|

Benefit Corporation

In business, and only in United States corporate law, a benefit corporation (or in some states, a public benefit corporation) is a type of for-profit corporate entity whose goals include making a positive impact on society. Laws concerning conventional corporations typically do not define the "best interest of society", which has led some to believe that increasing shareholder value (profits and/or share price) is the only overarching or compelling interest of a corporation. Benefit corporations explicitly specify that profit is not their only goal. An ordinary corporation may change to a benefit corporation merely by stating in its approved corporate bylaws that it is a benefit corporation. A company chooses to become a benefit corporation in order to operate as a traditional for-profit business while simultaneously addressing social, economic, and/or environmental needs. For example, a 2013 study done by MBA students at the University of Maryland showed that one main reas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benefit Corporation Laws In The United States

Benefit(s) may refer to: Arts and entertainment * Benefit (album), ''Benefit'' (album), by Jethro Tull, 1970 * Benefits (How I Met Your Mother), "Benefits" (''How I Met Your Mother''), a 2009 TV episode * "Benefits", a 2018 song by Zior Park * ''The Benefit'', a 2012 Egyptian action film Businesses and organisations * Benefit Cosmetics, an American cosmetics company * The Benefit Company, a Bahraini interbanking company Places * Benefit, Georgia, US Welfare and employment * Benefit (social welfare) ** Federal benefits, US ** Unemployment benefits * Benefit (sports), a pre-retirement event to benefit a player * Benefit performance, entertainment to support a cause ** Benefit concert, or charity concert * Employee benefits ** Health benefits (insurance) See also * Entitlement (other) * Health benefits (medicine) * Incentive * Incentive program * Loyalty marketing * Loyalty program * Reward (other) * Value (other) {{disambiguation, geo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delaware General Corporation Law

The Delaware General Corporation Law (sometimes abbreviated DGCL), officially the General Corporation Law of the State of Delaware (Title 8, Chapter 1 of the Delaware Code), is the statute of the Delaware Code that governs corporate law in the U.S. state of Delaware. The statute was adopted in 1899. Since the 1913 anti-corporation reforms in New Jersey under the governorship of Woodrow Wilson, Delaware has become the most prevalent jurisdiction in United States corporate law and has been described as the ''de facto'' corporate capital of the United States. Delaware is considered a corporate haven because of its business-friendly/anti-consumer corporate laws compared to most other U.S. states. 66% of the ''Fortune'' 500, including Walmart and Amazon (two of the world's largest companies by revenue) are incorporated (and therefore have their domiciles for service of process purposes) in the state. Over half of all publicly traded corporations listed in the New York Stock Exc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Mitchell Law Review

William Mitchell College of Law was a private law school from 1956 to 2015 in Saint Paul, Minnesota, United States. Accredited by the American Bar Association (ABA), it offered full- and part-time legal education in pursuit of the Juris Doctor (J.D.) degree. On December 9, 2015, Hamline University School of Law merged into William Mitchell College of Law, and became the Mitchell Hamline School of Law. History William Mitchell was the product of five predecessor schools, all in the Twin Cities, which ultimately merged in 1956. Although they varied in size and location, each one was originally established as a part-time, evening-program law school. This was meant to open the doors of the legal profession to men and women working full-time to support themselves and their families. St. Paul College of Law William Mitchell's first predecessor, the St. Paul College of Law, was founded in 1900 by five attorneys in Ramsey County. They intended the school to be an alternative for le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

C Corporation

A C corporation, under Income tax in the United States, United States federal income tax law, is any corporation that is taxed separately from its owners. A C corporation is distinguished from an S corporation, which generally is not taxed separately. Many companies, including most major corporations, are treated as C corporations for U.S. federal income tax purposes. C corporations and S corporations both enjoy limited liability, but only C corporations are subject to corporate income taxation. Versus S corporations Generally, all for-profit corporations are automatically classified as a C corporation unless the corporation elects the option to treat the corporation as a flow-through entity known as an S corporation. An S corporation is not subject to income tax; rather, its shareholders are subject to tax on their ''pro rata'' shares of income based on their shareholdings. To qualify to make the S corporation election, the corporation's shares must be held by residents, citize ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S Corporation

An S corporation (or S Corp), for United States federal income tax, is a closely held corporation (or, in some cases, a limited liability company (LLC) or a partnership) that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns. Overview S corporations are ordinary business corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The term "S corporation" means a "small business corporation" which has made an election under § 1362(a) to be taxed as an S corporation. The S corporation rules are contained in Subchapter S of Chapter 1 of the Internal Revenue Code (sections 1361 through 1379). The United Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cooperative

A cooperative (also known as co-operative, coöperative, co-op, or coop) is "an autonomy, autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically-controlled wikt:Enterprise, enterprise". Cooperatives are democratically controlled by their members, with each member having one vote in electing the board of directors. They differ from Collective farming, collectives in that they are generally built from the bottom-up, rather than the top-down. Cooperatives may include: * Worker cooperatives: businesses owned and managed by the people who work there * Consumer cooperatives: businesses owned and managed by the people who consume goods and/or services provided by the cooperative * Producer cooperatives: businesses where producers pool their output for their common benefit ** e.g. Agricultural cooperatives * Purchasing cooperatives where members pool their purchasing power ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

B Corporation (certification)

In business, a company that uses the “Certified B Corporation” trademark (also B Corporation or B Corp) is a for-profit corporation certified for its Social impact assessment, social impact by B Lab, a global 501(c) organization, non-profit organization. To be granted and to maintain certification, a company must receive a minimum score of 80 from an assessment of its social and environmental performance, integrate B Corp commitments to Stakeholder theory, stakeholders into By-law, company governing documents, and pay an annual fee based on annual sales. Companies must re-certify every three years to retain B Corporation status. , there are 9,576 certified B Corporations across 160 industries in 102 countries. Purpose B Lab certification is a third-party standard requiring companies to meet social sustainability and environmental performance standards, meet accountability standards, and be Sustainability reporting, transparent to the public according to the score they rec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patagonia (clothing)

Patagonia, Inc. is an American retailer of outdoor recreation clothing, equipment, and food. It was founded by Yvon Chouinard in 1973 and is based in Ventura, California. Patagonia operates stores in over ten countries, and factories in 16 countries. History Yvon Chouinard, an accomplished rock climber, began selling hand-forged mountain climbing gear in 1957 through his company Chouinard Equipment. He worked alone selling his gear until 1965, when he partnered with Tom Frost in order to improve his products and address the growing supply and demand issue he faced. In 1970, Chouinard obtained rugby shirts from Scotland that he wore while climbing because the collar kept the climbing sling from hurting his neck. Great Pacific Iron Works, Patagonia's first store, opened in 1973 in the former Hobson meat-packing plant at Santa Clara St. in Ventura, near Chouinard's blacksmith shop. In 1981, Patagonia and Chouinard Equipment were incorporated within Great Pacific Iron Works. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yvon Chouinard

Yvon Chouinard (born November 9, 1938) is an American rock climber, environmentalist, and businessman. His company, Patagonia, sells outdoor products, outerwear, and food. He was named one of the 100 most influential people in the world by ''Time'' magazine in 2023. Early life Chouinard's father was a French Canadian handyman, mechanic, and plumber. In 1947, Yvon and his family moved from Lewiston, Maine to Southern California. They were Catholic The Catholic Church (), also known as the Roman Catholic Church, is the List of Christian denominations by number of members, largest Christian church, with 1.27 to 1.41 billion baptized Catholics Catholic Church by country, worldwid .... His early climbing partners included Royal Robbins and Tom Frost.Yvon Chouinard, , Outside Online [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Nation

''The Nation'' is a progressive American monthly magazine that covers political and cultural news, opinion, and analysis. It was founded on July 6, 1865, as a successor to William Lloyd Garrison's '' The Liberator'', an abolitionist newspaper that closed in 1865, after ratification of the Thirteenth Amendment to the United States Constitution. Thereafter, the magazine proceeded to a broader topic, ''The Nation''. An important collaborator of the new magazine was its Literary Editor Wendell Phillips Garrison, son of William. He had at his disposal his father's vast network of contacts. ''The Nation'' is published by its namesake owner, The Nation Company, L.P., at 520 8th Ave New York, NY 10018. It has news bureaus in Washington, D.C., London, and South Africa, with departments covering architecture, art, corporations, defense, environment, films, legal affairs, music, peace and disarmament, poetry, and the United Nations. Circulation peaked at 187,000 in 2006 but dropped t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

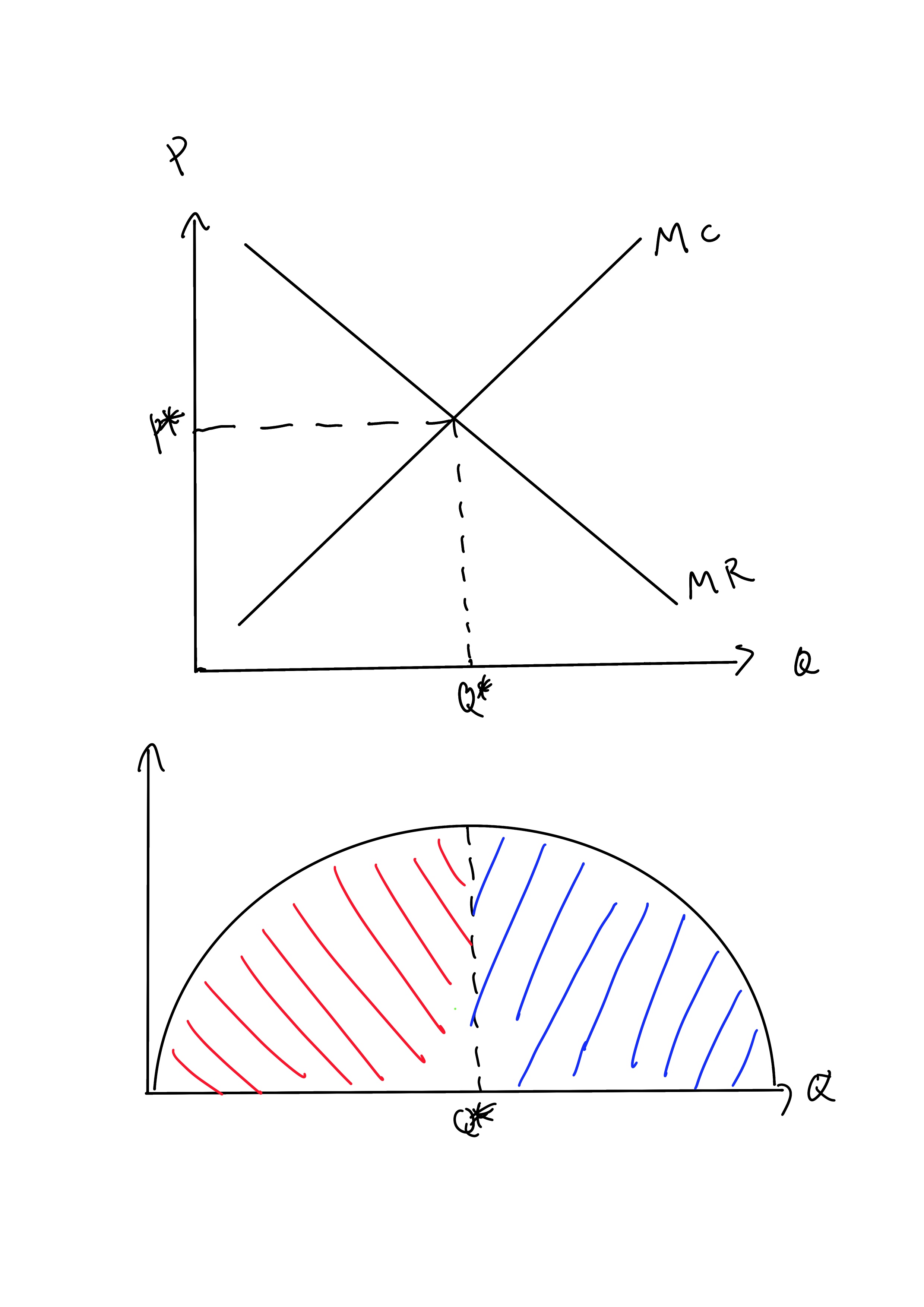

Profit Maximization

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a " rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |