|

Bermuda Black Hole (tax Avoidance)

Bermuda black hole refers to base erosion and profit shifting (BEPS) tax avoidance schemes in which untaxed global profits end up in Bermuda, which is considered a tax haven. The term was most associated with US technology multinationals such as Apple and Google who used Bermuda as the "terminus" for their Double Irish arrangement tax structure. Definition "Bermuda black hole" was used in relation to US corporate tax strategies that routed un-taxed profits to Bermuda, where they did not emerge again for fear of being subject to US corporation tax. Instead, the untaxed profits were "lent out" to the corporate parent, or its subsidiaries, thus avoiding the risk of incurring US taxation. The Bermuda black hole led to US corporations amassing over US$1 trillion in offshore locations from 2004 to 2017 (before the Tax Cuts and Jobs Act of 2017). A "Bermuda black hole" became the most favoured common final destination for the Double Irish with a Dutch Sandwich base erosion and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom On The Globe (Bermuda Special) (Americas Centered)

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film * ''The United'' (film), an unreleased Arabic-language film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe * "United (Who We Are)", a song by XO-IQ, featured in the television serie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Illegal State Aid Case Against Apple In Ireland

Apple's EU tax dispute refers to an investigation by the European Commission into tax arrangements between Apple Inc., Apple and Ireland, which allowed the company to pay close to zero corporate tax over 10 years. On 29 August 2016, after a two-year investigation, European Commission ordered Apple Inc., Apple to pay €13 billion, plus interest, in unpaid Irish taxes from 2004–14 to the Irish state. It was the largest corporate tax fine (in fact a recovery order, technically not a fine) in history. Helena Malikova, an EU civil servant, was credited with uncovering the extent of the tax avoidance by Apple, namely that the company was paying only 0.005 per cent tax on profits booked through its Irish subsidiary. In November 2016, the Government of Ireland, Irish government formally appealed the ruling, claiming there was no violation of Irish tax law, and that the commission's action was "an intrusion into Irish sovereignty", as national tax policy is excluded from T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

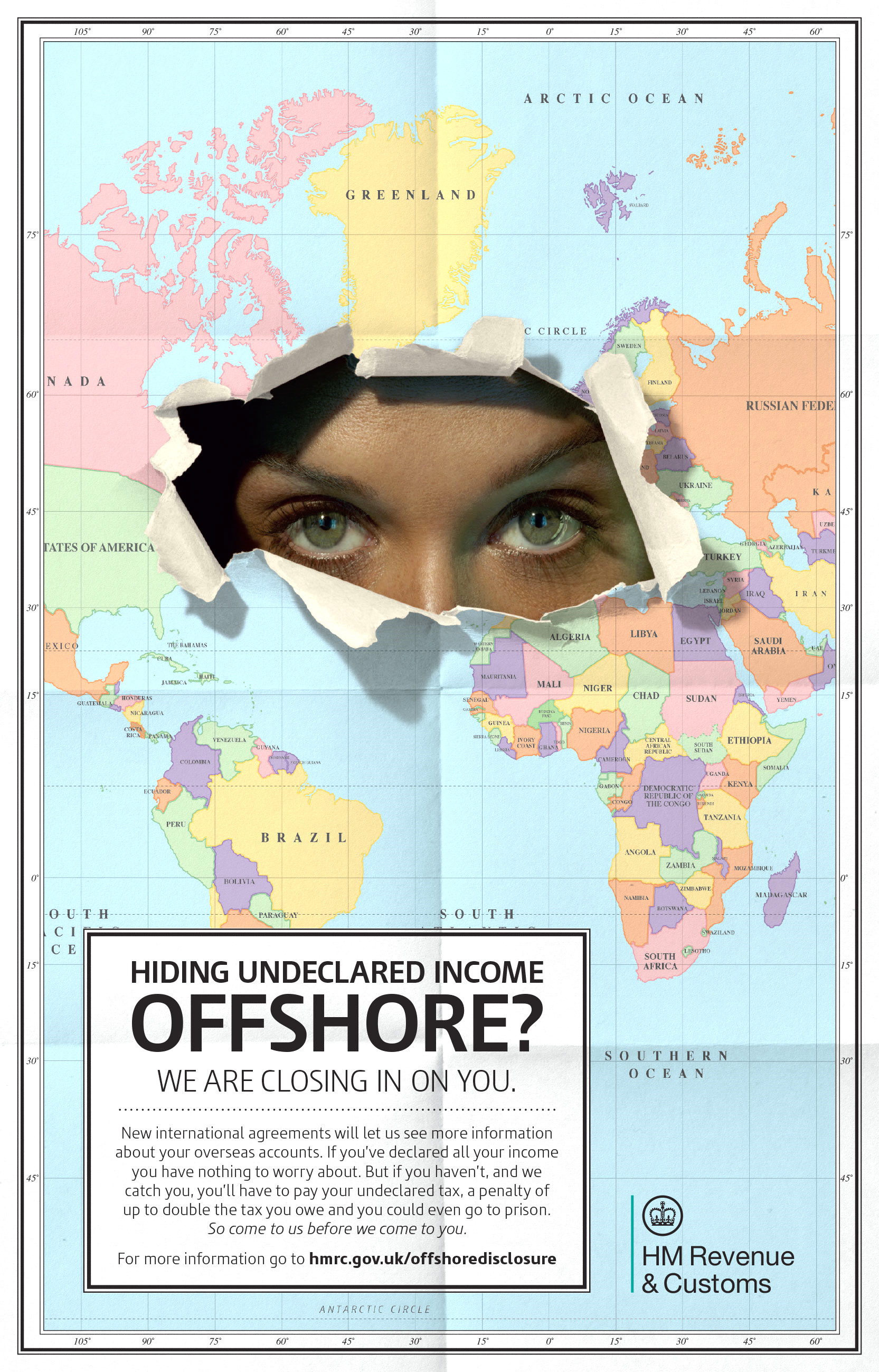

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Bermuda

Bermuda is a British Overseas Territory comprising a number of islands, with an area of , located in the North Atlantic Ocean, which in 2016 had a population of 65,331. Bermuda now has the fourth highest per capita income in the world, primarily fueled by offshore financial services for non-resident firms, especially offshore insurance and reinsurance, and tourism. In 2014, 584,702 tourists visited the territory. Tourism accounts for an estimated 28% of gross domestic product (GDP), 85% of which is from North America. The industrial sector is small, and agriculture is now severely limited by a lack of suitable land. About 80% of food is imported. International business contributes over 60% of Bermuda's economic output. A failed independence vote in late 1995 can be partially attributed to Bermudian fears of scaring away foreign firms. Government economic priorities are for further strengthening of the tourist and international financial sectors. History Early-season vegetable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dutch Sandwich (tax Avoidance)

Dutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring European Union withholding taxes on untaxed profits as they were being moved to non-EU tax havens (such as the Bermuda black hole). These untaxed profits could have originated from within the EU, or from outside the EU, but in most cases were routed to major EU corporate-focused tax havens, such as Ireland and Luxembourg, by the use of other BEPS tools. The Dutch Sandwich was often used with Irish BEPS tools such as the Double Irish, the Single Malt and the Capital Allowances for Intangible Assets ("CAIA") tools. In 2010, Ireland changed its tax-code to enable Irish BEPS tools to avoid such withholding taxes without needing a Dutch Sandwich. Explanation The structure relies on the tax loophole that most EU countries will allow royalty payments be made to other EU countries without incurring withholding taxes. However, the Dutch tax code a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Singapore Sling (tax Avoidance)

A Singapore Sling is a tax avoidance scheme in which a large multinational company sells products to a subsidiary owned by them in a jurisdiction with lower tax rates, which acts as a 'marketing hub'. The subsidiary then sells the product to end users, marking up its value and attributing the mark-up to various marketing activities undertaken by the subsidiary. The parent company retains a higher profit margin due to the lower tax rate. Singapore is a popular location of such subsidiaries, given its low tax rates and its willingness to grant large multinationals 'sweetheart deals' – an extremely low tax rate in exchange for locating the multinational's marketing activities in Singapore. Since at least 2015, it has been under investigation as an abusive practice in Australia. See also * Tax exporting * Tax inversion * Double Irish The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mainly by United States multinat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard Business Review

''Harvard Business Review'' (''HBR'') is a general management magazine published by Harvard Business Publishing, a not-for-profit, independent corporation that is an affiliate of Harvard Business School. ''HBR'' is published six times a year and is headquartered in Brighton, Massachusetts. ''HBR'' covers a wide range of topics that are relevant to various industries, management functions, and geographic locations. These include leadership, negotiation, strategy, operations, marketing, and finance. ''Harvard Business Review'' has published articles by Clayton Christensen, Peter F. Drucker, Justin Fox, Michael E. Porter, Rosabeth Moss Kanter, John Hagel III, Thomas H. Davenport, Gary Hamel, C. K. Prahalad, Vijay Govindarajan, Robert S. Kaplan, Rita Gunther McGrath and others. Several management concepts and business terms were first given prominence in ''HBR''. ''Harvard Business Review''s worldwide English-language circulation is 250,000. HBR licenses its content for pub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

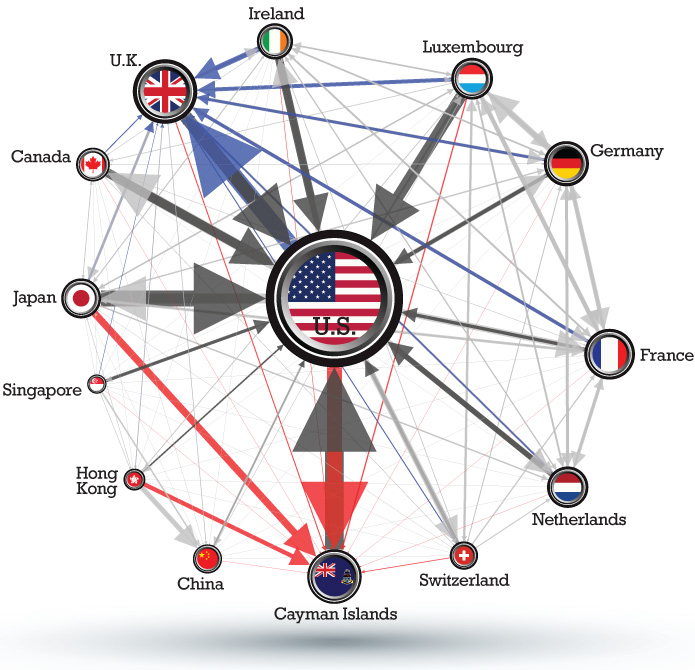

Conduit And Sink OFCs

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens. Traditional methods for identifying tax havens analyse tax and legal structures for base erosion and profit shifting (BEPS) tools. However, this approach follows a purely quantitative approach, ignoring any taxation or legal concepts, to instead follow a big data analysis of the ownership chains of 98 million global companies. The technique gives both a method of classification and a method of understanding the relative scale – but not absolute scale – of havens/OFCs. The results were published by the University of Amsterdam's CORPNET Group in 2017, and identified two classifications: * 24 global sink OFCs: jurisdictions in which a "disproportional amount of value disappears from the economic system" (i.e. the traditional tax havens). * Five global conduit OFCs: jurisdictions "through which a disproportional amount of valu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nature (journal)

''Nature'' is a British weekly scientific journal founded and based in London, England. As a multidisciplinary publication, ''Nature'' features Peer review, peer-reviewed research from a variety of academic disciplines, mainly in science and technology. It has core editorial offices across the United States, continental Europe, and Asia under the international scientific publishing company Springer Nature. ''Nature'' was one of the world's most cited scientific journals by the Science Edition of the 2022 ''Journal Citation Reports'' (with an ascribed impact factor of 50.5), making it one of the world's most-read and most prestigious academic journals. , it claimed an online readership of about three million unique readers per month. Founded in the autumn of 1869, ''Nature'' was first circulated by Norman Lockyer and Alexander MacMillan (publisher), Alexander MacMillan as a public forum for scientific innovations. The mid-20th century facilitated an editorial expansion for the j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Sink-OFCs, Ordered By Sink Centrality Value

A list is a set of discrete items of information collected and set forth in some format for utility, entertainment, or other purposes. A list may be memorialized in any number of ways, including existing only in the mind of the list-maker, but lists are frequently written down on paper, or maintained electronically. Lists are "most frequently a tool", and "one does not ''read'' but only ''uses'' a list: one looks up the relevant information in it, but usually does not need to deal with it as a whole".Lucie Doležalová,The Potential and Limitations of Studying Lists, in Lucie Doležalová, ed., ''The Charm of a List: From the Sumerians to Computerised Data Processing'' (2009). Purpose It has been observed that, with a few exceptions, "the scholarship on lists remains fragmented". David Wallechinsky, a co-author of ''The Book of Lists'', described the attraction of lists as being "because we live in an era of overstimulation, especially in terms of information, and lists help us ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New Yorker

''The New Yorker'' is an American magazine featuring journalism, commentary, criticism, essays, fiction, satire, cartoons, and poetry. It was founded on February 21, 1925, by Harold Ross and his wife Jane Grant, a reporter for ''The New York Times''. Together with entrepreneur Raoul H. Fleischmann, they established the F-R Publishing Company and set up the magazine's first office in Manhattan. Ross remained the editor until his death in 1951, shaping the magazine's editorial tone and standards. ''The New Yorker''s fact-checking operation is widely recognized among journalists as one of its strengths. Although its reviews and events listings often focused on the Culture of New York City, cultural life of New York City, ''The New Yorker'' gained a reputation for publishing serious essays, long-form journalism, well-regarded fiction, and humor for a national and international audience, including work by writers such as Truman Capote, Vladimir Nabokov, and Alice Munro. In the late ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |