|

Income Distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world. About Classical economists such as Adam Smith (1723–1790), Thomas Malthus (1766–1834), and David Ricardo (1772–1823) concentrated their attention on factor income-distribution, that is, the Distribution (economics), distribution of income between the primary factors of production (Land (economics), land, Labour economics, labour and Capital (economics), capital). Modern economists have also addressed issues of income distribution, but have focused more on the distribution of income across individuals and households. Important theoretical and policy concerns include the balance between income inequality and economic growth, and their often inverse relati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Inequality - Share Of Income Earned By Top 1% 1975 To 2015

Income is the Consumption (economics), consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit (accounting), profit, interest payment, Renting, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (such as mandatory pensi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Inequality

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world. About Classical economists such as Adam Smith (1723–1790), Thomas Malthus (1766–1834), and David Ricardo (1772–1823) concentrated their attention on factor income-distribution, that is, the distribution of income between the primary factors of production (land, labour and capital). Modern economists have also addressed issues of income distribution, but have focused more on the distribution of income across individuals and households. Important theoretical and policy concerns include the balance between income inequality and economic growth, and their often inverse relationship. The Lorenz curve can represent the distribution of income within ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

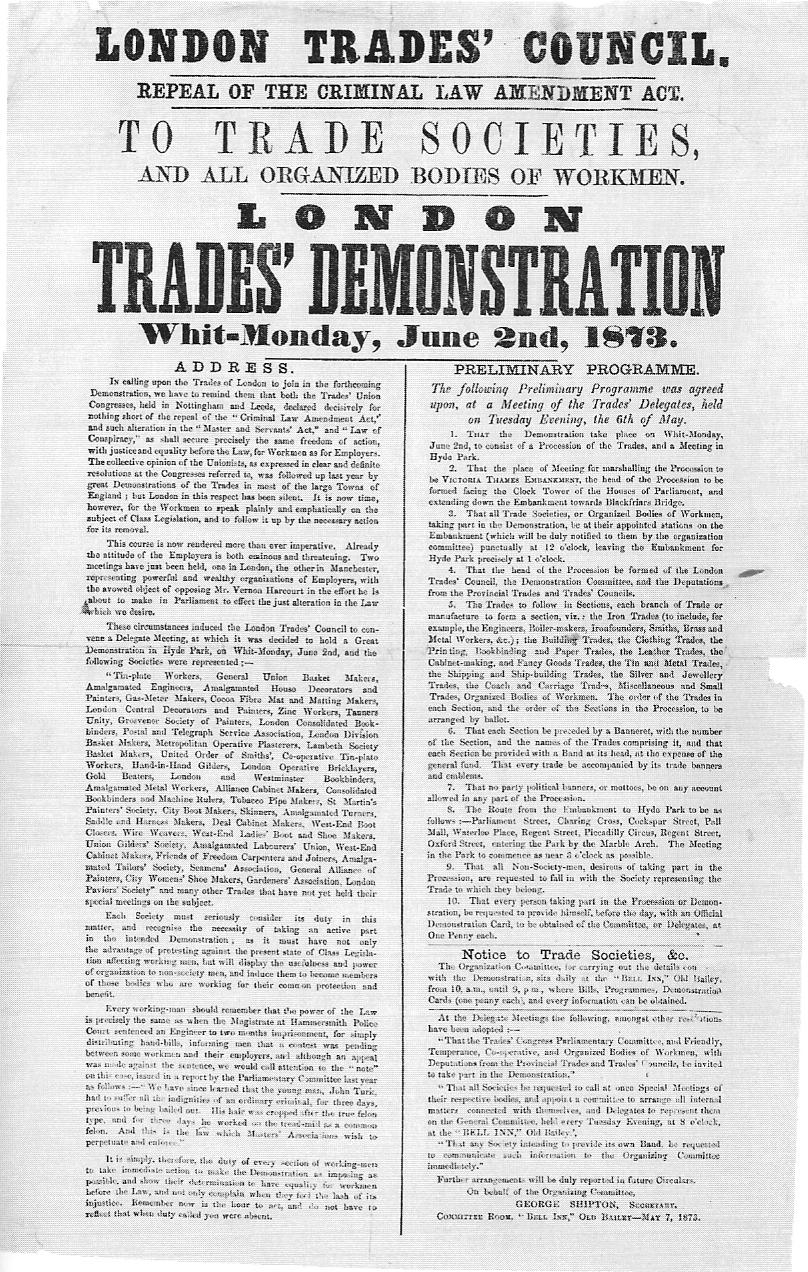

Labor Union

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages and Employee benefits, benefits, improving Work (human activity), working conditions, improving safety standards, establishing complaint procedures, developing rules governing status of employees (rules governing promotions, just-cause conditions for termination) and protecting and increasing the bargaining power of workers. Trade unions typically fund their head office and legal team functions through regularly imposed fees called ''union dues''. The union representatives in the workforce are usually made up of workplace volunteers who are often appointed by members through internal democratic elections. The trade union, through an elected leadership and bargaining committee, bargains with the employer on behalf of its members, known as t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Policy

Tax policy refers to the guidelines and principles established by a government for the imposition and collection of taxes. It encompasses both microeconomic and macroeconomic aspects. The former focuses on issues of fairness and efficiency in tax collection, and the latter focuses on the overall quantity of taxes to be collected and its impact on economic activity. The tax framework of a country is considered a crucial instrument for influencing the country's economy. Tax policies have significant implications for specific groups within an economy, such as households, firms, and banks. These policies are often intended to promote economic growth; however, there is significant debate among economists about the most effective ways to achieve this. Taxation is both a political and economic issue. Political leaders often use tax policies to advance their agendas through various tax reforms, such as changes to tax rates, definitions of taxable income, and the creation of new taxes. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Labour Economics

Labour economics seeks to understand the functioning and dynamics of the Market (economics), markets for wage labour. Labour (human activity), Labour is a commodity that is supplied by labourers, usually in exchange for a wage paid by demanding firms. Because these labourers exist as parts of a social, institutional, or political system, labour economics must also account for social, cultural and political variables. Labour markets or job markets function through the interaction of workers and employers. Labour economics looks at the suppliers of labour services (workers) and the demanders of labour services (employers), and attempts to understand the resulting pattern of wages, employment, and income. These patterns exist because each individual in the market is presumed to make rational choices based on the information that they know regarding wage, desire to provide labour, and desire for leisure. Labour markets are normally geographically bounded, but the rise of the internet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Piketty

Thomas Piketty (; born 7 May 1971) is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, associate chair at the Paris School of Economics (PSE) and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics (LSE). Piketty's work focuses on public economics, in particular income and wealth inequality. He is the author of the best-selling book '' Capital in the Twenty-First Century'' (2013), which emphasises the themes of his work on wealth concentrations and distribution over the past 250 years. The book argues that the rate of capital return in developed countries is persistently greater than the rate of economic growth, and that this will cause wealth inequality to increase in the future. Piketty proposes improving the education systems and considers diffusion of knowledge, diffusion of skills, diffusion of idea of productivity as the main mechanism that will l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital In The Twenty-First Century

''Capital in the Twenty-First Century'' () is a book written by French economist Thomas Piketty. It focuses on economic inequality, wealth and income inequality in Europe and the United States since the 18th century. It was first published in French (as ''Le Capital au XXIe siècle'') in August 2013; an English translation by Arthur Goldhammer followed in April 2014. The book's central thesis is that when the rate of return on capital (economics), capital (''r'') is greater than the rate of economic growth (''g'') over the long term, the result is wealth concentration, concentration of wealth, and this unequal distribution of wealth causes social and economic instability. Piketty proposes a global system of progressive tax, progressive wealth taxes to help reduce inequality and avoid the vast majority of wealth coming under the control of a tiny minority. At the end of 2014, Piketty released a paper where he stated that he does not consider the relationship between the rate of ret ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distribution Of Wealth

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or heterogeneity in economics, economic heterogeneity. The distribution of wealth differs from the income distribution in that it looks at the Distribution (economics), economic distribution of ownership of the assets in a society, rather than the current income of members of that society. According to the International Association for Research in Income and Wealth, "the world distribution of wealth is much more unequal than that of income." For rankings regarding wealth, see list of countries by wealth equality or list of countries by wealth per adult. Definition of wealth Wealth of an individual is defined as net worth, expressed as: wealth = assets − liability (financial accounting), liabilities A broader definition of wealth, which is rarely used in the measurement of wealth inequality, also includes human capital. For example ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (economics), output/Gross domestic product, GDP (gross domestic product) and national income, unemployment (including Unemployment#Measurement, unemployment rates), price index, price indices and inflation, Consumption (economics), consumption, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

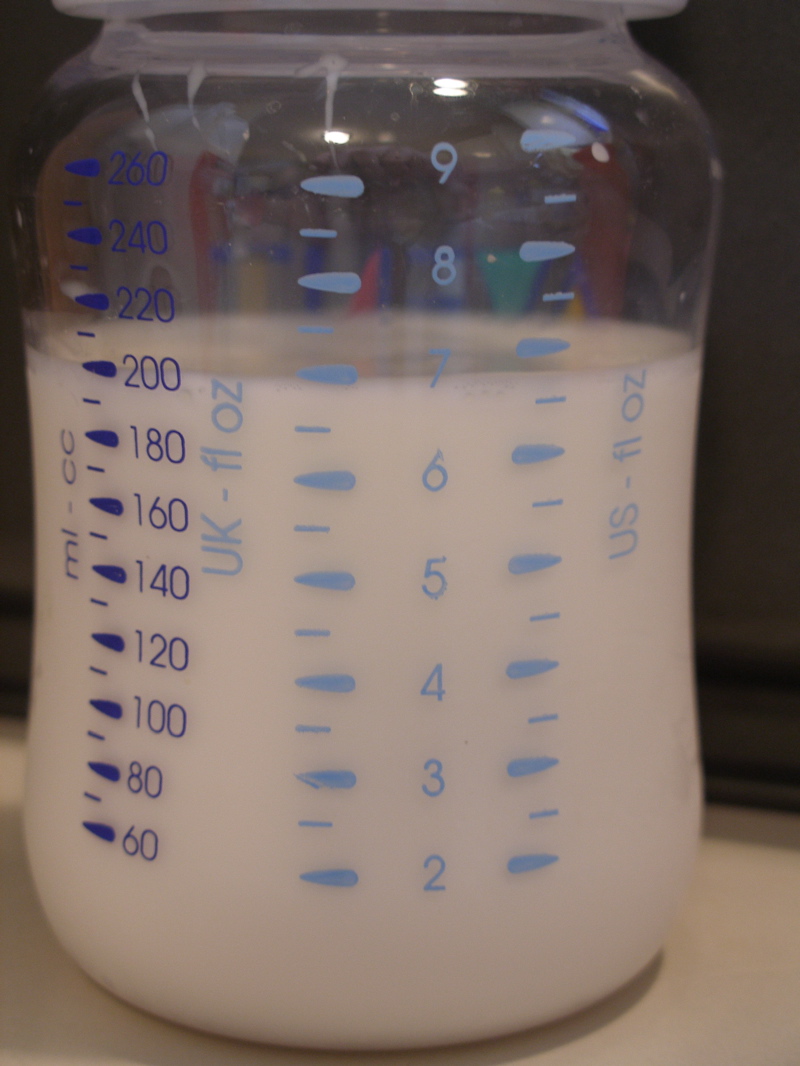

Systems Of Measurement

A system of units of measurement, also known as a system of units or system of measurement, is a collection of units of measurement and rules relating them to each other. Systems of measurement have historically been important, regulated and defined for the purposes of science and wikt:commerce, commerce. Instances in use include the International System of Units or (the modern form of the metric system), the British imperial system, and the United States customary system. History In antiquity, ''systems of measurement'' were defined locally: the different units might be defined independently according to the length of a king's thumb or the size of his foot, the length of stride, the length of arm, or maybe the weight of water in a keg of specific size, perhaps itself defined in ''hands'' and ''knuckles''. The unifying characteristic is that there was some definition based on some standard. Eventually ''cubits'' and ''yard, strides'' gave way to "customary units" to meet the n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distributive Justice

Distributive justice concerns the Social justice, socially just Resource allocation, allocation of resources, goods, opportunity in a society. It is concerned with how to allocate resources fairly among members of a society, taking into account factors such as wealth, income, and social status. Often contrasted with procedural justice, just process and Equal opportunity, formal equal opportunity, distributive justice concentrates on outcomes (substantive equality). This subject has been given considerable attention in philosophy and the social sciences. Theorists have developed widely different conceptions of distributive justice. These have contributed to debates around the arrangement of social, political and economic institutions to promote the just distribution of benefits and burdens within a society. Most contemporary theories of distributive justice rest on the precondition of material scarcity. From that precondition arises the need for principles to resolve competing intere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |