|

Child Tax Credit (United States)

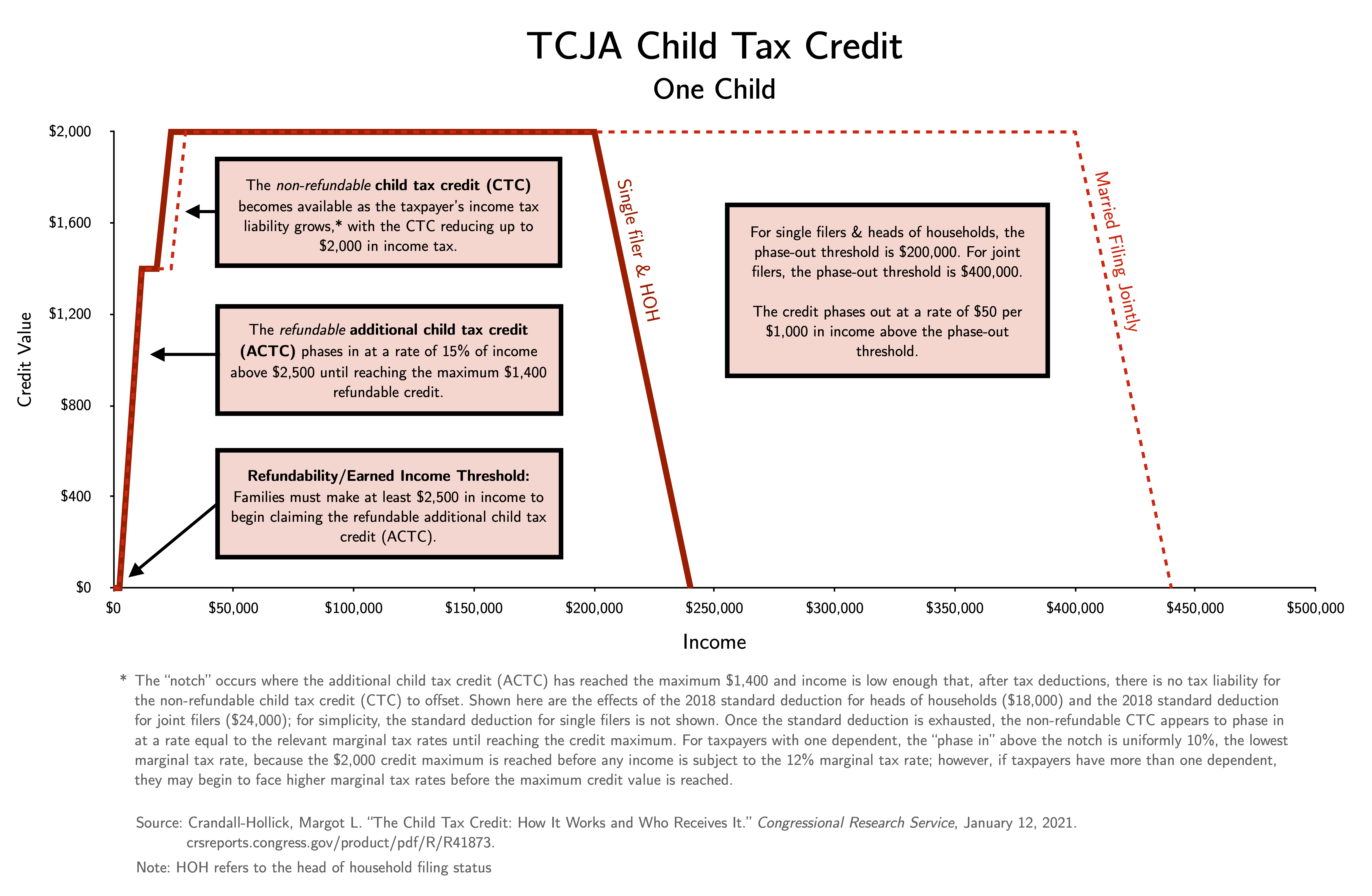

The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with Dependant, dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,600 of that Tax credit#Refundable vs non Refundable, refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. The CTC is scheduled to revert to a $1,000 credit after 2025. The CTC was estimated to have lifted about 3 million children out of poverty in 2016. A Columbia University study estimated that the expansion of the CTC in the American Rescue Plan Act, 2021 American Rescue Plan Act reduced child poverty by an additional 26%, and would have decreased child poverty by an additional 40% had all eligible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an international research think tank based in Washington, D.C. that collects data and publishes research studies on Taxation in the United States, U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) Tax exemption, tax-exempt Non-profit organization, non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Global Tax Policy. The group is known for its annual reports such as the ''State Tax Competitiveness Index'', ''International Tax Competitiveness Index'', and ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941. History The Tax Foundation was organized on December 5, 1937, in New York City by Alfred P. Sloan Jr., Chai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Taxpayer Relief Act Of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts". The Act centers on a partial resolution to the US fiscal cliff by addressing the expiration of certain provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (known together as the " Bush tax cuts"), which had been temporarily extended by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The Act also addressed the activation of the Budget Control Act of 2011's budget sequestration provisions. A compromise measure, the Act gives permanence to the lower rate of much of the Bush tax cuts, while retaining the higher tax rate at upper income levels that became effective on January 1 due to the expiration of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eligibility

Eligibility may refer to: * The right to run for office (in elections), sometimes called ''passive suffrage'' or ''voting eligibility'' * Desirability as a marriage partner, as in the term ''eligible bachelor'' * Validity for participation, as in eligibility to enter a Competition * Eligibility for the NBA draft * Eligible receiver In gridiron football, not all players on offense are entitled to receive a forward pass: only an eligible pass receiver may legally catch a forward pass, and only an eligible receiver may advance beyond the neutral zone if a forward pass crosses ..., gridiron football rules for catching a pass * NCAA eligibility, requirements to play college sports in the National Collegiate Athletic Association * FIFA eligibility rules, requirement to play for a national team in association football {{disambig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Temporary Expansion In 2021

Temporary or Temporaries may refer to: *''Temporaries'', also titled ''Richelieu'', a 2023 Canadian drama film directed by Pier-Philippe Chevigny *''Temporary'', a TV series created by Cyrina Fiallo and Chrissie Fit Chrissie Fit (born April 3, 1984) is an American actress and singer. In 2007, Fit rose to prominence after she was cast as the character Mercedes Juarez in the medical drama, ''General Hospital''. She also played the roles of CheeChee in the DCOM ... in 2017 * "Temporary" (song), a song by Eminem from the 2024 album ''The Death of Slim Shady'' * ''Temporary'' (album), a 2025 studio album by Everything Is Recorded See also * Temp (other), short for "temporary" {{disambig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Child Tax Credit TCJA

US or Us most often refers to: * ''Us'' (pronoun), the objective case of the English first-person plural pronoun ''we'' * US, an abbreviation for the United States US, U.S., Us, us, or u.s. may also refer to: Arts and entertainment Albums * ''Us'' (Brother Ali album) or the title song, 2009 * ''Us'' (Empress Of album), 2018 * ''Us'' (Mull Historical Society album), 2003 * ''Us'' (Peter Gabriel album), 1992 * ''Us'' (EP), by Moon Jong-up, 2021 * ''Us'', by Maceo Parker, 1974 * ''Us'', mini-album by Peakboy, 2019 Songs * "Us" (James Bay song), 2018 * "Us" (Jennifer Lopez song), 2018 * "Us" (Regina Spektor song), 2004 * "Us" (Gracie Abrams song), 2024 * "Us", by Azealia Banks from '' Fantasea'', 2012 * "Us", by Celine Dion from ''Let's Talk About Love'', 1997 * "Us", by Gucci Mane from '' Delusions of Grandeur'', 2019 * "Us", by Spoon from '' Hot Thoughts'', 2017 Other media * US Festival, two 1980s California music festivals organized by Steve Wozniak * ''Us'' (199 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Itemized Deductions

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available. Most taxpayers are allowed a choice between itemized deductions and the standard deduction. After computing their adjusted gross income (AGI), taxpayers can itemize deductions (from a list of allowable items) and subtract those itemized deductions from their AGI amount to arrive at the taxable income. Alternatively, they can elect to subtract the standard deduction for their filing status to arrive at the taxable income. In other words, the taxpayer may generally deduct the total itemized deduction amount or the applicable standard deduction amount, whichever is greater. The choice between the standard deduction and itemizing involves a number of considerations: * Only a taxpayer eligible for the standard deduction can choose it. * U.S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable. The standard deduction is available to individuals who are US citizens or resident aliens. The standard deduction is based on filing status and typically increases each year, based on inflation measurements from the previous year. It is not available to nonresident aliens residing in the United States (with few exceptions, for example, students from India on F1 visa status can use the standard deduction). Additional amounts are available for persons who are blind and/or are at least 65 years of age. The standard deduction is distinct from the personal exemption, which was set to $0 by the Tax Cuts and Jobs Act of 2017 for tax yea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adjusted Gross Income

In the United States income tax system, adjusted gross income (AGI) is an individual's total gross income minus specific deductions. It is used to calculate taxable income, which is AGI minus allowances for personal exemptions and itemized deductions. For most individual tax purposes, AGI is more relevant than gross income. Gross income is sales price of goods or property, minus cost of the property sold, plus other income. It includes wages, interest, dividends, business income, rental income, and all other types of income. Adjusted gross income is gross income less deductions from a business or rental activity and 21 other specific items. Several deductions (''e.g.'' medical expenses and miscellaneous itemized deductions) are limited based on a percentage of AGI. Certain phase outs, including those of lower tax rates and itemized deductions, are based on levels of AGI. Many states base state income tax on AGI with certain deductions. Adjusted gross income is calculat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the reference period. Unemployment is measured by the unemployment rate, which is the number of people who are unemployed as a percentage of the labour force (the total number of people employed added to those unemployed). Unemployment can have many sources, such as the following: * the status of the economy, which can be influenced by a recession * competition caused by globalization and international trade * new technologies and inventions * policies of the government * regulation and market * war, civil disorder, and natural disasters Unemployment and the status of the economy can be influenced by a country through, for example, fiscal policy. Furthermore, the monetary authority of a country, such as the central bank, can in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |