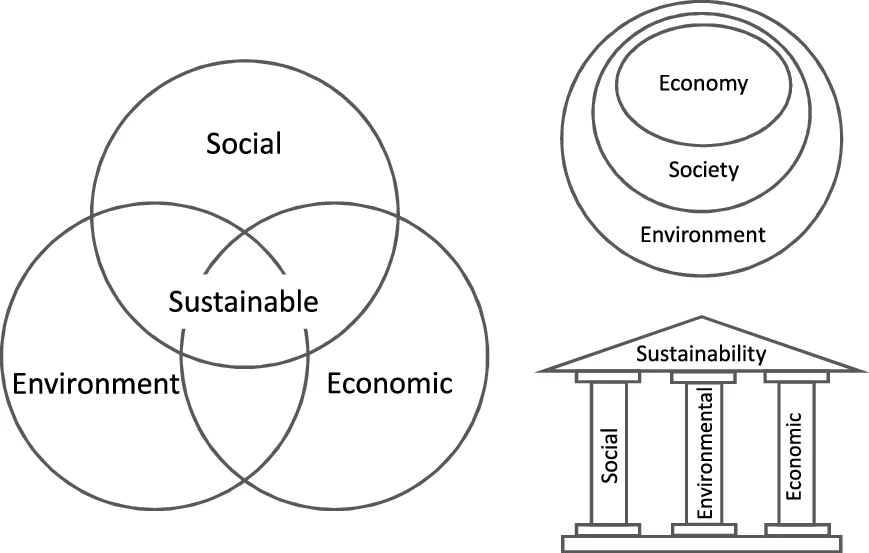

Sustainability is a social goal for people to co-exist on Earth over a long period of time. Definitions of this term are disputed and have varied with literature, context, and time. Sustainability usually has three dimensions (or pillars): environmental, economic, and social. Many definitions emphasize the environmental dimension. This can include addressing key environmental issues, environmental problems, including climate change and biodiversity loss. The idea of sustainability can guide decisions at the global, national, organizational, and individual levels. A related concept is that of sustainable development, and the terms are often used to mean the same thing. UNESCO distinguishes the two like this: "''Sustainability'' is often thought of as a long-term goal (i.e. a more sustainable world), while ''sustainable development'' refers to the many processes and pathways to achieve it." Details around the economic dimension of sustainability are controversial. Scholars have d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world. About Classical economists such as Adam Smith (1723–1790), Thomas Malthus (1766–1834), and David Ricardo (1772–1823) concentrated their attention on factor income-distribution, that is, the Distribution (economics), distribution of income between the primary factors of production (Land (economics), land, Labour economics, labour and Capital (economics), capital). Modern economists have also addressed issues of income distribution, but have focused more on the distribution of income across individuals and households. Important theoretical and policy concerns include the balance between income inequality and economic growth, and their often inverse relati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Opportunity Cost

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, it is the "cost" incurred by not enjoying the ''benefit'' that would have been had if the second best available choice had been taken instead. The '' New Oxford American Dictionary'' defines it as "the loss of potential gain from other alternatives when one alternative is chosen". As a representation of the relationship between scarcity and choice, the objective of opportunity cost is to ensure efficient use of scarce resources. It incorporates all associated costs of a decision, both explicit and implicit. Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of output forgone, lost time, pleasure, or any other benefit that provides utility should also be considered an opportunity cost. Types Expl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industrial Policy

Industrial policy is proactive government-led encouragement and development of specific strategic industries for the growth of all or part of the economy, especially in absence of sufficient private sector investments and participation. Historically, it has often focused on the manufacturing sector, militarily important sectors, or on fostering an advantage in new technologies. In industrial policy, the government takes measures "aimed at improving the competitiveness and capabilities of domestic firms and promoting structural transformation". A country's infrastructure (including transportation, telecommunications and energy industry) is a major enabler of industrial policy. Industrial policies are economic interventionism, interventionist measures typical of mixed economy countries. Many types of industrial policies contain common elements with other types of interventionist practices such as trade policy. Industrial policy is usually seen as separate from broader Macroeconomic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Haley

George T. Haley is an American author and academic, currently a tenured professor of industrial and international marketing at the University of New Haven in the US state of Connecticut. He is also the director of the Center for International Industry Competitiveness. His research covers industrial marketing, emerging markets, new product development, innovation and B2B marketing. He has testified about his research on China before the United States Congress and several government agencies. The American Marketing Association's ''Marketing News'' named him as one of six marketing academics to watch based on his research, teaching and broader impact. He was also named an American Made Hero for his work on the ramifications of trade for US manufacturing in a global economy. Early life Haley was born in San Antonio, Texas, where he attended the San Antonio Academy and the Texas Military Institute. Subsequently, he attended the University of Texas at Austin where he received u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Incentives

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments. Tax incentives can have both positive and negative impacts on an economy. Among the positive benefits, if implemented and designed properly, tax incentives can attract investment to a country. Other benefits of tax incentives include increased employment, higher number of capital transfers, research and technology development, and also improvement to less developed areas. Though it is difficult to estimate the effects of tax incentives, they can, if done properly, raise the overall economic welfare through increasing economic growth and government tax revenue (after the expiration of the tax holiday/incentive period). However, tax incentives can cause negative effects on a government's financial condition, among other negative effects, if they are not properly designed and implemented. According to a 2020 study of tax ince ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Soft Loan

A soft loan is a loan with a below-market rate of interest. This is also known as ''soft financing''. Sometimes, soft loans provide other concessions to borrowers, such as long repayment periods or interest holidays. Soft loans are usually provided by governments to projects they think are worthwhile. The World Bank and other development institutions provide soft loans to developing countries. This contrasts with a hard loan, which has to be paid back in an agreed hard currency, usually of a country with a stable, robust economy. An example of a soft loan is a $2 billion loan by China's Export-Import Bank to Angola in October 2004 to help build infrastructure. In return, the Angolan government gave China a stake in oil exploration off the coast. Another example is the interest free soft loan of Rs. 20 billion given by the Asian Development Bank (ADB) to the government of West Bengal West Bengal (; Bengali language, Bengali: , , abbr. WB) is a States and uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |