|

Book Entry

Book entry is a system of tracking ownership of securities where no certificate is given to investors. Several terms are often used interchangeably with "book entry" shares including "paperless shares", "electronic shares", "digital shares", "digital stock certificates", and "uncertificated shares". Some of these terms have somewhat different connotations but, at least in the United States, state securities laws only recognize certificated and uncertificated shares. In the case of book-entry-only (BEO) issues, while investors do not receive certificates, a custodian holds one or more global certificates. Dematerialized securities, in contrast, are ones in which no certificates exist; instead, the security issuer, its agent or a central securities depository keeps records, usually electronically of who holds outstanding securities. Most investors who use an online broker or even a regular full-service broker will have their shares held in book-entry form. This is generally con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or " book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Certificate

In company (law), corporate law, a stock certificate (also known as certificate of stock or share certificate) is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of share (finance), shares (or, under Article 8 of the Uniform Commercial Code in the United States, a securities entitlement or pro rata share of a fungible bulk) or Share capital, stock in a corporation. History A stock certificate is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of share (finance), shares (or, under Article 8 of the Uniform Commercial Code, a securities entitlement or pro rata share of a fungible bulk) or Share capital, stock in a corporation. The first such instruments were used in the Netherlands by 1606, and in the United States by the year 1800. Historically, certificates may have been required to evidence entitlement to dividends, with a receipt for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Custodian Bank

A custodian bank, or simply custodian, is a specialized financial institution responsible for providing securities services. It provides post-trade services and solutions for asset owners (e.g. sovereign wealth funds, central banks, insurance companies), asset managers, banks and broker-dealers. It is not engaged in "traditional" commercial or consumer/retail banking like lending. In the past, the custodian bank purely focused on custody, safekeeping, settlement, and administration of securities as well as asset servicing such as income collection and corporate actions. Yet, in the modern financial world, custodian banks have started providing a wider range of value-adding or cost-saving financial services, ranging from fund administration to transfer agency, from securities lending to trustee services. Definition Custodian banks are often referred to as global custodians if they safe keep assets for their clients in multiple jurisdictions around the world, using their own l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dematerialization (securities)

In finance and financial law, dematerialization refers to the substitution of paper-form securities by book-entry securities. This is a form of indirect holding system in which an intermediary, such as a broker or central securities depository, or the issuer (e.g., French system) holds a record of the ownership of shares usually in electronic format. The dematerialization of securities such as stocks has been a major trend since the late 1960s, with the result that by 2010 the majority of global securities were held in dematerialized form electronically. History Although the phenomenon is ancient, since book-entry systems for recording securities have been noted from civilisations as early as Assyria in 2000 BC, it gained new prominence with the advent of computer technology in the late 20th century. Even during the period when paper certificates were popular, book-entry systems continued since many small firms could not afford printing secured paper-form securities. Thes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Securities Depository

A central securities depository (CSD) is a specialized financial market infrastructure organization holding securities such as shares or bonds, either in certificated or uncertificated ( dematerialized) form, allowing ownership to be easily transferred through a book entry rather than by a transfer of physical certificates. This allows brokers and financial companies to hold their securities at one location where they can be available for clearing and settlement. In recent decades this has usually been done electronically, making it much faster and easier than was traditionally the case where physical certificates had to be exchanged after a trade had been completed. In some cases these organizations also carry out centralized comparison and transaction processing such as clearing and settlement of securities transfers, securities pledges, and securities freezes. In modern corporate debt markets, investors achieve collateralization through CSDs. The CSDs operate as trustee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronics

Electronics is a scientific and engineering discipline that studies and applies the principles of physics to design, create, and operate devices that manipulate electrons and other Electric charge, electrically charged particles. It is a subfield of physics and electrical engineering which uses Passivity (engineering), active devices such as transistors, diodes, and integrated circuits to control and amplify the flow of electric current and to convert it from one form to another, such as from alternating current (AC) to direct current (DC) or from analog signal, analog signals to digital signal, digital signals. Electronic devices have significantly influenced the development of many aspects of modern society, such as telecommunications, entertainment, education, health care, industry, and security. The main driving force behind the advancement of electronics is the semiconductor industry, which continually produces ever-more sophisticated electronic devices and circuits in respo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker

A broker is a person or entity that arranges transactions between a buyer and a seller. This may be done for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

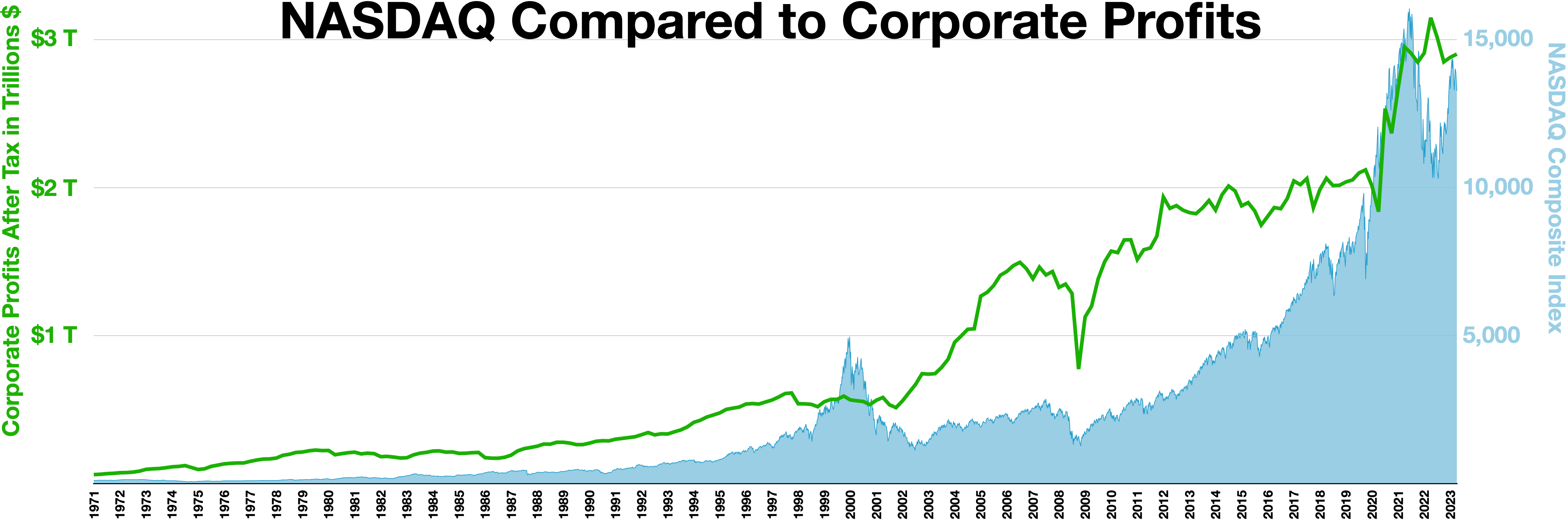

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NYSE

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Stock Exchange

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange. NYSE Euronext acquired AMEX on October 1, 2008, with AMEX integrated with the Alternext European small-cap exchange and renamed the NYSE Alternext U.S. In March 2009, NYSE Alternext U.S. was changed to NYSE Amex Equities. On May 10, 2012, NYSE Amex Equities changed its name to NYSE MKT LLC. Following the SEC approval of competing stock exchange IEX in 2016, NYSE MKT rebranded as NYSE American and introduced a 350-microsecond delay in trading, referred to as a "speed bump", which is also present on the IEX. History The Curb market The exchange grew out of the loosely organized curb market of curbstone brokers on Broad Street in Manhattan. Efforts to organize and standardize the market started early ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |