|

Economy Of The Isle Of Man

The economy of the Isle of Man is a low-tax economy with insurance, online gambling operators and developers, information and communications technology (ICT), and offshore banking forming key sectors of the island's economy. As an offshore financial centre located in the Irish Sea, the Isle of Man is within the British Isles but does not form part of the United Kingdom and was never a part of the European Union. As of 2016, the Crown dependency's gross national income (GNI) per capita was US$89,970 as assessed by the World Bank. The Isle of Man Government's own National Income Report shows the largest sectors of the economy are insurance and eGaming with 17% of GNI each, followed by ICT and banking with 9% each, with tourist accommodation in the lowest sector at 0.3%. Economic performance After 32 years of continued Gross Domestic Product (GDP) growth, the financial year 2015/16 showed the first drop in GDP, of 0.9%, triggered by decline in eGaming revenues. The unemployme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Agriculture

Agriculture encompasses crop and livestock production, aquaculture, and forestry for food and non-food products. Agriculture was a key factor in the rise of sedentary human civilization, whereby farming of domesticated species created food surpluses that enabled people to live in the cities. While humans started gathering grains at least 105,000 years ago, nascent farmers only began planting them around 11,500 years ago. Sheep, goats, pigs, and cattle were domesticated around 10,000 years ago. Plants were independently cultivated in at least 11 regions of the world. In the 20th century, industrial agriculture based on large-scale monocultures came to dominate agricultural output. , small farms produce about one-third of the world's food, but large farms are prevalent. The largest 1% of farms in the world are greater than and operate more than 70% of the world's farmland. Nearly 40% of agricultural land is found on farms larger than . However, five of every six farm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

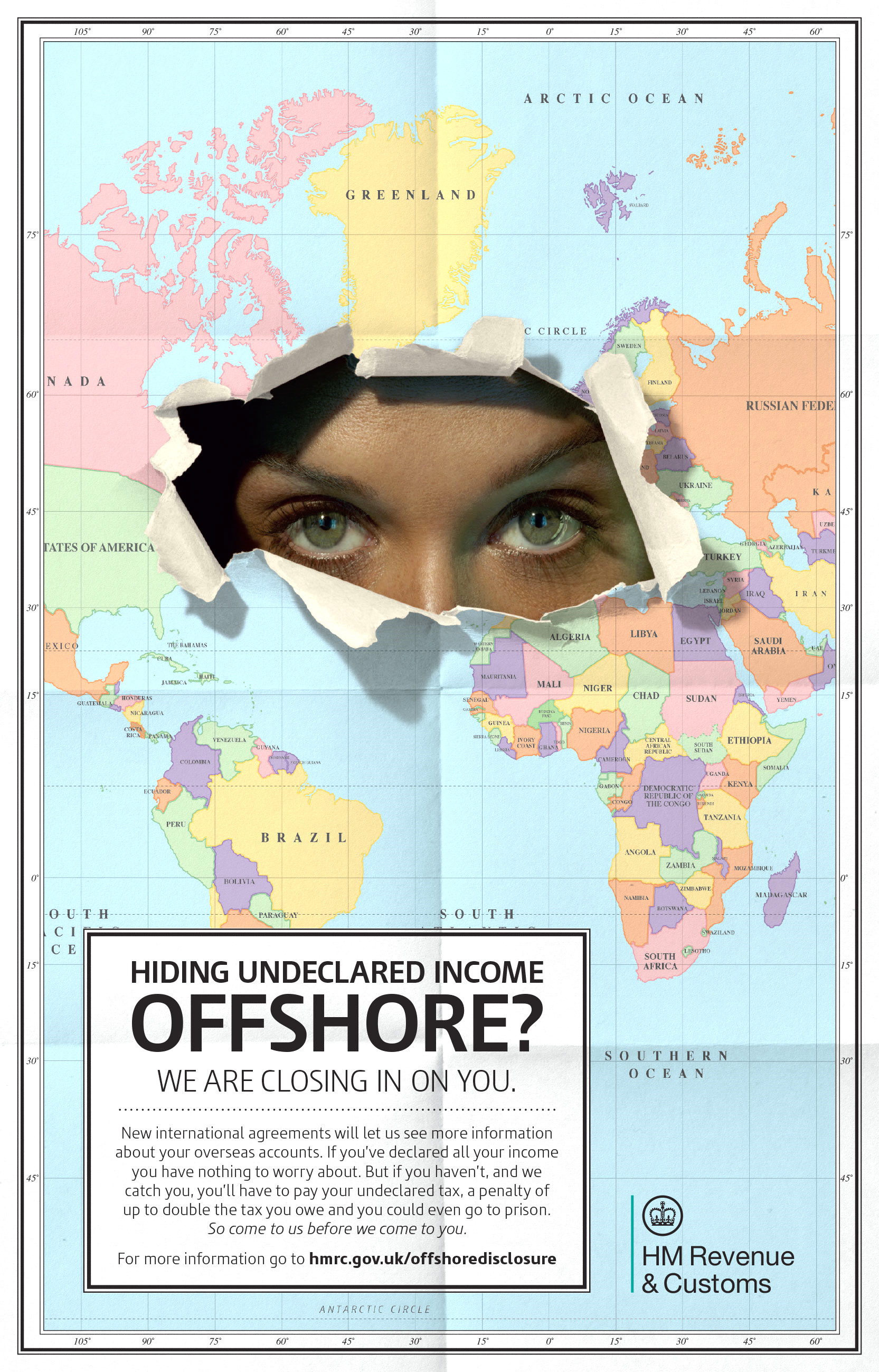

Global Forum On Transparency And Exchange Of Information For Tax Purposes

The Global Forum on Transparency and Exchange of Information for Tax Purposes was founded in 2000 and restructured in September 2009. It consists of OECD member countries as well as other jurisdictions that have agreed to implement tax related transparency and information exchange. The forum works under the auspices of the OECD and G20. Its mission is to "implement the international standard through two phases of peer review process". It addresses tax evasion, tax havens, offshore financial centres, tax information exchange agreements, double taxation and money laundering. In 2000, the Forum published a blacklist of 35 tax havens, which by 2009 had shrunk to zero. It has since focused on increasing the standard for exchange of information. , the Forum had 163 member tax jurisdictions and the European Union, all on equal footing. Activities The Forum promotes the implementation of two internationally agreed standards on exchange of information for tax purposes: the standard on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, world trade. It is a forum (legal), forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are generally regarded as developed country, developed countries, with High-income economy, high-income economies, and a very high Human Development Index. their collective population is 1.38 billion people with an average life expectancy of 80 years and a median age of 40, against a global average of 30. , OECD Member countries collectively comprised 62.2% of list of countries by GDP (nominal), global nom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paradise Papers

The Paradise Papers are a set of over 13.4 million confidential electronic documents relating to offshore investments that were leaked to the German reporters Frederik Obermaier and Bastian Obermayer, from the newspaper'' Süddeutsche Zeitung''. The newspaper shared them with the International Consortium of Investigative Journalists, and a network of more than 380 journalists. Some of the details were made public on 5 November 2017 and stories are still being released. The documents originate from the legal firm Appleby (law firm), Appleby, the corporate services providers Estera and Asiaciti Trust, and business registries in 19 tax jurisdictions. They contain the names of more than 120,000 people and companies. Among those whose financial affairs are mentioned are, separately, AIG, then-Charles III, Prince Charles and Elizabeth II, Queen Elizabeth II, President of Colombia Juan Manuel Santos, and United States Secretary of Commerce, U.S. Secretary of Commerce Wilbur Ros ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

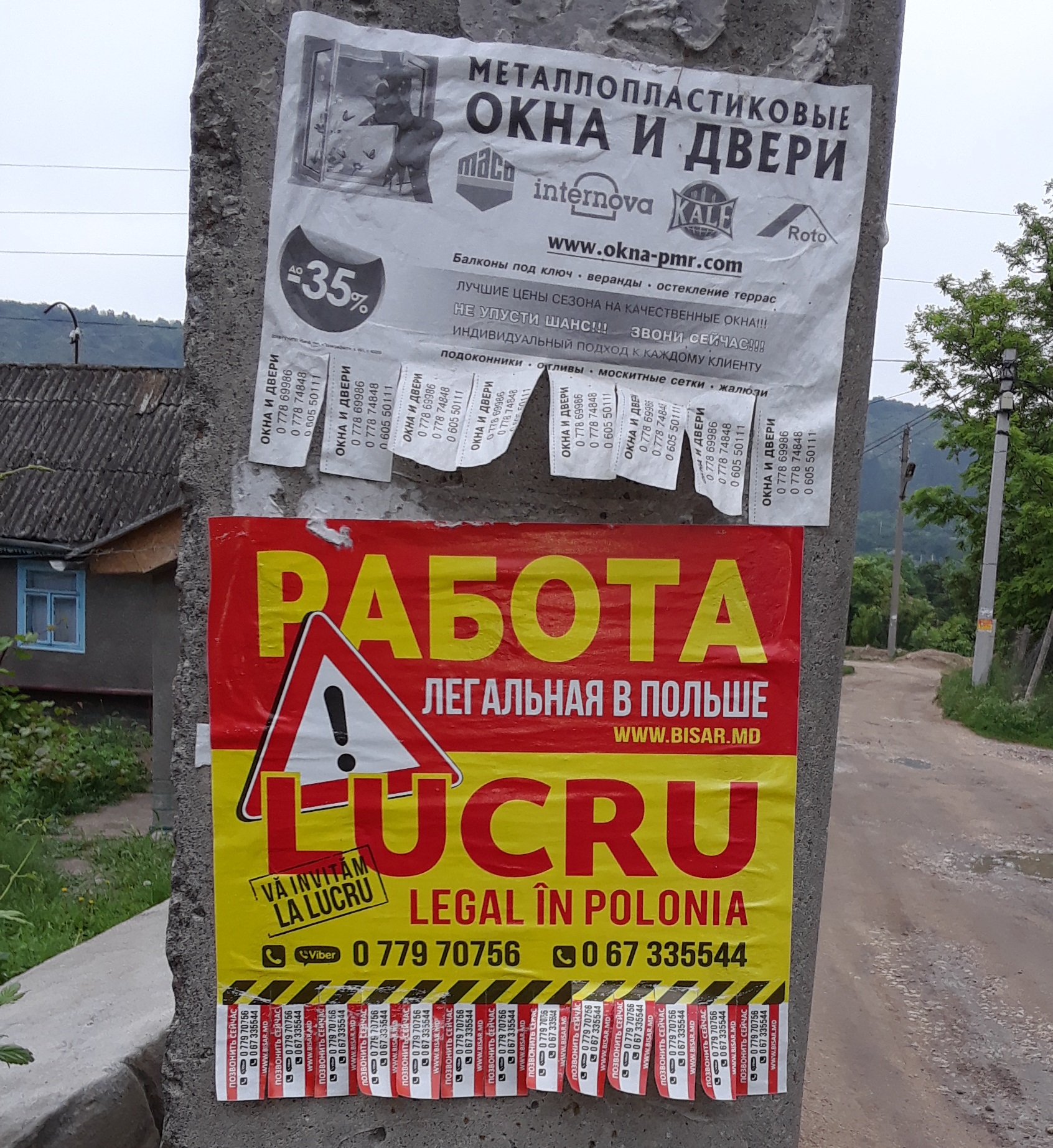

Remittance

A remittance is a non-commercial transfer of money by a foreign worker, a member of a diaspora community, or a citizen with familial ties abroad, for household income in their home country or homeland. Money sent home by migrants competes with international aid as one of the largest financial inflows to developing countries. Remittance is more than three times as large as the total global foreign aid. In 2021, $780 billion was sent to 800 million people, while foreign aid totalled $200 billion. Most remittance flows from high-income countries to lower-income countries. Workers' remittances are a significant part of international capital flows, especially with regard to labor-exporting countries. A substantial share of remittance ends up in the hands of banks and money-transfer companies due to fees imposed on money transfers. Governments can play a vital role in enabling migrants to support their families more effectively by implementing measures that help reduce transa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inherita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). Historically, a physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document was legally effective. More modern versions of the tax no longer require an actual stamp. The duty is thought to have originated in Venice in 1604, being introduced (or re-invented) in Spain in the 1610s, the Spanish Netherlands in the 1620s, France in 1651, and England in 1694. German economist Silvio Gesell proposed in 1891 that demurrage currency could be enabled by stamp duties, which would in turn stimulate economic growth. Gesell referred to this monetary policy as Freigeld. Usage by country Australia The Australian Federal Government does not levy stamp duty. However, stamp duties are levied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |