|

Presidency Of Carlos Menem

Carlos Menem was president of Argentina from 1989 to 1999. Economic policy When Menem began his presidency, there was a huge hyperinflation and recession. The first measure was a mandatory conversion of time deposits into government bonds. It generated more recession, but hyperinflation was lowered. Despite being a Peronist, Menem privatized several state-owned companies, such as telephones and airlines. One of the leading privatizations was YPF, engaged in the exploration and production of oil and gas. His fourth economy minister, Domingo Cavallo, deepened the Neoliberalism, neoliberal reforms. He proposed a Argentine Currency Board, Convertibility Plan that set a one-to-one fixed exchange rate between the Argentine peso and the United States dollar, US dollar. The law also limited public expenditures, but this was frequently ignored. A dramatic influx of foreign direct investment funds helped tame inflation (from 5,000% a year in 1989 to single digits by 1993) and improved l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Casa Rosada

The ''Casa Rosada'' (), , is the president of the Argentine Republic's official workplace, located in Buenos Aires. The palatial mansion is known officially as ''Casa de Gobierno'' ("House of Government" or "Government House"). Normally, the president lives at the Quinta de Olivos, the president of Argentina's official residence, located in Olivos, Greater Buenos Aires. The characteristic color of the Casa Rosada is baby pink, and it is considered one of the most emblematic buildings in Buenos Aires. The building also houses a museum, which contains objects relating to former presidents of Argentina. It has been declared a National Historic Monument of Argentina. History The ''Casa Rosada'' sits at the eastern end of the Plaza de Mayo, a large square which since the 1580 foundation of Buenos Aires has been surrounded by many of the most important political institutions of the city and of Argentina. The site, originally at the shoreline of the Río de la Plata, was first occupie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a currency basket, basket of other currencies, or another measure of value, such as gold standard, gold or silver standard, silver. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating exchange rate, floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Country Risk

Country risk refers to the risk of investing or lending in a country, arising from possible changes in the business environment that may adversely affect operating profits or the value of assets in the country. For example, financial factors such as currency controls, devaluation or regulatory changes, or stability factors such as mass riots, civil war and other potential events contribute to companies' operational risks. This term is also sometimes referred to as political risk; however, country risk is a more general term that generally refers only to risks influencing all companies operating within or involved with a particular country. Political risk analysis providers and credit rating agencies use different methodologies to assess and rate countries' comparative risk exposure. Credit rating agencies tend to use quantitative econometric models and focus on financial analysis, whereas political risk providers tend to use qualitative methods, focusing on political analys ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998 Russian Financial Crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defaulting on its debt. The crisis had severe impacts on the economies of many neighboring countries. Background and course of events The Russian economy had set up a path for improvement after the Soviet Union had split into different countries. Russia was supposed to provide assistance to the former Soviet states and, as a result, imported heavily from them. In Russia, foreign loans financed domestic investments. When it was unable to pay back those foreign borrowings, the ruble devalued. In mid-1997, Russia had finally found a way out of inflation. The economic supervisors were happy about inflation coming to a standstill. Then the crisis hit, and supervisors had to implement a new policy. Both Russia and the countries that exported to i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

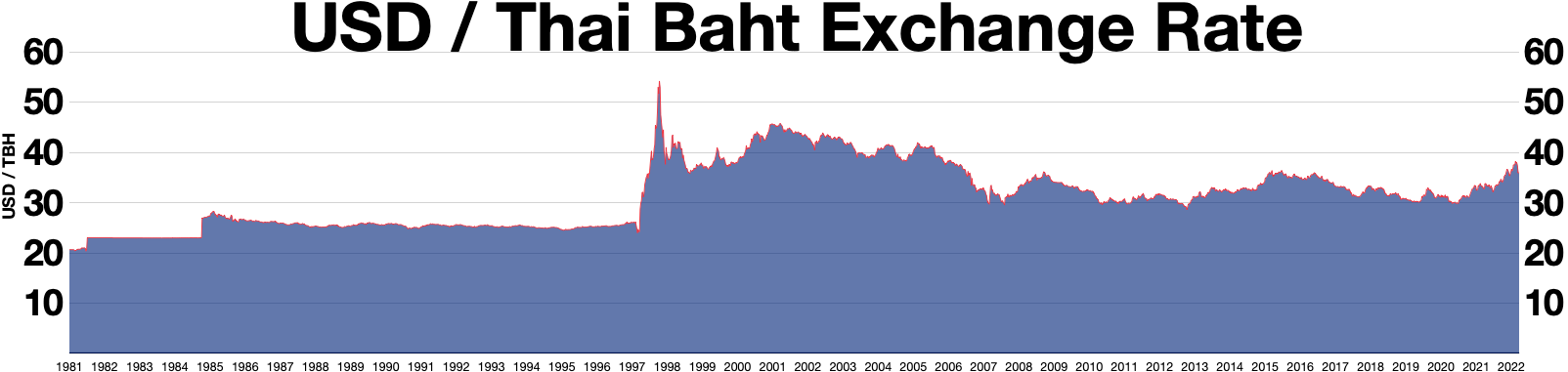

East Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the '' Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private debt. F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tequila Crisis

The Mexican peso crisis was a currency crisis sparked by the Mexican government's sudden devaluation of the peso against the U.S. dollar in December 1994, which became one of the first international financial crises ignited by capital flight. During the 1994 presidential election, the incumbent administration embarked on an expansionary fiscal and monetary policy. The Mexican treasury began issuing short-term debt instruments denominated in domestic currency with a guaranteed repayment in U.S. dollars, attracting foreign investors. Mexico enjoyed investor confidence and new access to international capital following its signing of the North American Free Trade Agreement (NAFTA). However, a violent uprising in the state of Chiapas, as well as the assassination of the presidential candidate Luis Donaldo Colosio, resulted in political instability, causing investors to place an increased risk premium on Mexican assets. In response, the Mexican central bank intervened in the fore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |