|

Currency Crisis

A currency crisis is a type of financial crisis, and is often associated with a real economic crisis. A currency crisis raises the probability of a banking crisis or a default crisis. During a currency crisis the value of foreign denominated debt will rise drastically relative to the declining value of the home currency. Generally doubt exists as to whether a country's central bank has sufficient foreign exchange reserves to maintain the country's fixed exchange rate, if it has any. The crisis is often accompanied by a speculative attack in the foreign exchange market. A currency crisis results from chronic balance of payments deficits, and thus is also called a balance of payments crisis. Often such a crisis culminates in a devaluation of the currency. Financial institutions and the government will struggle to meet debt obligations and economic crisis may ensue. Causation also runs the other way. The probability of a currency crisis rises when a country is experiencing a banki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euro

The euro (currency symbol, symbol: euro sign, €; ISO 4217, currency code: EUR) is the official currency of 20 of the Member state of the European Union, member states of the European Union. This group of states is officially known as the euro area or, more commonly, the eurozone. The euro is divided into 100 1 euro cent coin, euro cents. The currency is also used officially by the institutions of the European Union, by International status and usage of the euro, four European microstates that are not EU members, the British Overseas Territory of Akrotiri and Dhekelia, as well as unilaterally by Montenegro and Kosovo. Outside Europe, a number of special territories of EU members also use the euro as their currency. The euro is used by 350 million people in Europe and additionally, over 200 million people worldwide use currencies pegged to the euro. It is the second-largest reserve currency as well as the second-most traded currency in the world after the United Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed). The idea of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to his model of competition in an oligopoly. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep theirs unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob has no other strategy available that does better than B at maximizing his payoff in response to Alice c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen Salant

Stephen W. Salant (born c. 1945) is an economist who has done extensive research in applied microeconomics (mostly in the fields of natural resources and industrial organization). His 1975 model of speculative attacks in the gold market (with Dale Henderson) waadaptedby Paul Krugman and others to explain speculative attacks in foreign exchange markets. Hundreds of journal articles and books on financial speculative attacks followed. In a series of six articles,"The proposed cap-and-trade program to limit greenhouse gas emissions: the case of the unbuttoned collar" (with Makoto Hasegawa), 2010 Salant has continued to focus instead on ''real'' speculative attacks. These may be divided into two categories: (1) speculative attacks induced by government policies such as total allowable catch quotas in fisheries, H1-B immigration quotas, commodity price ceilings, and most recently the proposed price-collars on tradable emissions permits; and (2) speculative attacks that are naturally o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He was a columnist for ''The New York Times'' from 2000 to 2024. In 2008, Krugman was the sole winner of the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory, new trade theory and New Economic Geography, new economic geography. The Prize Committee cited Krugman's work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of Economy of scale, economies of scale and of consumer preferences for diverse goods and services. Krugman was previously a professor of economics at MIT, and, later, at Princeton University which he retired from in June 2015, holding the title of Emeritus, professor emeritus there ever since. He also holds the title o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

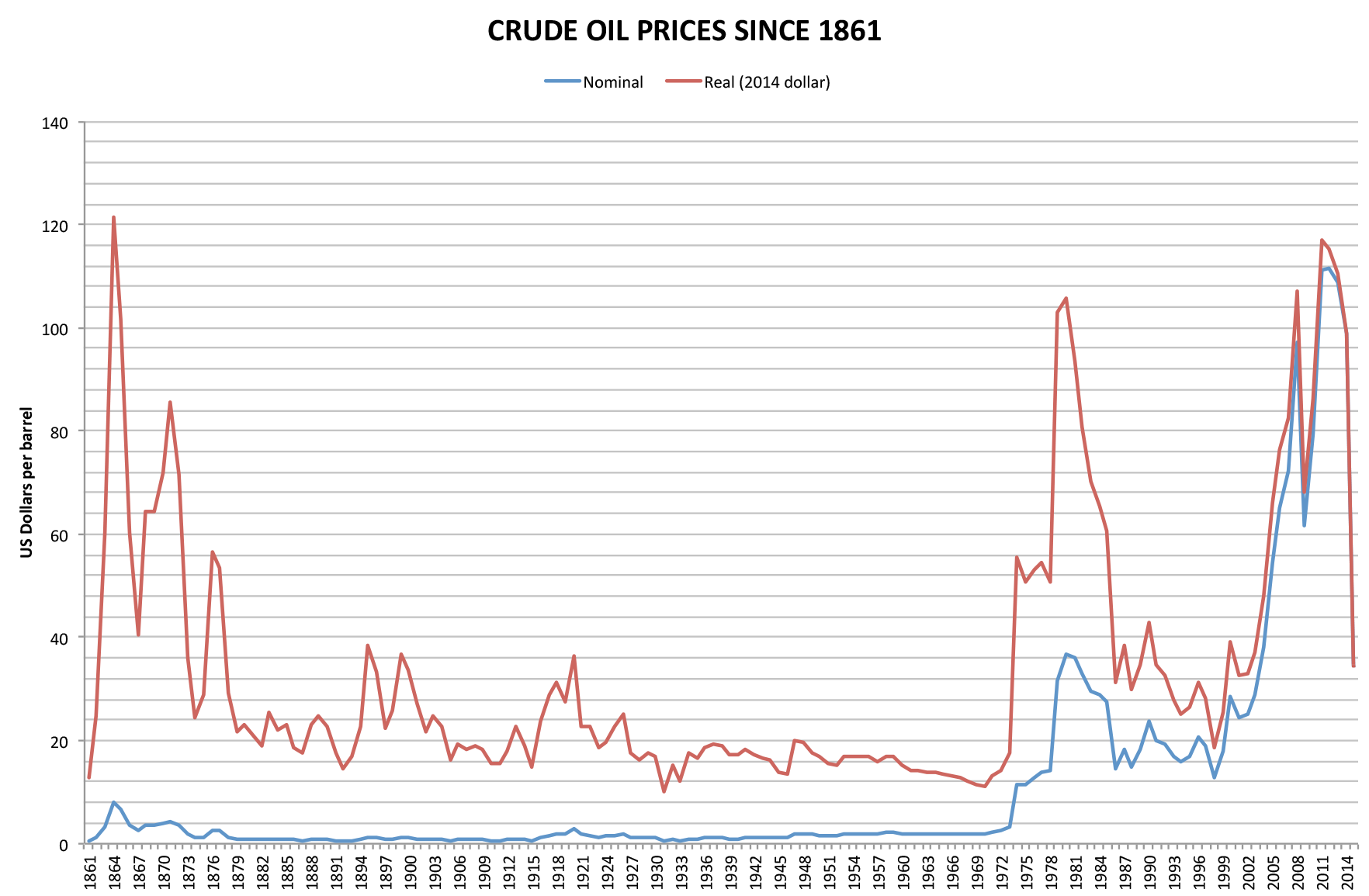

Latin American Debt Crisis

The Latin American debt crisis (; ) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as '' La Década Perdida'' (The Lost Decade), when Latin American countries reached a point where their foreign debt exceeded their earning power, and they could not repay it. The IMF's response to the crisis has been criticized for prolonging unsustainable borrowing and transferring private banking losses onto taxpayers, which deepened the region’s debt overhang and delayed necessary market corrections. Origins In the 1960s and 1970s, many Latin American countries, notably Brazil, Argentina, and Mexico, borrowed huge sums of money from international creditors for industrialization, especially infrastructure programs. These countries had soaring economies at the time, so the creditors were happy to provide loans. Initially, developing countries typically garnered loans through public routes like the World Bank. After 1973, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Default

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments (or receivables) may either be accompanied by that government's formal declaration that it will not pay (or only partially pay) its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments. Countries have at times escaped some of the real burden of their debt through inflation. This is not "default" in the usual sense because the debt is honored, albeit with currency of lesser real value. Sometimes governments devalue their currency. This can be done by printing more money to apply toward their own debts, or by ending or altering the convertibility of their currencies into precious metals or foreign currency at fixed rates. Harder to quantify than an int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Turkish Currency And Debt Crisis, 2018

Turkish may refer to: * Something related to Turkey ** Turkish language *** Turkish alphabet ** Turkish people, a Turkic ethnic group and nation *** Turkish citizen, a citizen of Turkey *** Turkish communities in the former Ottoman Empire * The word that Iranian Azerbaijanis use for the Azerbaijani language * Ottoman Empire (Ottoman Turkey), 1299–1922, previously sometimes known as the Turkish Empire ** Ottoman Turkish, the Turkish language used in the Ottoman Empire * Turkish Airlines, an airline * Turkish music (style), a musical style of European composers of the Classical music era * Turkish, a character in the 2000 film '' Snatch'' See also * * * Turk (other) * Turki (other) * Turkic (other) * Turkey (other) * Turkiye (other) * Turkish Bath (other) * Turkish population, the number of ethnic Turkish people in the world * Culture of Turkey * History of Turkey ** History of the Republic of Turkey * Turkic languages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2013–present Economic Crisis In Venezuela

The Venezuelan economic crisis is the deterioration that began to be noticed in the main macroeconomic indicators from the year 2012, and whose consequences continue, not only economically but also politically and socially. The April 2019 International Monetary Fund (IMF) World Economic Outlook described Venezuela as being in a " wartime economy". For the fifth consecutive year, Bloomberg rated Venezuela first on its misery index in 2019. Origins The origin of this economic collapse, framed in the context of the Great Recession, years after the improvement of the extraction of unconventional hydrocarbons in the U.S., showed a macro-economic phenomenon of great importance for the region. China's slowdown, a steady increase in oil production, and stable demand generated a surplus of crude oil that caused a drop in prices of reference crude oil, West Texas Intermediate (WTI), and Brent Crude, falling in 2014 from $100 a barrel to $50 a barrel, and causing unfavourable change ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998–2002 Argentine Great Depression

The 1998–2002 Argentine great depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed fifteen years of Economic history of Argentina#Stagnation (1975–1990), stagnation and a brief period of Economic history of Argentina#Free-market reforms (1990–1995), free-market reforms. The depression, which began after the 1998 Russian financial crisis, Russian and Samba effect, Brazilian financial crises, caused widespread unemployment, December 2001 riots in Argentina, riots, the fall of the government, a Sovereign default, default on the country's foreign debt, the rise of alternative currencies and the end of the Argentine peso, peso's fixed exchange rate to the United States dollar, US dollar. The economy shrank by 28 per cent from 1998 to 2002. In terms of income, over 50 per cent of Argentines lived below the official poverty line and 25 per cent were indigent (their basic needs were unm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998 Russian Financial Crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defaulting on its debt. The crisis had severe impacts on the economies of many neighboring countries. Background and course of events The Russian economy had set up a path for improvement after the Soviet Union had split into different countries. Russia was supposed to provide assistance to the former Soviet states and, as a result, imported heavily from them. In Russia, foreign loans financed domestic investments. When it was unable to pay back those foreign borrowings, the ruble devalued. In mid-1997, Russia had finally found a way out of inflation. The economic supervisors were happy about inflation coming to a standstill. Then the crisis hit, and supervisors had to implement a new policy. Both Russia and the countries that exported to i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

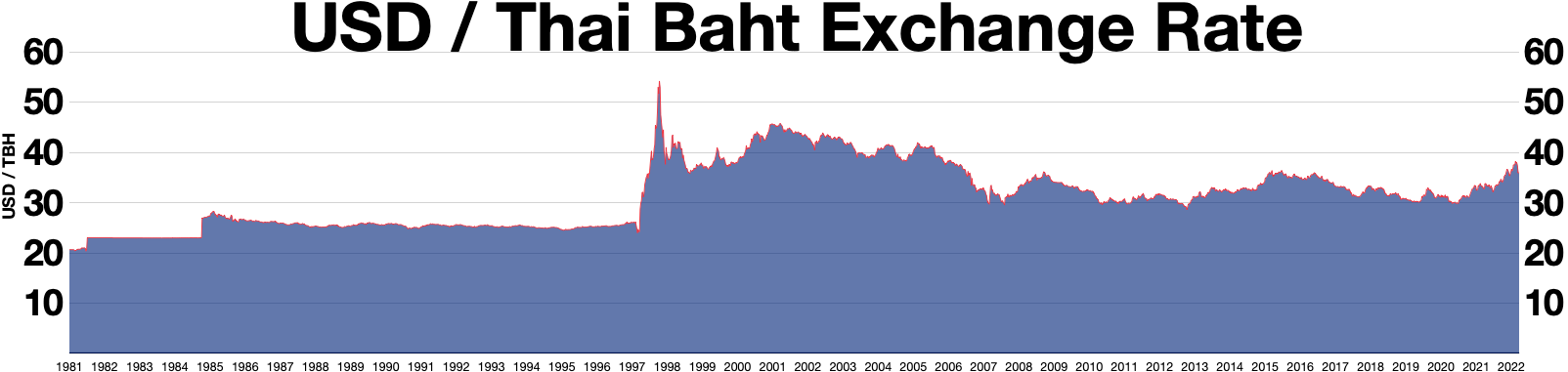

1997 Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |