|

Currency Appreciation And Depreciation

Currency depreciation is the loss of value of a country's currency with respect to one or more foreign reference currencies, typically in a floating exchange rate system in which no official currency value is maintained. Currency appreciation in the same context is an increase in the value of the currency. Short-term changes in the value of a currency are reflected in changes in the exchange rate. There is no optimal value for a currency. High and low values have tradeoffs, along with distributional consequences for different groups. Causes In a floating exchange rate system, a currency's value goes up (or down) if the demand for it goes up more (or less) than the supply does. In the short run this can happen unpredictably for a variety of reasons, including the balance of trade, speculation, or other factors in the international capital market. For example, a surge in purchases of foreign goods by home country residents will cause a surge in demand for foreign currency with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Huskisson - Question Concerning The Depreciation Of Our Currency, 1810 - 5221173

William Huskisson (11 March 177015 September 1830) was a British wikt:statesman, statesman, financier, and Member of Parliament (United Kingdom), Member of Parliament for several constituencies, including Liverpool (UK Parliament constituency), Liverpool. He is commonly known as the world's first widely reported railway passenger casualty as he was run over and fatally injured by Robert Stephenson's pioneering locomotive ''Stephenson's Rocket, Rocket'' (however, the first railway casualty had happened 9 years earlier). Background and education Huskisson was born at Birtsmorton Court, Malvern, Worcestershire, Malvern, Worcestershire, the son of William and Elizabeth Huskisson, both members of Staffordshire families. He was one of four brothers. After their mother Elizabeth died, their father William eventually remarried and had further children by his second wife. Early life Huskisson was a student at Appleby Grammar School (later renamed Sir John Moore Church of England Prim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Risk

Foreign exchange risk (also known as FX risk, exchange rate risk or currency risk) is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company. The exchange risk arises when there is a risk of an unfavourable change in exchange rate between the domestic currency and the denominated currency before the date when the transaction is completed. Foreign exchange risk also exists when the foreign subsidiary of a firm maintains financial statements in a currency other than the domestic currency of the consolidated entity. Investors and businesses exporting or importing goods and services, or making foreign investments, have an exchange-rate risk but can take steps to manage (i.e. reduce) the risk. History Many businesses were unconcerned with, and did not manage, foreign exchange risk under the international Bretton Woods system. It was not until the switch to floating exchange rates, following the collapse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

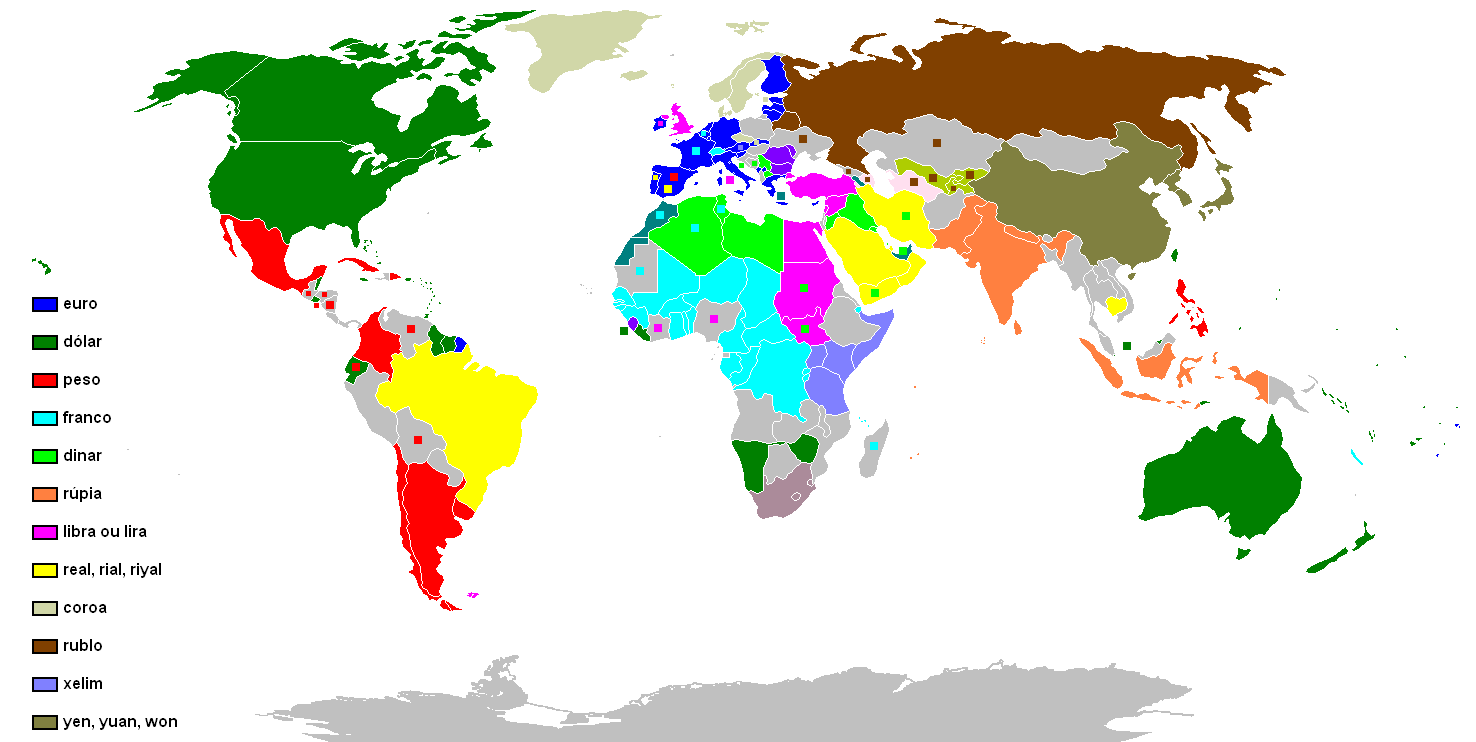

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income". The borrower wants, or needs, to have money sooner, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * the term to m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and, in some cases, to enforce policies on financial consumer protection, and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence. Central banks in most developed nations are usually set up to be institutionally independent from political interference, even though governments typically have governance rights over them, legislative bodies exercise scrutiny, and central banks frequently do show resp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of #Principal, principal and interest. Loans, bond (finance), bonds, notes, and Mortgage loan, mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity (finance), equity. The term can also be used metaphorically to cover morality, moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century and comes by way of Old French from the Latin verb ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Purchasing Power Parity

Purchasing power parity (PPP) is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currency, currencies. PPP is effectively the ratio of the price of a market basket at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the Exchange rate, market exchange rate because of tariffs, and other transaction costs. The purchasing power parity indicator can be used to compare economies regarding their gross domestic product (GDP), labour productivity and actual individual consumption, and in some cases to analyse price convergence and to compare the cost of living between places. The calculation of the PPP, according to the OECD, is made through a ''basket of goods'' that contains a "final product list [that] covers around 3,000 consumer goods and services, 30 occupations in government, 200 types of equipment goods and about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Account

In macroeconomics and international finance, the capital account, also known as the capital and financial account, records the net flow of Foreign direct investment, investment into an economy. It is one of the two primary components of the balance of payments, the other being the Current account (balance of payments), current account. Whereas the current account reflects a nation's Net national income, net income, the capital account reflects net change in ownership of State ownership, national assets. A Economic surplus, surplus in the capital account means money is flowing into the country, but unlike a surplus in the current account, the inbound flows effectively represent borrowings or sales of assets rather than payment for work. A deficit in the capital account means money is flowing out of the country, and it suggests the nation is increasing its Foreign ownership, ownership of foreign assets. The term "capital account" is used with a narrower meaning by the International ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |