|

Brander–Spencer Model

The Brander–Spencer model is an economics, economic model in international trade originally developed by James Brander and Barbara Spencer in the early 1980s. The model illustrates a situation where, under certain assumptions, a government can subsidize domestic firms to help them in their competition against foreign producers and in doing so enhances national welfare. This conclusion stands in contrast to results from most international trade models, in which government non-interference is socially optimal. The basic model is a variation on the Stackelberg competition, Stackelberg–Cournot competition, Cournot "leader and follower" duopoly game. Alternatively, the model can be portrayed in game theory, game theoretic terms as initially a game with multiple Nash equilibria, with government having the capability of affecting the payoffs to switch to a game with just one equilibrium. Although it is possible for the national government to increase a country's welfare in the model th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lockheed Corporation

The Lockheed Corporation was an American aerospace manufacturer. Lockheed was founded in 1926 and merged in 1995 with Martin Marietta to form Lockheed Martin. Its founder, Allan Lockheed, had earlier founded the similarly named but otherwise-unrelated Loughead Aircraft Manufacturing Company, which was operational from 1912 to 1920. History Origins Allan Loughead and his brother Malcolm Loughead had operated an earlier aircraft company, Loughead Aircraft Manufacturing Company, which was operational from 1912 to 1920. The company built and operated aircraft for paying passengers on sightseeing tours in California and had developed a prototype for the civil market, but folded in 1920 due to the flood of surplus aircraft deflating the market after World War I. Allan went into the real estate market while Malcolm had meanwhile formed a successful company marketing brake systems for automobiles. On December 13, 1926, Allan Loughead, Jack Northrop, John Northrop, Kenneth Kay and Fre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

Arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more marketsstriking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. Arbitrage has the effect of causing prices of the same or very similar assets in different markets to converge. When used by academics in economics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Terms Of Trade

The terms of trade (TOT) is the relative price of exports in terms of imports and is defined as the ratio of export prices to import prices. It can be interpreted as the amount of import goods an economy can purchase per unit of export goods. An improvement of a nation's terms of trade benefits that country in the sense that it can buy more imports for any given level of exports. The terms of trade may be influenced by the exchange rate because a rise in the value of a country's currency lowers the domestic prices of its imports but may not directly affect the prices of the commodities it exports. History The expression ''terms of trade'' was first coined by the US American economist Frank William Taussig in his 1927 book ''International Trade''. However, an earlier version of the concept can be traced back to the English economist Robert Torrens (economist), Robert Torrens and his book ''The Budget: On Commercial and Colonial Policy'', published in 1844, as well as to John St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Export Good

A trade route is a logistical network identified as a series of pathways and stoppages used for the commercial transport of cargo. The term can also be used to refer to trade over land or water. Allowing goods to reach distant markets, a single trade route contains long-distance arteries, which may further be connected to smaller networks of commercial and noncommercial transportation routes. Among notable trade routes was the Amber Road, which served as a dependable network for long-distance trade. Maritime trade along the Spice Route became prominent during the Middle Ages, when nations resorted to military means for control of this influential route. During the Middle Ages, organizations such as the Hanseatic League, aimed at protecting interests of the merchants and trade became increasingly prominent. In modern times, commercial activity shifted from the major trade routes of the Old World to newer routes between modern nation-states. This activity was sometimes carrie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brender Spencer

Argonaut Games is a British video game developer founded in 1982. It was known for the Super NES video game ''Star Fox'' and its supporting Super FX chip, and for '' Croc: Legend of the Gobbos'' and the ''Starglider'' series. The company was liquidated in late 2004, and ceased to exist in early 2007. It was relaunched in 2024. History Founded as Argonaut Software by teenager Jez San in 1982, the company name is a play on his name (J. San) and the mythological story of '' Jason and the Argonauts''. Its head offices were in Colindale, London,Company Summary . Argonaut Games. 29 October 1996. Retrieved on 21 May 2016. "Argonaut Techn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strategic Substitutes

In economics and game theory, the decisions of two or more players are called strategic complements if they mutually reinforce one another, and they are called strategic substitutes if they mutually offset one another. These terms were originally coined by Bulow, Geanakoplos, and Klemperer (1985). To see what is meant by 'reinforce' or 'offset', consider a situation in which the players all have similar choices to make, as in the paper of Bulow et al., where the players are all imperfectly competitive firms that must each decide how much to produce. Then the production decisions are strategic complements if an increase in the production of one firm increases the marginal revenues of the others, because that gives the others an incentive to produce more too. This tends to be the case if there are sufficiently strong aggregate increasing returns to scale and/or the demand curves for the firms' products have a sufficiently low own-price elasticity. On the other hand, the production d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Best Response Function

In game theory, the best response is the strategy (or strategies) which produces the most favorable outcome for a player, taking other players' strategies as given. The concept of a best response is central to John Nash's best-known contribution, the Nash equilibrium, the point at which each player in a game has selected the best response (or one of the best responses) to the other players' strategies. Correspondence Reaction correspondences, also known as best response correspondences, are used in the proof of the existence of mixed strategy Nash equilibria. Reaction correspondences are not "reaction functions" since functions must only have one value per argument, and many reaction correspondences will be undefined, i.e., a vertical line, for some opponent strategy choice. One constructs a correspondence , for each player from the set of opponent strategy profiles into the set of the player's strategies. So, for any given set of opponent's strategies , represents player s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partial Derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant (as opposed to the total derivative, in which all variables are allowed to vary). Partial derivatives are used in vector calculus and differential geometry. The partial derivative of a function f(x, y, \dots) with respect to the variable x is variously denoted by It can be thought of as the rate of change of the function in the x-direction. Sometimes, for the partial derivative of z with respect to x is denoted as \tfrac. Since a partial derivative generally has the same arguments as the original function, its functional dependence is sometimes explicitly signified by the notation, such as in: f'_x(x, y, \ldots), \frac (x, y, \ldots). The symbol used to denote partial derivatives is ∂. One of the first known uses of this symbol in mathematics is by Marquis de Condorcet from 1770, who used it for partial differ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

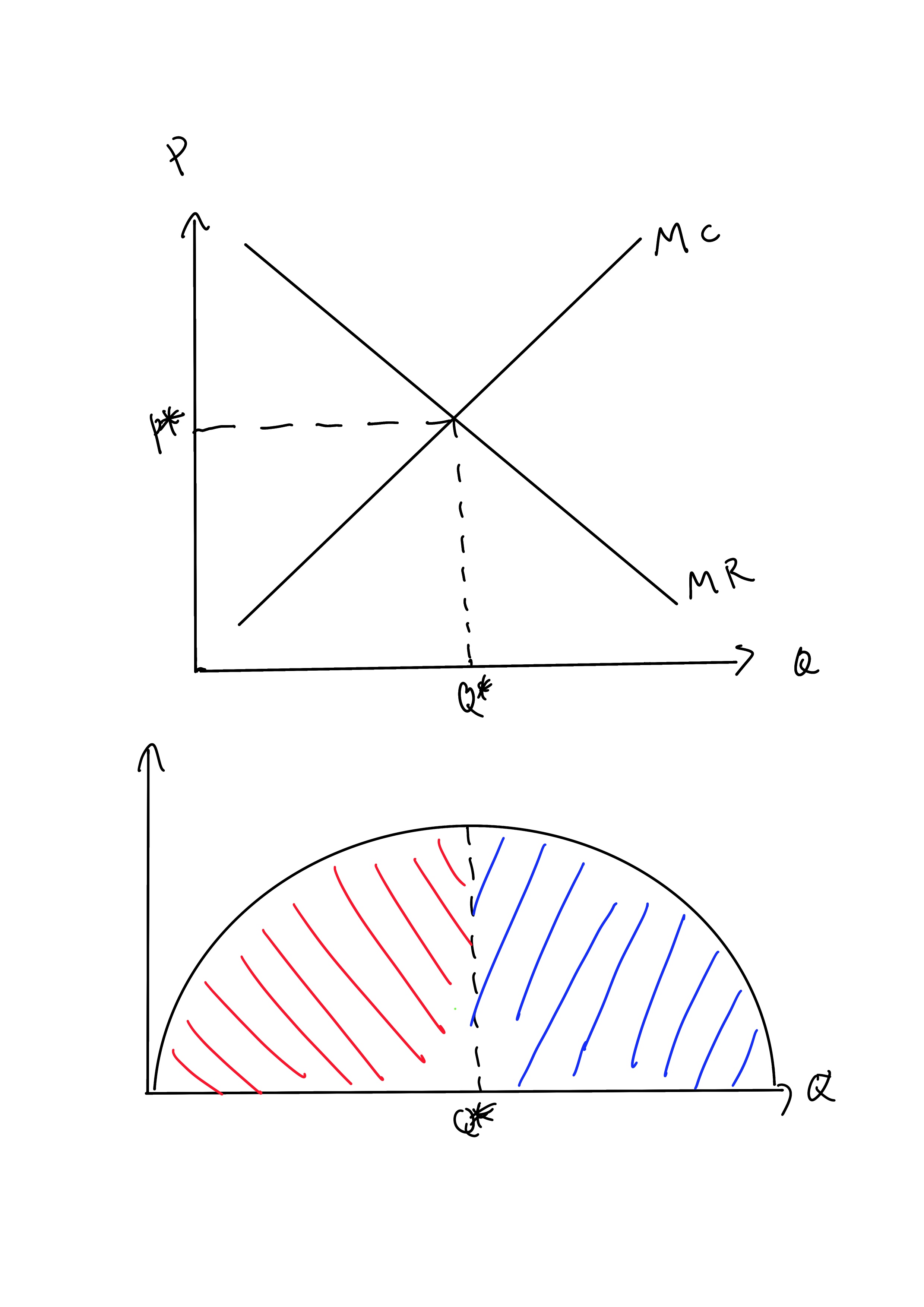

Profit Maximization

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a " rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inverse Demand Function

In economics, an inverse demand function is the mathematical relationship that expresses price as a function of quantity demanded (it is therefore also known as a price function). Historically, the economists first expressed the price of a good as a function of demand (holding the other economic variables, like income, constant), and plotted the price-demand relationship with demand on the x (horizontal) axis (the demand curve). Later the additional variables, like prices of other goods, came into analysis, and it became more convenient to express the demand as a multivariate function (the demand function): = f(, , ...), so the original demand curve now depicts the ''inverse'' demand function = f^() with extra variables fixed. Definition In mathematical terms, if the demand function is = f(), then the inverse demand function is = f^(). The value of the inverse demand function is the highest price that could be charged and still generate the quantity demanded. This is useful ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |